The Current Cost Accounting (CCA) method is based on the concept that a business enterprise is a going concern that is continuously replacing its assets. It is a valuation method whereby assets and goods used in production are valued at their actual or estimated current market prices at the time the production takes place

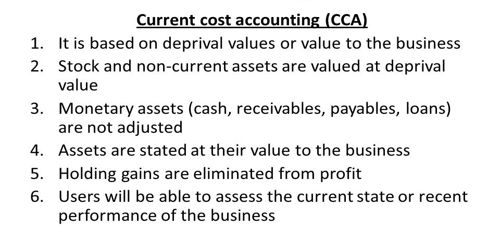

Features of Current Cost Accounting (CCA)

(1) The fixed assets are recorded at replacement cost value in the balance sheet. Fixed assets are shown not at their depreciated original cost but at their net replacement value.

(2) Inventory consumed is valued at the price at the date of consumption. Inventories are shown at market value rather than market or cost price whichever less as in the historical system is.

(3) Revaluation surplus is transferred to current cost accounting reserve but not distributed as dividends to shareholders.

(4) Depreciation is calculated at the current value of assets. The depreciation of fixed assets is to be calculated at replacement value.

(5) The difference between the current values and the depreciated original cost of fixed assets and of stocks, the increased requirements for monetary working capital, and the under the provision of depreciation in the past years may be adjusted through Revaluation Reserve Account.

(6) Two types of profit i.e. profit from operation and profit from revaluation are calculated. The cost of goods sold during the year has to be ascertained on the basis of prices prevailing at the date of consumption and not at the date of purchase.

(7) Liabilities are recorded in their original value because there is no change in the monetary unit.

(8) Stocks are shown at their net replacement value. Gain/ loss due to the changes in the price level are shown in a separate statement.

(9) Net Realisable value is the estimated selling price in the ordinary course of business less reasonably predictable costs of completion and disposal.

(10) Economic value is the sum of the discounted future cash flows expected from the use of an asset during its useful life.

The current cost accounting method is suitable when the management is committed to the industry and is interested in replacing the present plant with a new one at the end of its useful life. Most businesses have other working capital besides stock involved in their day-to-day operating activities. For example, when sales are made on credit the business has funds tied up in debtors.