A frequently used type of accelerated depreciation in which some percentage of straight-line depreciation rates are used is the declining balance method. This technique is useful for tracking the deterioration of increasingly obsolete computers, mobile phones, and other high-tech items. The usual practice is to use a 200% or 150% of the line rate to calculate depreciation expense for the amount. The declining balance technique represents the other of the straight-line depreciation method, which is more suitable for assets whose value steadily drops over time. The rate of depreciation calculated in this manner is known as the decreasing balance rate or the accelerated rate of depreciation. For instance, if the straight-line depreciation rate is 10 percent and the business uses 200 percent of the straight-line depreciation rate, 20 percent (10% × 2) will be the accelerated depreciation rate to be used in the declining balance method.

Declining Balance Method Calculating

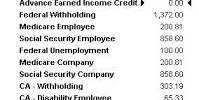

By and large, the expense assigned to the advantages is treated as the deterioration cost and is perceived as a cost for the assessment and monetary revealing purposes. In contrast to other devaluation strategies, the rescue esteem isn’t deducted from the expense of the advantage under this technique. At the beginning of the cycle, the accelerated depreciation rate is applied to the book value (underpreciated cost) of the asset. The persistent depreciation fee decreases the asset’s book value year by year. When the asset’s book value is lowered to its salvation, no further depreciation is given.

Depreciation under the declining balance method is calculated with the following formula:

Declining Balance Depreciation = CBV × DR

Where:

CBV = current book value

DR = depreciation rate (%)

The first step in the method of declining balance is to calculate a straight-line depreciation rate determined using the formula below:

Straight-line depreciation rate = 1/Useful life of the asset

The accelerated depreciation rate is determined after the measurement of the straight-line rate to be used in the decreasing balance process. It is determined using the formula below:

Accelerated depreciation rate = straight-line depreciation rate × Specific percentage

Current book value is the benefit’s net an incentive toward the beginning of a bookkeeping period, determined by deducting the aggregated deterioration from the expense of the fixed resource. Lingering esteem is the assessed rescue an incentive toward the finish of the valuable existence of the benefit. Furthermore, the pace of deterioration is characterized by the assessed example of a benefit’s utilization over its valuable life.

It is possible to quantify the depreciation of assets using several different approaches. All of these methods are applicable and the adaptation of an asset to one of these methods is solely based on the company’s decision or the generally accepted accounting principles (GAAP) in the country in which the company operates. The different types of depreciation method are:

- Straight-line depreciation method

- Declining-Balance depreciation method

- Fixed percentage depreciation method; and

- Sum-of-years’ digit method; etc.

The declining balance method also called the reducing balance method, is good for assets that quickly lose their values or inevitably become obsolete. This can be another method of depreciation that uses the charge per unit. For computer equipment, mobile phones, and other high-tech products, this is classically true, which are normally useful earlier on but becomes less so as new models are introduced to the market. An accelerated depreciation method which ultimately determines the phase-out of these properties.

In this method, we’ve to calculate the straight-line depreciation first and so double the speed we get from the straight-line depreciation method. The declining balance technique represents the opposite of the straight-line depreciation process, which is more fitting for assets whose book value decreases over their useful lives at a steady rate. This approach simply deduces the salvage value from the asset’s expense, which is then divided by the asset’s useful life.

Information Sources: