An Enquiry into the financial feasibility of Janata Bank Limited

Janata Bank Limited. is a state-owned commercial bank of Bangladesh established in 1971. Its headquarters is situated at Motijheel in Dhaka, the capital city of Bangladesh. It is the second largest commercial bank in Bangladesh.

Janata Bank Limited welcomes to explore the world of progressive Banking in Bangladesh. It is a state owned commercial bank and is catering the need of the mass business people. It was corporatized on 15th November 2007. Janata Bank was born with a new concept of purposeful banking sub serving the growing and diversified financial needs of planned economic development of the country.

Their commitment and the people’s belief have given them the edge over others to earn this trust about the safe keeping of their money in the right kind of banking channel. The main focus of Janata bank is financing business, trade and industrial activities through an effective delivery system. Janata Bank Limited offers credit to almost all sectors of commercial activities having productive purpose. The loan portfolio of the Bank encompasses a wide range of credit programs covering about 200 items. Loan is provided to the rural people for agricultural production and other off-farm activities. Loan pricing system is customer friendly. Prime customers enjoy prime rate in lending and other services. Quick appreciation, appraisal, decision and disbursement are ensured. Banks are profit – earning concern. The ‘word “Bank” refers to the financial institution deals with money transaction. Banks collect deposits at the lowest possible cost and provide loans and advances at higher cost. The difference between two is the profit for the bank. Commercial banks are the primary contributors to the country.

History of the Company:

Janata Bank Limited started operations in 1971. It is one of the state owned commercial banks in Bangladesh, has an authorized capital of Tk. 20000 million (approx. US$ 283.33 million), paid up capital of Tk. 5000.00 million, reserve of Tk.10823.01 million and retained surplus Tk. 5167.18 million. The Bank has a total asset of Tk. 345233.92 million as on 31st December 2010 from the beginning. Immediately after the emergence of Bangladesh in 1971, the erstwhile United Bank Limited and Union Bank Limited were renamed as Janata Bank. On 15th November, 2007 the bank has been corporatized and renamed as Janata Bank Limited.

Janata Bank Limited operates through 874 branches including 4 overseas branches at United Arab Emirates. It is linked with 1202 foreign correspondents all over the world. The Bank employs more than 15(fifteen) thousand persons.

The mission of the bank is to actively participate in the socio- economic development of the nation by operating a commercially sound banking organization, providing credit to viable borrowers, efficiently delivered and competitively priced, simultaneously protecting depositor’s funds and providing a satisfactory return on equity to the owners.

The Board of Directors is composed of 13 (Thirteen) members headed by a Chairman. The Directors are representatives from both public and private sectors since 1971.

The Bank is headed by the Chief Executive Officer & Managing Director, who is a reputed banker from the beginning.

Product/Service Offerings:

Janata Bank Limited offers a large number of products to the clients. The products offered by them are current deposit account, short term deposit, savings bank deposit account, fixed deposit, foreign currency deposit, monthly savings scheme, monthly profit based savings scheme, Janata Bank savings scheme, Janata Bank deposit scheme, education deposit scheme, medical deposit scheme, Janata Bank monthly savings scheme, Janata Bank special deposit scheme, Janata Bank school banking savings karjokram etc.

The new products offered by this bank are financing IT Sector, financing of industries, ready cash, windows for SMEs, loan to travel agencies, loan to diagnostic centers, NRB escrow account, NRB gift cheque etc.

Janata Bank Limited with a widely speeded branch network and skilled personnel provides prompt and personalized services like issuing demand draft, telegraphic transfer, mail transfer, pay order, security deposit receipt, transfer of fund by special arrangement, normal transfer, electronic transfer through ready cash card, locker service etc.

Visions for the Future :

The global financial meltdown caused a spillover effect in the economy around the world. The efficacy of policy tools and their applications in managing systematic crises were challenged. These almost inevitably compelled the policy makers and financial sectors supervisors to revisit their policy choices. JBL is well positioned to meet the challenges of 2013 and will continue to strive to innovate and capture opportunity for growth and value creation. Against the backdrop for achieving the short and long term goals, JBL will concentrate its focus on the following:

- JBL is well placed to meet the challenges of 2016 and will strive to achieve the opportunity for growth.

- Continue to launch new deposit, loan products and innovative banking services.

- Carry on expansion of branch network in rural and urban area.

- The Bank will give more emphases on green banking, corporate social responsibility, financial inclusion etc.

- Continue to develop the employees’ database andborrower’s database.

- Shifting of branches, branch up-gradation and renovation will be continuing at commercially important locations.

- The Bank will maintain strong support to the budding sectors such as retail, SME, remittance and financial inclusive programmers.

- Techniques is taken but it is not certain that there may not be JBL will bring the SME under the mainstream of JBL will bring the SME

Job Analysis:

Account Opening:

At first, I started to work in General banking and the assigned department was Account opening.

I used to fill the account opening form.It is a very interesting department because different types of customers opened different types of account. Mainly three types of Accounts are opened here:

Current Account, different types of deposit Account and Fixed account. Recently Janata Bank has started School Banking. It seems more interesting to me.

Dispatch Section:

After working in account opening department, I started to work in the Dispatch section. I used to keep the record on inward and outward document. In this section all the official workings were done. In the dispatch section, the main job is to keep record on inward and outward document. If any document needed to outward to another branch on other banks or head offices or any document came in bank all records here. (Example: foreign exchange application, document letter of credit, joining application, a/c reopening, A/c closing).

Bills Remittance Department:

I used to fill up the forms in this department. It is one of the most important departments. This section deals with the transfer of money from one branch to another branch. Nearly six drafts are issued daily from this department. Here I know the amount transferred and what is the procedure.

This department also deals with T.T. transfer of money.

Foreign Remittance Department:

I used to fill up different forms in this arena. In this departmentperson sendsmoney in Bangladesh from out of the national boundary, customers come to the officer and give a PIN number. If the Pin number is correct, the bank pays the customer that amount. The job of this department was to fill up the form and collect national ID card and other necessary papers.

Cash Collection Department:

This is a very restricted department in a Bank. Everyone is not permitted to go there. Sometimes, I used to check the cash voucher.

Description of the Project

Summary:

The project is on “An Enquiry into the Financial Feasibility of Janata Bank Limited, Mohammadpur Corporate Office”.My focus was to answer how the branch is generating as well as increasing profit. Being a bank, it is supposed to do so by concentrating on banking activities. Non-banking activities are not considered to be avoided but the bank should not pay more attention to it than its core banking activities.

It is evident that, this branch takes on more deposits than it gives loans. For example, in the last year, total deposits taken were Tk.235.21.66, 971 and total loans made were only Tk. 61, 82, 09,510. However, the interest spreads were positive. Interests paid on deposits hold the largest portion of expenses.

The information is about composition of total deposits, loans and advances. In additions, it includes interest spread for 3 years. It gives an expenditure of the items used. It gives an analysis of interest receivable and interest payable. It provides the rates of interest on different deposits. It gives an analysis of banking feasibility. It signifies the amount of profit earned by the bank. It describes the role of banking activity in the overall profit.

Introduction and statement of problems:

A bank should create sustainable value for it’s clients and employees, it’s shareholders and for society. It’s goal should be clear. It’s high performance culture must go hand in hand with a culture of responsibility.

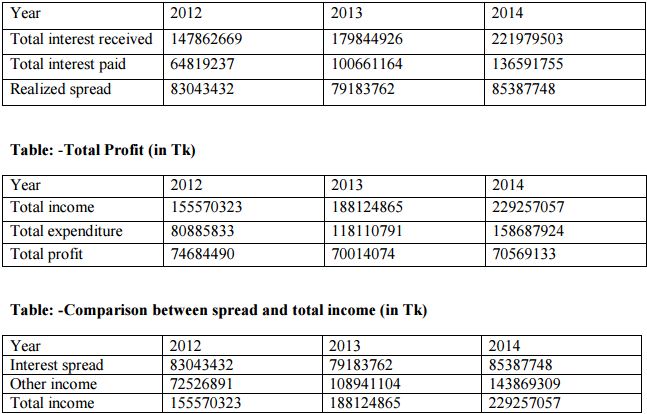

Public trust and dependence is a very important element for the banking success. The bank should involve with activities that provide the public with greater profit in order to gain such public confidence. For this bank, I collected data from their Statement of affairs and Statement of income and expenditure regarding deposits, loans and advances for 3 years 2012,2013 and 2014.

I found the following figures of 3 years as follows:

Table: – Realized Spread (in Tk)

Objective:

The objective of the report is to find out:

- Is the bank branch operating business in the right way?

- What consists of its profit?

- How the total profit is different from the profit that would be received if the bank was engaged solely in banking activities?

Methodology

Secondary Research:

Secondary research (also known as desk research) involves the summary, collation and/or synthesis of existing research rather than primary research, where data is collected from, for example, research subjects or experiments.

Care should be taken to distinguish secondary research from primary research that uses raw secondary data sources. The key of distinction is whether the secondary source being used has already been analyzed and interpreted by the primary authors.

This secondary research deals with the selection of sample, nature of data, nature of statistical techniques used, period under consideration, literature review etc. In this research, the composition of total deposits, loans and advances were taken into account. In addition, the expense analysis was calculated. The analysis of interest receivables and interest payables was calculated. There were different rates of interest for different types of deposits. In addition to that, the interest income and expenditure was calculated. In the final stage, it was found that, the cash inflows are greater than cash outflows. Thus, a positive profit is evident.

Sometimes secondary research is required in the preliminary stages of research to determine what is known already and what new data is required, or to inform research design. At other times, it may be the only research technique used.

Selection of Sample

The data collected are branch based data. That is Janata Bank Ltd, Mohmmadpur corporate office branch.

Nature of data

The data are collected from the statement of affairs and statement of income and expenditure of Janata Bank Ltd-Mohammadpur corporate office branch. These are secondary data.

Nature of statistical techniques and software used Ms. Excel has been the software platform used to perform all the calculations and mathematical analysis.

Period under consideration

Annual data have been collected for the analysis part. The data are representing 2012,2013 and 2014 years.

Literature review

The results indicate that the share of non-interest to total operating income is an important determinant of bank risk. Consistent with the view that non-interest income allows retail oriented banks to better diversify their income sources and to become more stable, we found that, savings and cooperative banks report significantly higher Z scores if they engage in non-interest income activities. This indicates that, a higher share of non-interest income increases and not decreases the stability of savings and cooperative banks in Germany.

Policy Implication

The paper has important implications. First, the results indicate whether the bank is providing substantial benefits to mass people. This suggests that, it might be beneficial for banks to have a more traditional business model and generate the largest part of their income from interests to increase their share of non- interest income to become more stable and not to decrease it. This implies that, banks are more stable if they have a more diversified income structure but should not heavily depend on non-interest income.

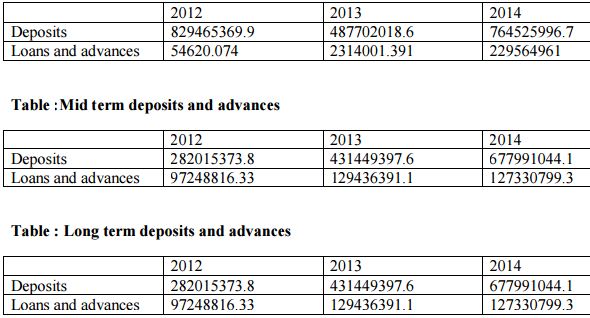

Composition of total depsits and total loans and advances

This bank’s branch offers 3 types of deposits and loans.

- Short term(1 year or less than 1 year)

- Midterm( 5 years or less than 5 years)

- Long Term( More than 5 years)

Table: Short term deposits and advances

Expense analysis

The expenditure items are given below:

- Interest on deposits

- Exchange loss

- Salaries

- Allowances

- Bonus

- Honorarium

- Rent office

- Rates and Taxes

- Electricity charge office

- Legal charges

- Telephone/Internet

- Postage

- Telephone- Office

- Telephone-Residence

- Repair and renovation

- Stationary

- Newspaper

- Office contingency

- Entertainment expense

- Fuel and car expense

- Cash carrying expense

- Travelling

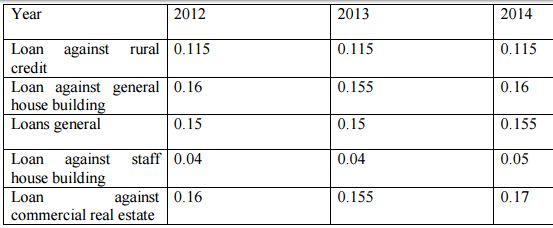

Analysis of Interest Receivable

Interest is a fee paid by a borrower of assets to the owner as a form of compensation for the use of assets. Interest income is the prime source for any bank. The bank receives interest income on loans and advances it provides to it’s customers. Commercial and retail banks raise funds by lending money at a higher rate of interest than they borrow it. This money is borrowed from other banks or from customers who deposit money with them. They also charge customers fees for services to do with managing their accounts and earn money from bank charges levied on overdrafts. The loan and advances made by this branch are:

- Loan against rural credit

- Loan against general house building

- Loans general

- Loan against staff house building

- Staff computer loan

- Loan against commercial real estate

Table: Interest rates 2012-2014

Analysis of Interest Payable

When money is borrowed, interest is typically paid to the lender as a percentage of the principal, the amount owed to the lender. A bank deposit will earn interest because the bank is paying for the use of the deposited funds. Assets that are sometimes lent with interest include money, shares, consumer goods through higher purchase and major assets such as aircraft and even entire factories in finance lease arrangements.

Interest is compensation to the lender for:

- a) Risk of principal loss called credit risk

- b) Foregoing other investments that could have been made with the loaned asset Janata Bank Ltd has several kinds of deposits with different features appropriate for different Current deposit

- Saving deposit

- Fixed deposit

- Deposit pension scheme

- JB savings pension scheme

- Medical deposit scheme

- Education deposit scheme

- JB school banking

- Monthly deposit scheme

- Double benefit scheme

- Gift cheque

Role of banking activity in the overall profit:

The role of banking activity in the overall profit is more focused on non-banking activities to make money like:

- Commission on foreign bills

- Remittances

- LC. Inland commission

- Remittances foreign

- LG. Inland Commission

- Commission bills-inland and foreign

- LC. Foreign commission

- Exchanges

- Lockers

- Commission on MICR cheque book

- Misc. earnings

- Account maintenance fee

- Transfer charges

Findings:

The findings from this project can be seen from different areas:

Firstly, the bank on which I conducted my research has a profitable bank’s record. Secondly, this bank takes on more deposits than it gives out loans and advances. Thirdly, this bank’s income is more than its expenditure. Fourthly, it takes large interest receivables than it gives out its payables. Fifthly, the interest income is larger than its interest expense. Sixthly, the cash inflows are greater than its cash outflows.

My focus was to mainly to find how the branch is generating as well as increasing profit. Being a bank, it is supposed to do so by concentrating on banking activities. Non-banking activities are not considered to be avoided but the bank should not pay more attention to it than its core banking activities.

After all the analysis, it can be said that, this branch is profitable but since 2012, it has been increasing its profit through non- banking activities. It has been more focused on the wholesale funding. The reasons behind such attempt could be lacking of creditworthy client, interest in easy money making without default risk etc.

Conclusion:

A fact for anyone interested in reforming the financial system is the universal recognition that modern societies need banking. In the trust form, banks take savings deposit and rather than hiding that money in vaults, lend it out for productive purposes. This provides credit for families, small businesses, corporations and state and local governments. Anyone looking to borrow money would have to find their own wealthy individual with extra available cash. Banks are middlemen but they serve a vital role that, its best complements economic prosperity by making sure the best ideas get the financial support to grow.

Janata Bank Ltd. Mohammadpur corporate branch is slowly consolidating its banking system and growing ever larger. They tend to focus instead on generating profits through a host of other complex methods. But, in their absence, lending does not go away; it merely filters down to a different set of less regulated intermediaries, typically known as shadow banking sector. With shadow banks making more and more traditional loans, the consequences will be far greater as shadow banks are more intertwined with traditional banks.

So, if banks derive less and less of their profits from lending, the rest of the lending is done by hedge funds, private equity firms and other asset managers which raise money from high net worth individuals and institutions like pension funds and make investments on their behalf.