Share capital refers to the funds a company receives from selling ownership shares to the public. Share capital comprises capital that is generated from funds generated by issuing shares for cash or non-cash considerations. It is responsible for keeping the business operation and functioning smooth and running Companies have a requirement of share capital for the purpose of financing their operations. The share capital of the company will increase with the issuance of new shares. Its indispensable role in the structure of a limited company and the enhancement of market reputation makes it vital for owners.

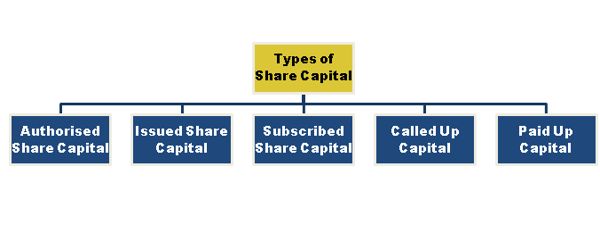

Share capital of a company can be divided into the following different categories:

- Authorized, registered, maximum or normal capital

This is the amount of capital with which the company intends to get itself registered. The maximum amount of capital, which a company is authorized to raise from the public by the issue of shares, is known as authorized capital. This is the amount of share capital that a company is authorized to issue. It is a capital with which a company is registered, therefore it is also known as registered capital.

- Issued Capital

A company need not issue the entire authorized capital at once. Generally, a company does not issue its authorized capital to the public for a subscription but issues a part of it. So, the issued capital is a part of authorized capital, which is offered to the public for subscription, including shares offered to the vendor for consideration other than cash. It goes on raising the capital as and when the need for additional funds is felt. The part of authorized capital not offered for subscription to the public is known as ‘un-issued capital’. Such capital can be offered to the public at a later date. Issued capital includes the shares allotted to the public, vendors, signatories to the memorandum of association, etc.

- Subscribed Capital

It cannot be said that the entire issued capital will be taken up or subscribed by the public. It may be subscribed in full or in part. It is that part of the nominal capital which has actually been taken up by shareholders who have agreed to give consideration in kind or in cash for shares issued to them. The part of issued capital, which is subscribed by the public, is known as subscribed capital. Subscribed capital cannot be more than issued capital.

- Called Up Capital

It is that part of subscribed capital, which is called by the company to pay on shares allotted. The amount due on the shares subscribed may be collected from the shareholders in installments at different intervals. It is not necessary for the company to call for the entire amount on shares subscribed for by shareholders. Called-up capital is that amount of the nominal value of shares subscribed for which the company has asked its shareholders to pay by means of calls or otherwise. The amount, which is not called on subscribed shares, is called uncalled capital.

- Paid-up Capital

It is that part of called up capital, which actually paid by the shareholders. Paid up capital of the company is calculated by deducting the calls in arrears from the called up capital. Therefore it is known as real capital of the company. Whenever a particular amount is called and a shareholder fails to pay the amount fully or partially, it is known an unpaid calls or calls in arrears.

Paid-up Capital = Called up capital – calls in arrears

- Reserve Capital

It is that part of uncalled capital which has been reserved by the company by passing a special resolution to be called only in the event of its liquidation. The portion of subscribed capital has not been called up except in the event and to wind up. This capital can not be called up during the existence of the company. It would be available only in the event of liquidation as additional security to the creditors of the company

Information Source: