The high-low method of cost accounting is a way of trying to distinguish fixed and variable costs, provided a limited amount of data. Although the high-low method is straightforward to use, it’s seldom used, because it can distort costs, because of its reliance on two extreme values from a given data set. The high-low method involves taking the best level of activity and therefore the lowest level of activity and comparing the entire costs at each level.

The high-low approach uses two sets of numbers: 1) the total mixed cost dollars that occur at the highest activity level, and 2) the total mixed cost dollars that occur at the lowest activity volume. When the variable cost is a fixed charge per year, and the fixed costs remain the same, the fixed and variable costs can be calculated by solving the equations system. Therefore, the change within the total costs is assumed to be the variable cost rate times the change within the number of units of activity. Calculating the end result for the high-low method requires some formula steps.

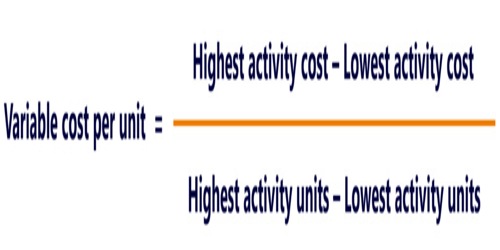

The formula for developing a cost model using the high-low method is as follows:

Once the variable cost per unit is determined:

Fixed cost = Highest activity cost – (Variable cost per unit x Highest activity units)

Or

Fixed cost = Lowest activity cost – (Variable cost per unit x Lowest activity units)

The resulting cost model after using the high-low method would be as follows:

Cost model = Fixed cost + Variable cost x Unit activity

Costs attributable to a product, product line, equipment, store, regional distribution area, or subsidiary consist of both variable and fixed costs. An analyst or accountant may employ a technique known as the high-low method to calculate all cost components of the total cost.

To illustrate the high-low method, let’s assume that an organization had total costs of electricity of $18,000 within the month when its highest activity was 120,000 machine hours; make certain to match the dates of the machine hours to the electrical meter reading dates. During the month of its lowest activity, there have been 100,000 machine hours and also the total cost of electricity was $16,000. This suggests that the whole monthly cost of electricity changed by $2,000 when the number of machine-hours changed by 20,000. This means that the variable cost rate was $0.10 per machine hour.

The high-low approach is a simple way of distinguishing fixed and variable costs. Cost accountants can rapidly and accurately calculate the cost behavior information by having only two data values and some algebra. Even the high-low approach does not use or require any methods or programs that are complex. However, the formula doesn’t take inflation into consideration and provides an awfully rough estimation because it only considers the intense high and low values, and excludes the influence of any outliers.

The high-low approach is fairly inaccurate, as it only takes into account two extreme rates of operation. The high-low approach assumes that the fixed and variable unit costs are constant, which in real life is not the case. Because it uses only two data values in its calculation, variations in costs aren’t captured within the estimate. The high-low method is mostly not preferred because it can yield an incorrect understanding of the information if there are changes in variable or fixed charge rates over time or if a tiered system is used.

Information Sources: