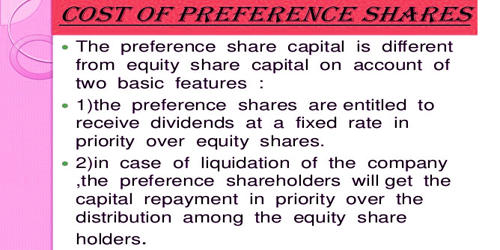

Features of Cost of Preference Share

Preference shares are shares of a company that pays out dividends to shareholders before common share dividends are issued. These are those shares which have the prior right on the dividend and refund of capital in case of liquidation of the company. These are one of the special types of share capital having a fixed rate of dividends and they carry preferential rights over ordinary equity shares in sharing of profits and also claims over assets of the firm. They are neither completely similar to equity nor equivalent to debt. The law treats them as shares but they have elements of both equity shares and debt. They do not hold voting rights as opposed to common dividends that allow shareholders the right to vote on company decisions if a high enough volume of shares is held by the shareholder.

The main features of preference share can be highlighted as follows:

- Fixed Dividend

Like debt carries a fixed interest rate, preference shares have fixed dividends attached to them. But the obligation of paying a dividend is not as rigid as debt. Non-payment of a dividend would not amount to bankruptcy in case of preference share.

- Face Value or Par Value

The value or price stated on the share certificate is called face value. The dividend is computed on the basis of face value. The share’s market price may be different from the face value depending upon the financial condition of the issuing company.

- Dividend Rate

The rate of dividend payable on preference share is predetermined. On the basis of such dividend rate and the face value of a share, the amount of dividend is determined as below:

Dividend per share (DPS) = Face value X Dividend rate

Total Dividend = Face value X Dividend rate X No. of preference share.

- Maturity Period

The maturity period is mentioned on the preference shares if such shares are redeemable after some years in the future. Generally, the maturity period is not mentioned on the preference share and such shares are called irredeemable.

- Net Proceeds

The amount received by the company issuing the preference hares after deducting all issuing expenses is called net proceeds. Net proceeds are computed on the basis of the face value of the share, discount on premium, and issuing cost or flotation cost.

- Fixed Maturity

Just like debt, preference shares also have a fixed maturity date. On the date of maturity, the preference capital will have to be repaid to the preference shareholders. A special type of shares i.e. irredeemable preference shares is an exception to this. They do not have any fixed maturity.