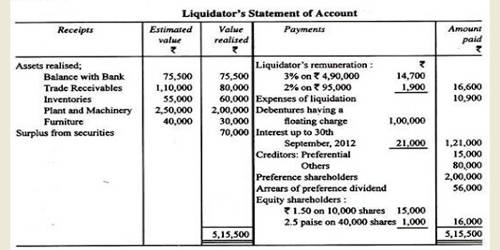

The final Statement of Accounts is the final result of all financial activities in a nutshell. A liquidator is a person or entity that liquidates something—generally assets. It is prepared at the end of a financial year to ascertain the profit/loss of the organization and to exhibit the condition of the organization in monetary terms. Liquidation basis accounting is concerned with preparing the financial statements of a business in a different way if its liquidation is considered to be imminent. If the liquidation is rushed, this could mean that the estimated selling price is less than the fair market value. There is no real point in doing so since the business will presumably be liquidated so soon that the amount of any discount would be immaterial. The liquidator is legally empowered to act on behalf of the company in various capacities. Assets of a company are sold by the liquidator and the resulting funds are used to pay off the company’s debts. Other actions include collecting outstanding receivables, paying off debts and finishing other corporate termination procedures.

Receipt Side of Liquidator’s Final Statement

(i) Assets Realized: The liquidator would collect the amount by selling the assets of the liquidating a company. Such an amount received from sold out of assets comes under this heading.

(ii) Surplus from securities: It is related to secured creditors. The secured creditors provide the loan against the security. In the treatment of realization from such security, there are possibilities of two situations:

- Only one surplus amount sent by the creditors.

- Whole securities realized by the liquidator and later the creditors are paid off.

In the condition a., the liquidator will receive remuneration on the net amount realized. On the condition b., the liquidator would receive the remuneration on the entire amount of securities realized.

(iii) Collection of unpaid calls: The liquidator can collect the unpaid calls if there is a shortage of amount to discharge the liability. These unpaid calls are collected from shareholders. Similarly, if there are any due calls, in that case, the liquidator can also make calls and can collect money from them.