Incremental cash flow (ICF) is the extra cash inflow created by the company from investing in any particular project. If it takes on a new project and if it does not, organizations must compare the expected cash flow to measure an additional cash flow, taking into account how accepting such a project will impact the cash flow of another section of the organization. A positive incremental cash flow is the right indication that a business enterprise makes investments in a project. The new assignment may make an income in the future, however, if taking it to motive a money flow trouble and have an effect on a whole company, so the management wishes this data in order to make an applicable decision.

In reality, incremental cash flow (ICF) can be a good tool for evaluating whether to invest in a new project or asset, but it should not be the only tool for evaluating a new venture. If the consequence of taking on a new project is a reduction in the cash flow of another element or product, then it is called cannibalization. There are countless elements that have to be identified when searching at incremental cash flows: the initial outlay, money flows from taking on the project, terminal fee or value, and the scale and timing of the project. In capital budgeting, the ICF is important because it helps to forecast cash flow in the future and assess the feasibility of a project. It is the total cash balance for a particular period from all cash inflows and outflows and from two or more company choices.

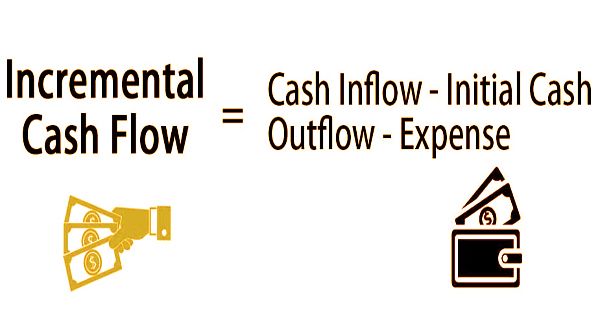

(Formula of Incremental Cash Flow)

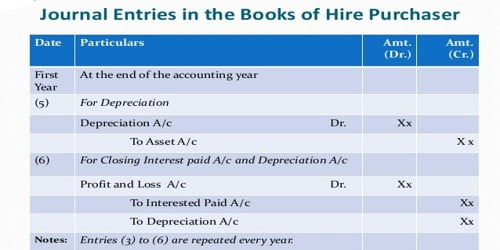

Incremental Cash Flows (ICF) Example:

XYZ is considering spending $500,000 worth of new equipment. With a scrap value of $50,000, it has a useful life of 5 years. Based on the forecast, with 40 percent of the variable cost, the company would be able to raise revenue by $1 million a year.

What is the incremental cash flows of this project?

The cash inflow over the project is $5,000,000 ($1,000,0000 × 5 years)

The cash outflow over the project is $2,000,000 (40% of the sale is a variable cost)

ICF =$5,00,000 – $2,000,000 – $500,000 = $2,500,000

Incremental Cash Flow (ICF) Formula:

Incremental Cash Flow = Cash Inflow – Initial Cash Outflow – Expense

Incremental cash flows, particularly in deciding whether or not a business can take on a new project, are helpful. It can also be useful to forecast incremental cash flows to determine whether to invest in those assets that will appear on the balance sheet. Accountants, however often face some obstacles when computing for incremental cash flow. Here are some of the struggles:

- Sunk costs: Sunk costs are also acknowledged as previous costs that have already been incurred. Incremental cash glide looks into future costs; accountants need to make sure that sunk fees are not covered in the computation. This is especially authentic if the sunk cost happened before any funding choice used to be made.

- Opportunity costs: From the term itself, opportunity costs refer to a business’ missed chances for revenues from its assets. They are often forgotten by accountants, as they do not include opportunity costs in the computation of incremental cash flow.

- Cannibalization: This happens as the corporation invests in a new project that takes the money from the current project. In total, the whole organization does not produce any new revenue or profit. They just distinguish the sale from the current one and benefit.

- Allocated costs: These are costs which are assigned to a particular department or project.

Compared to different strategies like Net present value (NPV) and Internal rate of return (IRR), Incremental cash flow (ICF) is simpler to calculate except for any problems of the cut-price rate. ICF is calculated in the initial steps whilst the usages of capital budgeting techniques like NPV. Market circumstances, regulatory policies, and legal policies can have uncertain and unforeseen impacts on incremental cash flow. Differentiating between cash flows from the project and cash flows from other company activities is another problem. Project selection may be made based on incomplete or faulty data without proper differentiation.

Information Sources: