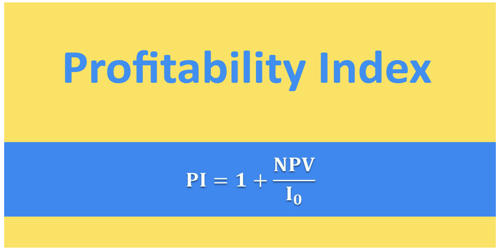

Concept of Profitability Index (PI)

The profitability index is known as the benefit-cost ratio. It is a useful tool for ranking projects because it allows you to quantify the amount of value created per unit of investment. PI is similar to the NPV approach. The profitability index approach measures the present value of return per dollar invested, while the NPV is based on the difference between the present value of the future cash inflow and the present value of cash outlay. It describes an index that represents the relationship between the costs and benefits of a proposed project. PI is calculated by dividing the present value of future cash inflow by the present value of cash outlay.

Profitability Index (PI) = Total present value/Net cash outlay

Or = (NPV + Initial investment) ÷ Initial Investment: As one would expect, the NPV stands for the Net Present Value of the initial investment.

Profitability Index Calculation

Example: a company invested $20,000 for a project and the expected NPV of that project is $5,000.

Profitability Index = (20,000 + 5,000) / 20,000 = 1.25

That means a company should perform the investment project because the profitability index is greater than 1.

Calculation Of Profitability Index (PI)

Illustration

The cash flow of the two projects are as under:

Years…………………..0…………….1……………….2………………….3……………….4

Project A……….-25000……….8000……….8000…………….8000…………8000

Project B……….-25000……….10000……..11000……………8000…………5000

The cost of capital is 10%

Required:

Calculate PI Of each project

Solution,

Project A.

Total present value = Annual cash flow x 10% annuity factor = 8000 x 3.170 = $ 25,360

Profitability Index (PI) = TPV/NCO = 25,360/25,000 = 1.01

Project B,

Year……………………….CFAT…………………….10% Factor…………………….PV

1…………………………….10000…………………..0.909……………………………9090

2…………………………….11000……………………0.826……………………………9086

3……………………………..8000……………………..0.751…………………………….6008

4……………………………..5000……………………..0.683…………………………….3415

Total present value (TPV)……………………………………………………………..27,599

Profitability Index (PI) = TPV/NCO = 27599/25000 = 1.10

Decision Rules Of Profitability Index(PI)

A. If projects are independent

Accept the project when the PI is higher than 1.

Reject the project when the PI is less than 1.

B. If projects are mutually exclusive

Accept the project which has a higher PI. (PI must be greater than one)

Reject other projects.

In the above calculation, project B should be selected because it has a higher PI.

The PI is helpful in ranking various projects because it lets investors quantify the value created per each investment unit. Thus, the profitability index helps investors in making decisions about whether or not to make a particular investment.

Merits of Profitability Index

- It takes into consideration, the Time Value of Money.

- The profits are considered throughout the life of the project.

- This method helps in giving the ranks to the projects.

- It helps in assessing the risk involved in cash inflows through the cost of capital.

Demerits of profitability Index

- Unlike the NPV, the Profitability Index may sometimes do not offer the correct decision with respect to the mutually exclusive projects.

- The cost of capital is a must to compute this ratio.