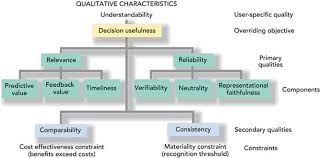

Qualitative Characteristics of Accounting Information

Concepts Statement no. 2 identifies primary and secondary qualitative characteristics of accounting information that distinguish better (more useful) information from inferior (less useful) information for decision-making purposes.

- Primary Qualities

The primary qualities that make accounting information useful for decision making are relevance and reliability.

Relevance: Accounting information is relevant if it is capable of making a difference in a decision. For information to be relevant, it should have

- predictive or feedback value, i.e.; Helpful in making predictions about ultimate outcomes of past, present and future events: Predictive value.

b. it must be presented on a timely basis.

Reliability: Accounting information is reliable to the extent that it is verifiable, is a faithful representation and is reasonably free of error and bias. To be reliable, accounting information must include:

- Verifiability – The ability to arrive at the same conclusion, given the same information, by independent evaluators or users

b. Representational faithfulness –Representational faithfulness is an important element of reliability in that it means the information represents what really existed or happened.

c. Neutrality – Neutrality is the characteristic that the information presented is free from bias. The information presented does not favor one party’s interests over another.

2. Secondary Qualities

The secondary qualities identified are comparability and consistency.

Comparability: Accounting information that has been measured and reported in a similar manner for different enterprises is considered comparable. Information is more useful if it lends itself to comparison with similar information about another enterprise. Information is measured and reported in a similar manner for different enterprises This characteristic allows users to identify real differences between enterprises, not those due to non-comparable accounting methods. Thus, it allows for the allocation of resources to the areas of greatest benefit.

Consistency : Accounting information is consistent when an entity applies the same accounting treatment to similar events from period to period. Accounting principles may be changed when it can be demonstrated the result would be preferable.