Shahjalal Islami Bank is one of the most popular private commercial Bank which follow Islamic Banking policy in Bangladeshi Banking sector. This report highlights the performance of General Banking Activities of this bank. Shahjalal Islami Bank has become one of the world wide recognized banks because of its retail product management which are part of general by following Islamic Shariah. The main focus of this report is to present an overview of Shahjalal Islami Bank and to get a brief description about the General Banking Department and their activities.

Methodology

The report would be based on an exploratory research paper. Here I would be discussing the consumer credit schemes and credit appraisal procedure of Shahjalal Islami Bank and critically analyze the appraisal procedure with the standard one. Through out the report, I will use different type of research method to find out proper and correct information and also provide a good report.

For preparing this internee report I will basically use my experience from different department of the Shahjalal Islami Bank Limited. And I will also use some official documents provided by the officers. For adding more value to this report I will use some books or lecture specialized on the banking sectors.

Sources of data collection

Primary sources:

- Observation of banking activities.

- Fruitful conversation with the in-charge of the General Banking department of Shahjalal Islami Bank Limited, Mitford Branch.

- Experiences gained during performing duties for General Banking department.

- Discussion with officials of Shahjalal Islami Bank Limited.

Secondary sources:

- Annual reports of Shahjalal Islami Bank Limited.

- Various documents from General Banking department.

- Loans and Advances Act.

- Different websites.

- Internal Records.

- Brochures of Shahjalal Islami Bank Limited.

- Different circulars sent by Head Office and Bangladesh Bank.

- Other published documents credit Scheme.

Shahjalal Islami Bank Limited at a glance

With a view to materialize the dream of the people of Bangladesh for doing their banking transactions in line with what is prescribed by Islam, a group of highly successful entrepreneurs conceived an idea of floating a commercial bank styled as “Shahjalal Islami Bank Limited” which is named after the name of the renowned saint Hajrat Shahjalal (R) who dedicated his life for the cause of peace in this world and hereafter and for the service of humanity. The sponsors are reputed personalities in the field of trade & commerce, industry and finance.

“Shahjalal Islami Bank Limited” offers the full range of banking services for personal and corporate customers, covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank. Diversification of products and services include Corporate Banking, Retail Banking and Consumer Banking right from industry to agriculture, real estate to software and is backed by the latest technology.

The Bank is being managed by a group of highly experienced professionals with diversified experience in finance and banking. The Management of the bank constantly looks after customers’ satisfaction and believes that a satisfied customer is a great Ambassador. The Bank has already achieved tremendous progress within only eight years. The bank has already ranked as one of the quality service providers & is known for its reputation. Offers the full range of banking services for personal and corporate customers, covering all segments of society within the framework of Banking Company Act and rules and regulations laid down by our central bank.

By now, the Bank established correspondent Banking relationship with 18 Banks covering their global network of 385 branches/units of International repute at different important locations. It also established accounting relationship with 10 Banks and maintaining 22 NOSTRO Accounts in 8 (eight) major Currencies at different convenient locations.

The Board of Directors of our Bank consists of reputed Industrialists and Businessmen who are successful in their respective fields headed by Mr. Sajjatuz Jumma, the founder Chairman of the Board who is an eminent Industrialist & reputed businessman in Bangladesh and current Chairman of Islamic Banks Consultative Forum (IBCF). The Board generally deals with policy matters relating to management of Business and sets goal for the growth & development of the Bank as a whole, review of the same from time to time and gives necessary guidance to the management.

The Bank is managed by a Team of professional Executives and Officials having profound banking knowledge & expertise in different areas of management and operation of Banks. The Team is headed by the immediate past Executive President and CEO of Islami Bank Bangladesh Ltd. (IBBL) for about 7 years. During his Incumbency, IBBL attained a remarkable growth & development. Above all, he had the opportunity to hold the position of Chairman of the Board of Directors of Islami General Insurance Company & then he Joined Shahjalal Islami Bank Ltd on February 25, 2004 as the Managing Director and Chief Executive Officer (CEO) to enrich Islamic Banking methodology in the Country.

During the short span of time, Shahjalal Islami Bank so far introduced a good number of attractive deposit products to broaden the resource base and also Investment products to deploy the deposit resources so mobilized. Some more schemes covering the deposits, Investments & Services will be introduced gradually in near future suiting to the taste and requirement of the clients. The Bank has a strong Shariah Council consisting of prominent Ulama, Fuquah & Economists who meet periodically to confer decisions on different Shariah issues relating to Banking Operation & to address them and to give necessary guidance to the management on Shariah Principle. Since inception, Bank has been performing in all the sectors i.e. general Banking, Remittance, Import, Export and Investment. All our branches are fully computerized having on line Banking facility for the clients.

All activities of the Bank including its products and services are mainly for different economic groups of Bangladesh at home & abroad. Bangladeshi expatriates living abroad in different countries form a strong economic group who contribute greatly towards the economic development of the country.

Vision of SJIBL

To be the unique modern Islami Bank in Bangladesh and to make significant contribution to the national economy and enhance customer’s trust and wealth, quality investment, employee’s value and rapid growth in shareholders equity.

Mission of SJIBL

- To provide quality services to customers

- To set high standards of integrity

- To make quality investment

- To ensure sustainable growth in business

- To ensure maximization of shareholders wealth

- To expand the customer’s innovative service acquiring state-of the-art technology blended with Islamic principles.

- To ensure human resource development to meet the challenges of the time.

Objectives of SJBL

From time immemorial Banks principally did the functions of moneylenders or “Mohajans” but the functions and scope of modern banking are now a days, very wide and different. They accept deposits and lend money like their ancestors, nevertheless, their role as catalytic agent of economic development encompassing wide range of services is very important. Business commerce and industries in modern times cannot go without banks. There are people interested to abide by the injunctions of religions in all sphere of life including economic activities. Human being is value oriented and social science is not value-neutral.

Shahjalal Islami Bank believes in moral and material development simultaneously.

“Interest” or “Usury” has not been appreciated and accepted by “the Tawrat” of prophet Moses, “the Bible” of prophet Jesus and “the Quran” of Hazrat Muhammad (sm). Efforts are there to do banking without interest Shahjalal Islami Bank Limited avoids “interest” in all its transactions and provides all available modern banking services to its clients and wants to contribute in both moral and material development of human being. No sustainable material well-being is possible without spiritual development of mankind. Only material well-being should not be the objective of development. Socio-economic justice and brotherhood can be implemented well in a God-fearing society.

The other objectives of Shahjalal Islami Bank include:

- To conduct interest-free and welfare oriented banking business based on Islamic Shariah.

- To implement and materialize the economic and financial principles of Islam in the banking arena.

- To contribute in sustainable economic growth.

- To help in poverty alleviation and employment generations.

- To remain one of the best banks in Bangladesh in terms of profitability and assets quality.

- To earn and maintain a ‘Strong’ CAMEL Rating.

- To introduce fully automated systems through integration of information technology.

- To ensure an adequate rate of return on investment.

- To maintain adequate liquidity to meet maturing obligations and commitments.

- To play a vital role in human development and employment generation.

- To develop and retain a quality work force through an effective Human Resources Management System.

- To ensure optimum utilization of all available resources.

- To pursue an effective system of management by ensuring compliance to ethical norms, transparency and accountability at all levels.

Strategies of SJIBL:

The strategies of Shahjalal Islami Bank include:

- To raise capital.

- To strive for customers’ best satisfaction and earn their confidence.

- To manage and operate the Bank in the most effective manner.

- To identify customers’ needs and monitor their perception towards meeting those requirements.

- To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

- To train and develop all employees and provide them adequate resources so that customers’ needs are reasonably addressed.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to employees in a timely fashion.

- To cultivate a congenial working environment.

- To diversify portfolio both in the retail and wholesale markets.

- To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

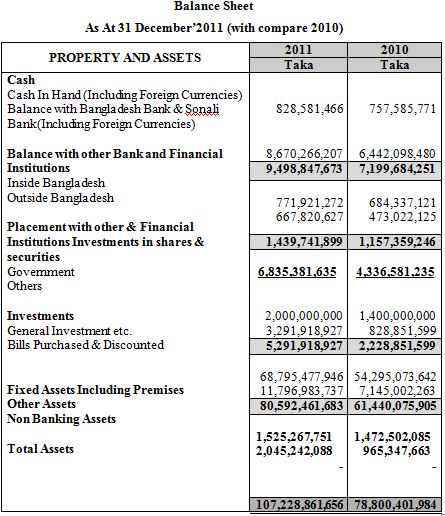

PERFORMANCE OF SHAHJALAL ISLAMI BANK LIMITED AT A GLANCE:

Departments of SJIBL

All branches of Shahjalal Islami Bank Limited are divided into three departments:

- General Banking Department.

- Foreign Exchange Department.

- Investment Department.

General Banking Department:

General banking department is one of the most important departments of Shahjalal Islami Bank Limited. Basically bank provides the main services to the customer through this department. In general this section of the Shahjalal Islami Bank Limited is divided into five sections.

- Accounts opening & closing section

- Cash section

- Clearing section

- Accounts section

Foreign Exchange Department:

Banks play a very important role in effecting foreign exchange transaction of a country. Mainly transactions with overseas countries are in respect of imports; exports and foreign remittance come under the purview of foreign exchange department. Banks are the vital sectors by which such transactions are effected/settled. Central Bank records all sorts of foreign exchange transactions. The other banks dealing with foreign exchange are to report to Bangladesh Bank regularly (viz. daily, monthly, quarterly, yearly etc.). The foreign exchange department consists of three sections. They are:

- Import section

- Export section

- Foreign remittance section

Investment Department:

Banking business consists of borrowing and lending, Bank act as an intermediary between surplus and deficit economic units. Thus a banker is a dealer in money and credit. Banks accept deposit from large number of customers and then lend a major portion of the accumulated money to those who wish to borrow. In this process banks secure reasonable return to the savers, make funds available to the borrowers at a cost and earn a profit after covering the cost of funds. Banks, besides their role of intermediation between savers and borrowers and providing an effective payment mechanism, have been allowed to diversify into many new areas of better paying business activities.

Social Welfare Activities:

With a view to providing financial assistance to the poor and needy people of the society and also for the welfare of the community, to this perspective, bank has established “Shahjalal Islami bank Foundation” with the objective to provide health care, relief and rehabilitation, education, humanitarian of winter clothes during the winter etc.

Shahjalal Islami Bank Foundation has a planning to establish the following projects and programs:

- Shahjalal Islami Bank International School and College

- Shahjalal Islami Bank Hospital

The foundation have also drawn up programs to look after the education, health and medical requirements of all the people of rural areas where the bank has launched Rural Investment Programs with vision 2020.

The foundation already introduced a program to reward poor student who passes SSC and HSC exam. Students who are not financially sound, the foundation gives financial assistance to them. The bank has started it from 2006 under these project 111 poor and meritorious students awarded by monthly scholarship and lump sum money at yearly basis. This will motivate students to do better in future. The bank appreciates the good things in the society.

Islamic Banking Concepts:

Islami Bank is a financial institution whose status, rules and procedures expressly state its commitment to the principle of Islamic Shariah and to the banning of the receipt and payment of interest on any of its operation. For millions of Muslims, banks were institution to be avoided. Islam is a religion, which keeps Believers from the tellers’ window. Their Islamic beliefs prevent them from dealings that involve usury or interest (Riba). Yet Muslim needs banking services as much as anyone and for many purposes: to finance new business ventures, to buy a house, to facilitate capital Investment to undertake trading activities and to offer safe place for saving. Muslims are not averse to legitimate profit as Islam encourages people to use money in Islamic ally legitimate ventures not just to keep their funds idle.

However in this fast moving world more than 1400 years after the Prophet (S.A.W) can Muslims find room for the principles of their religion? The answer comes with the fact that a global network of Islamic banks investment house and other financial institution have started to take shape based on the principals of Islamic finance laid down in the Quran and the Prophet’s traditions some 14 centuries ago. Islamic banking based on the Quranic prohibition of changing interest has moved from a theoretical concept to embrace more than 100 banks operating in 40 countries with multibillion-dollar deposits worldwide. Islamic banking is widely regarded as the fastest growing sector in the Middle Eastern financial services market. Exploding onto the financial scene barely thirty years ago an estimated $US100 billion worth of funds are now managed according to Shariah.

The best-known feature of Islamic Banking is the prohibition on interest. The Holy Quran forbids the charging of ‘Riba’ on money lent. It is important to understand certain principles of Islam that underpin Islamic finance. Muslim scholars accepted the word ‘Riba’ to mean any fixed or guaranteed interest payment on cash advances or on deposits.

The rules regarding Islamic finance are quite simple and can be summed up as follows:

- The predetermined payment over and above the actual amount of principal is prohibited.

- The lender must share in the profits or losses arising out of the enterprise for which the money was lent.

- Making money from is not Islamically acceptable

- Ggharar (Uncertainty, Risk or Speculation) is also prohibited.

- Investment should only support practices or products that are not forbidden.

Objectives of Islamic Banking

The objective of Islamic Banking is not only to earn profit but also to do good and welfare to the people. Islam upholds the concept that money, income and property belong to ALLAH and this wealth is to be used for the good of the society. The main objectives of Islamic Banking are as follows:

- To conduct interest free banking.

- To establish participatory Banking instead of Banking on debtor-creditor relationship.

- To invest through different modes permitted under Islamic Shariah.

- To accept deposits on profit-loss sharing basis.

- To establish welfare oriented Banking System.

- To extend operation to the poor, helpless and low income group for their economic enlistment.

- To contribute in achieving the ultimate goal of Islamic economic system.

- To facilitate the Islamic banking system in the country.

- To create new entrepreneurs and to arrange required finance them.

Evolution of Islamic Banking

Islamic Banking comes into reality through a long theoretical exercise of several renowned Islamic scholars and economists. The first attempt to establish an Islamic financial institution took place in Pakistan in 1950. In the modern world, the pioneering role in establishing the first Islamic Bank in 1963 named ‘Mit- Ghamar’ Saving Bank in Egypt at rural area of Nile Delta. As on today, there are many Islamic financial institutions operating through out the world covering both Muslim and non-Muslim countries of various socio-economic environment.

The first Islamic bank in Malaysia was established in 1983. In 1993, commercial banks, merchant banks and finance companies were allowed to offer Islamic banking products and services under the Islamic Banking Scheme (IBS). These institutions however, are required to separate the funds and activities of Islamic banking transactions from that of the conventional banking business to ensure that there would not be any co-mingling of funds.

In Malaysia, the National Syariah Advisory Council additionally set up at Bank Negara Malaysia (BNM) advises BNM on the Shariah aspects of the operations of these institutions, as well as on their products and services.

Legitimate Business Contracts for Islamic Banks

The modes of mobilization in Islamic banks have derived from the overall permissible contracts in Islam. In what follows we fast describe the concept of Aqd or contract form business perspective and then discuss the legitimate forms contracts that can be used in Islamic banks for both deposit collection and their profitable employment.

A business contract can be defined as the exchange of a thing of value by another thing of value with mutual consent. There are four element of an Aqd or contract:

- Contrat(Aqd).

- Subject Matter (Mabe’e).

- Price (Thaman).

- Prossession of delivery (Qabdh).

Common practices of Islamic banks in mobilization of funds

The common practices of Islamic banks in the sources of funds may be described as follows:

Current Accounts

All Islamic banks operate current account on behalf of their client individuals and business firms. These accounts are operated for the safe custody of deposits and for the convenience of customers. There is little different between conventional banks as far the operation of current accounts is concerned. There are two dominant views about current account. One is to treat demand deposit as amnah (trust). A trust deposit is defined by the Jordan Islamic Banks as “cash deposits received by the bank where the bank is authorized to use the deposits at its own risk and responsibility in respect to profit or loss and which are not subject to any conditions for withdrawals or depositing”.

Saving Account

All Islamic banks operate saving accounts. It must be pointed out that any return on capital is Islamically justified only if the capital is employed in such a way that it is expected to a business risk. Savings accounts at Islamic Banks Generally operate as follows:

- Savings accounts are opened with the condition that deposits provide the bank with an authorization to invest.

- Depositors have the right to deposit and withdraw funds.

- The profits in savings accounts are calculated on the minimum balance maintained during the month. Depositors participate in the profits of savings accounts with effect from the beginning of the month following the month in which the deposits are made. Profits are not calculated with effect from the beginning of the month in which a withdrawal is made from the account.

- A minimum balance has to be maintained in order to qualify for a share in profit.

Investment Deposit

Investment deposits are Islamic banks counterparts of term deposits or time deposits in the conventional system. They are also called profit and Loss-Sharing (PLS) Accounts or Participatory Account. However they can be distinguished from traditional fixed term deposits in the following manner:

- Fixed term deposits in the conventional system operate on the basis of interest while investment accounts in Islamic banks operate on the basis of profit sharing Instead of promising depositors a predetermined fixed rate of return on their investment the bank tells them only the ratio in which it will share the profits with them.

- While fixed term deposit are usually distinguished from each other on the basis of their maturities investment deposits can be distinguished on the basis of maturity as well as on the basis of purposes as it is possible to give special instructions to the bank to invest a particular deposit in a specified project or trade.

The main distinguishing characteristics of investment deposits can be described as follows:

- Deposit holders do not receive any interest. Instead they participate in the share of the profits or losses.

- Usually these accounts are opened for a specific period e.g. three months, six month, one year or more.

- The return on investment is determined according to actual profit s from investment operations of the bank and shared in an agreed proportion by depositors according to the amount of their deposits and the period for which the bank holds them.

- Generally speaking depositors do not have the right to withdraw from these accounts as is customary in time deposits in conventional banks.

Islamic Financial Vehicles

Islamic banks around the world have devised many creative financial products based on the risk sharing and profit sharing principles of Islamic banking. For day to day banking activities a number of financial instruments have been developed that satisfy the Islamic doctrine and provide acceptable financial returns for investors.

Al-Mudaraba (Profit sharing)

This implies a contract between two parties whereby one party the rabb al mal (beneficiary; owner or the sleeping partner), entrusts money to the other party called the mudarib (managing trustee or the labor partner). Important features of Mudaraba are as follows:

- The division of profits between the two parties must necessarily be on a proportional basis and cannot be a lump sum or guaranteed return.

- The investor is not liable for losses beyond the capital he has contributed.

- The mudarib does not share in the losses except for the loss of his time and efforts.

Murabaha

This is the sale of a commodity at a price, which includes a stated profit, which includes a stated profit known to both the vendor and the purchaser. This can be called a cost plus profit contract. The buyer in deferred payments usually pays the price back. Under Murabaha the Islamic bank purchases in its own name, goods that an importer or a buyer wants and then sells them to him at an agreed mark-up. This technique is usually used for financing trade, but because the bank takes title to the goods, and is therefore engaged in buying and selling its profit derives from a real service that entails a certain risk and is thus seen as legitimate.

Musharaka (Profit and loss sharing)

This is a partnership normally of limited duration formed to carry out a specific project. It is therefore similar to a western- style joint venture, and is regarded by some as the purest from of Islamic financial instrument, since it conforms to the underlying partnership principles of sharing in and benefiting from risk. In this case the bank enters into a partnership with a client in whom both share the equity capital and perhaps even the management of a project or deal and both share in the profits or losses according to their equity shareholding.

Ijarah (Lease financing)

Another popular instrument is leasing which is designed for financing an asset or equipment. It is a manfaah (benefit) or the right to use the asset or equipment. The lessor leases out an asset or equipment to the client at an agreed rental fee for a pre-determined period pursuant to the contract.

Ijara Wa Iktina (Hire Purchase)

Equivalent to the leasing and installment loan, hire- purchase, practices that put millions of drivers on the road each year. These techniques as applied by Islamic banks include the requirement that the leased items be used productively and permitted by Islamic law.

Muqarada

This technique allows a bank to flat what are effectively Islamic bonds to finance a specific project. Investors who buy muqaradah bonds take a share of the profits of the project being financed, but also share the risk of unexpectedly low profits or even losses.

Bai-Salam

A buyer pays in advance for a specified quality of a commodity, deliverable on a specific date at an agreed price. This financing technique, similar to a futures or forward- purchase contract is particularly applicable to seasonal purchase but it can also be used to buy other goods in cases where the seller needs working capital before he can deliver.

Istisna (Purchase order)

This is a sale and purchase agreement whereby the seller undertakes to manufacture or construct according to the specification given in the agreement. It is similar to bai salam the main distinction being the nature of the asset and method of payment. Istisna generally covers those things which are customarily made to order and advance payment of money is not necessary as required in bai salam. The method of payment in istisna is flexible.

Bai-Muajjal

The terms ‘Bai’ and ‘Muajjal’ have been derived from Arabic words ‘Bai’ and ‘Ajl’. The word ‘Bai’ means purchase and sale. The word ‘Ajl’ means fixed time or a fixed period. ‘Bai-Muajjal’ means sale for which payment is made at a future fixed date or within a fixed period. In short, it is a sale on credit. ‘Bai-Muajjal’ may be defined as a contract between a buyer and seller under which the seller sells specific goods to the buyerat an agreed fixed price payable at a certain fixed future date in lump sum or within a fixed period by fixed installment’s.

Hire Purchase under Shirkatul Melk

Shirkat means partnership. Shirkatul Melk means share in ownership when two or more persons supply equity to purchase an asset own the same jointly and share the benefit as per agreement and bear the loss in proportion to their equity, the contract is called Shirkatul Melk contract.

Quard-Al-Hasan

It is a virtuous loan. Through this mode, Bank provides loan to its customer for a certain period, which bears no profit/loss/compensation.

Direct Investment

Islamic Bank without the help/assistance of any client may directly invest its fund/capital in share, securities, business and industry. Profit and loss in this business is exclusively, the internal matter of the Bank.

The concepts of equity and morality are at the root of Islamic banking .In Islam moral and equitable values from an integral part of the rules of law governing contractual and financial relations to such an extent that the relationship, which exists between equity law and relation, is an organic rather than supplementary relationship. The importance of Islamic banking has increased dramatically over the past 10 years. The main differences between Western and Islamic style banking is the concentration on people and their businesses rather than on accounts it is a much more grass roots banking according to one expert.

General Banking:

Financial institution/ intermediary that mediates or stands between ultimate borrowers and ultimate lenders is knows as banking financial institution. Banks perform this function in two ways- taking deposits from various areas in different forms and lending that accumulated amount of money to the potential investors in other different forms.

General Banking is the starting point of all the banking operating. General Banking department aids in taking deposits and simultaneously provides some ancillaries services. It provides those customers who come frequently and those customers who come one time in banking for enjoying ancillary services. In some general banking activities, there is no relation between banker and customers who will take only one service form Bank. On the other hand, there are some customers with who bank are doing its business frequently. It is the department, which provides day-to-day services to the customers. Every day it receives deposits from the customers and meets their demand for cash by honoring cheques. It opens new accounts, demit funds, issue bank drafts and pay orders etc. since bank in confined to provide the service everyday general banking is also known as retail banking.

General Banking Section of a branch is designed-

- To serve the general people for saving money

- To ensure smooth transaction for commercial people and

- To ensure security of preaches wealth of the clients and also for all other important activities.

The general banking involves the following activities-

Account opening

One cannot be a customer of the bank without opening an account. Account opening is an agreement between the customer and the bank. The form of account opening acts as a contract evidence. So account opening is one of the most important activities of a bank. The rules and regulations for opening of an account can vary according to types of accounts.

Types of Accounts

One cannot imagine the banking business without deposits. So the most important activity of the commercial bank is to receive the deposits from the customers Shahjalal Islami Bnak’s deposits can be divided as follows—

AL-Wadiah Current Deposit

For private, individuals, merchants, traders, importers and exporters mill and factory overset this type of account is advantageous. The minimum deposit of Tk.5000 for opening of a current account is required with reference.

The benefits of current account are as follows-

- Statement of account on monthly basis/any time.

- Free checkbook

- Statement by fax on demand

- Any number of transactions a day.

Mudaraba Savings Deposit

There is restriction on withdrawals. Frequent withdrawal is prohibited. The saving account is primarily for small-scale savers. The main objective of this A/C is promotion of saving money.

Highlights of the Account

- Frequent withdrawal is not encouraged.

- Minimum amount of Tk.2000.00 is required as initial deposit.

- Normally withdrawal is not allowed more than one time in a week

Mudaraba Short Notice Deposit (MSTD)

The Bank offers more profits in the short-term deposit than savings account. The depositors must keep their money for at least six months to get the profit. Generally it is suitable for various big companies, organizations and govt. departments

Mudaraba Term Deposit Receipt (MTDR)

When an account of cash is kept in the bank for a fixed period of time these deposits cannot withdraw money from the bank before the maternity of a fixed period. When the depositors open these types of account the banker issue a receipt acknowledging the receipt of money, on deposit account. For three and six and twelve months the rate of interest is 12.5%, 12.75%, and 13% respectively.

SWOT Analysis of SJIBL, Mitford Branch:

Strength:

- Fully computerized accounts maintenance.

- Money counting machine for making cash transaction easy and prompt.

- In SJIBL Bank SWIFT is being used for foreign trade related operations like letter of credit, fund transfer, guarantee, etc with optimum security.

- Well decorated and air conditioned facilities.

- SJIBL has a well-diversified pool of human resources, which is composed of people with high academic background. Also, there is a positive demographic characteristic- most employees are comparatively young in age yet mature in experience.

- SJIBL provide ATM debit card and nonstop banking facilities.

- Structural set up and business location is strategic.

- Wide product line

- Bank is very alert to preserve the asset quality of the bank.

- Continuous training both at home and abroad is going on develop the skill of human resources.

- Shahjalal Islami Bank’s assets position is quite satisfactory

Weakness:

- Limited Market Share.

- Absence of an upgraded website.

- Lack of setting arrangement for the waiting customers.

- Sometimes the Customer Service Officers were so busy that it creates delay to the customer service. And at the end of the day the closing is also delayed.

Opportunity:

Here the opportunity means an area of buyer need or potential interest in which a bank can perform profitably. If the management can use the continuous support properly it can enjoy huge opportunity for improving its growth. Other opportunities are-

- Expansion of new area of investment

- Credit card business

- Regulatory environment favoring private sector bank.

- Technical support to small Scale industries (SSI) in order to enable them to run their enterprises successfully.

- SME and Agro based business.

- Besides, the Bank is to provide full range of commercial banking services.

Threat:

The environmental threat is a challenge posed by an unfavorable trend or development that would lead to deterioration in sales or profit. Bank’s other threats are as follows-

- Number of potential competitors in home and abroad is increasing day by day.

- Restless political condition in Bangladesh, such as Strike threats the prosperity of Bank.

- Market pressure for lowing Profit rate.

- The bank must be bound to follow the rules of central Bank.

Findings

While working on Shahjalal Islami Bank Limited, Mitford Branch, I have attained a newer kind of experience. After collecting and analyzing data I have some findings. These findings are completely my personal view to research work.

- This bank started on-line service newly. As a resulted customers are not getting the full service by the on-line service. Sometimes they have to face problem with on-line account.

- . General Banking Division is an efficient department. They are very much prompt to give decision to their valued client. They never keep any things pending.

- The employees of the bank cannot provide effective and efficient services to the customers because of lack of UPS facility & Load-shedding.

- The number of human resources in the Computer section is really insufficient to give services to huge number of customers.

- Shahjalal Islami Bank Limited has also shortage of efficient management information system.

Recommendation

I have the practical experience in SJIBL for only three months. Shahjalal Islami Bank Ltd introduces a new dimension of business among the local bank in the financial market of Bangladesh in Retail Product Management. But in the complex business environment and diversified business world these products cannot meet the customer needs. Today, customer classes are vibrant and it is difficult to keep the customers without an appropriately designed and also is not properly market driven. Developing a market driven product management system is essential for any company if the company would like to win the competitive condition and would like to survive in futuristic competitive market setting. In this regard, following specific recommendations are forwarded for the development of product management of Shahjalal Islami Bank Ltd.

- Officials whom are involved in Customer Services should be more trained properly. Because some time they cannot give proper suggestions to the customer queries. Though they try to give their best.

- Their jobs should be mentioned more frequently

- They should be made somewhat free from doing business

- Link between Customer Service Officer’s and Customer Service Manager should be easier

- Number of ATM booth can be increased

- Relationship between Bank and customer should be increased

- Charges and fees may be reduced for more customer satisfaction

- The website of SJIBL should upgrade regularly

- Last but not the list, the employees must be motivated when they do something good and creative.

Conclusion

Shahjalal Islami Bank Ltd, Mitford branch is one of the most potential Islami banks in the Islami banking sector. It has a large portfolio with huge assets to meet up its liabilities and the management of this bank is equipped with the expert bankers and managers in all level of management. So it is not an easy job to find out the drawbacks of this branch. But the branch needs more employees for its substantial growth. I would rather feel like producing my personal opinion about the ongoing practices in Mitford Branch.

Shahjalal Islami Bank limited is a leading Private Islami bank in Bangladesh with superior customer bases that are loyal, faithful, worthy towards the bank. The service provided by the young energetic officials of the Shahjalal Islami Bank Limited is very satisfactory. As an Islami bank SJIBL has to follow the rules of Bangladesh bank despite the fact that these rules sometime restrict the foreign business to some extent. During my internship in this branch I have found its General Banking, Investment department & foreign exchange department to be very efficient; therefore this department plays a major role in the overall profitability of the branch and to the Bank as a whole.

The Bank’s drive towards market leadership as well as quality in choosing business will continue in the coming years although competition is intensified with the opening of more financial institutions. The Bank is optimistic that the volume of business will increase in future through pragmatic and market friendly policies. The Bank shall continue to explore new Branches for Banking. We shall endeavor to adopt customer-oriented policies and introduce new techniques that will help to earn profit and increase greater confidence of the existing/ prospective customers. If Shahjalal Islami Bank Ltd, Mitford Branch adopts professionalism within the frame work of Shariah, they will be able to earn handsome “Halal Profit” and higher return to the depositors and share holders. Ultimately, public will get more confidence on this type of Banking.