Customer satisfaction on Excel Banking in BRAC Bank Limited

BRAC started as a development organization dedicated to alleviating poverty by empowering the poor to bring about change in their own lives. In Bangladesh It was founded in 1972 and over the course of evolution, it has established itself as a pioneer in recognizing and tackling the many different realities of poverty of which BRAC BANK is one of the largest operational commercial venture with a vision:

“Building a profitable and socially responsible financial institution focused on Markets and Business with growth potential, thereby assisting BRAC and stakeholders build a “just, enlightened, healthy, democratic and poverty free Bangladesh”.

BRAC Bank Limited is a scheduled commercial bank in Bangladesh. It established in Bangladesh under the Banking Companies Act, 1991 and incorporated as private limited company on 20 May 1999 under the Companies Act, 1994. BRAC Bank will be a unique organization in Bangladesh. The primary objective of the Bank is to provide all kinds of banking business. At the very beginning the Bank faced some legal obligation because the High Court of Bangladesh suspended activity of the Bank and it could fail to start its operations till 03 June 2001. Eventually, the judgment of the High Court was set aside and dismissed by the Appellate Division. BRAC Bank is one of country’s fastest growing banks, with 152 branches, 12 Apon Shomoy, 313+ ATMs, 30 CDMs, 399 SME Unit Offices and 7,695 (as on 15th July 2012) human resources, BRAC Bank’s operation now cuts across all segments and services in financial industry. With more than 1 Million Customers, the bank has already proved to be the largest SME financier in just 11 years of its operation in Bangladesh and continues to broaden its horizon into Retail, Corporate, SME, Probashi and other arenas of banking. In the year: 2010, BRAC Bank has been recognized as Asia’s most Sustainable Bank in Emerging Markets by the Financial Times and IFC.

Recently BRAC Bank has achieved the International award for “Excellence in Retail Financial Services”.

Values- CRYSTAL

C stands for being Creative, Be a person of innovative ideas in solving issues, thinking different ideas to reach one destination; do new associations between existing ideas or concepts for the organization’s overall growth.

R stands for being Reliable, Be worthy of reliance or trust at work so everyone could depend on you. Y stands for remaining Youthful, Be a person of freshness and vibrant characteristic at work. Feel young at HEART and project enthusiasm during performing duties.

S stands for being Strong; Be a person of willing to move forward and apply conscious choice, willpower, discipline and passion at work.

T stands for being Transparent, Be transparent at work at all level both internally and externally. Show openness and honesty through communication to bring transparency.

A stands for being Accountable, Be accountable for own actions and take responsibilities for the outcome of the actions; be responsible and answerable towards customers, organization, regulatory bodies as well as the society.

L stands for being Loyal, Be loyal to the organization by being compliant at work, taking ownership and create belongingness which will carry your brand as your pride.

MISSION, VISION, GOAL

Corporate Mission:

- Sustained growth in Small & Medium Enterprise sector.

- Continuous low-cost deposit Growth with controlled growth in retail assets.

- Corporate Assets to be funded through self-liability mobilization. Growth in Assets through syndications and investment in faster growing sectors.

- Continuous endeavor to increase non-funded income.

- Keep our debt charges at 2% to maintain a steady profitable growth.

- Achieve efficient synergies between the bank’s branches, SME unit offices and BRAC field offices for delivery of remittance and Bank’s other products and services.

Corporate Vision

“Building profitable and socially responsible financial institution focused on Market and Business with Growth potential, thereby assisting BRAC and stakeholders to build a just, enlightened, healthy democratic and poverty free Bangladesh”.

Objectives

The objective of BRAC Bank Limited is specific and targeted to its vision and to position itself in the mindset of the people as a bank with difference. The objectives of BRAC Bank Limited are as follows:

- Building a strong customer focus and relationship based on integrity, superior service.

- To creating an honest, open and enabling environment.

- To value and respect people and make decisions based on merit.

- To strive for profit & sound growth.

- To value the fact that they are a member of the BRAC family – committed to the creation of employment opportunities across Bangladesh.

- To work as a team to serve the best interest of our owners.

- To relentless in pursuit of business innovation and improvement.

- To base recognition and reward on performance.

- To establish, maintain, carry on, transact and undertake all kinds of investment and financial business including underwriting, managing and distributing the issue of stocks, debentures, and other securities.

- To finance the international trade both in import and export.

- To develop the standard of living of the limited income group by providing Consumer Credit.

- To finance the industry, trade and commerce in both the conventional way and by offering customer friendly credit service.

Goals:

BRAC Bank will be the absolute market leader in the number of loans given to small and medium sized enterprises throughout Bangladesh. It will be a world – class organization in terms of service quality and establishing relationships that help its customers to develop and grow successfully. It will be the Bank of choice both for its employees and its customers, the model bank in this part of the world.

CORPORATE RESPONSIBILITY

Since the inception, as a responsible corporate body BRAC Bank Ltd. has undertaken various initiatives considering the interest of customers, employees, shareholders, communities and environment. These initiatives go beyond the statutory obligation/mandatory compliances to voluntary activities that promote sustainable development.

A significant portion of earning of the bank is routed through the ownership structure of the Bank for building just enlightened poverty free Bangladesh – is the vision that the founder Chairman and Chairperson of BRAC, Sir Fazle Hasan Abed dearly and closely follows through. BRAC Bank’s vision is linked with social responsibility which focuses on the ‘triple bottom line’: People, Planet and Profit. Being guided by this vision, BRAC Bank provides continuous support to the environment and communities that it operates in.

BRAC Bank CSR Initiatives in 2011:

- Amor Ekushey Grontho Mela

- Bangla version of BRAC Bank Website

- Patriotic poem cd

- Computer Donation: Bagmara High School, Nawabgonj; Sallah Samabaya High School, Kalihati, Tangail

- Employment of Acid Victims

- Lifetime support to Bir Protik Taramon Bibi

- Scholarship for Adomyo Medhabi with Prothom Alo

- Scholarship for poor students of BRAC University

- Scholarship for Afghan Student

- Scholarship for the children of poor Journalists in Patuakhali region

- Supported Libya returnees in association with BRAC

- Donated to IRRI for their research activities

- Computer donation to Presidency University

- Daur 2011

- Warm Clothes Distribution to the cold hit poor people

BRAC BANK SUBSIDIARIES

bKash is designed to provide financial services via mobile phones to both the unbanked and the banked people of Bangladesh. The overall bKash value proposition is simple: a safe, convenient place to store money; a safe, easy way to make payments and money transfers. The bKash mobile wallet, a VISA technology platform which is fully encrypted to ensure most secure transactions, will be the customer account where money can be deposited and out of which money can be withdrawn or used for various services. It has a special focus to serve the low income people of the country and promote sustainable micro-savings by providing financial services that are convenient, affordable and reliable. In Bangladesh, where 15% of people are not connected to formal financial system, providing financial services using this mean can make the service more accessible and cost effective for the vast population of Bangladesh.

BRAC Equity Partners Ltd (EPL) is a brokerage house and a merchant bank, with 51% of its stake owned by BRAC Bank. BRAC EPL formally commenced operation under a new management team on October 1, 2009. The predecessor of the company, known as Equity Partners Limited (EPL) and its affiliate Equity Partners Securities Ltd (ESPL), was formed in early 2000 as a merchant bank and brokerage company subsequently. Since the acquisition by BRAC Bank, BRAC EPL is providing the stock brokerage and investment services as BRAC EPL Stock Brokerage Ltd & BRAC EPL Investments Ltd. Products and services provided by BRAC EPL Stock Brokerage Ltd. are:

- Open Beneficiary Accounts (BO) for individuals

- Provide margin lending

- Trade for institutional investors, both domestic and international

- Provide stop-gap liquidity support, especially to foreign institutional investors

- Assist to create and follow an investment strategy

- Provide corporate finance advisory services.

BRAC Saajan Exchange Limited, an Exchange Company incorporated in England and Wales, is a subsidiary of BRAC Bank Limited, Bangladesh. The Company has been formed through acquisition of the former Saajan Worldwide Money Transfer Limited, United Kingdom. BRAC Bank owns 87.485% share in BRAC Saajan Exchange.

The main purpose of introducing BRAC Saajan Exchange, is to have a footprint in UK and elsewhere in Europe to cater to the needs of Non-Resident Bangladeshis (NRBs) community which has a population of over one million. Non-resident Bangladeshis (NRBs) in UK now has a secured, fast, online transfer option available for sending remittance to their loved ones in Bangladesh from UK.

DIVISION OF BRAC BANK

If the jobs are not organized considering their inter relationship and are not allocated in a particular division it would be very difficult to control the system effectively. If the division is not fitted for the particular works, there would be haphazard situation and the performance of a particular department would not be measured. BRAC Bank Limited does these works very well.

SWOT ANALYSIS

A SWOT analysis is “a technique for matching organizational strengths and weaknesses with environmental opportunities and threats to determine the organization’s right niche”. SWOT analysis is an important tool for evaluating the company’s Strengths, Weaknesses, Opportunities and Threats. It helps the organization to identify how to evaluate its performance and scan the macro environment, which in turn would help organization to navigate in the turbulent ocean of competition. With this tool, we will be able to determine, though not perfectly, since we are not internal members of this organization, the internal strengths and weaknesses of BBL as well as the opportunities and challenges that the changing external environment provides.

Strength:

- BRAC Bank has a strong financial back-up on the industry. Ample source of finance means it is in a better position to serve the market with its products & also it has the financial resources to grow its business.

- BRAC is the parent organization of BRAC Bank Limited that already has reputed brand name in its own industry. It ultimately helps BRAC Bank to get well familiar in the country within a short period of time.

- BRAC Bank is more emphasized on the SME sector of Bangladesh. Before BRAC Bank there was no private commercial bank which has focused on this sector.

- BRAC Bank Limited is providing diversified product and services to the market.

Weakness:

- One of the major weaknesses that I have found during my internship period was their huge manpower. It is seen that BBL takes many initiatives but they cannot implement all their steps in a proper way because of its weak monitoring system.

- Higher interest than some other commercial private bank in Bangladesh is another weak point of BRAC Bank Ltd.

- Majority of its asset portion has come from its SME division. They have disbursed more than 50% of their total loans in SME sector so that’s why they have higher default rate.

- Remuneration package offered by BBL for its employee is lower than other private bank. So many employees don’t get motivated while working on BBL. Ultimately it causes higher employee turnover.

- Branch size of is another strong weak point of BBL. It has a huge number of customer base so most of the time its branches get jam packed at pick hour.

Opportunity:

- BBL can offer more services to its debit and credit card.

- As BBL shifted its focusing field from product centric to customer centric it may allow them to explore some new group of customers.

- BBL can start taking some deposit to its SME customers as they have a huge customer from its SME service.

- Large market share in SME sector Bangladesh has given BBL immense opportunity build strong relationship with its customers. Most of the times customer does take repeat their loans that are taken under SME division.

- Average ages of BBL employees are less than 30. So BBL can bring more outputs from its young employees more than other private commercial banks.

Thread:

- High competition with foreign banks is a tread for BBL. Majority people like to hold the credit card of SCB and HSBC in our country.

- Some new banks are coming in the market. These new banks can take customers from BBL. Customer will have more choices regarding selection of his\her desired banks.

- Majority of private commercial banks are now focusing on the SME sector. So they are hiring employee from BBL also. As a result SME division of BBL has a higher employee turnover rate.

- Political volatility is another thread for BBL.

- Sometimes Bangladesh Bank imposes some strict rules regulation to the private banks. These rules may become difficult for BBL to follow.

Overview of RRBBM

BRAC Bank Ltd recently has changed their business model from “Product Centric” to “Customer Centric” business model where there will be no traditional banking system and the latest customer wise different types of services will be provided. Actually they have segmented their customers in different categories and they will treat them by their segmentation. This type of segmentation from product centric to customer centric business model is first time implemented in Bangladesh and BBL is the first initiator of this.

Product Centric Model

A product-centric collections strategy is generally focused on account-level collections, per product, based on product-owner defined rules. Collections actions are product-focused, hence relatively simple to articulate, manage, automate and measure. A collections call is generally made for each account. In other words, even if multiple accounts of the same type are delinquent, the customer will receive multiple calls, each specific to one delinquent account.

The Advantages and Disadvantages of Product-Centric Model

Product-centric model allow for driving efficiency and productivity. This includes:

- Standardization and automation of customer communications

- Call scripting

- Simple measurement

- Training of collectors on a single-product and system

- Simple incentivizing and performance measurement aligned with product metrics

However, a product-based collections approach has its disadvantages. In this approach the customer actions are based on customer information that is reflected in a single-product view.

This may result in a fragmented customer experience and inconsistent or contradictory treatment and messages. The business could also overlook the seriousness of cross product defaulters, and take inappropriate lenient initial action.

The product-centric model approach is most effective when the majorities of customers are single-product account holders, or in instances where customers are delinquent on a single product.

Customer Centric Model

Customer-centric collections strategies usually aspire to deliver consistent treatment of customers across products, and ensure customer management decisions (pricing, risk-based decisions, service-level, sales strategy, collections strategy, etc) at customer portfolio level.

Significance

A customer-centric firm hopes to achieve higher sales, profitability and new-product success because of their focus on customers. The firm also saves on costs for agent commissions and wins business over its competitors. According to studies quoted in the book “Designing the Customer Centric Organization,” existing loyal customers are the most profitable group of customers. Rather than spending its resources on capturing new customers, a firm should instead use its resources on maintaining the loyalty of current customers.

Features

Becoming customer centric does not just involve customer service. A customer-centric firm detects the needs of its customers and uses its resources accordingly, while building relationships with them. All the business functions of the firm, including those that do not directly make contact with the customers, perform their roles with the customers in mind.

Identification

A customer-centric firm identifies the needs of its customers by dividing them into segments with common characteristics and determining the appropriate level of attention for them. A firm can classify its customers based on various factors, such as size, buying purpose, nature of products purchased, revenue, and potential for growth, geographic location and level of specialization required. A firm can collect the data using surveys and keeping data from all customer interactions, including sales, customer service, complaints, returns and third-party vendors.

Implementation

A customer-centric firm arranges itself around the customers. Its strategy, structure, processes, reward systems and people have to aim to maximize customer satisfaction. For example, the firm focuses on creating products that the existing customers need, as opposed to finding customers for its products. The firm rewards the managers who build customer relationships, rather than those who manage deadlines. The employees focus on customer retention, as opposed to reaching a certain share of the market.

Considerations

A firm must not over-customize its products to match customer requests to the point where profit suffers. For example, Japanese software companies often create many different versions of software products for different customers. As a result, they fail to reach economies of scale and do not have enough resources for international expansion. A firm should also not focus too much on its best customers when considering a new technology.

The Advantages and Disadvantages of Customer-Centric Model

One of the primary benefits of customer-centric model is that the customer experience remains consistent. All communication and messages required to be sent to the customer are integrated to reflect the true status of the customers overall delinquency status. All actions taken on the customer are appropriate as the actions are based on accurate customer information that has been assessed and well understood. However, since the business model collates customer information, the model is complicated by the need to accommodate multiple products in various stages of delinquency. This complexity of the customer centric model is difficult to monitor and measure.

This requires composite product and customer views in order to ensure a full and accurate understanding of the customer’s delinquency status. This also limits the ability to measure a collector’s performance, negatively affecting incentivizing, performance management and reward/recognition.

In addition, customer-centric model requires that employees have a wide range of knowledge across products and systems, complicating the training process and the length of time it would take to develop the requisite level of expertise. Further cost – and complexity – is caused by the fact that communications must be customized to accommodate multiple products.

The customer-centric model approach is most effective when:

- Customer volumes are low and efficiency is not the driving priority

- The number of customers with multiple delinquent products is high

- There are complex products or cross-product dependencies (e.g. business plans, Small Business structure, securities, etc.)

Customer Segmentation:

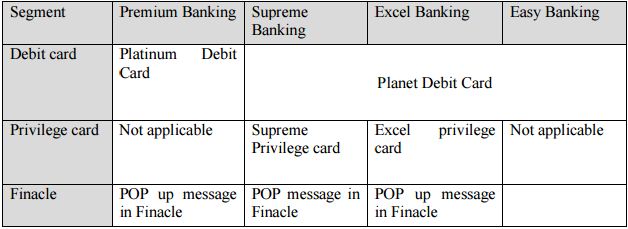

BBL have grouped their customers into four segments namely,

- Premium Banking

- Supreme Banking

- Excel Banking

- Easy Banking

Product Centric Model Customer Centric Model

- Maximizes product profitability Focus on Customer Segment wise approach

- Overlook customers need and Push Sell products

- Focus on customers need & customized offers

- May lead to customer dissatisfaction and worsen relationship

- Relationship based banking creates long term relationship

- Does not focus on Customer experience Focus on Customer experience (e.g. touch points, products, pricing etc)

- Customer looks for better alternative Customer will be attached through his life cycle with the bank

- Conventional Banking Fundamental shift to “VALUE” based Retail

- Banking business model

- Customer can get service from our PB Lounges

Premium Banking

Following benefits will be entitled for Premium Banking customers,

- Dedicated Relationship Manager

- Personalized banking services

- Discounts & Benefits from Tie up partners

- Existing BSSOs from selective branches will be assigned as Shared RM

Supreme Banking

To be a customer of Supreme Banking segment, total deposit balance has to be within BDT 10 lakhs to less than BDT 50 lakhs.

A loan customer having 20 lakhs or above outstanding will fall under Supreme Banking for reporting purpose but the customer has to meet the deposit eligibility criteria to avail Supreme Banking facilities.

A Platinum cardholder will also fall under Supreme Banking for reporting purpose but have to meet deposit eligibility criteria to avail Supreme Banking facilities.

Following benefits will be entitled for Supreme Banking customers,

- Dedicated counter in selective branches

- Discounts & Benefits from Tie up partners

- Special rates, discounts & benefits on selective banking products

Excel Banking

To be a customer of Excel Banking segment, total Relationship balance has to be within BDT 50k to less than BDT 10 lakhs.

A customer availing loan facility only of BDT 5 lakhs to less than 20 lakhs will fall under Excel Banking for reporting purpose but has to meet the deposit eligibility criteria to avail Excel Banking facilities.

Customer Satisfaction on RRBBM of BRAC Bank Ltd 33

A Gold Credit Card holder only will fall under Excel Banking for reporting purpose but has to meet the deposit eligibility criteria to avail Excel Banking facilities.

Following benefits will be entitled for Excel Banking customers,

- Service through Branches

- Discounts & Benefits from selective Tie up partners

Easy Banking

A customer with total Relationship balance below BDT 50k is an Easy Banking customer.A customer availing loan facility only of less than BDT 5 lakhs will fall under Easy Banking for reporting purpose

An Easy Banking customer will be entitled to get fast and convenient transactional banking services through ATM, CDMs, IVR, bKash, etc.

BBL will identify the segment of a customer from the following:

CONCLUSION

In this age of modern civilization bank is playing its splendid role to keep the economic development wheel moving. We can see lot of new commercial banks has been established in last few years and these banks have made banking sector more competitive. Maintaining a strong relationship has become a weapon for most of the private banks in this competitive market.

Customers are the main blessings for any business. Banking sector is service based business. So customer would prefer to take the service from those banks which are providing the highest level service to their customers and BRAC Bank is definitely one of them. On this regard BRAC Bank has taken some initiative by taking a new project of Restructuring Retail Banking Business Model (RRBBM) to improve the customer relationship. They are the first one in banking sector of Bangladesh introducing customer centric business model instead product centric model. So, if they can implement and continue it properly, hopefully they will be one of the top successful banks in Bangladesh.