The Percentage of Completion (POC) is an accounting method which on the basis of the proportion of work done, measures the continuing identification of income and expenditures related to longer-term projects. This is in contrast to the completed contract process, which delays the revenue and cost reporting until the end of a project. Income, costs, and gross benefit are perceived every period dependent on the level of work finished or costs acquired. The level of-culmination technique for bookkeeping is basic for the development business, yet organizations in different areas likewise utilize the strategy. Through doing so in any accounting period in which the project continues to be operational, the seller can identify any benefit or loss linked to a project. Some businesses have misused the percentage of the completion method to improve short-term results.

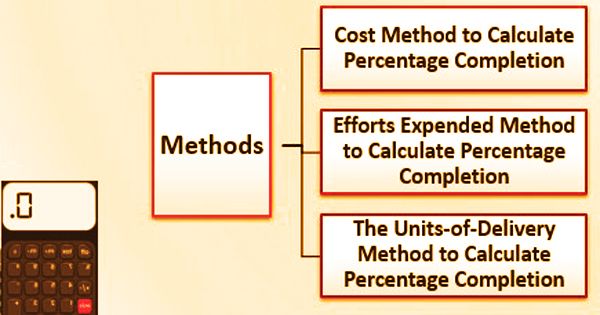

The method works best when it is sensibly conceivable to assess the phases of task finish on a progressing premise, or if nothing else to gauge the leftover expenses to finish a venture. The representing long haul contracts utilizing the level of fruition technique is a special case for the essential acknowledgment standard. This methodology is used in which the profits are measured on the basis of the costs incurred so far. In proportion to the completeness of the contracted project, the system considers revenues and expenditures. It is generally calculated by the metric of cost-to-cost.

(Percentage Of Completion Method)

There are two conditions to use the percentage of completion method:

- Collections by the company must be reasonably assured.

- Costs and project completion must be reasonably estimated.

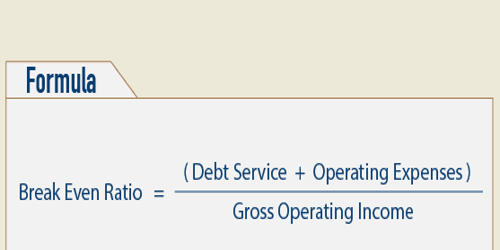

Conversely, where there are substantial questions about the percentage of completion of the remaining costs to be incurred, this approach should not be used. The assessing capacities of a contractual worker should be viewed as adequate to utilize the level of culmination technique on the off chance that it can appraise the base all out income and most extreme complete expense with adequate certainty to legitimize an agreement offer. To calculate the tax liability for the year, the current income and expenditures are compared with the total projected costs.

For example, a project that is 20 percent completed in year one and 35 percent completed in year two will only have the second year’s incremental 15 percent of revenue remembered. In the income statement, the identification of income and expenditures on this work-in-progress basis applies, but the balance sheet is treated in the same manner as the process of the finished contract.

In the cost-to-cost approach, the level of finishing depends on the expenses caused to the assessed all-out expense to finish the undertaking. Consequently, the condition for the cost-to-cost of rate finish is:

Percentage complete = Cost incurred to date / Estimated total cost

Revenue recognized:

Revenue = Cost incurred to date / Estimated total cost × Contract price – Revenue previously recognized

Construction companies that are contractors for homes, energy installations, public sector utilities, and other long-term physical projects typically use the percentage of the completion accounting process. The percentage of completion method helps one to consider the percentage of overall revenue that corresponds to the percentage of completion of a project as revenue. It has likewise been utilized by guard temporary workers (think atomic submarines or plane carrying warships) and programming designers whose ventures speak to a multi-year duty of assets. For programming engineers, the item should be a critical handcrafted venture for a customer.

- The steps needed for the percentage of completion method are as follows:

- To meet the total estimated gross profit, deduct the total estimated contract costs from the total estimated contract revenues.

- Measure, using one of the methods mentioned above the degree of progress towards completion.

- To arrive at the total sum of revenue that can be recognized, calculate the total expected contract revenue by the estimated completion percentage.

- Subtract from the overall sum of profits that can be recognized the contract revenue recognized to date through the preceding period. In the present accounting cycle, consider the outcome.

- Calculate the expense of acquired income in a similar way. This implies duplicating a similar level of fruition by the absolute assessed contract cost and deducting the measure of the cost previously perceived to show up at the expense of procured income to be perceived in the current accounting period.

The percentage of the completion process is prone to misuse by dishonest businesses. Those who choose to engage in creative accounting, understating or overstating numbers, can easily switch around income and expenditures from one time to another period. This method is dependent upon deceitful action, generally to over-gauge the measure of income and benefit that should be perceived. Detailed project milestone documents and completion status will mitigate, but cannot eradicate, the risk of fraud.

Information Sources: