General Activities of Janata Bank Ltd., Elephant Road Branch:

The general Banking performs the most important and basic work of a Bank. It is the heart of banking activities. Bank provides the services to the customer by general banking. Because funds are mobilized, cash transaction are made, remittance accounting activities are done here.

The general banking of Janata Bank Ltd. performs various activities. The following departments are under general banking.

- Dispatch

- Cash Department

- Account Opening

- Remittance

- Bills & Clearing

- Accounts & Reconciliation

- Loans & Advances

- Foreign exchange operation

- Foreign remittance

Dispatch:

The Bank every day receives and sends documents by dispatch. Here they open every closed envelope. When any documents receive or sent both time have to give entry in register book. There are two parts of dispatch.

- Inward mail

- Out ward mail

Inward mail

When Bank receives any documents it is called inward mail. It usually comes through local currier or FedEx, DHL and so on. First task of inward mail is opening of closed envelopes then entry of registered letters in inward mail register. After register delivery against acknowledgement of receipt.

Out ward mail

Out ward mail means sent documents from bank to the outside. It sent either hand to hand or currier

Cash Department:

Cash is lifeblood of every financial activity. Bank, as a financial institution, which accepts surplus money from the people as deposit, and give them opportunity to withdraw the money by cheque. Through cash department bank receive the deposit and paying the cash on demand. The main functions of this section are following:

- Cash receipt

- Cash payment

Cash receipt:

When customers want to deposited his money then he deposited it by deposit slip in the cash counter. After receiving money and deposit slip from client, officer done following functions, which is, arrange at sequentially: –

- Officer ensure that all the writing on deposit slip have been right.

- Then count money and write denomination in the backside of the deposit slip.

- Then officer put cash receive seal on the carbon copy of the deposit slip main copy as well.

- Officer put his signature on the both copy.

- Then give entry in receive register book

Cash payment process

When depositor wants to withdraw his money then he present or order cheque for withdrawing cash from cash counter. At first deposit holder present his cheque on the computer desk. Then the authorized officer checks that cheque and amount has been balance in his account. When every things right then the amount has been debited from the depositor account on which the cheque has been drawn. If there is any doubt in the signature, which has been appeared on the specimen signature card, has verified. When everything ok then payment seal put on the cheque. Then bearer has signed on the backside of the cheque and authorized officer made payment. The authorized officer must have to maintain cash payment register. Following give the components of cash payment register book: –

- Cheque number

- Account number

- Payment amount

- Authorized signature

- Payment date.

Account Opening Department:

Another function of the banking is A/C opening. The established a banker and customer relationship account opening is the first step. Opening of account binds the banker and customer into contractual relationship. A bank has to maintain different types of accounts for different purposes. Janata Bank Ltd. offers the general deposit products in the form of various accounts.

- Saving Account.

- Current Account.

- Short term deposit Account.

- Fixed deposit Account.

Saving account (SB):

Savings account is that account whose interest rate is higher than current account and saving account holder can withdraw several times in a week. Savings account can be open by individual, joint name or club, society, association etc.

Requirements for opening individual saving account:

- Three copies pass port size photo

- National ID card

- Pass port no (if any)

- TIN number (if any)

- Require an introducer who has an account in the JBL, Elephant road branch.

- Name of nominee and a passport size photo with attested by introducer

- Two signatures on the specimen signature card

Requirements for opening joint saving account:

- Two copies pass port size photo (both parties)

- The amount can be received by any person signature or both

- National ID card

- Pass port no (if any)

- TIN number (if any)

Rules for opening saving account:

- Account opening money at least 1000 taka

- If deposit holder wants to close his account then he should pay 100 taka as cancellation charge.

- Savings account interest rate is 6 %

- Depositor can withdraw money as wish he/she can in a week if available in his or her account.

- In the case of savings account Chequebook is 10 leaves.

Current account (CD):

Current account is that type’s account where depositor can withdraw his deposited money at any time there is no restriction. Current account can be divided into following such as: –

- Proprietorship current

- Partnership

- Limited Companies

- Trustees/ clubs/ association/ and different types of institution etc.

Following are given the requirements which are need for opening current account:

For proprietorship current account:

- Introducer (Current Account holder)

- Two copies passport size photograph duly attested by the introducer.

- Trade license

- Valid passport

- Seal of the firm.

- TIN & VAT Certificate.

For current partnership account:

- Introducer (Current Account holder)

- Two copies passport size photograph all partners duly attested by the introducer

- Trade license

- Valid passport

- Seal of the firm.

- Partnership Deed or agreement

- TIN & VAT Certificate

Current account for limited companies:

- Introducer (Current Account holder)

- Two copies passport size photograph all partners duly attested by the introducer

- Seal of the company.

- TIN & VAT Certificate

- Other required Papers and documents as noted over leaf of the A/C opening form.

- Power of attorney

- Resolution of the board of directors

Following documents which is certified by the chairman of the company:

- List of the directors

- Certificate of commencement of business

- Certificate of incorporation

Janata Bank Ltd. ltd offer different types of account for their target groups. These are as follows:

- Monthly saving scheme (MSS)

- Fixed term deposit account (FDR)

- Short term deposit account (STD)

- Special deposit scheme (SDS)

Following are broadly explaining all this types of accounts: –

Monthly saving scheme (MSS):

Monthly saving scheme (MSS) is specially offer for limited income group peoples, students. This MSS account help to accumulate in hand sum amount at the end of maturity date of MSS.

MSS has two phrases, such as: –

| Monthly instrument | Received after 5 years | Received after 5 years |

| Tk. 500 | Tk. 40,100 | Tk. 1,12,500 |

| Tk. 1,000/- | Tk. 75,791 | Tk1,41,697/- |

| Tk. 2000/- | Tk. 1,51,583 | Tk. 2,83,570 |

| Tk. 3000 | Tk. 2,27,348 | Tk. 4,25,091 |

| Tk. 4000 | Tk. 3,03,166 | Tk. 5,66,788 |

Fixed term deposit account (FDR):

Fixed term deposit (FDR) application form has been used both for application form and as a credit voucher for the bank. In the case of FDR specimen signature card used and client give three signatures on the specimen signature card. In the case of FDR it is clearly mention that when this amount will be withdrew account holder receive principle amount plus interest. FDR account holder gets a FDR slip that is provided by the JBL officer. FRD slip contains name of account holder, deposited amount, and interest rate, and time of maturity. If depositor withdraws his money before maturity date he does not get any interest. If account holder lost FDR slip then indemnity bond is required to issue a duplicate FDR slip.

FDR account can be open by individually or joint name. In the case of FDR holder death, his nominee will get the amount. Following are given the interest rate according to the maturity date:

| Maturity date | Interest rate |

| For 3 months | 7.75% |

| For Above 6 months | 8.00% |

Short-term deposit (STD):

Short tram deposit account interest is calculated at daily basis and its interest rate is 4.50%.

Document required for opening short term deposit:

- Two copies of pass port size photo

- TIN number

- Require an introducer who has an account in the JBL, Elephant road branch

- Trade license

Special deposit scheme (SDS):

Under SDS client can deposit for five years and his deposited money is fully refundable. Under this SDS depositor enjoy a monthly profit corresponding to their deposited amount.

Following are given the structure of SDS and their monthly benefit: –

Deposited amount Monthly profit

55000 500

110000 1000

165000 1500

220000 2000

275000 2500

330000 3000

Document requirements for SDS:

- Two copies of pass port size photo

- Mentioning nominee with address and relation

- Require an introducer who has an account in the JBL, Elephant road branch

Issuing chequebook:

There are three types of cheque book in the Janata Bank Ltd. ltd. those are:-

- Ten leaves cheque book: -Ten leaves cheque book use only for savings account.

- Twenty leaves cheque book: -Twenty leaves cheque book is use for current account.

- Fifty leaves cheque book: – Fifty leaves cheque book use for current account but this is provided those depositors who are loyal customer or those whose transaction has done randomly.

Chequebook issue to a new account holder:

New account holder has to fill up an application form, which is provided by JBL. After verifying depositor signature the authorized officer put branch seal and put his signature then date, name of the account holder, account number, cheque number are recorded in the register book. When all this function is successfully completed the client gets his chequebook and put his signature on the register book.

Chequebook issue to existing account holder:

When a existing deposit holder wants to withdraw a new cheque book then he should be give a requisition slip to the bank which he get from previous cheque book then authorized officer verifying deposit holder signature. After verifying signature authorized officer put breach seal, and his signature on new cheque book then date, name of account, account number, cheque no, are recorded in the register book then client get his cheque book and put his signature on the register book.

In the case of lost Chequebook:

It has been observed that when a cheque book has been lost by the account holder, the account holders have to give an application to the branch manager for providing a cheque book. After verifying sign he gets a cheque book.

Remittance:

Remittance means transfer of money from one place to another. It is one of the safest ways to transfer money from one place to another. Janata Bank Ltd. ltd has 91 brunches so they have strong network through whole country and they can easily reemit money most of the districts with in the country.

For transferring money Janata Bank Ltd. ltd. offer different instruments such as:-

- Telegraphic transfer (TT)

- Pay order (PO)

- Demand draft (DD)

Telegraphic transfer (TT)

Telegraphic transfer (TT) is the quickest and self-way of transferring money from one destiny to another destiny. It is done by telephone massage, telex massage. The message is authenticated by prefixing of suffixing a cheque cipher. A cheque cipher for any remittance is worked out on test key table and a code block, which is allowed only authorized officer.

Elements of the test code for TT:

- Code for name

- Code for amount

- Code for date

- Code for branch

This test code is generally given by the authorized officer because it is confidential.

TT Sending

Requirements for sending TT: –

- Client should have account in National at Elephant road branch and sending place.

- Client should paid commission, VAT and telex charge

Procedure for sending TT:

When client want to transfer money from JBL, Elephant road branch to JBL, Agrabad branch (suppose) then following ways he should follow: –

- At first collect TT form remittance division

- Deposit money in cash department, which he mentioned in TT form.

- Then client collect cost memo from remittance division, this cost memo works as evidence in favour of client.

The authorized officer put test code and registers it in the TT payment register book then authorized officer send massage to the Agrabad branch by telephone or telex. This massage contains Client account number, test number, amount.

Commission of TT:

- Up to 25000 commissions is 25 taka

- Above 25000, for every one thousand pay one taka as commission.

VAT: – 10% of commissions

Telex charge: – It is always 40 taka

In the case of advisor pay:

If authorized officer received TT massage for advisor pay the debit voucher is same and credit voucher has to be changed, which as follows: –

Pay order (PO)

Pay order is an order by an issuing branch or bank upon client for made payment of the amount mentioned there in that named pay on according to client order. Pay order issued only for local payment.

For issuing a PO, following formalities are to be maintained. These are:

- Duly filled up the application form by the customer

- Deposit money either in cash or by cheque with necessary charges

- Prepare the instrument and make necessary entries in the PO register where payees name, date, PO no and so are noted.

- Deliver the instrument to the customer after scrutinized and approved by authority by taking signature of the customer on counterpart.

Demand draft (DD)

Characteristics of demand draft (DD):

It is drawn on one branch upon another branch of the same bank

Its payment cans only that whose name is mentioned in the pay orders.

Commission:

Up to 25000 taka commission 25 taka

Above 25000 taka every one thousand carry 1 taka

VAT: – VAT is 10% of commission.

Clearing and Bills Department:

Cheque, pay order, demand draft, collection of amount of other banks on behalf of its customer is a basic function of a clearing department.

Clearing:

Clearing is a system by which a bank can collect customers fund from one bank to another bank through clearing house.

Clearing house:

Clearing house is a place where the representative of different banks gets together to receive and deliver cheque with another bank.

Normally Bangladesh bank performs the clearing house. Where there is no branch of Bangladesh bank Sonali bank performs this function.

Procedures for collection:

- Putting the receive seal on the cheque.

- Putting crossing seal on the cheque.

- “Payee’s A/C credited” endorsement is given.

- Entry is given in the outward clearing register.

- Clearing seal is given

- Cheques are sorted bank wise and entries are given to the computer.

- Entries are given in the clearing house register before dispatching to the clearing house

After clearing process some instruments is made cleared and some instrument might be retuned. Then local principle office sends a credit advice and all instruments those have been the whole clearing process takes time three working days.

After receiving credit advice Elephant road branch authorized officer has to respond on the “credit advice” (IBCA) send by local office. IBCA bears the documents of the total amount of instruments received by the local office from Elephant road branch. IBCA has described that JBL Elephant road branch general accounts have credited.

Return cheque

In the time of clearing process some instruments might be returned.

Reasons for cheque return or dishonoured

- Insufficient fund

- Nor arrange for

- Effect not cleared .may be presented

- Exceed arrangement

- Full cover not received

- Payment stopped by drawer

- Payee’s endorsement irregular/ illegible/ required

- …Payee’s endorsement irregular required bank’s conformation

- Drawer’s signature differs/ required

- Alternation in date/ figure/ words require drawer’s full signature.

- Cheque is past dated/ out of date/ multi date

- Amount in word and figure different

- Crossed cheque must be presented through bank

- Clearing stamp required/ requires cancellation

- Addition to bank discharge should be authenticated

- Cheque crossed” account payee’s only”

- Collection bank’s discharge irregular/ required

The dishonour cheque entry in the return register & the party is informed about it. Parties signature is required in the register to deliver the dishonour cheque.

If the cheque is dishonour due to insufficiency of funds then bank charges TK. 50 only as penalty.

Outward bill for collection (OBC)

When any cheque received by Janata Bank Ltd., Elephant road branch but it drawn on another bank or another branch of Janata Bank Ltd., which is situated outside of Dhaka city, then it must be OBC (other bank collection). How OBC function has done that given below at sequentially:-

- Give an endorsement seal on the backside of that cheque.

- Put OBC seal and BOC serial number

- Entry in the OBC register with OBC no, name of account, drawn on, cheque no, amount

- Send a forwarding letter with the cheque of that drawn bank. Following are given a format of forwarding letter:-

- Following a given a format of forwarding letter.

Accounts division

Accounts division is the most important for all banks. In accounts division maintain all types of accounting procedures of Elephant road branch and support the branch to take different types of initiatives by providing various data and information.

Functions of Accounts division: –

- Prepare daily statement of affairs

- Give posting of voucher in computer.

- Maintain transfer book

- Prepare supplementary

- Prepare daily, weekly, monthly, and quarterly, half yearly and annual statement

- Reconciliation of CIBTA

- Prepare advice

- Prepare incomes and expenditures statement

- All administrative work

- When accounts officer receive any types of voucher then he has to identify whether it are

- Clearing

- Cash

- Transfer

Clearing

When accounts officer receive clearing voucher then he send it to the clearing division.

Cash

When accounts officer receive cash voucher then payment made by clients.

Transfer

When accounts officer receive transfer voucher that means this amount should be transfer one account head to another account head. In this case accounts officer register it in register book before computer posting. Before register this voucher in register book officer put a serial number that is register in register book. In transfer register book contains debit and credit side, particulars and amount.

End of banking hour accounts officer calculate the transferred amount and debit balance and credit balance should be equal and he make sure that the debit balance and credit balance of transfer, clearing and cash position should be same figure. Every day accounts division prepared daily statement affairs and send them to the every department.

Reconciliation

The reconciliation division collects all the CIBTA (Computerized Inter Bank Transaction Advice) related voucher. Foreign exchange division take some voucher which is related to their division and rest of the vouchers are supposed to make advice. Before written advice, accounts officer slotting those vouchers according to IBCA (Inter Branch Credit Advice) IBDA (Inter Branch Debit Advice) responding and originating wise. When all are complete then those are posting in computer and take a print of originating and responding sheet and make extract.

Extract: – extract needs to reconciliation all transaction between Elephant road branch and all other branch of JBL through IBCA and IBDA. Extract are two types such as, Extract for originating and responding credit entries and extract for origination and debit entries.

Loan & Advance division:

Advance division is heart for any bank. A big portion of income of the Janata Bank Ltd. ltd is comes from this advance division. This income comes from different types of investment of depository money. Investment decision is the most important which is taken by the management of the Janata Bank Ltd. ltd. JBL advance division play a vital role for economical development.

JBL has an investment committee they are responsible following things: –

- To ensure the cash liquidity requirement and can this cash liquidity meet depositor requirement.

- To identify new investment portfolio and this is profitable for the Janata Bank Ltd..

- To examine bank’s deposit, investment and identify their surplus money.

- They should be active for recovery their substandard, doubtful and bed loan.

- They should be take short-term investment but this investment return is comparably high.

- They should aware about market study and existing portfolio of investment.

- They should aware to identify new sources of investment.

Consideration factors for loan:

When Janata Bank Ltd. gives loan that time they should consider some factors, such as

- Safety

- Security

- Liquidity

- Adequate yield

- Diversity of risk

Safety:

Safety is the most important for sanctioning loan. At the time of repayment borrower may be unable to pay the loan amount. That’s why when bank-sanctioning loan they have to take collateral security from the borrowers.

Security:

Banker should be aware in the selections of security for their loan. They should properly evaluate the value of security it should not less than or equal to loan Amount.

Liquidity:

When banker sanctioning any loan then they should ensure the liquidity position of Janata Bank Ltd..

Adequate yield:

Banker should select those investment which interest rate is higher then savings Interest rate.

Diversity of risk:

Bank should not invest in one or two sector. If it is happened then their investment risk is higher then market risk. Bank should maintain investment portfolios for reducing their risk. In this case when one investment makes loss another investment will cover that loss.

Types of loan:

By the nature of loans are three types. Following describe different types of loan are:-

Current loan:

Current loan is also called revolving credit. Current loan holder can withdraw or deposit money in his account in several times with in the loan period. If loan holder wants to renew his loan amount then it can be done with the authorization of the bank. Current loan duration time is one year and interest is charged by quart lay basis. End of the duration period loan holder must have to pay loan amount with the interest.

Current loan is two types:

- Cash credit (CC)

- Security over draft (SOD)

Cash credit (CC):

Nature of cash credit: –

- Its duration is one year.

- Interest charged quarterly

- End of the duration loan holder must have to pay loan amount with interest rate.

- Risk fund and service charge is not needed for cash credit.

- Collateral security is essential for cash credit

- Cash credit is offer for those peoples whose need working capital or there is a shortage in their capital.

Secured over draft (SOD)

Nature of secured over draft (SOD): –

- SOD loan issue against FDR or Work order

- Duration of land is one year

- Bank issue letter of lies if loan is against FDR

- SOD loan is offering for those persons whose need money to meet his financial obligation.

- Secured over draft (SOD) loan are two types:

- SOD (G) against work order

- SOD Bid Bond.

SOD (G) against work order Sometimes SOD loan is issued against work order for complete the work. For issuing SOD loan remaining value of work is important and this loan gives on the basis of bills receivable. When SOD issued against work order party gives the power of attorney for draw the cheques. SOD against work order loan involves three parties such as bank, loan holder, and work giver.

Bills receivable calculation following ways: –

{Total value of work- (17.5% of work value+ cheque receive)}= bills receivable.

Charge documents for SOD against work order: –

- Promissory note (DP note)

- Letter of arrangement

- Letter of continuity

- Letter of guarantee.

SOD (Bid Bond)

SOD (Bid Bond) is gives for those borrowers who want to participate any bid for collect work. In SOD Bid Bond payment is making by the pay order. If borrower gets that work then interest is charger of that amount. If borrower does not get that work then he deposit that amount which he has issued by pay order.

Charge documents for SOD (Bid Bond): –

- Promissory note (DP note)

- Letter of arrangement

- Letter of continuity

- Letter of guarantee.

- Letter of disbursement

SOD against FDR

Some times JBL give SOD loan against FDR. In this case the loan amount is 80% of FDR account. In SOD against FDR interest rate is 3% more then FDR interest rate. This loan is more secured then other types of loan. In the case of SOD loan against FDR party gives Power to the bank if borrower unable to pay loan amount then bank can withdrawn his loan amount from parties FDR account.

Charge documents for SOD against work order: –

- Promissory note (DP note)

- Letter of arrangement

- Letter of continuity

- Letter of attorney

- Letter of Lien

In this charge document describe that client arrange all the loan documents and he does not bound by Janata Bank Ltd. to take loan. Here he also promise that bank have right to cancel the loan facility at any time. In the even of the loan facility being cancelled by Janata Bank Ltd. client must be pay all dues together with all other charge.

Letter of disbursement: –

By this charge document client request to the bank for disburse the loan amount credited to client accounts.

Letter of continuity: –

In this charge document describe that client agree to continue loan until repayment of loan amount.

Letter of hypothecation: –

Letter of hypothecation describe that bank will remain in force until closed by the bank and to be secured by goods to be hypothecated with the bank. Letter of hypothecation is an agreement between the borrowers and Janata Bank Ltd. for following factors: –

- Security

- Balance due to the date

- Borrowers not to encumber or past with the goods.

- Inspection

- Borrower to pay rent

- Insurance

- Margin

- Interest rate

- Repayment

- Sales of goods

Letter of guarantee:

Letter of guarantee ensure that borrower give guarantee to the bank that he will pay all dues including other charges in due time.

Letter of lien:

It is ensure that borrower give guarantee to the bank he will repay all the dues including other charges. If borrower is unable to prepayment of loan amount then bank can debating borrower FDR account which is mention in loan application.

Letter of hypothecation (bills):

This charge document is use in import and export. This document ensure that bank and client negotiating any bill of exchange.

Counter guarantee:

This document ensure that client give counter guarantee on the letter of guarantee that borrowers will pay any claim of JBL.

Purpose of this charge document:

All these documents should be correctly is takes for the safety of JBL loans this documents works as a legal documents when documents or produce in the court. For effective documentation bank should be follows following steps: –

- Prepare a list of document

- Verify by the legal advisor.

- It document is more then one page then signature required for Every page.

- Eyewitness

- Date should correctly mention.

Phase thirteen:

Loan amount disburse after all required documents are filled by the borrowers.

Phase fourteen:

At last JBL should be monitor borrower account and repayment nature.

Payment procedure:

In the case of current loan interest is calculate by the basis of product such as: –

Product = outstanding balance * no of days

Interest= (product * interest rate)/360

Consumer credit scheme (CCS)

Janata Bank Ltd. offers consumer credit scheme to the consumers to buy different household items. Now consumers can easily purchase different items such as TV, VCR, PC, Washing machine, car etc on instalment basis by taking CCS loan from Janata Bank Ltd. ltd.

Charge documents for CCS loan:

Promissory note (DP note)

- Letter of arrangement

- Letter of undertaking to pay monthly instalments under CCS

- Letter of hypothecation

- Letter of disbursement

- Personal grantee of borrower.

Employees house building loan (EHBL)

The employee of JBL can take house-building loan from bank but the range of loan amount depends on person’s designations. Simple interest rate is charge on employee’s house building loan and interest rate is 8%.

House building loan (HBL)

Janata Bank Ltd. provide house-building loan for their target groups. In the case of HBL interest rate is 14.5%. For HBL loan bank keep land as a collateral security for their safety.

Foreign Exchange Department:

Foreign exchange is the means and methods by which rights to wealth in a country’s currency are converted into rights to wealth in another country’s currency. There are three kinds of foreign exchange transaction.

- Import

- Export

- Remittance

According to import and export control Act, 1950, the office of Chief controller of import export provides the registration (IRC) to the importer. In an international business buyers and sellers are unknown to each other. So seller always seeks to security for the payment of his exported goods. Bank gives guaranty to the exporter that it will pay if buyer does not pay. This guaranty is called ‘Letter of credit’. This is the contract between importer and exporter, which is legal shape by the bank.

Parties to the L/C:

Importer: who applies for the L/C?

Issuing bank: Which open L/C on behalf importer?

Confirming bank: the bank, which adds its confirmation to the credit and it, is done at the request of issuing bank.

Advising bank: The bank is situated in exporter’s country.

Negotiating bank: This is the bank, which negotiates the bills and pays the amount of the beneficiary. The advising and beneficiary bank may or may not same.

Accepting bank: It is the bank, which the bill will be drowned.

Reimbursing bank:

It is the bank would reimburse the negotiating bank after getting payment.

Steps for L/C operation:

Registration with CCI&E:

For engaging in international trade every trader must be registered with the Chief controller of importer & exporter.

By paying specified registration fees to the CCI&E the trader will get IRC/ERC (import/export registration certificate) to open L/C with a bank.

Determination of terms and credit:

The terms of the letter of credit are depending upon the contract between importer and exporter. The terms of credit specify the amount of credit, name, and address mode of shipment and destination, nature of credit, expiry date and so on.

Proposal for opening of L/C:

The proposal contains the following particular

- The bank account

- Nature of the business

- Required amount of limit

- Payment terms and condition

- Goods to be imported

- Offered security

- Repayment schedule

Submit an application of opening a L/C:

For opening L/C the importer is required to fill up a prescribed application form provided by the banker.

Opening a L/C by the bank:

- Receive filled up application form

- Collects credit report of exporter

- Bank then issues credit by air mail/SWIFT followed by L/C advise as asked by the opener through his foreign corresponded.

Shipment of goods and lodgement of document by exporter:

Then exporter sends the goods to the importer’s country

Sends the documents to the L/C opening bank through his negotiating bank. Generally the following documents are sent to the opening banker with L/C

- Bill of exchange

- Bill of loading

- Commercial invoice

- Certification of origin

- Packing list

- Advice details of shipment

- Vessel particulars

- Shipment certificate

Janata Bank Ltd. (Elephant Road Branch)

Operation Elephant Road Branch

The Operations of Elephant Road Branch are performed under several functional departments. Functions of all departments are briefly mentioned are as follows:

- Job design

- Job rotation

- report on employees performance for increments

- Prepare leave plan

- Monitor overall banking functions

- Preparation of daily statement

- Preparation of supplementary

- Transfer of all transaction for adjusting

- Maintain and adjust all branches accounts

- Preparation of monthly and quarterly statements to head office and Bangladesh Bank

- All dealing with reconciliation report

Ratio Analysis

The Bank performance Evaluation entails interactions between the environment, internal operation, and external activities. The prime object of management is to maximize the value of the banks equity shares by making an operational risk-return trade off. Realising this bank management usually develops a comprehensive plan in order to define objectives, goals, budgets, and strategies that will be consistent with the maximization of the share value. Financial ratios comprising accounting items present a historical configuration of bank returns and risk.

Analysing Bank performance with financial ratio:

Financial are constructed by forming ratios of accounting data contained in the bank’s Reports of income (i.e. profit & loss) and condition (i.e. balance sheet). Ratio analysis is a powerful tool of financial analysis. A ratio is defined as s“the indicated quotient of two mathematical expressions” and as” the relationship between two or more things”. In financial analysis, a ratio is used as a benchmark for evaluation the financial position and performance of a bank. A wide variety of financial ratios can be calculated to assess different characteristics of financial performance. To evaluate a financial ratio for a bank, comparison with peer group banks are also used. Also, it is beneficial to track the ratio over time relative to other banks. Even without comparison with other bank, ratio trends over time may provide valuable information about the bank performance. The ratios commonly used by bank analysis to evaluate different dimensions of financial performances of a bank are given below:

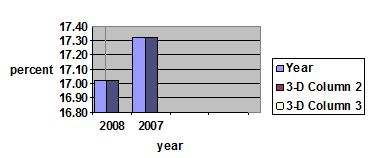

Profitability Analysis:

To measure the performance of the bank it is important to measure some of the ratios to get a clear picture about the bank activities. Some of the important ratios are Return on investments (ROI), Return on Equity (ROE), Profit Margin and Asset Utilization ratio.

Table:

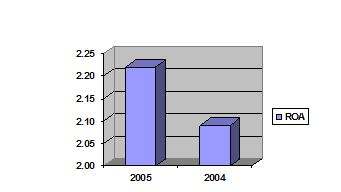

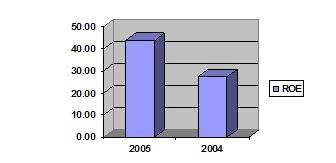

| Ratios | 2008 | 2007 |

| Current Ratio | 1.10% | 1.16% |

| Assets Turnover (ROA) | 2.22% | 2.09% |

| Profit Margin | 17.02% | 17.32% |

| ROI | 8.25% | 6.62% |

| ROE | 43.85% | 27.44% |

| Debt Equity | 81.92% | 79.83% |

Profit Margin Ratio:

The profit margin ratio gives some ingredients to judge the ability of management to control expenses, including taxes, given a particular level of operating income.

If profit margin of a bank increase then stability of bank increases. Here JBL profit margin of 2008 slightly lower than that of 2007. Only 0.3% decreases profit margin than the previous year, it is not so harmful. This may cause due to the decrease of evaluation of taka against dollar and delinquency of loan.

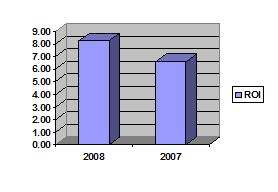

Rate of Return on Investment (ROI)

The Rate of Return of Investment is frequently used to evaluate bank management. The ROI measures the ability of management to utilize the real and financial resources of the bank to generate returns. It indicates net income per taka of total investments owned during the period.

Rate of Return on Assets (ROA)

The rate of return of assets is frequently used to evaluate bank management. The ROA measures the ability of management to utilize the real and financial resources of the bank to generate returns. It indicates net income per taka of total assets during the period.

Rate of Return on Equity (ROE)

The rate of return on equity is considered as well as judgement in analyzing a bank’s financial health. ROE shows what contribution the equity capital on net income. It measures the percentage return on each dollar of stockholders equity is the aggregate return to stockholders before disbursing dividends

Higher the return, better the condition, as bank can add more to retained earnings and pay more In cash dividends when profits are higher.

Foreign Exchange

The import and export trade of our country is regulated by Chief Controller of Import and Export (CCI&E). No person who has been granted registration by the CCI&E shall indent, import or export any thing into or out of Bangladesh except in cases of exemption issued by the government.

Business person in our country can import product from another country, for this transaction they transfer Letter of Credit. In this part we will discuss about import procedure as general basis because this procedure is accepted world wide.

Letter of Credit:

Letter of credit is a written undertaking issued a bank (Guaranteeing payment) at the request of buyer (Importer) to the seller (Exporter) to pay at sight or a determined future date, up to a stated sum of money, within a prescribed validity of the instrument (L/C) and against stipulated shipping documents.

There are different types of L/C:

Circular letter of credit: It is issued by a bank at the request of this customer for availing credit facility from beneficiary or draws his traveling expenses from banks in different places. But with the introduction of Travelers Cheques and Credit Card, issuing of circular L/C is now outdated.

Revocable credit:

It is credit, which can be revoked or cancelled at any time without the consent or notice of the beneficiary.

Irrevocable credit: This credit cannot be revoked, revised or amended/ changed without the consent of all the parties i.e. the buyer, seller, issuing bank and confirming/ advising bank.

Red-clause or packing credits: Which bears an endorsement by opening bank on the credits in “Red-Ink” a clause authorizing the confirming or negotiating bank to pay the beneficiary against his drafts alone coupled with his simple promise to provide the documents in future. “Packing” because the merchandise bought in the interior is shipped to the ocean port, assembled and packed for over as shipment. Subsequently, bank can reimburse the amount by negotiating the shipping documents plus interest accrued.

Revolving credit:

An L/C can be revolving credit provided the wording will permit the amounts of drawings to be again available to the beneficiary within the validity period. Clause of opening bank to advising bank. The amount paid under this credit become available to you upon your receiving from us advice to this effect. The amounts paid under this credit are again available to you automatically until the total of the payments reaches a fixed amount. L/C opening branch doesn’t need to get permission from HO to open L/C each time if it is in the limit.

Stand by letter of credit: It is a contractual agreement between one bank to another or a bank to its customers to provide agreed amount of funds as per arrangements set in the agreement. Applicable only in case of subsidiaries of a bank abroad when they like to borrow from others in that country since Parents Company is restricted by the law of the land to issue guarantee for its subsidiary company.

Participants of L/C opening:

Importer: A company can import finished goods or purchase raw materials to produce the product.

Exporter/ Beneficiary:

Those who supply raw material or finished goods.

Issuing bank:

L/C opening bank is called issuing bank or L/C opening bank. Some time issuing bank also does the work of advising.

Advising bank:

Advising bank will receive the L/ C and send it to exporter or negotiating bank

Reimbursement bank: Issuing bank can pay to the negotiating directly or through reimbursement bank. In this bank, issuing bank has an account, which is called “a/c. in this a/c issuing bank deposit required amount for L/ C payment.

Add confirmation:

Supplier may want to receive payment from a specified and reputed organization through that bank they will collect their payment.

Syndicate financing: It may be difficult for a small bank to finance for a big amount of L/C. In this, few banks may finance circumstances L/C.

Indenter:

An exporter may have an agent in the importing country. Then they do all process and they send “Indent” to the importer. Indent includes all information required by importer as types of product, price, quantity, shipment date, negotiating bank etc.

Import procedure:

At the request of the buyer, issuing bank opens L/C on behalf of importer. Advising bank in the seller’s/ exporter’s country advice L/C to the beneficiary. The issuing bank may also request advising bank to confirm the credit.

The advising bank will advise/ inform the exporter that the L/C has been issued.

As soon as the seller/ exporter receive L/C and are satisfied with the terms and conditions, they take initiative for shipment of goods.

After making shipment, the exporter submits documents to negotiating bank for negotiation along with L/C copy.

Negotiating bank scrutinizes the documents and if satisfied, then they send the documents with forwarding letter to the L/C opening bank.

After receiving documents, the opening bank checks the documents and if no discrepancy is found, makes payment directly to the negotiating bank or through reimbursement bank.

Required documents for L/C opening:

A request letter for L/C opening with margin, amount of product and total cost IRC (Import Registration Certificate): It is issued by CCI&E, which will certify that the company has included itself as an importer.

TIN (Tax Identification No): Company gives their tax regularly or not, this information will be known from tax identification no.

Pro-forma invoice/ Indent: Three copies duly accepted. Exporter sends “Performa Invoice” to the importer, which contains types of product, price, quality, shipment date, negotiating bank etc.

Insurance cover note: An insurance company must insure imported product.

VAT registration: Whether company submit VAT on their product or not.

Trade license: A valid trade license if expiry date is over they must renew it. Membership certificate by Chamber of Commerce & Industry or Register trade association.

L/ C application (Provided by bank)

LCA form (L/C authorization form)

IMP form (Import permission): It is issued by CCI&E which will identify whether the product is authorized to import or not.

Banker’s solvency certificate

Approval of Drug Administration in case of importing pharmaceutical raw material and packing materials etc.

Banker will consider following documents to open a L/ C:

Proper assessment of applicant’s credit worthiness, integrity, past performance etc.

General Banking is engaged in cash receipt and payment, Cheque clearing, local remittance etc. The amount of deposit in Elephant road branch is very high because Elephant area is big business area of Dhaka city.

Loans and Advance department analyses the credit proposal and disburse credit if the proposal is sound. As specialized financing, it provides term finance to medium and small-scale industries.

General Banking is engaged in cash receipt and payment, Cheque clearing, local remittance etc. The amount of deposit in Elephant road branch is very high because Elephant area is big business area of Dhaka city.

Loans and Advance department analyses the credit proposal and disburse credit if the proposal is sound. As specialized financing, it provides term finance to medium and small-scale industries.

Conclusion

General Banking is engaged in cash receipt and payment, Cheque clearing, local remittance etc. The amount of deposit in Elephant road branch is very high because Elephant area is big business area of Dhaka city.

Loans and Advance department analyses the credit proposal and disburse credit if the proposal is sound. As specialized financing, it provides term finance to medium and small-scale industries.