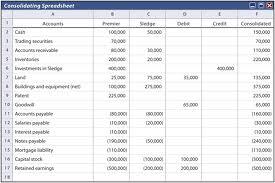

Consolidated Balance Sheet

A consolidated balance sheet presents the assets and liabilities of a parent company and all its subsidiaries on a single document, with no distinctions on which items belong to which companies. If your company has $1 million in assets and it purchases subsidiaries with assets of $400,000 and $300,000, respectively, then your consolidated balance sheet will show $1.7 million in assets, and the sheet will commingle those assets. For example, in the asset section, accounts receivable will list the total amount of receivables held by all three companies.

When to Consolidate

A company must issue consolidated financial statements whenever it owns a controlling stake in another business — that is, whenever it owns more than 50 percent of that business. If the parent company owns 100 percent of the subsidiary, this is pretty straightforward. Complications arise, however, if the parent company owns a controlling stake with less than 100 percent ownership. Part of the subsidiary belongs to someone else, and that must be reflected on the balance sheet. The parent company handles this by consolidating the balance sheet as usual, then creating a separate account in the owners’ equity section of the sheet. This account, called “minority interest” or “non-controlling interest,” is equal to the value of the portion of the subsidiary that the parent company doesn’t own. In essence, the parent company claims all of the subsidiary’s assets and liabilities on the balance sheet and then “gives some of the value back” in the equity section.

Alternatives to Consolidation

When one company owns a less-than-controlling stake in another — that is, less than 50 percent — then it does not consolidate the balance sheet. Say your business owns 45 percent of another company. Your balance sheet would list only your company’s assets, liabilities and equity. Your investment in the other company would exist as a single asset on your balance sheet, equal to the value of your 45 percent stake.

Other Statements

Parent companies don’t just consolidate the balance sheet; they consolidate all of their financial statements. So the parent company’s consolidated income statement combines the revenue, expenses, gains, losses and taxes of the parent and all its subsidiaries. Likewise, the consolidated cash flow statement combines all the companies’ operational, investment and financing cash flows. The combined owners’ equity statement looks like the equity section of the balance sheet: It will show the combined equity in all the companies and “give back” whatever value belongs to minority owners of subsidiaries.