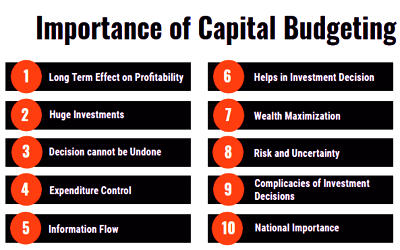

Importance of Capital Budgeting

Capital budgeting is a process that helps in planning the investment projects of an organization in the long run. It is the process of evaluating and selecting long-term investments that are consistent with the goal of the firm. It is important because it creates accountability and measurability. Any business that seeks to invest its resources in a project without understanding the risks and returns involved would be held as irresponsible by its owners or shareholders.

The need and importance of capital budgeting have been explained as follows:

(1) Long-term Implication

Capital expenditure decision affects the company’s future cost structure over a long time span. For the growth & prosperity of the business, long-term goals are very important for any organization. The investment in fixed assets increases the fixed cost of the firm which must be recovered from the benefit of the same project. It is difficult to find the market for that asset. A wrong decision can be disastrous for the long-term survival of the firm. If the investment turns out to be unsuccessful in the future or gives less profit than expected, the company will have to bear the extra burden of fixed cost. The only way remains with the company is to scrap the asset & incur heavy losses. Capital budgeting has its effect in a long time span. It also affects companies’ future costs & growth. Such risk can be minimized through the systematic analysis of projects which is an integral part of investment decisions.

(2) Irreversible Decision

The capital investment decisions are generally irreversible as it requires large amounts of funds. These decisions are not easily reversible without much financial loss to the firm because there may be no market for second-hand plant and equipment and their conversion to other uses may not be financially viable. Hence, capital investment decisions are to be carried out and performed carefully and effectively in order to save the company from such financial loss. The investment decision which is undertaken carefully and effectively can save the firm from huge financial loss aroused due to the selection of unfavorable projects.

(3) Long-term Commitments Of Funds

Capital Investment requires a large number of funds. It involves the funds for the long-term. So, it is a long-term investment decision. As the companies have limited resources, the company has to make a wise & correct investment decision. The long-term commitment of funds leads to financial risk. The wrong decision would harm the sustainability of the business. Hence, careful and effective planning is a must to reduce financial risk as much as possible. The large investment includes the purchase of an asset, rebuilding, or replacing existing equipment.

(4) Transfer of information

The time that project starts off as an idea, it is accepted or rejected; numerous decisions have to be made at a various level of authority. The capital budgeting process facilitates the transfer of information to appropriate decision-makers within a company.

(5) Risk and Uncertainty

When we invest in a certain project expect a certain return in the permanent commitment of funds. More risk is involved because of the permanent commitment of funds. Capital budgeting decision is surrounded by a great number of uncertainties whether the investment is in the present or in the future. The longer the period of the project, the more the risk and uncertainty involved.