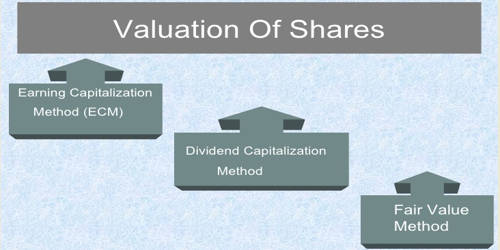

Methods of Valuation of Shares

Valuation of shares is the process of determining the fair value of the company shares. The methods of valuation depend on the purpose for which valuation is required. Share valuation is done based on quantitative techniques and share value will vary depending on the market demand and supply. Generally, there are three methods of valuation of shares:

(1) Net Assets Method of Valuation of Shares

Under this method, the net value of assets of the company is divided by the number of shares to arrive at the value of each share. Since the valuation is made on the basis of the assets of the company, it is known as Asset-Basis or Asset- Backing Method. For the determination of the net value of assets, it is necessary to estimate the worth of the assets and liabilities. The goodwill, as well as non-trading assets, should also be included in total assets. Under this method, the value of the net assets of the company is to be determined first. The following points should be considered while valuing of shares according to this method:

- Goodwill must be properly valued

- The fictitious assets such as preliminary expenses, discount on issue of shares and debentures, accumulated losses, etc. should be eliminated.

- The fixed assets should be taken at their realizable value.

- Provision for bad debts, depreciation, etc. must be considered.

- All unrecorded assets and liabilities ( if any) should be considered.

- Floating assets should be taken at market value.

The external liabilities such as sundry creditors, bills payable, loan, debentures, etc. should be deducted from the value of assets for the determination of net value.

The net value of assets, determined so has to be divided by a number of equity shares for finding out the value of the share. Thus the value per share can be determined by using the following formula:

Value Per Share=(Net Assets-Preference Share Capital)/Number Of Equity Shares

(2) Yield or Market Value Method of Valuation of Shares

Yield is the effective rate of return on investments that is invested by the investors. The expected rate of return in investment is denoted by yield. The term “rate of return” refers to the return which a shareholder earns on his investment. Since the valuation of shares is made on the basis of Yield, it is called Yield-Basis Method. Further, it can be classified as (a) Rate of earning and (b) Rate of dividend. In other words, yield may be earning yield and dividend yield.

- Earnings Yield

Under this method, shares are valued on the basis of expected earning and a normal rate of return. The value per share is calculated by applying the following formula:

Value Per Share = (Expected rate of earning/Normal rate of return) X Paid-up value of equity share

Expected rate of earning = (Profit after tax/paid-up value of equity share) X 100

- Dividend Yield

Under this method, shares are valued on the basis of expected dividend and normal rate of return. The value per share is calculated by applying following formula:

Expected rate of dividend = (profit available for dividend/paid up equity share capital) X 100

Value per share = (Expected rate of dividend/normal rate of return) X 100

(3) Earning Capacity Method Of Valuation Of Shares

Under this method, the value per share is calculated on the basis of disposable profit of the company. The disposable profit is found out by deducting reserves and taxes from net profit. The following steps are applied for the determination of value per share under earning capacity:

Step 1: To find out the profit available for dividend

Step 2: To find out the capitalized value

Capitalized Value =( Profit available for equity dividend/Normal rate of return) X 100

Step 3: To find out value per share

Value per share = Capitalized Value/Number of Shares.

Information Source: