General objective of this report is to analysis overall deposit management system of National Bank Limited and to get a clear knowledge on management policy of National Bank as well as commercial Bank. Here briefly focus on Deposit Analysis. Other purpose are analyze various deposit schemes of NBL and observe the overall asset quality of NBL. Finally recommend some suggestions for further development and know the customer opinion about deposit scheme in NBL.

Objective

As business student it is indispensable to undergo some practical Report like this for the purpose of having flavor of professional atmosphere and make rectification, as required.

Broad Objectives

- General objective of the study is to examine overall deposit management system of National Bank Limited.

- To get an overall idea about the management policy of NBL as well as commercial Bank.

Specific Objectives

- To analyze various deposit schemes of National Bank Ltd.

- To examine the deposit appraisal procedures followed by National Bank Ltd.

- To Report the control mechanism followed by NBL for deposit.

- To observe the overall asset quality of NBL.

- To recommend some suggestions for further development of NBL..

- To know the customer opinion about deposit scheme in NBL.

History and Heritage

National Bank Limited has its prosperous past, glorious present, prospective future and under processing projects and activities. Established as the first private sector bank fully owned by Bangladeshi entrepreneurs, NBL has been flourishing as the largest private sector Bank with the passage of time after facing many stress and strain. The members of the board of directors are creative businessmen and leading industrialists of the country. To keep pace with time and in harmony with national and international economic activities and for rendering all modern services, NBL, as a financial institution, automated all its branches with computer networks in accordance with the competitive commercial demand of time. Moreover, considering its forth-coming future, the infrastructure of the Bank has been rearranging. The expectation of all class businessmen, entrepreneurs and general public is much more to NBL. At present we have 154 branches under our branch network. In addition, our effective and diversified approach to seize the market opportunities is going on as continuous process to accommodate new customers by developing and expanding rural, SME financing and offshore banking facilities.

The emergence of National Bank Limited in the private sector was an important event in the Banking arena of Bangladesh. When the nation was in the grip of severe recession, the government took the farsighted decision to allow the private sector to revive the economy of the country. Several dynamic entrepreneurs came forward for establishing a bank with a motto to revitalize the economy of the country.

National Bank Limited was born as the first hundred percent Bangladeshi owned Bank in the private sector. From the very inception, it was the firm determination of National Bank Limited to play a vital role in the national economy. We are determined to bring back the long forgotten taste of banking services and flavors. We want to serve each one promptly and with a sense of dedication and dignity. National Bank, has now acquired strength and expertise to support the banking needs of the foreign investors. NBL stepped into a new arena of business and opened its Off Shore Banking Unit at Mohakhali to serve the wage earners and the foreign investors better than before.

NBL at A Glance

National Bank is the dynamic first generation bank established in 1983 focusing on technology and service. The then President of the People’s Republic of Bangladesh Justice Ahsanuddin Chowdhury inaugurated the bank formally on March 28, 1983 but the first branch at 48, Dilkusha Commercial Area, Dhaka started commercial operation on March 23, 1983. At present, NBL has been carrying on business through its 155 branches and 20 SME spread all over the country. Since the very beginning, the bank has exerted much emphasis on overseas operations and handled a sizable quantum of home bound foreign remittance. It has drawing arrangements with 415 correspondents in 75 countries of the world, as well as with 37 overseas Exchange Companies located in 13 countries. NBL was the first domestic bank to establish agency arrangements with the world famous.

NBL was also the first among domestic banks to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS. NBL has been continuing its small credit programmers for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for improving their livelihood. National Bank, has now acquired strength and expertise to support the banking needs of the foreign investors. NBL stepped into a new arena of business and opened its Off Shore Banking Unit at Mohakhali to serve the wage earners and the foreign investors better than before.

Since its inception, the bank was aware of complying with Corporate Social Responsibility. In this direction, we have remained associated with the development of education, healthcare and have sponsored sporting and cultural activities. During times of natural disasters like floods, cyclones, landslides, we have extended our hand to mitigate the sufferings of victims. It established the National Bank Foundation in 1989 to remain involved with social welfare activities. The foundation runs the NBL Public School & College at Moghbazar where present enrolment is 1140. Besides awarding scholarship to the meritorious children of the employees, the bank has also extended financial support for their education. It also provided financial assistance to the Asiatic Society of Bangladesh at the time of their publication of Banglapedia and observance of 400 years of Dhaka City.

NBL focused on all key areas covering capital adequacy, maintaining good asset quality, sound management, satisfactory earning and liquidity. As a consequence, it was possible to a record growth of 175.51 percent with Tk. 8,809.40 million pretax profits in the year under review over the preceding year. The net profit after tax and provision stood at Tk. 6,860.34 million which was Tk. 2,070.47 million in the previous year registering a 231.34 percent rise. The total deposits increased to Tk. 102,471.83 million being 33.37 percent increase over the preceding year. Loans and advances stood at Tk.92,003.56 million in the year under report which was Tk. 65,129.289 million representing 41.26 percent rise over the preceding year. Foreign trade stood at Tk. 144,255.00 million in 2010 compared to Tk. 115,939.00 million, increased by 24.42 percent compared to that of the previous year. During 2010, the bank handled inward remittance of Tk. 49,145.30 million, 10.73 percent higher than that of the previous year. Return on Equity (ROE) registered a 77.84 percent rise over the preceding year. The bank has a strong team of highly qualified and experienced professionals, together with an efficient Board of Directors who play a vital role in formulating and implementing policies.

Vision and Mission

Every men has mission and vision which they reach expected aim. As men or persons manage, operate or maintain their company or business, also company or business has vision and mission. By this vision and mission we can easily gain our dream or expected aim step by step.

National Bank Limited Vision and Mission

Vision

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country are our cherished vision.

Mission

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, account ability, improved clientele service as well as to our commitment to serve the society through which we want to get closer and closer to the people of all strata. Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Division of NBL

- Audit & Inspection Division.

- ATM Card Division

- Board Secretariat

- Budget & Monitoring Division.

- Credit Division-1.

- Credit Division.-2.

- Credit Card Division.

- Classified Loan Recovery Division.

- Financial Administration Division.

- General Banking Division.

- Human Resources Division.

- International Division.

- Information System & Technology Division.

- Law & Recovery Division.

- Marketing Division.

- Merchant Banking Division.

- Protocol Division.

- Reconciliation Division.

- System & Operations Division

Services of NBL

We provide the following range of services:-

- Strategic planning and organizational development

- Faculty and departmental operational advice support and services

- Staff development

- Projects and information management

Financial Highlights of NBL

| Particulars | 2011 | 2010 |

| Paid-up Capital | 8603.66 | 4412.13 |

| Total Capital Fund | 24905.03 | 19190.79 |

| Capital Surplus/deficit | 5223.79 | 5137.42 |

| Total Assets | 169037.38 | 134732.31 |

| Total Deposits | 128215.97 | 102471.83 |

| Total Loans and Advance | 115388.89 | 92003.56 |

| Total Contingent Liabilities and Commitments | 44392.67 | 45045.10 |

| Credit Deposit Ratio (in %) | 90.00% | 89.78% |

| Percentage of Classified Loans against Total Loans and Advances (in %) | 2.83% | 3.89% |

| Profit after Tax and Provision | 6085.70 | 6860.34 |

| Amount of Classified Loans during the year | 3264.95 | 3642.57 |

| Provision kept against classified Loans | 1166.79 | 1086.08 |

| Provision Surplus | 325.41 | 268.79 |

| Cost of Fund (in %) | 10.35% | 9.12% |

| Interest Earning Assets | 140198.97 | 110401.84 |

| Non-interest Earning Assets | 28838.42 | 24330.47 |

| Return on Investment (ROI) (in %) | 12.00% | 32.78% |

| Return on Assets (ROA) (in %) | 4.01% | 6.05% |

| Income from Investment | 3320.22 | 6115.41 |

| Earnings Per Share (Tk.) | 7.07 | 7.97 |

| Net Income Per Share (Tk.) | 7.07 | 7.97 |

| Price Earning Ratio (approximate) | 9.45 | 24.03 |

| Net Assets Value per shares (Tk.) | 25.02 | 43.30 |

| Net operating cash flow per share (Tk.) | 8.88 | 7.90 |

Overview of Deposit

“Those who use time properly become successful; those who save money in due time, never face financial difficulties”. ——- Hazrat Ali (R 🙂

Bank Deposit refers to an amount of money in cash or cheque form or sent via a wire transfer that is placed into a bank account. The target bank account for the Bank Deposit can be any kind of account that accepts deposits. Another, A bank deposit is a sum of money deposited in a financial institution for the purpose of providing access to investments or storing the money in a secured location.

For example, a Bank Deposit is generally made when opening an account or in the course of routine business or personal transactions that involve placing funds with the bank for future use. Bank deposits can be made in a number of different ways. The most direct way is to walk into a bank or a bank branch in which you hold an account. You are then usually required to fill in a Bank Deposit slip with the particulars of your account and the amount of money you wish to deposit. In addition, Bank Deposits can be made via wire transfer, as well as through a direct deposit plan from employers in many cases.

Deposit Product and services are

- Savings Deposit

- Current Deposit

- Term Deposit

- Foreign Currency Deposit

- Monthly Savings Scheme

- Monthly Income Scheme

- Double Benefit Scheme

- Milliner Income Scheme

- Serious Saver’s Account

- Super Saver’s Term Deposit Account

- School Banking

Savings Deposit

Savings accounts are accounts maintained by retail financial institutions that pay interest but cannot be used directly as money (for example, by writing a check). These accounts let customers set aside a portion of their liquid assets while earning a monetary return. For the bank, money in a savings account may not be callable immediately and therefore often does not incur a reserve requirement freeing up cash from the bank’s vault to be lent out with interest.

Mainly we see Saving Account open lower and middle classes people who have to save a part of their incomes to meet their future need intend to earn an income from their savings. This cause people are encouraging savings of individual, jointly, non-trading people, institutions, society, clubs and so on the depositing small amount of money in the bank.

Benefits and Restriction of Savings Account

By this savings account we can get some interest after half year for specific deposit amount. The rate of interest payable by the Bank’s on deposit mention in the savings account will determined by the respective bank. Interest is now calculated in the minimum balance to the credit of the account during the period from first to last day of each calendar month on every half year at the end of June and December. This interest rate may be 4% or 5%.

On the other hand NBL has some restriction such, account opening amount or initial deposit amount minimum TK. 5,000 which is some people burden. Minor problem is account introducer or reference which some people not found this time. Another problem is withdrawal facilities which one savings account customers can maximum 3/4 days transaction in a week. Interest rate is low.

Savings Account Opening Formalities

Saving Account can open individually or jointly any person but some NBL rules and regulation or formalities maintain which is discus below:

- Collect Savings Account application from and fill up

At first collect saving account application from and properly fill up persons account page, person related information from ( if jointly need two person related information from), KYC from, Transaction Profile(TP) which is most important , transaction type, quantity etc fill up.

- Collect Introducer

Introducer means which person has savings account exists in this bank. By this introducer signature and his account number include in S/B account opening from. This system apply may be more security about in this account.

- Specimen Signature

Every customer is required to supply to the bank with his/her signature. These signatures are taken on cards, which are preserved by the bank, and the signature of the account holder on the cheques is compared with the specimen signature.

- Mandate for operation of the account by an agent

In case a customer desires to get his/her account operated upon by another person then the bank will obtain a mandate in writing to that effects as well as the specimen signature of the person in whose favor the mandate is given.

- Opening and operation the account

After the above formalities are over, the banker opens an account in the name of applicant. Generally the minimum amount to be deposited initially is Taka 5,000 for opening a current account. Then the bank provides he customer with.

Documentation of Saving Account

- Personal TIN certificate

- Two copies passport size photographs

- National ID card or Passport Photocopy

- Nominees photographs

Saving Deposit Slip Book

With a view to facilitate the receipt of credit items paid in by a customer, the bank will provide him/her deposit book either loose or in book forms. The customer has to fill up the pay in slip at the time of depositing the money to the bank. The cashier with his/her initials and stamps will return the counterfoil to the customer on the receipt of the money.

Saving Deposit Cheque Book

To facilitate withdrawals and payment to third parties by the customer, the bank will also provide cheque book to the customer. But it is noted that to get a cheque book, the customer has to dully fill up the cheque requisition slip to the banker.

Current Deposit

In deposit terminology, the term Current Deposit refers to a deposit to a bank account or financial institution without a specified maturity date. These types of Current Deposit account generally only earn demand deposit interest.

Current Deposit Example:

Current Deposit will often be made into a bank or other financial institution’s account in the local currency. The deposit will then generally be made available to the customer for withdrawal at any time and without an early withdrawal penalty. Funds are typically made immediately available to the customer for withdrawal by writing a check. Such Current Deposit accounts are generally used for businesses that have a need for issuing checks to pay employee salaries and bonuses, as well as to provide cash for inventories and other such business expenses. The bank or financial institution where the Current Deposit account is held usually pays out interest on the funds periodically, such as monthly or quarterly.

The special characteristic of a current account are as follows-

- The primary objective of current account is to save big customers as big businessman, joint stock companies, private limited companies, public limited companies etc from the risk of handling cash themselves.

- The cost of providing current account facilities is considerable to the bank since they undertake to make payments and collects the bills, drafts, cheques for any number of times daily. The bank therefore does not pay interest on current deposit while on the other hand some banks charge for incidental charges on such account.

- For opening of a current account minimum deposit of Taka 10,000 is required.

- Introductory reference is also required for opening of such account.

Documentation of Current Account

Proprietorship

- National ID card or Passport Photocopy

- Trade License

- Chairman certificate/ commissioner certificate

- Personal TIN certificate

- Two copies passport size photographs

For Partnership

- Partnership Deed

- TIN certificate of all partners personal

- Trade License

- Photocopy of all partners National ID Card and passport photocopy

- Passport size photograph of all partners and mention in from who operate this account.

- For Private & Public LTD Company

- TIN & VAT certificates of company

- Trade License up to date

- TIN certificate of all Directors Personal

- List of Directors duly signed by all Director’s and forwarded by the Chairman/Managing Director

- Memorandum & Article of Association of the company duly certified by the RJSC/by law/constitution.

- Resolution of the board of Directors for opening and operate the Bank A/c.

- Certificate of Incorporation

- Photographs (2 copies) of all Directors duly attested by the introducer.

- Photocopy of passport/Chairman Certificate/Commissioner Certificate of other ID in connection of Nationality for all Directors.

- Company or personal Rubber Stump

- List of Directors as per return of joint stock Company with signature.

Fixed Deposit Account (FDR)

These are the deposit, which are made with the bank a fixed period specified in advance. It is purely a time deposit account. The bank does not maintain cash reserves against these deposits and therefore the bank offers higher rates of interest on such deposits. Interest is paid at rate determined by the length of the period of deposit; the higher is the rate of interest. Loan is sanctioned against FDR.

Opening and Operation of Fixed Deposit Account

The depositor has to fill in an application from wherein he/she mentions the amount of deposit, the period for which deposit is to be made the names in which the fixed deposit receipt is to be issued. In case of deposit in joint names, the banker also takes the instructions regarding payment of money on maturity of deposit ex, whether payable jointly or payable to either or survivor etc. The banker also takes the specimens signature of the depositors. A fixed deposit receipt is then issued to the depositor acknowledging receipt of the sum of money mentioned therein. It also contains the rate of interest and the date on which the deposit will fall due for payment. In this account no transaction is allowed and no cheque book is issued. Customers are given Fixed Deposit Receipt or Slip only.

Benefits of FDR

- Any amount can be deposited.

- Premature encashment facility is available.

- Overdraft facility available against term receipt.

Account Opening

- 1 copy of recent photograph of account holder.

- Nominee’s Photograph.

Monthly Saving Scheme (MSS)

National Bank Limited offers monthly savings scheme for its retail customersThere are three types of saving scrim such as 3 years, 5 years and 8 years period in this account. After specific time/period you get attractable amount by this scrim

| Monthly Installment | Return after 3 years | Return after 5years | Return after 8 years |

| 500 | 20,627 | 37,896 | 70,849 |

| 1,000 | 41,255 | 75,791 | 1,41,697 |

| 2,000 | 82,510 | 1,51,583 | 2,83,394 |

| 3,000 | 1,23,765 | 2,27,374 | 4,25,091 |

| 4,000 | 1,65,020 | 3,03,166 | 5,66,788 |

| 5,000 | 2,06,274 | 3,78,957 | 7,08,485 |

| 10,000 | 4,12,549 | 7,57,914 | 14,16,970 |

| 20,000 | 8,25,098 | 15,15,828 | 28,33,940 |

| 30,000 | 12,37,647 | 22,73,742 | 42,50,910 |

| 50,000 | 20,62745 | 37,89,570 | 70,84,850 |

Benefits of Monthly Saving Scheme

- Account may be opened for any installment and term, which is not changeable.

- You can open this account monthly installments of deposit will be Tk.500/-, Tk.1, 000/- , Tk.2, 000/- , Tk.3, 000, Tk.4000/- , Tk.5, 000/- and Tk. 10, 0000 or any countable amount (Highest Tk. 50,000).

- A person is allowed to open more than one account for different installment in a Branch/ Bank’s no Monthly Installments (Taka) Amount to be paid on completion of Term

- This account open different name

- Below 18 years children can open this account with their guardian.

Account Opening

- 1 copy of your recent photograph.

- Nominee’s Photograph.

Monthly Income Scheme (MIS)

Under this scheme one will deposit a minimum of tk.1, 00,000/- or its multiple for three years and will enjoy monthly benefit of Tk.1, 000/- for every Tk.1, 00,000/-.

Benefits of Monthly Income Scheme

- Deposit of Tk.1, 00,000/- and its multiple maximum of Tk 50, 00,000/- shall be acceptable under this scheme.

- The account may be opened either singly or jointly.

- Below 18 years children can open this account with their guardian.

| One Time Deposit | Monthly Income |

| 1,00,000.00 | 1,000.00 |

| 2,00,000.00 | 2,000.00 |

| 3,00,000.00 | 3,000.00 |

| 4,00,000.00 | 4,000.00 |

| 5,00,000.00 | 5,000.00 |

| 10,00,000.00 | 10,000.00 |

| 20,00,000.00 | 20,000.00 |

| 30,00,000.00 | 30,000.00 |

| 40,00,000.00 | 40,000.00 |

| 50,00,000.00 | 50,000.00 |

Account Opening

- 1 copy of recent photograph of account holder.

- Nominee’s Photograph.

- Valid photocopy of Voter ID card or passport.

Millionaire Deposit Scheme (MDS)

Your future life to bring ensures security for NBL come this Millionaire Income Scheme. Under this scheme one will deposit a fixed amount on monthly basis for 5, 7 or 10 years and on maturity he/she will be just a millionaire.

Benefits of Millionaire Income Scheme

- Deposit of fixed monthly amount for 5, 7 or 10 years. Deposit size will be based on tenure. Upon maturity the depositor will get Tk. 10, 00,000/-.

- A person is allowed to open more than one MIS Account.

- The account may be opened either singly or jointly. Installment Tenure On maturity

- Below 18 years children can open this account with their guardian

| Deposit Quantity | Year | Payable Money |

| 12,450.00 | 5 | 10,00,000.00 |

| 7,870.00 | 7 | 10,00,000.00 |

| 4,550.00 | 10 | 10,00,000.00 |

Account Opening

- 1 copy of your recent photograph.

- Nominee’s Photograph.

Double Benefit Scheme (DBS)

Dreams come true. National Bank Limited now offers Double Benefit Scheme for its customers. The benefits under this scheme shall become double after 6 years.

Benefits of Double Benefit Scheme

- Deposit of Tk.50, 000/- and its multiple maximum of Tk 50, 00,000/- shall be acceptable under this scheme.

- A person is allowed to open more than one DBS Account.

- The account may be opened either singly or jointly.

- All DBS account holder shall be offered with free Life Insurance Policy under this scheme.

- Below 18 years children can open this account with their guardian.

Account Opening

- 1 copy of your recent photograph.

- Nominee’s Photograph.

School Banking

Adult or non adult student can save their money for next time. They can also related country’s economic development activities by this money. For more interested to save their money NBL offer school banking. By this account they can save money and operate with their guardian.

Serious Saver Account

Serious Saver Account is a attractable scheme which offer NBL. You can easily open this account by monthly deposit minimum Tk. 20,000/10,000.

- By condition you can withdraw money next time deposit minimum Tk.10, 000/5,000 but you get extra 3% interest more than saving account.

- The account may be opened either singly or jointly.

- Below 18 years children can open this account with their guardian

Account Opening

- 1 copy of recent photograph of account holder.

- Nominee’s Photograph.

- Valid photocopy of Voter ID Card or passport.

Term Deposit

Term means specific time which can be short term, Medium Term or Long Term. Term Deposit is 1 year, 2 years, 3 years, 5, 7, 10 years and after specific time we can get expected amount by this term deposit.

Short Term Deposit (STD)

It is also a time deposit account. The formalities for opening of this account are similar to those required for current account. The only difference is that 7 (seven) days notice is required for withdrawal of any sum and interest is paid. If the withdrawal on demand is desired, it may be paid to the for-feature of interest for the period of notice or the expired period of notice. STD interest rate is 4.5%.

Special Notice Deposit (SND)

National Bank Limited offers interest on customer’s special notice deposit account and gives facility to withdraw money any time.

Benefits of SND

- Minimum maintenance charges half yearly Tk.500.

- Standing Instruction Arrangement are available for operating account.

Account Opening

- 2 copies of recent photograph of account holder.

- Nominee’s Photograph.

- Valid photocopy of Voter ID Card or passport.

Super Saver’s Term Deposit Account

National Bank Limited offers fixed term savings that will scale up your savings amount with the time. By this account we can highest interest rate and after one year get expected amount

Benefits of Super Saver’s Term Deposit Account

- We can open this account by one Lac or any countable amount for one year

- One year term special saving scheme

- Interest rate is highest in this account

- 18 years or above any people open this account

- One person can operate more than one account

- The account may be opened either singly or jointly.

- Below 18 years children can open this account with their guardian.

Account Opening

- 2 copies of recent photograph of account holder.

- Nominee’s Photograph.

- Valid photocopy of Voter ID Card or passport.

Foreign Currency Deposit

National Bank Limited gives opportunity to maintain foreign currency account through its Authorized Dealer Branches. Bangladesh nationals residing abroad or foreign nationals residing abroad or Bangladesh and foreign firms operating in Bangladesh or abroad or Foreign missions and their expatriate employees can operate this account.

Benefits of Foreign Currency Deposit

- No initial deposit is required to open the account.

- Interest will be offered 1.75% for US Dollar Account, 3.00 % for EURO Account and 3.25% for GBP Account.

- They will get interest on daily product basis on the credit balance (minimum balance of US$ 1,000/- or GBP 500/- at least for 30 days) maintaining in the account.

Account Opening

- 2 copies of recent photograph of account holder.

- Nominee’s Photograph.

- Passport Copy.

- ID of residence in abroad.

NFC Deposit

National Bank Limited gives opportunity to maintain foreign currency account through its Authorized Dealer Branches. All non – resident Bangladeshi nationals and persons of Bangladesh origin including those having dual nationality and ordinarily residing abroad may maintain interest bearing NFCD Account.

Benefits NFC Deposit

- NFCD Account can be opened for One month, Three months, Six months and One Year through US Dollar, Pound Starling, Japanese Yen and Euro.

- The initial minimum amount of $1000 or 500 Pound Starling or equivalent other designated currency.

- Interest is paid on the balance maintain in the Account. This interest is tax free in Bangladesh.

Account Opening

- 2 copies of recent photograph of account holder.

- Nominee’s Photograph.

- Passport Copy.

- ID of residence in abroad.

NBL Deposit Interest Rate at a Glance

| SL. | Category Of Deposit | Revised rate of interest (p.a.) w.e.f July 01, 2011 (%) | |

| 1 | Savings | Below 1.00 Crore | 4.00 |

| 1 Crore to below 25 Crore | 4.50 | ||

| 25 Crore & above | 8.50 | ||

| 100 crore & above | 9.00 | ||

| 2 | Special Notice Deposit | Below 1.00 Crore | 4.00 |

| 1 Crore to below 25 Crore | 7.00 | ||

| 25 Crore to below 50 Crore | 7.50 | ||

| 50 Crore to below 100 Crore | 7.75 | ||

| 100 Crore & above | 9.00 | ||

| 3 | FDR for 1 month & above but less than 3 months | Any amount | 10.50 |

| Up to 12.00 | |||

| 4 | FDR for 3 months & above but less than 6 months | Any amount | 11.00 |

| Up to 12.00 | |||

| 5 | FDR for 6 months & above but less than 1 year | Any amount | 11.00 |

| Up to 12.00 | |||

| 6 | FDR for 1 year and above | Any amount | Up to 12.00 |

Present Deposit Scenario of NBL

| Year | Deposit (in Millions) | Percentage Change (Increase / Decrease) |

| 2007 | 47961.22 | 18.86 % |

| 2008 | 60187.89 | 25.49 % |

| 2009 | 76834.13 | 27.66 % |

| 2010 | 102471.83 | 33.37 % |

| 2011 | 128215.97 | 25.12 % |

NBL invests their funds in different sectors. They actually diversify their deposit by investing their funds in the share of different companies, zero coupon bonds, debenture, Govt. bond, Govt. security, and other bonds. The deposits of National Bank Limited for last five years are as follows-

Trend Analysis of Deposit

The deposit for the year 2010 is 102471.83 million and in the year 2011 is 128215.97 million. In the year 2011 deposit amount is increased by Tk. 25744.14 million than the previous year. The main reasons for increasing deposit in 2011 are to reduce of the government securities and bond. NBL deposit increased during the year 2009 by Tk. 16646.3 million and stood at Tk. 76834.13 million as at 31 December 2009. In 2009 the investment is increased from the previous year. The Bank purchased government treasury bills to cover the increased SLR requirement. In addition to the above, NBL had to buy Government Treasury Bills which were devolved by Bangladesh Bank. There was no investment made by subsidiary and Off-Shore Banking Unit. From the analysis of last five years investment scenario, in 2007 the investment increased almost 18.86% rather than the previous year.

From the deposit trend graph we see that the deposit of NBL is in increasing trend in case of amount. But the percentage change from year to year has fluctuated year by year. The deposit increase 18.86% in 2007, 25.49% in 2008, 27.66% in 2009, 33.37% 2010 and in 2011 rather than the previous year and 25.12% increase in the last year. These percentage changes are in the decreasing trend from the previous year. Due to banking supervision and also bank’s internal affairs, lack of proper projection and so on, this bank is in the serious trouble for decreasing trend in the deposit in the year 2010. Deposit is one of the major earning prospects of the bank but this bank’s investment interest income decreased in the year 2010 and this affected the net operating income of the bank.

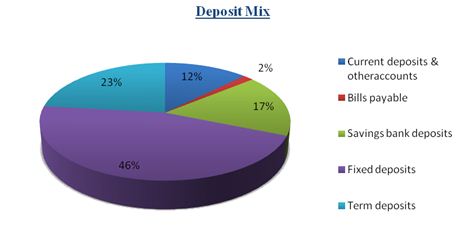

Deposit mix

Figure: Percentage of Deposit Mix

This chart is showing the percentage of different type of deposit account. Current deposits & other accounts 16034.78, bills payable 2017.62, saving bank deposits 21930.64, fixed deposits 58519.63, term deposit 29713.3. We can see that from total deposit most of the account is fixed deposits which are 46%.

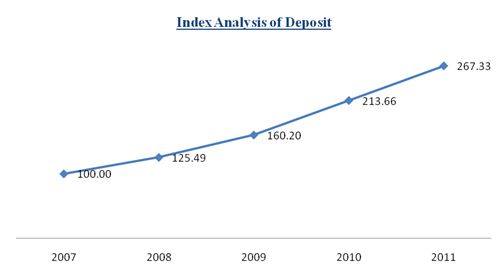

Index Analysis of Deposit

| Year | 2007 | 2008 | 2009 | 2010 | 2011 |

| Total Deposit | Tk. 47961.22 | Tk. 60187.89 | Tk. 76834.13 | Tk. 102471.83 | Tk. 128215.97 |

| % change from Base Year | 100% | 125% | 160% | 213% | 267% |

The bank’s deposit changing information can be discussed below through index analysis, changing from base year 2007.

Figure : Index Analysis of Deposit

Here, the index analysis is performed according to the information of deposit of NBL from 2007 to 2011. The base year is 2007. From the above figure it is found that in 2011 National Bank Limited’s deposit is much more flourishing rather than any other preceding year which was 267.33% change from base year 2007. This indicates that this bank is in increasing trend in deposit but with lower amount in different investment projects; government and others securities. From the base year 2007 in every year the deposit was increased in a significant amount. But in 2010 the investments are increased by 25744.14 million and an overall effect is 213.66% increased than the base year. In 2009 it was 160.20%, in 2008 it was 125.49% and in 2007 it was 100%.

Contribution of Deposit Income on Operating Profit

| Year | Operating Profit (in million) | Deposit Amount (in million) | Contribution of Income (%) |

| 2007 | 98 | 16 | 16.33% |

| 2008 | 136 | 25 | 18.38% |

| 2009 | 214 | 48 | 22.43% |

| 2010 | 489 | 72 | 14.72% |

| 2011 | 575 | 109 | 18.96% |

Table: Contribution of deposit on Operating Profit

Deposit plays a major role in operating profit of a bank. NBL deposited income consists of those customers who want to save money for future. Moreover, those persons who are unemployed after a time where they have no way are opened to work anywhere then the customer take money from the deposit amount and used it to any kind of need. Deposit Income (II) increased by Tk. 37 million during the year 2011 registering a growth of 30.84% during the year. Interest/discount received from treasury bills/bond contributed to the growth. In 2011 the investment incomes is Tk. 929 million and contribute 18.96% on total operating profit. This contribution trend to total operating income is gradually increasing year to year of this bank.

Findings

General Findings

- This bank invests deposited funds maximum in the long term maturity bucket rather than short term maturity bucket.

- NBL has more long term deposit than short term deposit, and due to competitive market NBL has to incur higher cost on their deposits.

- NBL has lack of manpower to serve the growing customer demand. So they not are being able to provide service to the customer in efficient manner.

- NBL don’t have any effective training policy. Though it has a training institute but they are not using this institution properly.

- This introduced ATM facility to customers yet. But customers are not satisfied about this.

- The client’s are bound to submit a lot of documents to the bank to avail Consumer Credit. The Bank is overloading the clients by charging so much documents and papers which seems to the clients being harassed by the relevant officer.

SWOT on Findings

It is needless to say that there are certain risk factors which are external in nature and can affect the business of the bank. The factors discussed below can significantly affect the business:

- General business and political condition

NBL’s performance greatly depends on the general economic conditions of the country. Although the bank is in the lower capacity of using its total assets effectively. The effect of recession is still unfolding which may result to slowdown in business environment. Political stability is a must for growth in business activities.

- Changes in borrowers credit quality

Risk of deterioration of credit quality is inherent in banking business. This could result due to global economic crisis and supply side distortion. The changes in the import prices affected the commodity sectors and ship breaking industry. Deterioration in credit quality requires provisioning

- The risk of litigation

In the ordinary course of business, legal actions, claims by and against the Bank may arise. The outcome of such litigation may affect the financial performance of the bank.

- Implementation of Basel II

Basel II will run parallel during 2009 but NBL needs to be complied with respect to credit risk management, its supervision and establishment of effective internal control. The grading of the borrowers and its link with capital requirement may slow down the credit expansion. The establishment of effective control requires more investment in technology and operating expenses are likely to increase.

- Volatility in equity market

Securities and Exchange Commission and the stock exchanges improved their supervisory role but the equity market is still volatile. The recession fear also added to the volatility. If volatility continues it is likely to affect the performance of the bank.

- Changes in market conditions

Changes in market conditions particularly interest rates on deposits, volatility in FX market are likely to affect the performance of the bank. Depositors are becoming price sensitive and any unilateral upward change by a bank will exert pressure on interest rate structure of the banking sector. It is feared that wage earners remittances may decline due to fall in job opportunity in international market. Unless offset by export performances, there may be pressure in the FX market.

- Success of strategies

NBL is proceeding with its strategic plan and its successful implementation is very important for its financial performance. Major deviation due to external and internal factors will affect the performance of the bank.

- Operational risk

Operational risk is inherent to all businesses more so when the operation is technology based. Although all risk mitigation techniques are taken but it is not certain that there may not be any major failure in the operating system arising from error, fraud, unforeseen external events etc. The failure may impact the performance of the bank.

Recommendations

- New investment schemes should be introduced to meet customer demands to stay ahead in competition and better satisfy customer requirements.

- Proper future forecasting is much more needed in case of credit or investment opportunities.

- The productive sectors of our country are not so developed. So the bank has to invest on the productive sector of our country to improve this sector for the betterment of our economic condition.

- Large investment risk must be minimized and should be emphasis to its SME and consumer credit scheme so that recovery rate may increase and risk may decrease.

- The bank has to improve their deposit policy. The deposit of the bank should be more diversified.

- The employee especially credit department are deal with different dimension of risk, so they have to properly trained.

- In order to successfully implement the strategy, the in-house capacity development is important. This is to be done through continuous training of the employees.

- Extend the business to existing clients through more product range and penetrate new markets through expansion of network in rural areas.

- The bank has to ensure adequate and timely loan loss provisions are made based on actual and expected losses.

- They have to make the regular review of the worse accounts.

- NBL should concentrate on Smoothing service and reducing time consumption. Therefore, NBL should recruit more employees at their branches.

- Ensure the use of latest technology in banking operation to meet up the customers demand.

- NBL has to introduce their ATM booth across the country to meet up the customers demand.

Conclusion

The popularity of banks is increasing day by day which leads to increase competition as well. All the Commercial Banks are offering almost the same products and services and almost same their operation system. But the ways they provide the services are different from each other. So people choose their bank according to their satisfaction and need. They believe in developing strong interpersonal relationship with each other. As such, they are morally bound to provide high quality banking services with the latest technology to obtain optimum return on shareholder’s equity ensuring safety of depositor’s money and making all out efforts to introduce their innovative Islamic Banking products to their existing and prospective customers. Banks always contribute towards the economic development of a country. It is obvious that the right thinking of this bank including establishing a successful network over the country and increasing resources.