Online Banking is the new method of banking using the new technologies available in the world today. Instead of travelling to a local branch of your bank, the Internet allows customers to do a wide variety of useful things with their accounts. Prime Bank Limited is one the pioneer bank who introduced online banking service in Bangladesh at the very beginning.

This report contains study on Prime Bank‟s online banking service. First part of the study contains information about online banking service of Prime Bank Limited. Prime Bank Limited started providing these electronic services as Internet Banking providing to over 13,000 numbers of accounts. Moreover they are now capable to provide “faster access” to 91 corporate customers. Second part of the study contains the evaluation of Prime Bank Limited Online Banking according to survey conducted over online banking customers of Prime Bank Limited. This approach is to find out how well Prime Bank‟s online service is performing in the market.

Introduction:

In the backdrop of economic liberalization and financial sector reforms, a group of highly successful local entrepreneurs visualized an idea of introducing a commercial bank with different outlook. For them, it was competence, excellence and consistent delivery of reliable service with superior value products. Accordingly, Prime Bank was created and commencement of business started on 17th April 1995.

As a fully licensed commercial bank, Prime Bank is being managed by a highly professional and dedicated team with long experience in banking. They constantly focus on understanding and anticipating customer needs. As the banking scenario undergoes changes so is the bank and it repositions itself in the changed market condition. Prime Bank has already made significant progress within a very short period of its existence. The bank has been graded as a top class bank in the country through internationally accepted CAMELS rating. The bank has already occupied an enviable position among its competitors after achieving success in all areas of business operation.

Prime Bank offers all kinds of Commercial Corporate and Personal Banking services covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, and real state to software.

Management of the Bank:

Boards of directors are the sole authority to take decision about the affairs of the business. Now there are 18 directors in the management of the bank. All the directors have good academic background and have huge experience in business. Azam J Chowdhury is the chairman of the bank.

Executive Committee: The Executive Committee consists of the members of the Board of Directors. This committee exercises the power as delegated by the Board from time to time and approves all matters beyond the delegation of Management.

Management Committee: The Management Committee consists of the Managing Directors and Head Office Executives. They discuss about the progress on portfolio functions. Different ideas and decisions, guidelines regarding deposits, lending and management of Human and Material resources are the main concern of this committee. All these committees meet on a regular basis for discussing various issues and proposals submitted for decisions.

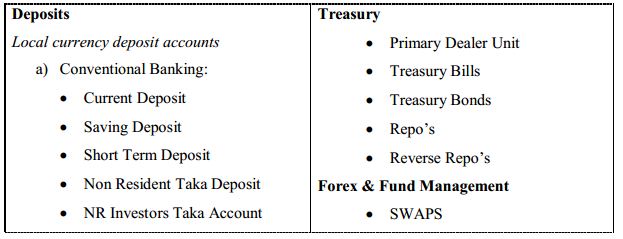

Major Functions & Services Offering:

The Prime Bank Ltd. focuses on a wide range of banking and financial services which include commercial banking, retail & SME asset management, Islamic banking, investment banking, merchant banking, and card business. Moreover, Prime Bank is a market leader in corporate to consumer banking and retail lending to SMEs in Bangladesh. Prime Bank services and products are following.

Functional Structure of PBL:

Prime Bank Ltd. has several functional departments. Among those, followings are the most significant functional departments of Prime Bank Limited.

Logistic & Support Services Division (L&SSD):

This Division was formerly known as General Services Division (GSD). Their main function relates to procurements and supply of all tangible goods and services to the Branches as well as Head office of Prime Bank Limited. This includes:

- Every tangible functions of Branch opening such as making lease agreement, interior decoration etc.

- Print all security papers and Bank Stationeries.

- Distribution of these stationeries to the branch

- Purchase and distribute all kinds of bank‟s furniture and fixtures.

- Receives demand of cars, vehicles, telephones etc from branched and different divisions in head office and arrange, purchase and delivery of it to the concerned person / Branch.

- Install & maintain different facilities in the Branches.

Financial Administration Division (FAD):

Financials Administration Division mainly deals with the account side of the Bank. It deals with all the Head Office transactions with bank and its Branches and all there are controlled under the following heads:

- Income, Expenditure Posting: All income and expenditures are maintained and posted under these heads.

- Cash Section: cash section generally handles cash expenditure for office operations and miscellaneous payments.

- Bills sections: this section is responsible for inland bills only.

- Salary & Wages of the Employee: Salary and wages of the Head Office executives, Officers 7 Employees are given in this department.

- Maintenance of Employee Provident Fund: Employee provident fund accounts are maintained here.

Credit Division:The main function of this division is to maintain the Bank‟s credit portfolio. A well reputed

and hard working group of executives & officers runs the functions of this division. Other major functions are the following:

- Receives proposals

- Proposes and appraises.

- Get approval

- Communication and Sanction

- Monitoring and follow-up

- Set price for credit and ensure effectiveness of it.

- Prepare various statements for onward submission to Bangladesh bank.

International Division:

The objective of this division is to assist management to make international dealing decisions and after decision is made, guide Branches in their implementation. Its functional areas are as follows:

- Maintaining correspondence relationship

- Monitoring foreign exchange rate and exchange dealings

- Authorizing of signing and test key.

- Monitoring foreign exchange returns & statements

- Sending updated exchange rates to concern branches

Public Relations Division:

It has to perform certain functions related to all types of communication. The broad routine functions can be enumerated as follows:

- Receiving and Sanctioning of all advertisement application

- Keeping good relation with different newspaper offices

- Inviting concern ones for any occasion.

- Keeping good relation with different officers of electronic media

Marketing Division: Marketing Division is involved in two types of Marketing.

Asset Marketing: Marketing of assets refers to marketing of various kinds of loans and advances. In-order to perform this job, they often visits dome large organizations and attract them to borrow from the Bank to finance profitable ventures.

Liability Marketing: The process of Liability marketing is more of less same as Asset marketing. In this case different organizations having excess funds are solicited to deposit their excess fund to the Bank. If the amount of money to be deposited is large, the Banks sometimes offer a bit higher price than the prevailing market rate.

Human Resources Division:

HRD performs all kind of administrative and personnel related matters. The broad functions of the division are as follows:

- Selecting & Recruitment of new Personnel.

- Prepare all formalities regarding appointment and joining of the successful candidates.

- Placement of Manpower

- Deal with the transfer, promotion and leave of the employees

- Training & Development

- Termination and retrenchment of the employees

- Keeping records and personal file of every employee of the Bank

- Employee welfare fund running.

- Arranges workshops & trainings for employee & executives

Inspection & Audit Division:

Inspection and Audit division works as internal audit division of the Company. The officers of this division randomly go to different Branches examine the necessary documents regarding each single account. If there is any discrepancy, they inform the authority concerned to take care of that/those discrepancies. They help the bank to comply with the

rules and regulation imposed by the Bangladesh Bank. They inform the Bangladesh Bank about the Current position of the rules and regulation followed by the Bank.

Credit Card Division:

Prime Bank obtained the principal membership of Master Card International in the month of May, 1999. A separate Division is assigned to look after this card. The Marketing Team of this division goes to the potential customers to sell the card. Currently Prime Bank Ltd. offers four types of card:

- Local Silver Card

- International Silver Card

- Local Gold Card

- International Gold Card

- VISA credit Card

Merchant Banking and Investment Division:

This division concentrates its operation in the area of under writing of initial public offer (IPO) and advance against shares. This division deals with the shares of the Company. They also look after the security Portfolio owned by the Bank. The Bank has a large amount of investment in shares and securities of different corporations as well as government treasury bills and prize bond.

An Empirical Analysis on Prime Bank Online Banking Service – Altitude

Summary of the Project:

Banks are very old form of financial institution that channel excess funds from surplus unit to deficit unit in consideration of a price called Interest. Banking business definitely established on a relationship of Debtor-Creditor between the surplus unit called depositors and the bank and between the deficit unit called borrowers and the bank. Economic development of a country requires a well-organized, smooth, easy to reach and efficient saving-investment

process. The banking sector of Bangladesh compared to its economic size is moderately bigger than many other economies of equal level of development and per capita income.

There are forty-seven commercial banks operating in this small economy. Although over the last thirty years, the country achieved noticeable success regarding the access to banking services, in 1972 population per branch was 57,700 and in the year of 2013, it was 11,162 per branch. The statistics indicates that getting banking services is not a significant problem for the country. Being the central bank of the country, Bangladesh Bank is responsible to regulate, monitor and supervise all the banks operating in the country. This particular report provides an overview of online banking service and evaluation of online banking service in context of Prime Bank Ltd. So here I have worked on overall activities of Prime Bank‟s online banking service which is generally known as Altitude.

Objective of the Project:

A careful statement and purpose help in the preparation of a well decorated report on which others can take the right type of decisions. The major objective of this study is to gain practical exposures about the online banking mechanism and evaluate the performance level of Prime Bank Limited‟s online banking service.

The specific objectives of the study may be spelled out as follows

- To get an overall view of the Prime Bank Ltd. and its general banking activities

- To analyze the online banking mechanism and reporting system

- Conduct a research on the online banking customers‟ feedback to make a descriptive analysis over the online banking service and its acceptability.

- Interpret the outcomes to expose the performance level of the online banking system and find out the problems to provide recommendations on how to improve.

Methodology of the Project:

This report is investigative in nature. The study has been performed based on the information extracted from different sources and organized by using a specific methodology.

Collection of data

Primary sources of data:

- Face-to-Face conversation and shared experience with the respective officers.

- Questionnaire based survey over online banking customers of Prime Bank Limited.

Secondary sources of data:

Annual Report 2013 of Prime Bank Ltd.

- Bangladesh Bank publications

- Official websites of Prime Bank Ltd.

- Official websites of Bangladesh Bank and Prime Bank Ltd.

- Other websites such as Wikipedia, Investopedia etc.

- Related books, journals, and articles

Prime Bank Limited Online Banking Service (Altitude)

Online Banking (or Internet banking or E-banking) is defined as “the use of technology to communicate instructions and receive information from a financial institution where an account is held. This service includes the system that enables financial institution customers, individuals or business to access accounts transact business, or obtain information on financial products and services through a public or private network”. E-banking is now a global phenomenon. It is an invaluable and powerful tool driving development, supporting growth, promoting innovation and enhancing competitiveness.

The evolution of banking technology has been driven by changes in distribution channels as evidenced by automated teller machine (ATM), Phone-banking, Tele-banking, PC-banking and most recently internet banking. From the date of inception PBL has always been moving with the latest technology and time to time the bank has adopted different advantages of the technology which has enriched its IT infrastructure. Technological development of the bank tremendously increased its customer service as well as trust worthiness of the stakeholders towards the bank. Now PBL is the pioneer in providing multi-dimensional banking products and services with latest international standard technologies. The bank is dedicated towards its customer satisfaction with help of the technological advantages.

Now, the IT Division is well equipped not only with technology, but also with a dedicated professional workforce which has been built-up for support as well as development of new satellite application. Prime Bank Limited started providing electronic services as Internet Banking in early January 2010. Till now, the bank is providing this service to over 13,000 numbers of accounts. Moreover, in January 2011, the bank introduced Corporate Internet banking for corporate customers. By year end 2013, the bank has provided this service to 91 numbers of corporate users‟ to provide “faster access”.

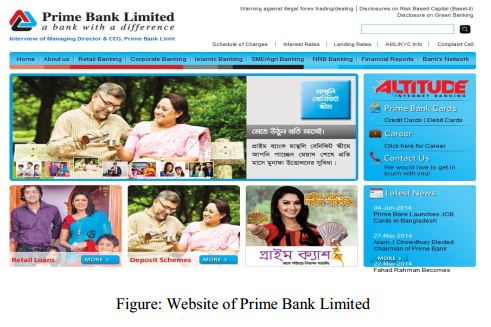

Prime Bank Limited‟s web is largely informational, providing commercial and noncommercial information about the bank. It can provide insight into the background of the company, partners, and policies. Another important content is the product/service description, including price, specifications, photographs, etc. Information provided in the website of Prime Bank Limited:

- General company information

- Product/services information

- Price information

- Automatic Teller Machines (ATM) and branch information

- Financial Reports

- Schedule of Charges

- Interest Rates

- Exchange Rates

- Latest News about Prime Bank Limited etc.

Alternative Delivery Channels:

The bank introduced ATM services as well for the convenience of the customers and a separate unit under the name of Alternative Delivery Channels (ADC) was opened at Head Office to effectively monitor smooth functioning of these ATMs. As a newly formed division, ADC is now trying to increase alternate delivery channels as well as to offer broader services to the customers of the bank.

Prime Bank Cards:

a) ATM Card:

The number of ATM card was only 153,021 at year end 2012. But by year end 2013, Prime Bank Limited has managed to increase this number to almost 289,000.

b) Master Debit Card:

The bank has launched Master Debit Card in January 2011 and almost 34,000 cards have been issued till 2011. With this card the following facilities can be achieved:

- Customers can access any Master ATM terminal;

- Customers can access any Master POS terminal. 21

Credit Cards:

Prime Bank Limited has a wide offering in credit card section too. They offer:

- Prime Bank Master Card Gold

- Prime Bank Master Card Silver

- Prime Bank International Credit Card

- Prime Bank VISA Gold

- Prime Bank VISA Classic

- Platinum Credit Card

ATM Booth

As at end December 2012, Prime Bank Limited had only 55 ATMs. But in 2013, the bank installed 40 new ATMs country wide. Now the bank has 95 ATMs in operation & these are located in the busy and preferred locations across the country. As per bank‟s approved expansion plan, Prime Bank Limited shall install another 50 ATMs in 2014.

SMS Banking

Now a day Mobile Phones are the easiest channels by which customers can reach the bank to access their account 24 x 7. So, PBL introduced SMS Service in July 2010. With this service, a customer can enjoy the following:

- Verify payment, receive status anywhere;

- Get alert automatically on an individual basis when loan installment falls due and becomes overdue;

- Save time & cost as this will minimize their visit to their respective branches for simple queries.

Phone Banking:

With IT support, ADC successfully implemented Phone Banking services in May 2011 and till 2013 the bank has provided this service to over 1,100 numbers of accountholders. Some facilities under this service are:

- Account related enquiry:

– Available balance22 - Debit Card related enquiry

– Card activation

– Lost card block

– TIN number change - Credit Card Related Enquiry

– Available balance

– Last date of bill payment

– TIN number change

Information KIOSK / Bills Pay:

The bank has successfully launched 4 (four) Information KIOSK:

PBL ATM Card and Master Debit Card holders can enjoy the following facilities through Information KIOSK:

- Account balance enquiry

- Account statement

In addition, “Utility Bill” payment of a number of companies is also possible by Information KIOSK and ATMs.

Prime Cash

Prime cash is Biometric Smart Card where your thumb impression will work as authentication code. Prime Bank limited and Dipon Consultancy jointly bring this banking service. It is fast, simple and secured. Benefits that can be enjoyed:

- Day long banking hours through Prime Cash service points

- Finger print authentication system

Internet Banking (General & Corporate)

Prime Bank Limited started providing these online services as Internet Banking in early January 2010. Till now, the bank is providing this service to over 13,000 numbers of accounts. Moreover, in January 2011, the bank introduced Corporate Internet Banking for corporate customers.

There are basically two divisions of internet banking:

- Altitude – General Internet Banking

- Corporate Internet Banking

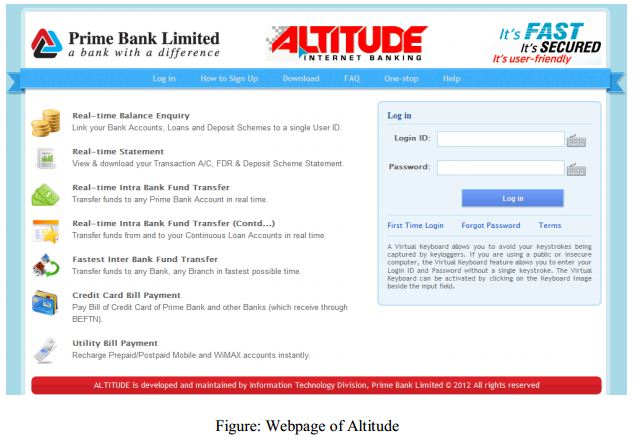

Altitude – General Internet Banking:

IT development team successfully replaced the Temenos Internet Banking module with its self-developed Internet Banking software “Altitude‟, which has enabled the bank to serve its customers with various real-time online banking services without requiring them to come to the bank. Now the customers can access the internet banking application using any browser from their Desktop PC, Laptop and any handheld devices like Mobile Phone, PDA, and Tablet etc. Using Altitude, customers will get the following services. A fee of take 500 with 15% VAT shall be charged annually as Account maintenance fee. In addition to that the management has right to modify charges any time and customers will be informed through Altitude websites about the changes immediately.

Facilities that offered through Altitude are noted down below:

Balance enquiry

Customer can know about their present balance of account through online banking service. Customers are provided with an Id and specific password is allocated to each account .Then by logging in through these account customers can know about their balance. So in short it can be said that customers can link their bank accounts, loans and deposits Schemes to a singular user Id.

View FDR and deposit scheme information

With the help of Prime Bank limited websites customers can easily know about the detail information of different deposits schemes and FDR.

View loan information

Bank‟s website also contains loan features of PBL. Through website customer can know about the lending offerings of Prime Bank Limited.

Transaction search

Transaction made by customers in different times can be checked out through online service.

Statement download

Rather going to bank now customers can view and download transaction A/C, FDR and scheme statement through online service. Thus it will save time, money and energy of people.

Real-time fund transfer within PBL

With the help of online banking service customer can transfer funds to any prime bank account in real time. In addition to that customer can transfer fund to their continuous loan account through online service and can avoid the crowd and hassle of going bank.

Real-time utility bill payments

Prime Bank limited utility bill pay services enables the customers to pay postpaid cell phone bills easily. Customers can get this service at Prime Bank ATM booths or information kiosks round the clock. Prime Bank ATM/Master Debit Card holders are eligible to enjoy these services.

The lists of services are given bellow:

- Grameen post-paid cell phone bills only

- Robi post-paid cell phone bills only

- Banglalink post-paid cell phone bills only

- Airtel post-paid cell phone bills only

Utility bills pay service provides 24/7 support and has the following features:

- Card holder can make payments any time at any Prime Bank ATM booth

- Customers will receive auto generated advice slips after the bills are paid

- The customer will need ATM card and pin code to access the facility and the procedure is absolutely secured

Charges and Fees:

- All these services are provided free of charge.

- Credit Card Bill Payments

- Prime bank has both Credit card and Debit card through which customers can pay bills

- Fund Transfer to Any Bank, Any Branch (through BEFTN)

Bangladesh Electronic Fund Transfer Network (BEFTN) is the central clearing facility, monitored and regulated by Bangladesh Bank that receives entries from Originating Bank, distributes the entries to appropriate Receiving Bank and facilitates the settlement functions for the participating banking institutions. Though the operation of BEFTN started from February 2011, it was not in a full operation because of infrastructure limitations in banking sector though PBL was ready to start EFT Transaction from the day of inauguration. PBL has been operating full-fledged transactions both Outward and Inward EFT. After implementation of the BFTN service the customers are eligible to receive or send the remittance at any branch of any bank of the country. The bank has started to remit foreign

remittances received by us to the Beneficiaries Accounts maintained with other banks through BEFTN. Within a short span of the bank has got a remarkable positive response from its retail and corporate customers regarding the BEFTN service. It has also reduced the remittance transfer cost to “Zero” level.

Security Features of ALTITUDE

Security is one of the greatest concerns for online banking services. Systems should be developed in such a way so that the confidentiality of customer can be strictly maintained. Along with that secured online transaction is a must achieve customer satisfaction. Some features of security issues of Altitude are given below:

- The web address of Altitude is: https://pib.primebank.com.bd. Altitude websites is “http” enabled which means that the communication between client device and Altitude server takes place over an encrypted as well as secured channel.

- Altitude website is verified by Verisign with „Verisign Class 3 Extended Validation SSL Certificate‟. Verisign certificate is the world‟s most renowned Certificate Authority (CA) for issuing SSL certificates.

- Two –factor authentication (2FA) is an approach to authentication which requires the presentation of two or more of the three authentication factors. “Something the use knows”, “Something the user has” and “Something the user is”. Altitude has the Two Factor Authentication (2FA) to authorize an internet banking user to perform transaction. A user will need Internet Banking logging ID and Password (Factor 1: Something user know) to log in to application .When user wants to do a fund transfer, a temporary secret code is sent to user mail inbox (Factor 2: Something the user has), this code must be correctly given by the user to execute the fund transfer.

- Once a customer logs in to the Altitude, if s/he stays idle for more 5 minutes her/his session will be expire automatically and s/he will have to re-log in to Altitude to access own account.

- If any customer Information of altitude is to be changed, only user himself can place the request through Altitude. Branch has the authority to authorize the request only.

- Branch itself cannot make or initiate any changes of customers account. Moreover each activity of the Altitude user is logged by Altitude for audit trail.

Corporate Internet Banking In January 2011, the bank introduced Corporate Internet banking for corporate customers. Now they are providing “faster access” for the corporate customer too. Corporate customers now also can enjoy the certain facilities through online services. This service will help to avoid unwanted hassle and accelerate the business growth too.

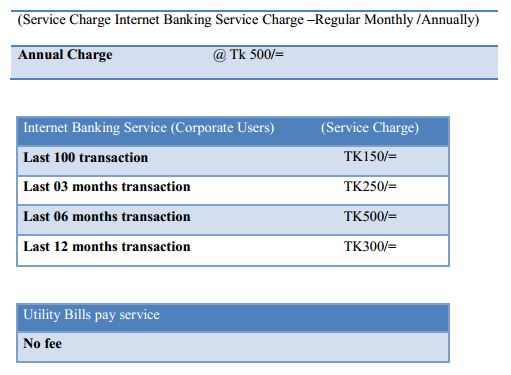

Internet Banking Service Charge:

Analysis

There are basically two parts of the study. The first part of the study will shed light on Prime Bank Limited Online Banking service. Second Part of the study aims at evaluating the performance level of Prime Bank Internet Banking Service (Altitude) and providing necessary suggestions to the shortcomings & loopholes.

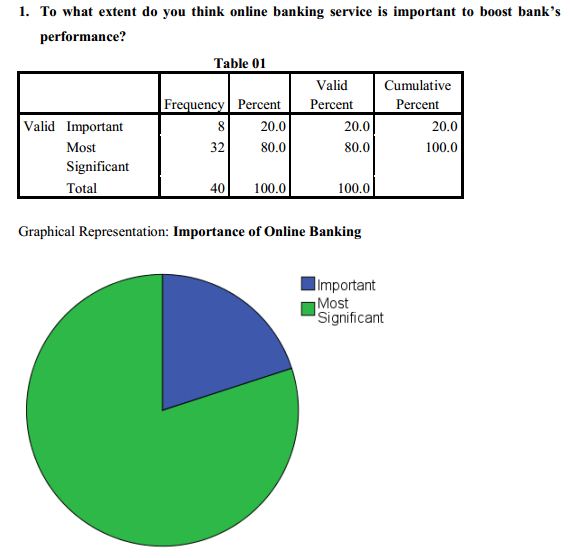

A survey was conducted over forty online banking customers of Prime Bank Limited to figure out the performance level of internet banking service. Due to certain limitation respondents are selected randomly only from Tejgaon Branch & Mohakhali Branch. So the sample size is forty. Statistical analysis and graphs are prepared in SPSS 19.0 & Microsoft Office Excel.

Interpretation:

The above Table 01 represents about how the customers of Prime Bank Ltd. are evaluating importance of online banking services in order to excel bank‟s performance. Among forty respondents thirty two are considering online services as the most significant for the organization. Only eight respondents are considering it as an important component for the bank. So according to graph 80% respondents considering online banking “Most significant” and 20% weight was put on “Important”.

Interpretation:

The above Table 02 represents the satisfaction level of customers regarding Prime Bank‟s website access speed. Respondents put 27.5% weight on “Highly satisfactory”, 30% weight on “Excellent”, 35% weight on “Satisfactory” and 7.5% weight on “Neutral”.

Interpretation:

The above Table 03 mentioned about the frequency of complaining to the bank about online banking service. Prime Bank Limited. As shown in graph among all respondents 20% complain often, 2.5% complain very often and 77.5% do not usually complain about online banking service to the Prime Bank Ltd.

Interpretation:

Here the Table 04 shows us the how promptly Prime Bank response to their customer while they make any complain about banks‟ online banking services. Though time requires solving any problem regarding online banking varies on the type of problem. Still among forty respondents 57.5% respondents got response from their bank within 24 hours, 27.5% got response within 36 hours and 15% got response from their bank within 48 hours while they complained to the Prime Bank Limited.

Interpretation:

This Table 05 describes about the time span of visiting banks‟ official website by the customers of Prime Bank Limited. According to graph among the respondents 25% visit bank‟s website every week, 27.5% visit website every month and 47.5% do it as per requirement.

Interpretation:

The above Table 06 shows about the progress of the banking service due to online banking system. Prime Bank Limited is successfully operating their online banking service through enhanced IT infrastructure. So they are considering that online banking brought significant changes for banking services. So according to graph 50% respondents go for “Significant progress” 40% go for “Noticeable progress” and 10% remain “Neutral” in order to defined progress due to online banking system.

Interpretation:

In order to adjust with the online banking system the bank needs to provide its employees special training. So the above Table 07 tells us about the skill level of Prime Bank Limited employees. Prime Bank Limited informed that, training session to cope with online banking service is arranged periodically. So according to graph 67.5% respondents stated employees from Prime Bank Limited are skilled in online banking service, 22.5% showed negative impression regarding this and 10% remained neutral.

Interpretation:

The above table 08 represents about requirement of promotional activities to attract more potential online banking customers. Since Prime Bank Tejgaon Branch is located in isolated area from massive customers the authority strongly agreed with the fact that promotional activities for internet banking should be increased to attract more customer. So as showed in graph the respondents put 30% weight on “Agree”, 55% on “Strongly Agree” and 15%

weight on “Neutral”.

Findings

Prime Bank is one of the very first commercial banks who introduced online banking services. From the beginning they are striving to provide with better quality service. Based on four factors described below Prime Bank‟s Online Banking services are being evaluated.

Cost/Price factors:

Price is a major factor that influences consumer adoption of any product. Prime Bank Limited is charging very minimum amount for online services. Prime Bank Limited charges only TK 500 annually whereas other banks charge more than TK 500 annually. For utility bills pay service Prime Bank Limited are not charging anything from their customer. Whereas other banks charge from their customer for bills pay service.

Customer interest to change:

Prime Bank Limited receive customer who shows interest for internet banking service every day. The bank is providing this service to over 13,000 numbers of accounts. So the customer base is pretty strong in Prime Bank Limited

Customer Service Quality:

Prime Bank Limited always tries to provide the better quality service. Even when the customers leave any complain about online services they try to respond within 24 hours.

Security Concern:

Security is one of the very important factors in determining the decision of consumers to use internet banking service. Prime Bank Limited is fully concerned about the security factor and they upgrade their system regularly. They have two factor authentication systems and their Altitude website is verified by Verisign with „Verisign Class 3 Extended Validation SSL Certificate‟. Verisign certificate is the world‟s most renowned Certificate Authority (CA) for issuing SSL certificates.

Recommendation & Conclusion

Recommendation

Though Prime Bank‟s online Banking Service is satisfactory while comparing with the other three banks. But to cope up with the competition and keep them ready with the changing trend they should always keep upgrading their online services. Some proposals for improving their Online Services:

- Increasing the number of ATM booth

- Heavy marketing and promotional campaign should be conducted to popularize the internet banking service

- In order to improve the level of customer service satisfaction is should give more emphasize on processing the task within promised time and give personal attention to each customer

- Increase number of online services for corporate clients

- Improve the website access quality

- Increase number of online services for non-resident Bangladeshi

Conclusion

Due to technological advancement online banking is getting more popularity than traditional banking. With online banking, customer won‟t ever have to worry about full access to their account. They will have quick and easy twenty-four hour access from anywhere in the world. The online bank won‟t ever be closed for a holiday. Being a leading private commercial bank of Bangladesh, Prime Bank Limited is also serving promising online banking service to its

customers. Customers‟ interest for online banking service is satisfactory. The charges for online banking service are also very reasonable. Prime Bank Limited is being operated with the world famous core banking software Temenos. Bank has made an agreement with the Temenos to upgrade the core banking software from version R06 to R10. In a nutshell, online banking service of Prime Bank Limited is playing a crucial role to accelerate its banking activities. It enables to customer to enjoy top class online services.