Islamic banking is a kind of banking system which is following Islamic rules and regulations in their Banking system. They don’t believe in interest and their Banking system is totally out of interest. In 1978 a conference of OIC was held in Senegal and in that conference a definition of Islamic Banking is selected and accepted by OIC which is “Islamic Bank is a financial Institution whose statutes, rules and procedures expressly state its commitment to the principals of Islamic Shariah and to the banning of the receipt and payment of riba on any of its operations.

Islami Bank Training and Research Academy

Q01. What is Islamic Banking? Write down the mission and vision of Islami Bank Bangladesh Limited and features of Islamic Banking.

Ans: Islamic banking (or participant banking) is banking or banking activity that is consistent with the principles of Islamic law (Sharia) and its practical application through the development of Islamic economics. Sharia prohibits the payment or acceptance of specific interest or fees (known as Riba or usury) for loans of money. Investing in businesses that provide goods or services considered contrary to Islamic principles is also Haraam (forbidden). While these principles were used as the basis for a flourishing economy in earlier times, it is only in the late 20th century that a number of Islamic banks were formed to apply these principles to private or semi-private commercial institutions within the Muslim community.

Mission of Islami Bank:

To Islamic Banking through the introduction of a welfare oriented banking system and also ensure equity and justice in the field of all economic activities, achieve balanced growth and equitable development through diversified investment operations particularly in the priority sectors and less development areas of the country.

To encourage socio economic uplift and financial services to the low income community particularly in the rural areas.

Vision:

Our vision is to always strive to achieve superior financial performance, be considered a leading Islamic bank by reputation and performance.

- Our goal is to establish and maintain the modern banking techniques, to ensure the soundness and development of the financial system based on Islamic principles and to become the strong and efficient organization with highly motivated professionals, working for the benefit of people, based upon accountability, transparency and integrity in order to ensure stability of financial system.

- We will try to encourage savings in the form of direct investment.

- We will also try to encourage investment particularly in projects which are more likely to lead to higher employment.

Features of Islamic Banking

An Islamic bank has several distinctive features as compared to its conventional counterpart. Chapra(1985, PP.154-57) has outlined six essential differences as below:

Abolition of interest (Riba): Since Riba is prohibited in the Quran and interest in all its forms is akin to Riba, as confirmed by Fuqaha and Muslim economists with rare exceptions, the first distinguishing feature of an Islamic bank must be that it is interest-free.

Adherence to public interest: Activity of commercial banks being primarily based on the use of public funds, public interest rather than individual or group interest will be served by Islamic commercial banks. The Islamic banks should use all deposits, which come from the public for serving public interest and realizing the relevant socio-economic goals of Islam. They should play a goal-oriented rather than merely a profit-maximizing role and should adjust themselves to the different needs of the Islamic economy.

Multi-purpose bank: Another substantial distinguishing feature is that Islamic banks will be universal or multi-purpose banks and not purely commercial banks. These banks are conceived to be a crossbreed of commercial and investment banks, investment trusts and investment -management institutions, and would offer a variety of services to their customers. A substantial part of their financing would be for specific projects or ventures. Their equity-oriented investments would not permit them to borrow short-term funds and lend to long-term investments. This should make them less crisis-prone compared to their capitalist counterparts, since they would have to make a greater effort to match the maturity of their liabilities with the maturity of their assets.

More careful evaluation of investment demand: Another very important feature of an Islamic bank is its very careful attitude towards evaluation of applications for equity oriented financing. It is customary that conventional banks evaluate applications, consider collateral and avoid risk as much as possible. Their main concern does not go beyond ensuring the security of their principal and interest receipts. Since the Islamic bank has a built in mechanism of risk sharing, it would need to be more careful in how it evaluates financing requests. It adds a healthy dimension in the whole lending business and eliminates a whole range of undesirable lending practices.

Work as catalyst of development: Profit-loss sharing being a distinctive characteristic of an Islamic bank fosters closer relations between banks and entrepreneurs. It helps develop financial expertise in non-financial firms and also enables the bank to assume the role of technical consultant and financial adviser, which acts as catalyst in the process of industrialization and development.

Q02.What is history of Islamic Banking in Bangladesh? Write down the important information of IBBL.

Ans: A development of complete Islamization of banking at national levels had been gaining momentum since the second half of the 1970s. The movement took basically two forms. First, an attempt was made to establish Islamic financial institutions side-by-side with traditional banking. In such attempts, two types of institutions were evolved: Islamic banks were established mostly in Muslim countries; and Islamic investment and holding companies started operating in some Muslim but mostly in non-Muslim countries. These institutions claimed to be operating without interest in their transactions and competed with conventional banks to attract deposits. The majority of these institutions were established through private initiatives. Second, an attempt was made to restructure the whole financial system of the economy in accordance with the teachings of Islam. This second approach was accomplished in two distinct ways, as exemplified by the changes in Iran and Pakistan. Complete Islamization efforts of Bangaladesh is now discussed.

In August 1974, Bangladesh signed the Charter of Islamic Development Bank and committed itself to reorganise its economic and financial system as per Islamic Shariah. In January 1981, Late President Ziaur Rahman while addressing the 3rd Islamic Summit Conference held at Makkah and Taif suggested, ”The Islamic countries should develop a separate banking system of their own in order to facilitate their trade and commerce.”

This statement of Late President Ziaur Rahman indicated favourable attitude of the Government of the People’s Republic of Bangladesh towards establishing Islamic banks and financial institutions in the country. Earlier in November 1980, Bangladesh Bank, the country’s Central Bank, sent a representative to study the working of several Islamic banks abroad.

In November 1982, a delegation of IDB visited Bangladesh and showed keen interest to participate in establishing a joint venture Islamic bank in the private sector. They found a lot of work had already been done and Islamic banking was in a ready form for immediate introduction. Two professional bodies -Islamic Economics Research Bureau (IERB) and Bangladesh Islamic Bankers’ Association (BIBA) made significant contributions towards introduction of Islamic banking in the country. They came forward to provide training on Islamic banking to top bankers and economists to fill-up the vacuum of leadership for the future Islamic banks in Bangladesh. They also held seminars, symposia and workshops on Islamic economics and banking throughout the country to mobilise public opinion in favour of Islamic banking.

Their professional activities were reinforced by a number of Muslim entrepreneurs working under the aegis of the then Muslim Businessmen Society (now reorganised as Industrialist & Businessmen Association). The body concentrated mainly in mobilising equity capital for the emerging Islamic bank. At last, the long drawn struggle to establish an Islamic bank in Bangladesh became a reality and Islami Bank Bangladesh Limited was established in March 1983 in which 19 Bangladeshi national, 4 Bangladeshi institutions and 11 banks, financial institutions and government bodies of the Middle East and Europe Including IDB and two eminent personalities of the Kingdom of Saudi Arabia joined hands to make the dream a reality. Later, other three Islamic Banks were established in the country. .

Islami Bank Bangladesh Limited (IBBL) is considered to be the first interest free bank in Southeast Asia. It was incorporated on 13-03-1983 as a Public Company with limited liability under the companies Act 1913. The bank began operations on March 30, 1983.

IBBL is a joint venture multinational Bank with 63.92% of equity being contributed by the Islamic Development Bank and financial institutions like-Al-Rajhi Company for Currency Exchange and Commerce, Saudi Arabia, Kuwait Finance House, Kuwait, Jordan Islamic Bank, Jordan, Islamic Investment and Exchange Corporation, Qatar, Bahrain Islamic Bank, Bahrain, Islamic Banking System International Holding S. A., Luxembourg, Dubai Islamic Bank, Dubai, Public Institution for Social Security, Kuwait Ministry of Awqaf and Islamic Affairs, Kuwait and Ministry of Justice, Department of Minors Affairs, Kuwait. In addition, two eminent personalities of Saudi Arabia namely, Fouad Abdul Hameed Al-Khateeb and Ahmed Salah Jamjoom are also the sponsors of IBBL. The total number of branches as of December 2010 stood at 251. The authorized capital of the bank is Tk. 500 million and subscribed capital is Tk. 160 million.

History & Milestone of IBBL:

History & Milestone of IBBL:

In 1974 – Bangladesh signed the charter of Islamic Development

Bank (IDB)

In 1980 – Bangladesh Bank made study on the operations of Islamic

Banks abroad

In 1982 – Islamic Development Bank came forward to participate a

joint venture Islamic Bank in Bangladesh.

In 1983 – Islami Bank Bangladesh Limited came into being the first

Islamic Bank in the Southeast Asia.

In 1985 – IPO & Listing in Dhaka Stock Exchange

In 1991 – Opening of 50th Branch

In 1997 – Opening of 100th Branch

In 2004 – Opening of 150th Branch

In 2007 – Opening of 186th Branch

In 2008 – Opening of 206th Branch

Now Islami Bank Bangladesh LTD. has 251 branches.

Other remarkable islamic banks in bangladesh begins their journey

In 1987 – Al Baraka Bank Bangladesh Ltd, Now ICB Islamic Bank.

In 1995 – Al Arafah Islami Bank Limited.

In 1995 – Social Islami Bank Limited.

In 1997 – Foysal Islamic Bank, Later Shamil Bank of Bahrain.

In 2001 – Shahjalal Islami Bank Limited.

In 2004 – Export Import Bank of Bangladesh

In 2009 – First Security Islami Bank Limited.

Q03. What are the deposit products, special investment scheme and other services of IBBL?

Ans: Deposit Products of IBBL are listed below:

Al-Wadeeah Current Account

Mudaraba Term Deposit Receipt

Mudaraba Special Notice Account

Mudaraba Special Savings (Pension) Account

Mudaraba Hajj Savings Account

Foreign Currency Account

Non-Residential Investor Taka Account

Mudaraba Savings Bond Scheme

Mudaraba Foreign Currency Deposit Scheme (Savings)

Mudaraba Waqf Cash Deposit Account

Mudaraba Monthly Profit Deposit Scheme

Mudaraba Muhor Savings Deposit Scheme

Foreign Currency Account

Mudarba NRB savings Bond

Special investment schemes are shown below:

Household Durable Scheme

Housing Investment Scheme

Real State Investment Program

Transport Investment Program

Car Investment Scheme

Investment Scheme for Doctors

Small Business Investment Scheme

Agriculture Implements Investment Scheme

Micro Industries Investment Scheme

Mirpur Silk Weavers Investment Scheme

Other banking services :

Issuance of payment order, demand drafts, telegraphic transfer.

ATM Service is available.

Locker service is available in selected branches.

The bank gives counseling on different issues.

On banking is available.

SMS banking.

Q04. Mention present status of IBBL in respect of deposit, investment and profit as well as Board of directors, shariah supervisory committee, wings, division, and no. of zonal office and branches.

Ans: Present status of IBBL in respect of deposit:

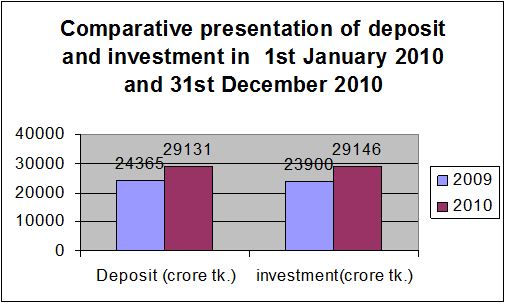

The total deposit of Islami Bank Bangladesh Limited has reached at Tk. 29,131 crore as on 31 December 2010 increasing Tk.4,766 crore in a year from January 1, 2010 showing the growth rate of 20%.

The total investment reaches at Tk.29,146 crore increasing Tk.5,246 crore showing the growth rate of 22%.

Present status of IBBL in respect of profit:

Islami Bank Bangladesh Ltd. (IBBL) was one of the top operating profit earners — Tk 11.43 billion in 2010 against Tk 8.440 billion earned in the previous year.

Board of directors:

Prof. Abu Nasser Muhammad Abduz Zaher

Chairman

Janab Yousif Abdullah Al-Rajhi

Vice Chairman

Engr. Mustafa Anwar

Vice Chairman

Engr. Md. Eskander Ali Khan

Director

Janab Md. Khurshed Hossain

Director

Dr. Abdulhameed Fouad Al Khateeb

Director

Mominul Islam Patwary

Director

Janab Mohammad Adnan Midani

Director

Janab Mohammad Abdullah AlJalahma

Director

Janab Hafizul Islam Mian

Director

Janab Md. Shahidul Islam

Director

Engr. Muhammad Dawood Khan

Director

Janab Mohammed Nazrul Islam

Director

Janab Md. Abdus Salam, FCA, FCS

Depositor Director

Janab Humayun Bokhteyar

Depositor Director

Janab Professor NRM Borhan Uddin, PhD

Independent Director

Janab Md. Abdul Mannan

Ex-Officio, Director

Shariah supervisory committee:

Shariah Council of the Bank is playing a vital role in guiding and supervising the implementation and compliance of Islamic Shariah principles in all activities of the Bank since its very inception. The Council, which enjoys a high status in the structure of the Bank, consists of prominent ulema, reputed banker, renowned lawyer and eminent economist.

Members of the Shariah Council meet frequently and deliberate on different issues confronting the Bank on Shariah matters. They also conduct Shariah inspection of branches regularly so as to ensure that the Shariah principles are implemented and complied with meticulously by the branches of the Bank.

| Name | Designation |

| Moulana Muhammad Kutubuddin President, Baitush Sharaf Coplex, Chittagong | Chairman |

| Moulana Delawar Hossain Sayedee former Member of Parliament, Dhaka | Vice Chairman |

| Prof. Dr. Abu Bakr Rafique Ahmed Pro- Vice Chancellor International Islami University Chittagong | Member Secretary |

| Principal Muhammad Serajul Islam Ex. Principal Madrasha-E-Mesbahul Ulum, Motijheel, Dhaka | Member Additional Secretary |

| Mufti Sayed Ahmed Head Mufti of Al Jamiatus Siddikiah Darul Ulum (Madrasha-e-Furfura Sharif), Dhaka | Member |

| Abdur Raquib Former Executive President of Islami Bank Bangladesh Limited | Member |

| Muftee Shamsuddin (Zia) Mufti & Muhaddis, Al-Jameatul Islamiah, PatiyaChittagong | Member |

| Advocate Mujibur Rahman Senior Advocate, Bangladesh Supreme Court | Member |

| Moulana Abdus Shaheed Naseem President, Bangladesh Quaran Shikkha Society | Member |

| Dr. Hafez Moulana Hasan Muhammad Moinuddin Chairman, Da`wah & Islamic Studies Department, Darul Eahsan University, Dhaka | Member |

| Dr. Moulana A. S. M. Toriqul Islam Associate Professor, Islami University, Kushtia | Member |

| Dr. Md. Abdus Samad Assistant Professor, Department of Arabic, International Islamic University Chittagong, Dhaka Campus | Member |

| Dr. Manzur-e-Elahi Assistant Professor of National University | Member |

| Moulana Mohiuddin Rabbani Muhaddis, Fayzul Ulum Madrasha | Member |

Operations Wing

Division / Department

Financial Administration Division

Policy & General Accounts Department

Budget & Expenditure Control Depts.

Reconciliation Department

Establishment & Common Services Division

Common Services Department

Printing and Stationery Department

Dead Stock & Premises

Central Stationery Supply Department

Investment Wing

General Investment Division

GID – I: Dhaka South Zone

GID – II: HO Complex Br and North Zone

GID – III: Chittagong and Comilla Zone

GID – IV: Khulna & Bogra Zone

Project Investment Division

Small Enterprise & Consumer Investment Division

(SE & CID)

Assets Management Division

Recovery Department.

CIB Department

Investment Supervision Department

MIS Monitoring Department

Law Department

Investment, Policy & Planning and Mudaraba & Musharaka Division

International Banking Wing

Foreign Trade Operation Division

Agency and Corresponding Banking Department

Garments Department

Other than Garments department

Treasury and Fund Management Division

Foreign Remittance Service Division

NOSTRO Account Department

Reconciliation Department

Overseas Department

Internal Control & Compliance Wing

Audit and Inspection Division

Compliance Division

Monitoring Division

Human Resources Division

Administration and Personnel Planning Department

Discipline and Appeal Depts.

Staff Welfare and Training Department

Other Divisions

Board Secretariat Division

Research, Planning & Development Division

Rural Development Division

Share Department

No. of Zonal offices :

Number of zonal offices are 12.

No. of branchs:

Number of branches as on 31st December 2010 are 251.

Q05.Mention the accounting cycle with diagram. Write down the golden rules of dedit and credit.

Ans: The sequence of six steps in the processing of financial transactions (from the time they occur to their inclusion in financial statements) pertaining to an accounting period. These steps are: (1) analyzing the transactions as they occur, (2) recording them in the journals, (3) posting debits and credits from journal entries to the general ledger, (4) adjusting the assets with a trial balance, (5) preparing financial statements, and (6) closing the temporary accounts.

Accounting Cycle:

Accounting cycle refers to a complete sequence of accounting procedures which are required to be repeated in same order during each accounting period. Accounting cycle includes:

Recording:

First, all transactions should be recorded in the journal or books of original entry known as subsidiary books as and when they take place.

Classifying:

All entries in the journal of books of original entry should be posted to the appropriate ledger accounts to find out at a glance the total effect of all such transactions in a particular account.

Summarizing:

Last stage is to prepare the trial balance and final accounts with a view to ascertaining the profit or loss made during a trading period and the financial position of the business of a particular date.

Three golden rules of debit and credit:

There are three Golden Rules for Debit & Credit, whole accounting is depend on these three rules :- 1. Debit what comes in & Credit what goes out. 2. Debit the receiver & Credit the giver. 3. Debit all loss/expenses & Credit all gains/profits.

The above rules do not always apply, it is not as simple as Debit is what comes in and Credit is what goes out. If you pay a bill, yes you “Credit” the cash that is going out, but you also Debit the expense account (the opposite side).

The basic rules are, for every Debit there must be an equal Credit and (of course) for every Credit there must be an equal Debit. Debits and Credits MUST BALANCE, ALWAYS!

The terms Debit and Credit literally mean

Debit = Left side of the accounting columns

Credit = Right side of the accounting columns

Also look at Revenue, if you GET money for doing a job or selling a product, there are TWO Sides that must Equal, if you receive cash you (Debit) Cash, but at the same time you must also (Credit) Income (Revenue).

Assets increase with a Debit (as do expense accounts)

Liabilities increase with a Credit (as does Owners Equity or Capital accounts)

Q06. What is cheque and what are the essential conditions of Cheque? What are the parties of a cheque

Ans: Cheque is a very common form of negotiable instrument. If you have a savings bank account or current account in a bank, you can issue a cheque in your own name or in favor of others, thereby directing the bank to pay the specified amount to the person named in the cheque. Therefore, a cheque may be regarded as a bill of exchange; the only difference is that the bank is always the drawee in case of a cheque. The Negotiable Instruments Act, 1881 defines a cheque as a bill of exchange drawn on a specified banker and not expressed to be payable otherwise than on demand.

From the above dentition it appears that a cheque is an instrument in writing, containing an unconditional order, signed by the maker, directing a specified banker to pay, on demand, a certain sum of money only to, to the order of, a certain person or to the bearer of the instrument. The person who draws a cheque is called the ‘drawer’. The banker on whom it is drawn is the ‘drawee’ and the person in whose favor it is drawn is the ‘payee’. Actually, a cheque is an order by the account holder of the bank directing his banker to pay on demand, the specified amount, to or to the order of the person named therein or to the bearer.

Features of a Cheque

- A cheque must be in writing and duly signed by the drawer.

- It contains an unconditional order.

- It is issued on a specified banker only.

- The amount specified is always certain and must be clearly mentioned both in figures and words.

- The payee is always certain.

- It is always payable on demand.

- The cheque must bear a date otherwise it is invalid and shall not be honored by the bank.

- A cheque must be in order to pay money only.

- The cheque must be signed by the maker or drawer.

- Delivery of the cheque is essential.

Parties to a cheque

There are three parties involved in every cheque or payment order:

- Drawer

The person who gives the order (writes out the cheque); - Drawee

The financial institution upon whom the cheque is drawn; - Payee

The person or organisation named to receive payment.

There may also be an endorser and/or an endorsee:

- Endorser

Person who negotiates the cheque by endorsing (signing) it over to someone else. - Endorsee

Person to whom the cheque is endorsed

Q07. What are the checking points for payment of cheque? What are checking points for passing officer and paying officer?

Ans: Cheque is payable on due presentation for payment if it is:

- the cheque is issued from the payee branch.

- duly signed by the drawer

- sufficient credit balance on the account

- presented within stipulated time of banking hour

- the check is not post dated or stale

- the amount in figure and word does not differ.

Checking points of passing officials:

1. check particulars of cheque

2. check posting mark

3. check singnature of account holder.

4. if Ok,cancelled the cheque with signature. Affixed pay ‘cash’ seal.

5. Handed over the cheque to paying cashier for payment.

Checking point of paying cashier:

1.check particular of cheque

2. check “posted seal” and signature of computer operator

3. signature of the cancellation officials and “pay cash” seal.

4. call back the token foil.

5. obtain signature of bearer on the back of cheque and tally the signatures.

6. if “ok”, affixed cash paid seal.

7. pay the amount to its holder

8. noted the amount of denomination on the back of the cheque

9. enter the particular in paying register(B -12).

Q08. What are the duties and responsibilities of collecting and paying bankers?

Ans: The banker’s duty of care in payment and collecting of checks

A collecting banker is one who undertakes to collect the amount of a cheques & bills for his customer from the paying banker. A banker is under no legal obligation to collect cheques drawn upon other banks for a customer. But this function is performed by every modern bank.

Banks are the main financial institutes which could deal with checks. No other financial institution is generally permitted by law to offer the services which are related to checks.

Therefore, the payment and collection of checks may be the most important function performed by banks for their customer. Generally, the payment and collection of checks involves two banks.

In the case of uncrossed checks, the payee or the holder of check could present it for payment at the counter of the paying bank upon whom the check is drawn. In such a situation, only one bank, the paying bank is involved.

But, in the case of crossed checks, payee must have to forward the check to his bank for collection from the drawer’s bank and therefore two banks, the paying and the collecting banks are involved.

However, there may be some instances where both the paying and collecting banks are the same. For example, where the payee or a holder of the check maintains his account in the same branch of the bank in which the drawer has his account.

Let’s see, what the duties of a banker are in relation to payment and collecting of checks. Bankers liability in the payment and collecting of checks mainly arises when the checks handle by them are associated with forgeries. Therefore, the banker has a duty to act in good faith, without negligence and due diligence in the ordinary course of business so as to mitigate the forgeries.

First of all, it is the paying banker’s duty to check whether the check has been signed by the drawer and his signature confirms with the specimen signature and also make sure that there is no material alteration apparent on the check.

In the case where there is any suspicious circumstance, banker should decide the best interest of his customer and should return the check to obtain confirmation from the drawer.

On the other hand, a drawer of a check may issue an advice to his bank to stop the payment where he came to know that a check drawn by him was lost. Then the banker should act in good faith and should immediately take steps to stop the payment.

If the banker receives advice of stop payment by the drawer over the phone, he should immediately make sure that party who gave the advice was the drawer of the check.

However, the banker acting as his customer’s agent in collection of checks is also expected to act with reasonable care and diligence. It is a fundamental duty of the collecting bank to examine the endorsements on the checks and to make sure that they are regular.

Therefore, the collecting bankers should act in due diligence and without negligence in order to protect the title of the true owner. Thus, a collecting bank should take extreme care identifying the party in payment and the genuineness of the transaction

However, it does not mean that, the collecting bank must do a microscopic examination to detect every irregularity. What is expected to do is to take reasonable care and proper attention to minimize the forgeries.

Q09. What are the elements of sources of fund? What are the elemets of replication of funds? What do you mean by intangible assets and share holder equity?

Ans: Sources of Fund

Banking is a business which is run on the confidence and trust of people. This confidence enjoyed by banks enables them to mobilize funds from the various categories of sources comprising of:

- Paid-up Share capital

- Reserve fund and undistributed profits

- Deposits form the public I various accounts.

- Borrowings from Bangladesh Bank and others Bank.

Replication of fund: For the purpose of supervision, capital has been categorized into three tiers which are shown below:

Core and Supplementary capital and their components

Capital | Components |

| Tier-1 Core Capital |

(Comprises of highest quality capital elements)

- Paid up Capital

- Non- repayable share premium account

- Statutory Reserve

- General Reserve

- Retained Earnings

- Minority Interest in Subsidiaries(N/A)

- Non- Cumulative Irredeemable Preference Shares(N/A)

- Dividend Equalization Account.

- Investment Loss Off- setting Reserve

Tier-2 Supplementary Capital

(Comprises other elements which fall short of some of the characteristics of the core capital)

- General provisions (1% of unclassified investment)

- Assets revaluation reserve(50%)

- All other preference shares(N/A)

- Exchange equalization account

- Revaluation reserve of securities

- Mudaraba Perpetual Bond(30%) of Core capital

Tier-3 Supplementary capital( Consists of short term subordinated debt & meets a partial capital requirement for market risk only

- Short term subordinated debt.

Intangible Asset

Intangible assets are nonphysical resources and rights that have a value to the firm because they give the firm some kind of advantage in the market place. Examples of intangible assets are goodwill, copyrights, trademarks, patents and computer programs, and financial assets, including such items as accounts receivable, bonds and stocks.

Share holder equity

A firm’s total assets minus its total liabilities. Equivalently, it is share capital plus retained earnings minus treasury shares. Shareholders’ equity represents the amount by which a company is financed through common and preferred shares.

Share holder equity is also known as “share capital”, “net worth” or “stockholders’ equity”. Shareholders’ equity comes from two main sources. The first and original source is the money that was originally invested in the company, along with any additional investments made thereafter. The second comes from retained earnings which the company is able to accumulate over time through its operations. In most cases, the retained earnings portion is the largest component.

Q10. What do you mean by income statement, Balance sheet and Cash flow statement?

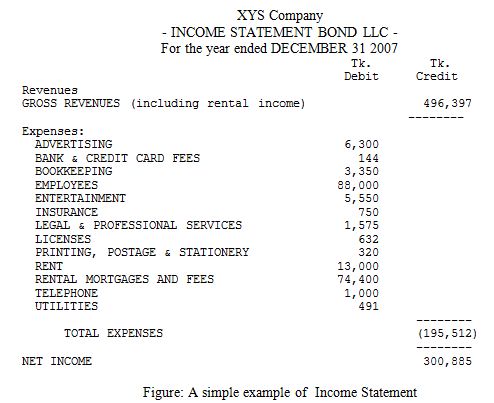

Ans: Income statement (also referred as profit and loss statement (P&L), statement of financial performance, earnings statement, operating statement or statement of operations)[1] is a company’s financial statement that indicates how the revenue (money received from the sale of products and services before expenses are taken out, also known as the “top line”) is transformed into the net income (the result after all revenues and expenses have been accounted for, also known as the “bottom line”). It displays the revenues recognized for a specific period, and the cost and expenses charged against these revenues, including write-offs (e.g., depreciation and amortization of various assets) and taxes. The purpose of the income statement is to show managers and investors whether the company made or lost money during the period being reported.

The important thing to remember about an income statement is that it represents a period of time. This contrasts with the balance sheet, which represents a single moment in time.

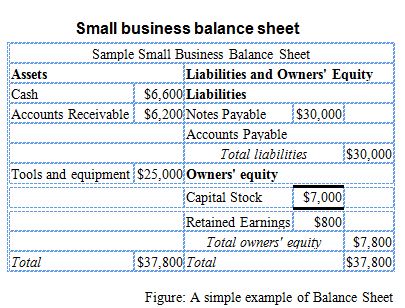

In financial accounting, a balance sheet or statement of financial position is a summary of the financial balances of a sole proprietorship, a business partnership or a company. Assets, liabilities and ownership equity are listed as of a specific date, such as the end of its financial year. A balance sheet is often described as a “snapshot of a company’s financial condition”. Of the four basic financial statements, the balance sheet is the only statement which applies to a single point in time of a business’ calendar year.

A standard company balance sheet has three parts: assets, liabilities and ownership equity. The main categories of assets are usually listed first, and typically in order of liquidity.[2] Assets are followed by the liabilities. The difference between the assets and the liabilities is known as equity or the net assets or the net worth or capital of the company and according to the accounting equation, net worth must equal assets minus liabilities.

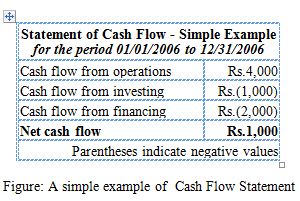

In financial accounting, a cash flow statement, also known as statement of cash flows or funds flow statement, is a financial statement that shows how changes in balance sheet accounts and income affect cash and cash equivalents, and breaks the analysis down to operating, investing, and financing activities. Essentially, the cash flow statement is concerned with the flow of cash in and cash out of the business. The statement captures both the current operating results and the accompanying changes in the balance sheet.[1] As an analytical tool, the statement of cash flows is useful in determining the short-term viability of a company, particularly its ability to pay bills. International Accounting Standard 7 (IAS 7), is the International Accounting Standard that deals with cash flow statements.

Q11. What is clearing house? What do you mean by transfer delivery? What is OBC and IBC?

Ans: Movement of a check from the bank in which it was deposited to the bank on which it was drawn, and the movement of its face amount in the opposite direction. This process (called ‘clearing cycle’) normally results in a credit to the account at the bank of deposit, and an equivalent debit to the account at the bank on which it was drawn. Also called clearing.

Clearing stands for mutual settlement of claims made in among member banks at an agreed time and place in respect of instruments drawn on each other.

Clearing House is an arrangement under which member banks agree to meet, through their representatives, at the appointed time and place to deliver instruments drawn on the other and in exchange to receive instruments drawn on them.

The net amount payable or receivable as the case may be is settled through an account kept with the controlling bank (Bangladesh Bank/Sonali Bank)

After receiving, instruments should be crossed with the bank’s “Crossing Stamp” immediately. When preliminary checking is over and stamping of the instruments done, the deposits should be classified in to three groups:

1. Transfer

2. Outstation Collection

3. Clearing

Clearing department deals with the cheques, drafts & other instruments and its collection & payment process. Instrument intended for the clearing house should be branded with Bank’s Clearing Stamp. If the deposits are made at a time when it is too late for those to be presented to the drawee banks on the same day stamp. “Too late for today’s clearing” should be affixed on the counterfoil of the deposit slips.

Meaning of Transfer Delivery:

Transfer delivery system is an easy and quick system of collection/settelement of the drafts, foreign drafts, payment orders etc. drawn on the branches of same bank and located under the same clearing house or or under jurisdiction of collecting branches. It may also be noted as “internal clearing house” system.

Cheque are not under transfer delivery, its are under on line system.

Outward Bills for Collection (OBC):

The instrument out of station i.e. beyond clearing house area are called Outward Bills for Collection (OBC). A schedule is prepared for OBC where mentioned the proceed remitted by IBCA or Demand draft. OBCs instrument must always be endorsed. The endorsement of the instrument is always endorsement –3. OBCs are recorded in a pucca register with date, serial number, drawee’s bank, amount.

Inward Bills for Collection (IBC):

The instrument sent to us from the outstation branches of the banks for collection are called Inward Bills for Collection (IBC). Such instruments may be drawn on us or on other branches /banks of the city. On receipt of the IBC the same is to be inserted in the IBC register and IBC No. is to be written on the forwarding letter of the same by fixing rubber stamp.

In case the cheques and bills received through IBC are drawn on our branches the same are to be collected through transfer delivery.

In case of instrument drawn on other Bank’s branches in the city the same are to be collected through clearing house.

Q12. What is negotiable instruments? What do you mean by crossing? What are the types of crossing?

Ans: A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time. According to the Negotiable Instruments Act, 1881 there are just three types of negotiable instruments i.e., promissory note, bill of exchange and cheque.Cheque also includes Demand Draft.

More specifically, it is a document contemplated by a contract, which (1) warrants the payment of money, the promise of or order for conveyance of which is unconditional; (2) specifies or describes the payee, who is designated on and memorialized by the instrument; and (3) is capable of change through transfer by valid negotiation of the instrument.

Negotiable instruments distinguished from contracts

A negotiable instrument can serve to convey value constituting at least part of the performance of a contract, albeit perhaps not obvious in contract formation, in terms inherent in and arising from the requisite offer and acceptance and conveyance of consideration. The underlying contract contemplates the right to hold the instrument as, and to negotiate the instrument to, a holder in due course, the payment on which is at least part of the performance of the contract to which the negotiable instrument is linked. The instrument, memorializing (1) the power to demand payment; and, (2) the right to be paid, can move, for example, in the instance of a ‘bearer instrument’, wherein the possession of the document itself attributes and ascribes the right to payment. Certain exceptions exist, such as instances of loss or theft of the instrument, wherein the possessor of the note may be a holder, but not necessarily a holder in due course. Negotiation requires a valid endorsement of the negotiable instrument. The consideration constituted by a negotiable instrument is cognizable as the value given up to acquire it (benefit) and the consequent loss of value (detriment) to the prior holder; thus, no separate consideration is required to support an accompanying contract assignment. The instrument itself is understood as memorializing the right for, and power to demand, payment, and an obligation for payment evidenced by the instrument itself with possession as a holder in due course being the touchstone for the right to, and power to demand, payment. In some instances, the negotiable instrument can serve as the writing memorializing a contract, thus satisfying any applicable Statute of Frauds as to that contract.

Classes

Promissory notes and bills of exchange are two primary types of negotiable instruments.

Promissory note

A negotiable promissory note is an unconditional promise in writing made by one person to another, signed by the maker, engaging to pay on demand to the payee, or at fixed or determinable future time, ertain in money, to order or to bearer.Bank note is frequently referred to as a promissory note, a promissory note made by a bank and payable to bearer on demand.

Bill of exchange

A bill of exchange or “draft” is a written order by the drawer to the drawee to pay money to the payee. A common type of bill of exchange is the cheque (check in American English), defined as a bill of exchange drawn on a banker and payable on demand. Bills of exchange are used primarily in international trade, and are written orders by one person to his bank to pay the bearer a specific sum on a specific date. Prior to the advent of paper currency, bills of exchange were a common means of exchange. They are not used as often today.

Definitaion of Crossing

Crossing of a cheque means that the cheque is payable only through a collecting bank. Therefore, it is not payable at the counter of any ridge.

Crossing of cheque ensures security to the holder because only the collecting backer can credit the proceeds to the account of the payee.

Crossing of cheques

Cheques can be of two types:-

1. Open or an uncrossed cheque

2. Crossed cheque

Open Cheque

An open cheque is a cheque which is payable at the counter of the drawee bank on presentation of the cheque.

Crossed Cheque

A crossed cheque is a cheque which is payable only through a collecting banker and not directly at the counter of the bank. Crossing ensures security to the holder of the cheque as only the collecting banker credits the proceeds to the account of the payee of the cheque.

When two parallel transverse lines, with or without any words, are drawn generally, on the left hand top corner of the cheque. A crossed cheque does not effect the negotiability of the instrument. It can be negotiated the same way as any other negotiable instrument.

Types of Crossing

• General Crossing

• Special Crossing

• Account Payee or Restrictive Crossing

• ‘Not Negotiable’ Crossing

Cheque crossed generally

Where a cheque bears across its face an addition of the words ‘and company’ or any abbreviation thereof, between two parallel transverse lines, or of two parallel transverse lines simply, either with or without the words ‘Not Negotiable’, that addition shall be deemed a crossing, and the cheque shall be deemed to be crossed generally.

Cheque crossed specially

Where a cheque bears across its face an addition of the name of a banker, either with or without the words ‘Not Negotiable’, that addition shall be deemed a crossing, and the cheque shall be deemed to be crossed specially, and to be crossed to that banker.

Account Payee or Restrictive Crossing

This crossing can be made in both general and special crossing by adding the words Account Payee. In this type of crossing the collecting banker is supposed to credit the amount of the cheque to the account of the payee only. The cheque remains transferable but the liability of the collecting banker is enhanced in case he credits the proceeds of the cheque so crossed to any person other than the payee and the endorsement in favour of the last payee is proved forged. The collecting banker must act like a blood hound and make proper enquiries as to the title of the last endorsee from the original payee named in the cheque before collecting an ‘Account Payee’ cheque in his account. The same can be done by place slanted parallel line in the top most left corner of the cheque – in writing over their A/C payee’s only.

Not Negotiable Crossing

The words ‘Not Negotiable’ can be added to General as well as Special crossing and a crossing with these words is known as Not Negotiable crossing. The effect of such a crossing is that it removes the most important characteristic of a negotiable instrument i.e. the transferee of such a crossed cheque cannot get a better title than that of the transferor (cannot become a holder in due course) and cannot convey a better title to his own transferee, though the instrument remains transferable.

Q13. What do you mean by self development? What is the process of self development under islamic perspective?

Ans: Self Development

Self Development is defined as a deliberate focus by an individual on self-improvement and the self-realisation of their goals and desires. Self Development can be physical, experiential, mental, emotional or spiritual. Self Development is essentially the exploration of self. The Motivation to undertake Self Development begins with a desire to realise our higher selves through transcending the negative qualities and behaviours we have learned and adopted throughout our lives.

Islam and Notions of the Self

It is interesting to note that the Human Being is considered to be the meeting point of the two different dimensions. The arabic word for such a meeting point is barzakh – interspace:

SPIRITUAL + (BARZAKH) PHYSICAL

In the light of this Islamic perspective, any efforts to gain an understanding of the self require a study of the spiritual aspect of the self. Knowledge of the self, and what it means to be human, in modern times however is not so much the domain of religion as the domain of the field of psychology. In todays’ secular age, the field of psychology is in a way the new theology, and therapists and psychologists are the priests of this age. The irony is that the word “psychology” is based on the Greek word psyche, meaning “soul”, or, “spirit”. Psychology therefore means study of the soul. However it is now anything but, and indeed the idea of a soul or spiritual nature is not even acknowledged in mainstream psychology. As I discussed earlier this attitude of rejecting the spiritual can be traced to the implicit assumptions of Western psychology rooted in secularism – which arose out of a negation of religion or spiritual experience. Instead, within Western psychology, a fragmented view of man is presented. In trying to gain a deeper understanding of human nature, Western psychological theories have tended to focus only on one aspect of the self, e.g. psychoanalysis focuses on the unconscious, cognitive psychology focuses on thoughts, and behavioral psychology focuses on behavior. No doubt, important insights have been gained, yet no model is truly comprehensive in itself. I believe most Western psychotherapies are limited at both ends of the spectrum – they ignore individual spirituality, and they ignore the effects of socio-political factors on the lives of the clients. Fundamental questions relating to man’s existence e.g. ( Where have we come from? What is our purpose in life? What happens after we die? cannot be addressed even by the more sophisticated approaches in mainstream psychology. So really how much knowledge of the self do they have, and how deep is their understanding of human psychology? Even very ‘new’ more integrated therapies which try to include more than one aspect of the self are limited, as they too ignore a dimension of the self which many people regard as central to being human – the spiritual dimension.

On the other hand all Muslims should be excellent psychologists. Our whole life is based on knowing the answers to these basic questions. Wherever you go, from remote villages to modern cities, practising Muslims will be able to tell that we are on a journey: Before we were born we were with Allah, and all souls bore witness that Allah is their Lord ( 7:172) Our purpose in this life is to worship Allah (51:56) After death we will be raised up and according to our deeds in this lifetime we will be rewarded or punished (101:5-8).

Islamic Perspective of Journey of Self

It is clear to us when we view our lives from this perspective; our time here on earth is actually only a small part of our ultimate destiny. The Prophet (pbuh) described this life as a mere drop of water as compared to a whole ocean. Yet, most of us focus the majority of our energy and time on things related only to this life – whether it be our education, our jobs, aiming to reach a certain status, having big bank accounts, wearing the right clothes etc… we rarely step back and think where we have come from, and ultimately where we are all going to. For one thing that every single person on this planet shares in common whether they are rich or poor, white or black, from a high or low class, is that each moment brings us all closer to our death. The death we experience, however, is only physical. Within each and every human is a part of them which is beyond this. It is amazing to reflect that all of us contain infinity within us, within our souls. This is the real us. The part that is not destroyed. How we look after this part of us determines our state in this world and in the hereafter. It is a very simple reality but often forgotten. It is up to each of us to focus on and do our utmost to develop this inner, spiritual aspect of ourselves. Just as people recognize the need to do regular exercise to keep our bodies fit and toned we need to exercise our inner senses. Simple physical neglect we know leads to slackness in our body and ultimately disease. In the same way neglect of our inner selves leads to slackness and disease. Inner diseases include things like arrogance, selfishness, greed, impatience etc. …..all these affect our inner hearts, they are like layers of “dirt” which can lead to us becoming blind inside. Sometimes when people become tuned into their inner hearts they say “my eyes opened” and they wish that others could ‘see’ what they could and regret not seeing it sooner. Obviously there was nothing wrong with their eyesight, it was their inner heart which had been blind. In the simple diagram above, lies the distinct approach that Islam has to the aims and objectives of human beings.

Islam has it’s own definition of ‘progress’ – encompassing both spiritual progress of man – affecting his psychological and social state, and material progress – the harnessing of resources and skills development, which is also very much encouraged in Islam. The important thing to remember here is that for the last few centuries the Western definition of ‘progress’ has really only related to material, technical progress. It is only now being acknowledged, even within Western academic and scientific circles that the West has paid a heavy price in social terms for this material success. It has been learning in a slow and painful manner that material progress in itself cannot ensure social progress. It may help alleviate certain problems but not solve them completely. And if not pursued in a cautious and conscious manner, the rise in technology itself can be a source of social problems. As a psychotherapist I have to deal first hand with the many social and psychological problems people experience in England, which is considered among the most developed and ‘progressive’ countries in the world. Social cohesion has been eroded and the family unit has disintegrated. Cases of anxiety and depression have increased at alarming rates. The irony is that I am actually being approached by mainstream psychology services in England to provide ‘spiritual therapy’ even within the National Health Service. This shows the limitations of the standard psychological therapies: they are simply not adequate in dealing with the severe problems society is facing. However, my message is not that we should not progress materially – of course we should – people have a right to good living standards. Only that we see before us the results of a scientific experiment on the part of the West. It would be unwise to not learn from the results of this – otherwise history would simply repeat itself in the developing countries. Let us take the best and beneficial aspects of Western technology, but from the basis of a firm Islamic foundation and perspective. In this way we should avoid repetition of some of the West’s mistakes of material progress at the expense of social progress. There is no reason why we cannot have the best of both.

Concept of Nafs

Of particular interest in the model of the self is the concept of ‘Nafs’ – the Arabic word used in the Qur’an and translated as ‘self’ or ‘soul’. Due to the different possible states of the self, different types of ‘Nafs’ have been described in the Quran. From the Islamic point of view Nafs can be good or evil as it can be pulled toward higher potentials of the self or lower potentials of the self (Quran, 95:14-16). Earthly existence is about choice – which way will we go? Again the idea of the journey of the self is important. We are capable of choosing various paths – some which are consistent with Islamic aim in life – Union with the creator, and others which are not. The point is that the self is always in a dynamic flux – the same person experiences different states within themselves at different times.

Three important states of the self mentioned in the Quran include:

Nafs Ammara (the commanding or lower self) Quran 12:53. This self is prone to the lower aspects of the self, representing the negative drives in man. It can be viewed as analogous to the Freudian concept of ‘id’ e.g ‘I want to do it now… I don’t care if it’s right or wrong.’

Nafs Lawwama (The self reproaching self) Quran 75:2 This state corresponds to the self when it becomes aware of wrong- doing and feels remorse. A parallel between the Freudian concept of ‘superego’ and nafs lawwama may be drawn. The feeling of “I shouldn’t have done that” or “why did I do that – I wish I hadn’t…”.

Nafs Mutmainnah (The peaceful self) Quran 89:27-28 This is the state of inner peace and happiness, when you feel satisfied and content in yourself. This is the state that we are aiming to achieve. In order to achieve the state of tranquility and peace one has to activate the remorseful self (e.g. through sincere repentance) and control the lower commanding self (through self discipline). 3.

Importance of Balance and Boundaries in Islam

The idea of balancing the different aspects of the self – physical and spiritual – is very important in Islam. One should not go to the extreme of emphasising one aspect of the self at the expense of the other. Exhortation to seek a balance in satisfying both body and soul is found in the Quran: “But seek the abode of the hereafter in that which Allah has given you and neglect not your portion of the world, and be kind even as God has been kind to you and seek not corruption in the Earth…..” (Quran 28:77) We can place Islam’s attitude to physical appetites on a continuum where it lies in between the extremes of suppression and overindulgence.

SUPPRESSION MIDDLE/BALANCE OVERINDULGENCE

Continuum of Attitudes to Physical Instincts

The extremity of suppression is condemned :

“who has forbidden the beautiful and good things which God has bestowed?” (Quran 7:32).

For example, the relationship of attraction between men and women is sanctified, not viewed as a moral compromise, but a blessing, elevated to the rank of the signs of God himself:

“And among his signs is this, that He created for you spouses from among yourselves, that you may find repose in them, and He has put between you love and mercy. Verily in that are indeed signs for people who reflect.” (Quran 30:21)

Also “God has created for your enjoyment everything on earth” (Quran 2:29)

In Islam physical aspects of man are not only legitimated, but man is encouraged to enjoy them. In the light of this, the secular, eg Freud’s view of religion as repressive of natural instincts is clearly not universally applicable. The extremity of over indulgence however is also warned against:

“…..eat and drink without excess, for God loves not those given to excess” (Quran 7:31).

In this way boundaries are set up to ensure moderation. Removal of boundaries and unlimited indulgence may appear attractive at first. However they inevitably lead to an imbalance, the result being an unhealthy state as opposed to a healthy and fulfilled one.

Self Development under Islam

The notion of balance in Islam has implications for the important area of self development. Western psychology conceptualizes self indulgence as removal of moral restrictions on people so that they are not ‘repressed’. According to Freud religious belief is a pathological symptom and sign of arrested development leading to neurosis. In this way the removal or ‘transgression’ of those boundaries limiting free expression of physical drives is encouraged. However no real notion of a ‘healthy’ ideal is suggested. This Freudian approach to mental health of ‘absence of pathology’ is reflected within the tradition of western medicine as a whole. This can be seen to be a rather limiting approach, however. A model at best aimed at ‘absence of disease’ offers no contribution to the important area of self development, as it is unable to define positive mental health. The Islamic model however, would advocate seeking to establish an equilibrium within the physical aspects, so that they are neither denied nor over indulged. The notion of moderation in the Islamic perspective is very much related to concepts of ideal states, balance, adopting the middle way and justice in Islam:

“Thus we have appointed you a middle nation, that you may be witnesses for mankind.” (Quran 2:413).

Indeed, the arabic word ‘Wasata’ in the Quran, translated here as ‘middle’ has been translated in differing English translations as ‘just and best’ (Hilali and Khan) and ‘golden mean’ (Maududi’s commentary translated by Akbar). In this way one word conveys many interrelated concepts. Justice is the consequence of following the middle way, and it is one of the main characteristics of the middle way. Adoption of the ‘middle way’ in the Islamic perspective, is thus both a means and aim of self -development and fulfillment. By taking the middle path we will achieve the ideal state and the ideal state itself is the ‘middle’ or balanced state. In this way, boundaries (determined by God) are not viewed as simply limiting the human self, but as providing parameters within which ultimate inner balance and development can take place. As Muslims we can appreciate the perfection in the balance and limits Allah has placed in creation. If the earth was even slightly closer to the sun, everything would be burnt, and if the earth was even slightly further from the sun, it would be too cold to sustain life. But where Allah has placed it is just right for living things to grow. It is amazing when we discover the beauty, the intricacy and harmony that Allah has placed in the natural system – from cosmology to biology to physics. In the same way the beliefs and practices of Islam provide people with the perfect balance. Islam provides the perfect context for optimum growth and development as it is from Allah who has placed such beauty and order in everything else. He has placed it within us, in our Fitra. When we go beyond the correct limits, we commit an injustice, and ultimately it is an injustice to ourselves – we only betray ourselves in the end:

“O Mankind ! Your rebellion is only against yourselves!” (Quran 10:23). But because we have free will we can choose not to live in this perfect balance within ourselves and with the rest of creation.

Summary

The Islamic approach to the self development can be summarized in two basic points. Striving for self for unification with the Divine, and Striving for self for equilibrium within physical instincts. Both spiritual and physical possibilities are thus optimized.

Q14. What is weightage? What are the factors of weightage?

Ans: Weightage

Weightage means preference of one product in comparison to other product. On the other hand we can say weightage means giving the value of the specific or particular matter / subject higher or lesser than that of / in comparison to similar one.

Factors of Weightage:

1.The more risk, the more weightage.

2.The longer the period, more the risk.

3.More the uses of Bank’s facility, less the weightage.

4.Less the Uses of Bank’s facility, more the benefit weightage.

5.Moral Dimension / Ethical values

Q15. What do you mean by AAOIFI and its objective?

Ans: AAOIFI stands for Accounting and Auditing Organization for Islamic Financial Institutions.

● AAOIFI Objectives:

The objectives of AAOIFI are:

1. To develop accounting and auditing thoughts relevant to Islamic financial institutions;

2. To disseminate accounting and auditing thoughts relevant to Islamic financial institutions and its applications through training, seminars, publication of periodical newsletters, carrying out and commissioning of research and other means;

3. To prepare, promulgate and interpret accounting and auditing standards for Islamic financial institutions; and

4. To review and amend accounting and auditing standards for Islamic financial institutions.

AAOIFI carries out these objectives in accordance with the precepts of Islamic Shari’a which represents a comprehensive system for all aspects of life, in conformity with the environment in which Islamic financial institutions have developed. This activity is intended both to enhance the confidence of users of the financial statements of Islamic financial institutions in the information that is produced about these institutions, and to encourage these users to invest or deposit their funds in Islamic financial institutions and to use their services.

Q16. What do you know about electronic banking?

Electronic banking is an umbrella term for the process by which a customer may perform banking transactions electronically without visiting a brick-and-mortar institution. The following terms all refer to one form or another of electronic banking: personal computer (PC) banking, Internet banking, virtual banking, online banking, home banking, remote electronic banking, and phone banking. PC banking and Internet or online banking are the most frequently used designations. It should be noted, however, that the terms used to describe the various types of electronic banking are often used interchangeably.

PC banking is a form of online banking that enables customers to execute bank transactions from a PC via a modem. In most PC banking ventures, the bank offers the customer a proprietary financial software program that allows the customer to perform financial transactions from his or her home computer. The customer then dials into the bank with his or her modem, downloads data, and runs the programs that are resident on the customer’s computer. Currently, many banks offer PC banking systems that allow customers to obtain account balances and credit card statements, pay bills, and transfer funds between accounts.

Internet banking, sometimes called online banking, is an outgrowth of PC banking. Internet banking uses the Internet as the delivery channel by which to conduct banking activity, for example, transferring funds, paying bills, viewing checking and savings account balances, paying mortgages, and purchasing financial instruments and certificates of deposit. An Internet banking customer accesses his or her accounts from a browser— software that runs Internet banking programs resident on the bank’s World Wide Web server, not on the user’s PC. NetBanker defines a “ true Internet bank” as one that provides account balances and some transactional capabilities to retail customers over the World Wide Web. Internet banks are also known as virtual, cyber, net, interactive, or web banks.

To date, more banks have established an advertising presence on the Internet— primarily in the form of informational or interactive web sites—than have created transactional web sites. However, a number of Banks that do not yet offer transactional Internet banking services have indicated on their web sites that they will offer such banking activities in the future.

Although Internet banks offer many of the same services as do traditional brick-and-mortar Banks, analysts view Internet banking as a means of retaining increasingly sophisticated customers, of developing a new customer base, and of capturing a greater share of depositor assets. A typical Internet bank site specifies the types of transactions offered and provides information about account security.

Because Internet banks generally have lower operational and transactional costs than do traditional brick-and-mortar banks, they are often able to offer low-cost checking and high-yield Certificates of deposit. Internet banking is not limited to a physical site; some Internet banks exist without physical branches, for example, Telebank (Arlington, Virginia) and Banknet (UK). Further, in some cases, web banks are not restricted to conducting transactions within national borders and have the ability to make transactions involving large amounts of assets instantaneously. According to industry analysts, electronic banking provides a variety of attractive possibilities for remote account access, including:

- Availability of inquiry and transaction services around the clock;

- worldwide connectivity;

- Easy access to transaction data, both recent and historical; and

- “Direct customer control of international movement of funds without intermediation of financial institutions in customer’s jurisdiction.”

Online banking (or Internet banking) allows customers to conduct financial transactions on a secure website operated by their retail or virtual bank, credit union or building society

Online banking solutions have many features and capabilities in common, but traditionally also have some that are application specific.

The common features fall broadly into several categories

- Transactional (e.g., performing a financial transaction such as an account to account transfer, paying a bill, wire transfer, apply for a loan, new account, etc.)

- Payments to third parties, including bill payments and telegraphic/wire transfers

- Funds transfers between a customer’s own transactional account and savings accounts

- Investment purchase or sale

- Loan applications and transactions, such as repayments of enrollments

- Non-transactional (e.g., online statements, cheque links, cobrowsing, chat)

- Viewing recent transactions

- Downloading bank statements, for example in PDF format

- Viewing images of paid cheques

- Financial Institution Administration

- Management of multiple users having varying levels of authority

- Transaction approval process

Features commonly unique to Internet banking include

- Personal financial management support, such as importing data into personal accounting software. Some online banking platforms support account aggregation to allow the customers to monitor all of their accounts in one place whether they are with their main bank or with other institutions.

An automated teller machine (ATM), also known as a Cash Point, Cash Machine or sometimes a Hole in the Wall in British English, is a computerised telecommunications device that provides the clients of a financial institution with access to financial transactions in a public space without the need for a cashier, human clerk or bank teller. ATMs are known by various other names including automatic banking machine, cash machine, and various regional variants derived from trademarks on ATM systems held by particular banks.

On most modern ATMs, the customer is identified by inserting a plastic ATM card with a magnetic stripe or a plastic smart card with a chip, that contains a unique card number and some security information such as an expiration date or CVVC (CVV). Authentication is provided by the customer entering a personal identification number (PIN).

Using an ATM, customers can access their bank accounts in order to make cash withdrawals, credit card cash advances, and check their account balances as well as purchase prepaid cellphone credit. If the currency being withdrawn from the ATM is different from that which the bank account is denominated in (e.g.: Withdrawing Japanese Yen from a bank account containing US Dollars), the money will be converted at a wholesale exchange rate. Thus, ATMs often provide the best possible exchange rate for foreign travelers and are heavily used for this purpose as well.

Q17. What are the important features of Money Laundering Prevention Act -2009?

Ans: Whereas it is expedient and necessary to re-enact the Money Laundering Prevention Act 2002(Act 7 of 2002) with several amendments on cancellation of it; and thereafter the Parliament has enacted Money Laundering Prevention Act, 2009.

The main features of Money Laundering Prevention Act -2009 stated as follows:

| 1. | Short title and commencement: | ||

| i) | This Act may be called Money Laundering Prevention Act, 2009 | ||

| ii) | This Act shall come into force immediately. | ||

| 2. | Definition: Unless there is any thing repugnant to the subject or context in this act. | ||

| a) | “Financial Institution” means financial institutions as defined under section 2(b) of Financial Institution Act, 1993 (Act XXVII of 1993): | ||

| b) | ‘Court’ | ||

| c) | ‘Investigation Organization’ means ‘Anti Corruption Commission’ established as per Anti- Corruption Commission Act’ 2004( Act V of 2004); and it also includes any officer empowered by the Commission for the purpose; | ||

| d) | “Currency” | ||

| e) | “Disposal Properties” includes the power to sell in case of, perishable or rapidly depreciating property or power to destroy or to transfer legally by an open tender a property which is required to be destroyed under any other law; | ||

| f) | “Bangladesh Bank” means Bangladesh bank established under Bangladesh bank order, 1972 (PO No. 127 of 1972); | ||

| g) | “Insurance Company” means Insurance Company as defined in section 2(8) of Insurance Act, 1938( Act IV of 1938) | ||

| h) | “Foreign Currency” | ||

| i) | “Bank” means the Bank Company as defined under the section 5(o) of the Bank Company Act. 1991 (Act. XIV of 1991); | ||

| j) | “Money Changer” | ||

| k) | “Money Laundering” means | ||

| i) | transfer, conversion, remitting abroad or remit or bring from abroad to Bangladesh the proceeds or properties acquired through commission of a predicate offence for the purpose of concealing or disguising the illicit origin of the property or illegal transfer of properties acquired or earned through legal or illegal means. | ||

| ii) | to conduct, or attempt to conduct a financial transaction with an intent to avoid a reporting requirement under this Act. | ||

| iii) | to do or attempt to do such activities so that the illegitimate source of the fund or property can be concealed or disguised or knowingly assist to perform or conspire to perform such activities. | ||

| iii) | to do or attempt to do such activities so that the illegitimate source of the fund or property can be concealed or disguised or knowingly assist to perform or conspire to perform such activities. | ||

| l) | “Reporting organization” means the following organisations: | ||

| i) | Banks | ||

| ii) | Financial Institutions | ||

| iii) | Insurance Companies | ||

| iv) | Money Changers | ||

| v) | Companies or organisations remitting or transferring money | ||

| vi) | Other business organisations approved by Bangladesh Bank | ||

| vii) | such other organisations as the Bangladesh Bank with approval of Government may notify from time to time. | ||

| m) | “High Court” means High Court Division of the Supreme Court. | ||

| n) | “Suspicious or unusual transaction” means | ||

| i) | a transaction that substantially deviates fro the usual norm by which that transaction is usually conducted, or | ||

| ii) | there is reasonable cause to believe that the transaction is related to any proceeds of crime. | ||

| o) | “Property” means- | ||

| i) | any kind of assets, whether tangible or intangible, movable or immovable however acquired; or | ||

| ii) | cash, legal documents or instruments in any form, including electronic or digital, evidencing title to or interest in, such assets. | ||

| p) | “Special Judge” means Special Judge appointed under the Criminal Law Amendment Act. 1958 | ||

| q) | “Predicate Offence” means the offences, the proceeds derived form committing those offences are laundered or attempt to be laundered and will include the following offences: | ||

| i) | corruption and bribery; | ||

| ii) | counterfeiting currency; | ||

| iii) | counterfeiting documents; | ||

| iv) | extortion; | ||

| v) | fraud; | ||

| vi) | forgery; | ||

| vii) | illicit arms trafficking; | ||

| viii) | illicit dealing in narcotic drugs and psychotropic substances; | ||

| ix) | illicit dealing in stolen and other goods; | ||

| x) | kidnapping, illegal restraint, hostage- taking; | ||

| xi) | murder, grievous bodily injury; | ||

| xii) | woman and child trafficking; | ||

| xii) | smuggling and unauthorized cross-border transfer of domestic and foreign currency; | ||

| xiii) | smuggling and unauthorized cross-border transfer of domestic and foreign currency; | ||

| xiv) | robbery or theft; trafficking in human beings and migrant smuggling; | ||

| xv) | dowry and | ||

| xvi) | any other offence which Bangladesh Bank with approval of the Government and by notification in the official gazette declares as predicate offence for the purpose of this Act. | ||

| 3. | Act to override all other laws: Notwithstanding anything contained in any other law for the time being in force, the provisions of this Act shall have effect. | ||

| 4. | The Offence of Money Laundering and punishment: | ||

| i) | for the purpose of this Act money laundering shall be treated as an offence; | ||

| ii) | any person engaged in money laundering or abetting or aiding or conspiring in the commission of such offence shall be punished with imprisonment for a term not less than six months but which may extend to seven years and in addition to this property involved with the offence shall be forfeited in favour of the state; | ||

| 5. | Punishment for violating of freezing/ attachment order- | ||

Whoever contravenes the freezing order or and order of attachment passed under this Act shall be punished with imprisonment of either description for a term which may extend to one year, or with fine, which may extend to taka five thousand taka, or with both.6.Divulging of information7.Obstruction or non co-operation in investigation, failure to report or supply of information8.Providing False Information to Banks/ Financial Institutions9.Investigation, Prosecution etc.:10.Jurisdiction and power of special Judge:11.Cognizance, compound ability and non-bail ability of offence12.Inevitability of the approval of ACC13.Provision for Bail14.Freezing and Attachment order15.Return of freezed or attached property16.Appeal against the order for freezing or attachment of the property17.Procedure in Forfeiture Proceeding18.Return of Forfietured property19.Appeal against the order to frofeiture of the property20.Disposal of Forfeited property21.Appointment of Manager or caretaker for the freezed, attached or forfeited property.22.Appeal23.Powers and responsibilities of Bangladesh Bank in preventing and combating money laundering.24.Establishment of financial intelligence Unit(FIU)25.Responsibility of reporting organizations in preventing money laundering.26.Contract with Foreign Countries27.Offence committed by company, etc.28.Protection against proceedings undertaken in good faith29.Power to make rule30.Publish an English version of the Act.31.Repeal and Savings.

Q18. What are the important features of Anti- Terrorism Act -2009?

Ans: Important features of Anti- Terrorism Act -2009 are

| Section 6 | Offence: For the purpose of endangering the integrity, solidarity, security or sovereignty of Bangladesh by creating panic among the people or compelling any individual to do or preventing from doing any Act. Of killing of any individual, grievous hurt confinement or kidnapping or damaging property of any individual or using any explosives, combustible substance, arms or any chemicals or keeping the same in possession will be considered as predicate offence of terrorism activities. |

| Punishment: sentence to that or imprisonment for life or for a term not exceeding 20 years and rigorous imprisonment of any term up to a minimum of 3 years and in addition to fine. | |

| Section 7 | Offence: If any body provides finance, service or any other property or induces for providing/ accepts/ arranges and expresses his desire for using the same in terrorism activities or there exists reasonable ground for doubting that the said thing will be or may be users in terrorism activities. |

| Punishment: sentence to that or imprisonment of any term for 3 years to 20 years and in addition to fine. | |

| Section 8 | Offence: Becoming a member of any prohibited organisation or claiming to be a member of the same |

| Punishment: Imprisonment not exceeding 6 months or fine or both. | |

| Section 9 | Offence: Requesting any body to become a member of prohibited organisation, involvement in arranging any meeting, delivering speech, giving publicity of information through Radio, TV, Press or Electronic Media. |

| Punishment: Imprisonment for 2 to 7 years and in addition to fine. | |

| Section 10 | Offence: Conspiring for committing offence. |

| Punishment: Imprisonment to two-third of term of imprisonment fixed for the original offence. In case of maximum punishment being death sentence, punishment for conspiring will be imprisonment for life or 5 to 14 years. | |

| Section 11 | Offence: Making efforts for committing offence |

| Punishment: Like as section 10. | |

| Section 12 | Offence: Assistance in committing offence. |

| Punishment: Same punishment as fixed for the concerned offence. | |

| Section 13 | Offence: Instigation for terrorism activities |

| Punishment: Same punishment as fixed under section 10. | |

| Section 14 | Offence: Sheltering the criminal (for protecting from punishment even after knowing that the offence has been committed.) |

| Punishment: In Case of punishment being death sentence for the original offence, imprisonment not exceeding 5 years, fine or both. In case of punishment for the original offence being imprisonment for life or for any term, imprisonment for 3 years and in addition to fine. | |

Cognizabality of offence and bail