Marginal revenue (MR) is the rise in revenue that comes from the selling of an additional unit of production, also known as ‘marginal benefit.’ It is the cash that a business makes for each additional sale. For each additional unit sold, it is the income that a business will generate; there is a marginal cost added to it, which has to be compensated for. In other words, it determines how a great deal a company would receive from promoting one in addition to true. Marginal revenue (MR) is a fundamental tool for monetary decision making within a firm’s placing, collectively with a marginal fee to be considered.

Although marginal revenue may remain constant over a certain output level, it follows from the decreasing returns rule and will gradually slow down as the level of output rises. Therefore, businesses set a price level equal to their marginal sales (MR = P) in a perfectly competitive market. Marginal Revenue (MR) is a significant idea as it permits benefit amplifying organizations to recognize when to quit creating further items. For instance, when Marginal Revenue surpasses Marginal Cost, it turns into a total deficit for the business. This is on the grounds that it is costing the firm more to deliver an extra unit than it is getting from its deal.

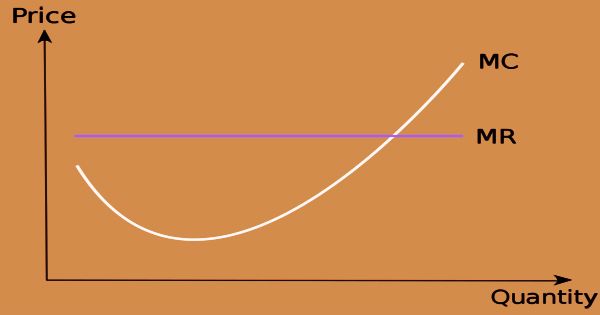

A company calculates marginal revenue by using dividing the exchange in total revenue by way of the alternate in general output amount. Therefore, the sale fee of a single extra object offered identical marginal revenue. The Marginal Cost curve is a “U”-shaped curve since the marginal cost will be lower for 1-5 additional units, while the marginal cost will continue to increase with the sale of more incremental units. The Marginal Revenue bend is inclining downwards in light of the fact that, with one extra unit sold, we would produce income near our ordinary income however as we begin selling to an ever-increasing extent, we would be needed to diminish the cost of the thing we are selling. Else, we won’t have the option to sell all the units, which is otherwise called the law of decreasing edge.

Marginal revenue (MR) curve

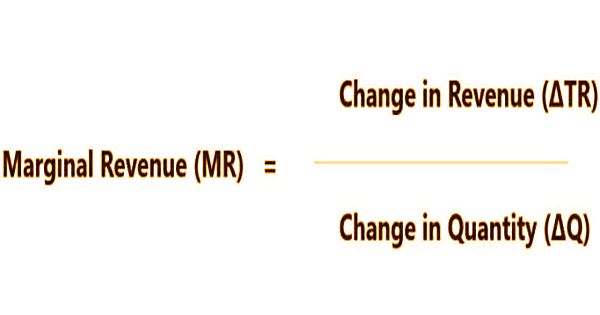

The marginal benefit is proportional to the ratio of the change in income to some change in the quantity sold as a result of the change in the quantity sold. A company, for instance, sells its first 100 products for a total of $1,000. If it sells the next item for $8, the 101st item’s marginal revenue is $8. The previous average price of $10 is disregarded by marginal income, as it only analyzes the gradual shift. By dividing the change in revenue by the change in quantity, a business measures Marginal Revenue.

Marginal revenue (MR) formula

In other phrases, MR is calculated by way of dividing the trade-in total sales via the alternate in total output quantity. To assist with the calculation of marginal revenue, a sales schedule outlines the total sales earned, as well as the incremental sales for every unit. The components above break this calculation into parts: one, exchange in sales (total revenue – old revenue), and, exchange in amount (total quantity – old quantity).

There is an Average Revenue bend or Demand bend, which isn’t the purchasers’ interest bend yet rather the makers’ interest bend. The bend speaks to a normal amount at a normal cost. The negligible income for a monopolist is the private increase of selling an extra unit of yield. Beneath monopoly, the price of all units lowers every time a firm will increase its output sold, this reasons the firm to stand diminishing marginal sales. Marginal revenue for competitive firms is typically steady. This is due to the fact the market dictates the surest fee degree and corporations do now not have plenty if any discretion over the fee.

In other words: marginal revenue (MR) is the figuring used to decide how much a firm would get from selling one further item or administration. It turns out contrastingly for imposing business models; for a monopolist, the negligible advantage of selling an extra unit is not exactly the market cost.

Information Sources: