Operating leverage is a cost-accounting formula that measures the degree to which a firm or project can increase operating income by increasing revenue. It may be defined as the firm’s ability to use fixed operating costs to magnify the effect of changes in sales on its earnings before interest and tax. A business that generates sales with a high gross margin and low variable costs has high operating leverage. The relationship between contribution margin and earnings before interest and tax (EBIT) is called a degree of operating leverage.

Operating leverage is used to measure the business risk. It is a cost-accounting formula that measures the degree to which a firm or project can increase operating income by increasing revenue.

It may be defined as the rate of changes in EBIT due to the change in the rate of sales. It is important to compare operating leverage between companies in the same industry, as some industries have higher fixed costs than others. The firm operating with high fixed operating costs have a higher degree of operating leverage. A company with high fixed costs and low variable costs has high operating leverage; whereas a company with low fixed costs and high variable costs has low operating leverage. The benefits of high operating leverage can be immense. Companies with high operating leverage can make more money from each additional sale if they don’t have to increase costs to produce more sales.

There are several different formulas for calculating this leverage:

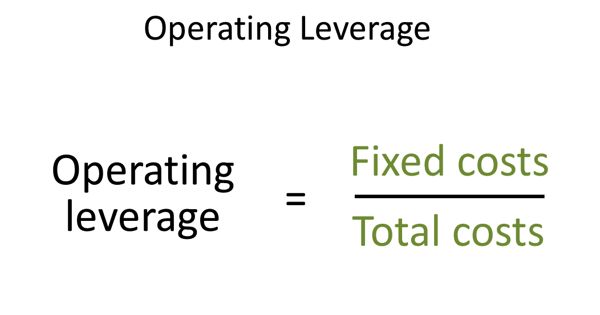

- Formula 1: Fixed Costs / (Fixed Costs + Variable Costs) [The problem with this one is that most companies don’t spell out what is a fixed vs. variable cost in their filings.]

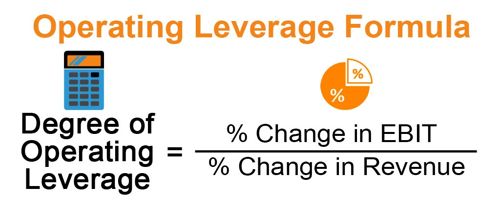

- Formula 2: % Change in Operating Income / % Change in Sales

- Formula 3: Net Income / Fixed Costs

- Formula 4: Contribution Margin / Operating Margin

Higher levels of risk are attached to a higher degree of leverage. High operating leverage is good when sales are increasing and bad when they are falling. Conversely, operating leverage is lowest in companies that have a low proportion of fixed operating costs in relation to variable operating costs. Knowledge of the level of operating leverage can have a profound impact on pricing policy since a company with a large amount of operating leverage must be careful not to set its prices so low that it can never generate enough contribution margins to fully offset its fixed costs.

Operating leverage is used to measure the business risk. It measures a company’s fixed costs as a percentage of its total costs. Business risk is the risk of the firm not being able to cover its fixed operating costs. It is used to evaluate the breakeven point of a business, as well as the likely profit levels on individual sales.

Information Source: