Partners’ Loan Account with Interest Thereon

At the time of retirement of a partner, the partners after calculating the final payment to the retiring partner may decide to keep the capital of the retiring partners as a loan. If any partner advances an amount over and above his/her commitment then it is considered as a partners’ loan to the firm with a view to getting it back in the days to come from the partnership as per the valid partnership deed agreed upon. The remaining partners can pay the final amount payable to the retiring partner as a lump sum payment or may treat it as a loan and repay in installments. Whenever a partner provides loan capital to the firm, then it should not be mixed up with his/her originally contributed capital account. Sometimes, the remaining partners repay the amount of loan in equal installments with interest on the balance amount. Instead of writing in the capital account, a separate account is opened as partners’ loan account. The logic behind the separation of capital and loan account is:

- Partners’ loan is repayable on dissolution in priority to capital

- In the absence of a valid agreement, partners are entitled to get interested in the loan, whereas the partners not getting interested in the capital.

The sum of the contributions represents the capital of the firm. There should be a valid written document between the firm and among the partners for legal purposes. The installment will consist of principal plus interest. It is hereby advisable ti treat and records the loan provided by the firm to a partner in the partners’ loan account instead of recording to partners’ drawing accounts. The partnership deed usually mentions the method of maintaining capital accounts of partners.

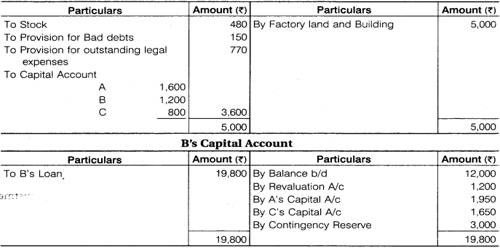

Interest in partners’ loans to the firm is a charge against profit. Such interest is to be allowed whether there is profit or not. So, interest as a partners’ loan is credited to his loan account and later on, it is transferred to the debit of profit and loss account. Hence, for this purpose, they transfer the balance amount after all the adjustments on the credit side of the Retiring Partner’s Capital A/c to Partners Loan Account.

Interest on partners’ loan A/C……………………Dr.

To partners’ loan A/C

Profit and loss A/C ……………………..Dr.

To interest on partners’ loan A/C

However, interest in partners’ loans may also be taken as an appropriation of profits. So, the following accounting treatment can also be followed:

If the partner receives the interest in cash:

Profit and loss appropriation A/C…………………Dr.

To Interest (cash).

Information Source: