The main objective of this report is to analysis Operational Activities of Foreign Exchange Division of Jamuna Bank Limited. Other objectives are describe the customer service process and describe how the branches are efficiently controlled. Here also discuss accustom with the management policy or process of JBL in Bangladesh. Finally give an idea regarding general banking system and Foreign Exchange.

Objectives Of The Report

- Give an overview of Jamuna Bank.

- To explore General Banking activities of Jamuna Bank.

- To be accustom with the management policy or process of JBL in Bangladesh

- To explore Foreign Exchange activities of Jamuna Bank.

- To observe the working environment in commercial banks.

- To apply theoretical knowledge in the practical filed.

- To study the existing overall banker customer relationship.

Jamuna Bank Ltd. in Brief

Jamuna bank ltd started its activities in June 03, 2001 and under the leadership of Late Mr. S A Chowdhury, founder chairman who had a long dream of floating a commercial bank, which would contribute to the socio-economic development of our country. He had a long experience as a good banker. A group of highly qualified and successful entrepreneurs joined their hands with the founder chairman to materialize his dream. In deed, all of them proved themselves in their respective business as most successful star with their endeavor, intelligence, hard working and talent entrepreneurship. Among them, Mr. Alhaj Nur Mohammad became the honorable chairman after the demise of the honorable founder chairman.

This bank starts functioning from 3rd June 2001 with Mr. Abul Khair as the chairman and Mr. Solaiman Khan Mozlish as the Managing Director. Both of them have long experience in the financial sector of our country. By their pragmatic decision and management directives in the operational activities, this bank has earned a secured and distinctive position in the banking industry in terms of performance, growth, and excellent management. The name of present chairman is Nur Mohamad and Managing Director Mohammad Lakiotullah who is one of the best MD in banking sector. The authorized capital and paid up capital of the bank are Tk.1000.00 million and Tk.313.87 million respectively. Shantinagar Branch of Jamuna Bank Ltd is opened in June 01, 2003. It is situated at 41 Chamilibag, Shantinagar, and Dhaka. The name of the present branch Manager is Md. Belal Hossain.

Customer service is the set of activities an organization uses to win and retain customer’s satisfaction. It can be provided before, during, or after the sale of the product or exist on its own. There are some elements of customer service and the Bank uses these elements, which are as follows:

Organization

- Identify each market segment.

- Write down the requirements.

- Communicate the requirements.

- Organize processes.

- Organize physical spaces.

Customer care

- Meet the customer’s expectations.

- Get the customer’s point of view.

- Deliver what is promised.

- Make the customer feel valued.

- Respond to all complaints.

- Over-respond to the customer.

- Provide a clean and comfortable customer reception area.

Communication

- Optimize the trade-off between time and personal attention.

- Minimize the number of contact points.

- Provide pleasant, knowledgeable, and enthusiastic employees.

- Write documents in customer-friendly language.

Front-line people

- Hire people who like people.

- Challenge them to develop better methods.

- Give them the authority to solve problems.

- Serve them as internal customers.

- Be sure they are adequately trained.

- Recognize and reward performance.

Leadership

- Lead by example.

- Listen to the front-line people.

- Strive for continuous process improvement

Vision

To become a leading banking institution and to play a pivotal role in the development of the country.

Mission

The Bank is committed to satisfying diverse needs of its customers through an array of products at a competitive price by using appropriate technology and providing timely service so that a sustainable growth, reasonable return and contribution to the development of the country can be ensured with a motivated and professional work-force.

Features of Jamuna Bank ltd

There are so many reasons behind the better performance of Jamuna Bank Ltd than any other newly established banks.

- Highly qualified and efficient professionals.

- Jamuna Bank ltd has established a core Research & Planning Division comprising skilled person from the very inception of the Bank.

- Jamuna Bank ltd has become a member of SWIFT system to expedite foreign exchange transaction.

- The inner environments of the all branches of Jamuna Bank ltd have been computerized to provide the promptly & frequently customer services.

- Jamuna Bank ltd provides the attractive interest rate than the other financial bank.

- The bank provides loan to the customers at lower interest rate with easy and flexible condition than the others do.

- Profit earning is not the main aim of the Jamuna Bank Ltd the bank is responsible to maintain the social duties.

- The bank frequent arranges customers meeting to achieve their valuable suggestions.

- Letter of Credit (L/C) commission and other change are very lower than the others bank.

Strategies

- To strive for customer satisfaction through quality control and delivery of timely services.

- To identify customers’ credit and other banking needs and monitor their perception towards our performance in meeting those requirements.

- To manage and operate the Bank in the most efficient manner to enhance financial performance and to control cost of fund.

- To review and update policies, procedures and practices to enhance the ability to extend better service to customers.

- To promote organizational effectiveness by openly communicating company plans, policies, practices and procedures to employees in a timely fashion.

- To cultivate a working environment that fosters positive motivation for improved performance.

- To diversify portfolio both in the retail and wholesale market.

- To increase direct contact with customers in order to cultivate a closer relationship between the bank and its customers.

Aims and Objectives

JBL is always ready to maintain the highest quality of services by upgrading banking technology prudence in management and by applying high standard of business ethic through its established commitment and heritage.

- Jamuna Bank Ltd is always ready to maintain the highest quality of services by upgrading banking technology prudence in management and by applying high standard of business ethic through its established commitment and heritage.

- JBL is committed to ensure its contribution to national economy by increasing its profitability through professional and disciplined growth strategy for its customer and by creating corporate culture in international banking area.

- The objective of JBL is not only to earn profit but also to keep the social commitment and to ensure its co-operation to the person of all level, to the businessman, industrialist specially who are engaged in establishing large scale industry by consortium and the agro-based export oriented medium & small scale industries by self inspiration.

- JBL is committed to continue its activities in the new horizon of business with a view to developing service oriented industry and culture of morality and its maintenance in banking.

- JBL has been working from its very beginning to ensure the best use of its creativity, well disciplined, well managed and perfect growth.

- JBL is always pre-occupied to encourage the inventors for purchasing its share by creating the opportunity of long-term investment and increasing the value of share through prosperity as developed day by day

Corporate Culture

This bank is one of the most disciplined Banks with a distinctive corporate culture. Here we believe in shared meaning, shared understanding and shared sense making. Our people can see and understand events, activities, objects and situation in a distinctive way. They mould their manners and etiquette, character individually to suit the purpose of the Bank and the needs of the customers who are of paramount importance to us. The people in the Bank see themselves as a tight knit team/family that believes in working together for growth. The corporate culture we belong has not been imposed; it has rather been achieved through our corporate conduct.

Corporate Mission

Will become most caring, focused for equitable growth based on diversified deployment of resources, and nevertheless would remain healthy and gainfully profitable bank. Jamuna quality of operations in their banking sector. The bank has some mission to achieve the organizational goals. Some of them are-

- Its aim to ensure their competitive advantages by upgrading banking technology and information system.

- JBL intend to provide better benefits to their customers and good returns to their shareholders.

- The bank intends to meet the needs of their clients and enhance their profitability by creating corporate culture.

- Jamuna Bank Ltd provides high quality financial services to strengthen the well-being and success of individual, industries, and business communities.

- The bank believes in strong capitalization.

- It maintains high standard of corporate and business ethics.

- Jamuna Bank Ltd extends highest quality of service, which attracts the customers to choose them first.

- The bank maintains congenial atmosphere for which people are proud and eager to word with Jamuna Bank ltd.

- JBL believes in discipline growth strategy.

Human Resources Practices in Jamuna Bank ltd

Employees are the core resources of any organization. Without them, one cannot run their organization. And, human resources approach is concerned with the growth and development of people toward higher level of competency, creativity and fulfillment. It helps employees become better, more responsible persons, and then it tries to create a climate in which they may contribute to the limits of their improved abilities. It assumes that expanded capabilities and opportunities for people will lead directly to improvements in operating effectiveness. Essentially, the human resources approach means that better people achieve better results.

Recruitment

The set-vice rule of Jamuna Bank ltd states the recruitment policy of the bank. In, general the board of directors determines the recruitment policy of the bank from time to time. The minimum entry-level qualification for any official position other than supportive management is a Bachelors degree. However, informally the management prefers a minimum master’s degree for the appointed of probationary officers in the Executive Officer position. The recruitment for entry level positions begins with a formal written test which is conducted and supervised by the Institute of Business Administration, University of Dhaka. After successful completion of the written test, a personal interview is conducted for the successful candidates by a panel of experts comprising of renowned bureaucrats and prominent bankers of the country.

General Banking

General banking department is the heart of all banking activities. This is the busiest and important department of a branch, because funds are mobilized, cash transactions are made; clearing, remittance and accounting activities are done here.

Since bank is confined to provide the services everyday, general banking is also known as ‘Retail Banking’. In Jamuna Bank ltd Principal Branch, the following departments are under general banking section:

- Account opening section

- Deposit section

- Cash section

- Remittance section

- Clearing section

- Accounts section

Account Opening Section

Account opening is the gateway for clients to enter into business with bank. It is the foundation of banker customer relationship. This is one of the most important sections of a branch, because by opening accounts bank mobilizes funds for investment. Various rules and regulations are maintained and various documents are taken while opening an account. A customer can open different types of accounts through this department. Such as:

- Current Account.

- Savings account.

- Fixed Deposit

- Short Term Deposit (STD)

Types Of Accounts With Terms And Conditions:

Current Account:

Current account is purely a demand deposit account. There is no restriction on withdrawing money from the account. It is basically justified when funds are to be collected and money is to be paid at frequent interval.

Some Important Points are as follows-

- Minimum opening deposit of TK.5000/- is required, but under special circumstances it may be opened with tk.1000.

- There is no withdrawal limit.

- No Interest more or less is given upon the deposited money;

- Minimum Tk.1000/= balance must always maintain all the time;

- Profit rate is 0.00%.

Savings Account:

This deposit is primarily for small-scale savers. Hence, there is a restriction on withdrawals in a month. Heavy withdrawals are permitted only against prior notice. Some Important Points are as follows-

- Minimum opening deposit of Tk.1000/= is required;

- Minimum Tk. 1000/= balance must always maintain all the time;

- Withdrawal amount should not be more than 1/4th of the total balance at a time and limit twice in a month.

- If withdrawal amount exceed 1/4th of the total balance at a time no Profit more or less is given upon the deposited money for that month.

- Profit more or fewer rates are 6.

Fixed Deposit:

The Local Remittance section of Jamuna Bank ltd Shantinagar Branch also issues FDR.They are also known as time deposit or time liabilities. These are deposits, which are made with the bank for a fixed period, specified in advance. The bank need not maintain cash reserves against these deposits and therefore, the bank offers higher of Profit more or less on such deposits.

- Opening of fixed Deposit Account: The depositor has to fill an account form where in the mentions the amount of deposit, the period for which deposit is to be made and name/names is which the fixed deposit receipt is to be issued. In case of a Joint name Jamuna Bank ltd also takes the instructions regarding payment of money on maturity of the deposit. The banker also takes specimen signatures of the depositors. A fixed deposit account is then issued to the depositor acknowledging receipt of the sum of money mentioned there. It also contains the rate of Profit more or less and the date on which the deposit will fall due for payment.

- Term Deposits: These rates are not negotiable. In this table we can find out the percentage that is given by the bank for specific period of time to the customer.

- Fixed deposit: 3 (three) month but less than 1 month Rate of Profit is 9.00%-9.50%

- Fixed deposit: 6 (six) month, but less than 12 month Rate of Profit is 9.25%-9.50%

- Fixed deposit: 12 (twelve) month & above Rate of Profit is 9.00%-9.50%

- Payment of Profit more or less: It is usually paid on maturity of the fixed deposit. Jamuna Bank ltd calculates Profit more or less at each maturity date and provision is made on that “miscellaneous creditor expenditure payable accounts” is debited for the accrued Profit more or less.

- Encashment of FDR: In case of premature FDR< Jamuna Bank ltd is not bound to accept surrender of the deposit before its maturity date. In order to deter such a tendency the Profit more or less on such a fixed deposit is made cut a certain percentage less the agreed rate. Normally savings bank deposit is allowed.

- Loss of FDR: In case of lost of FDR the customer is asked to record a GD (general diary) in the nearest police station. After that the customer has to furnish an Indemnity Bond to Jamuna Bank ltd a duplicate FDR is then issued to the customer by the bank.

- Renewal of FDR: In Jamuna Bank the instrument is automatically renewed from the date of its maturity if the customer does not come to en-cash the FDR the period for renewal is determined as the previous one.

STD (Short Term Deposit) Account

Normally various big companies, organizations, Government Departments keep money in STD account. Frequent withdrawal is discouraged and requires prior notice. The deposit should be kept for at least seven days or thirty days to get Profit more or less. The Profit more or less offered for STD is less than that of savings deposit. Profit more or less is calculated based on daily minimum product and paid two times in a year. Profit more or less rate is 5.50%.

Account Opening Procedure:

| Step 1 | The account should be properly introduced by Any one of the following:

|

| Step 2 | Receiving filled up application in bank’s prescribed form mentioning what type of account is desired to be opened. |

| Step 3 |

|

| Step 4 | Authorized Officer accepts the application. |

| Step 5 | Minimum balance is deposited – only cash is accepted. |

| Step 6 | Account is opened and a Cheque book and pay-in-slip book is given. |

Different Schemes:

Besides these types of account Jamuna Bank ltd offers some attractive and profitable schemes to its valuable clients. These are:

- Special Savings Scheme:

Savings helps to build up capital and capital is the prime source of business investment in a country. Investment takes the country towards industrialization, which eventually creates wealth. That is why savings is treated as the very foundation of development. To create more awareness and motivate people to save, Jamuna Bank ltd offers Special Savings Scheme.

The schemes are:

- Monthly saving scheme

- Monthly benefit scheme

- Double/ triple growth benefit scheme

- Lakhpati deposit scheme

- Milloiner deposit scheme

- Kotipati deposit scheme

- Marriage deposit scheme

- Education saving scheme

Terms and conditions of the scheme:

- Any individual may invest their savings under this scheme. Double Growth Benefit Scheme may open by club or society, limited company, government organization, proprietary concern.

- The period of deposit is for 3 (three) years to 20 (twenty) years.

- Any customer can open more than one account in a branch in different amount in his name or in joint names. A deposit receipt will be issued at the time of opening the account.

- The depositor can avail loan up to 80% of the deposit under this scheme.

- If the deposit is withdrawn after six months then savings rate profit will be applied before payment is made. However no Profit more or less will be paid if the deposit is withdrawn within six months.

- In case of death of the depositor before the term, the deposit (with Profit more or less at savings rate profit) will be given to the nominee. Without nominee the legal heirs/successors will be paid on production of succession certificate.

- In case of issuing a duplicate deposit receipt the rules of issuing duplicate receipt of Term Deposit will be applicable.

- The government taxes will be deducted, if necessary, from the accumulated Profit more or less, in future.

Loan Advantage:

After two years of savings in this scheme the depositor (if an adult) is eligible for a loan up to 80%of his deposited amount. In that case, Profit more or less rates on the loan will be applicable as per prevailing rate at that time. Only Tk/-200will be collect for service charge.

Reasons For Disqualification From This Scheme:

- If the depositor fails to pay 3 installments in a row, then he will be disqualified from this scheme and Profit more or less will be applicable as mentioned in withdrawal clause.

- In case of death of the depositor the scheme will mark deceased to function. The amount will be handed over to the nominee of the deceased depositor. In case of absence of the nominee the bank will handover the accumulated amount to the successor of the deceased.

Example:

Monthly Benefit scheme: Table-2

| Term (year) | Monthly Installment BDT 1000 | Monthly Installment BDT 2000 | Monthly Installment BDT 5000 |

| 1000 | 2000 | 5000 | |

| 3 | 42260 | 84520 | 211300 |

| 5 | 80000 | 160000 | 400000 |

| 10 | 221000 | 442000 | 1105000 |

A monthly income scheme that really makes good senses a sure investment for a steady return.

Highlights Of The Scheme:

- Minimum deposit Tk 100,000/-

- Higher monthly income for higher deposit.

- The scheme is for 6 months, 1, 3, 5 years.

- Monthly income will be credited to the depositor’s account after one month.

| Deposit | Term | Monthly Profit |

| 1,00,000 | 5 years | 1,020 |

| 1,00,000 | 3 years | 1,000 |

| 1,00,000 | 1 year | 875 |

| 1,00,000 | 6 months | 850 |

Objectives:

- An account is to be opened by filling up a form.

- The Bank will provide to the customer a deposit receipt after opening the account. This receipt is non-transferable.

- If the deposit is withdrawn before maturity term, then saving rate of profit will be applicable and paid to the depositor. However, no profit will be paid if the deposit is withdrawn within six months of opening the account and monthly income paid to the customer will be adjusted from the principal amount.

- A depositor can avail loan/quard up to 80% of the deposit amount under this scheme. In this case, profit will be charged against the loan, the monthly income will be credited to the loan account until liquidation of the loan amount inclusive of profit.

Deposit Section

Deposit is the lifeblood of a bank. From the history and origin of the banking system.We know that deposit collection is the main function of a bank.

Accepting deposits

The deposits that are accepted by Jamuna Bank ltd like other banks may be classified in to,

a) Demand Deposits

b) Time Deposits

Demand deposits:

These deposits are withdrawn able without notice, e.g. current deposits. Jamuna Bank ltd accepts demand deposits through the opening of –

a) Current account

b) Savings account

c) Call deposits from the fellow bankers

Time deposits:

A deposit which is payable at a fixed date or after a period of notice is a time deposit. Jamuna Bank ltd accepts time deposits through Fixed Deposit Receipt (FDR), Short Term

Deposit (STD):

While accepting these deposits, a contract is done between the bank and the customer. When the banker opens an account in the name of a customer, there arise contracts between the two. This contract will be valid one only when both the parties are competent to enter into contracts. As account opening initiates the fundamental relationship & since the banker has to deal with different kinds of persons with different legal status, Jamuna Bank ltd officials remain very much careful about the competency of the customers.

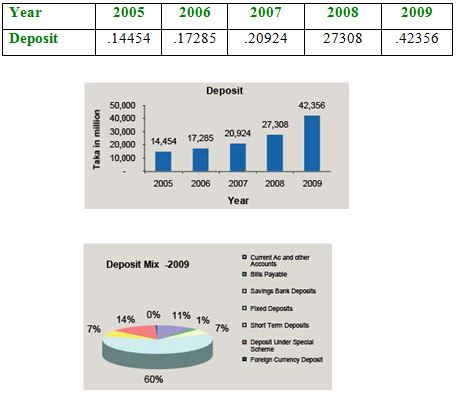

Deposit and Deposit Mix:

In Commercial banks operation starts with mobilization of resources i,e. tapping of deposits and then the said resources are deployed as loans , advances and investments for the purpose of maximizing wealth which means deposits have dominance in Commercial bank’s operation. That is why there is common saying that deposit is the lifeblood of a bank. In keeping with this JBL attaches utmost importance to the deposit mobilization campaign and to the optimal deposit mix for minimizing COF as far as practicable. A stiff competition persisted in the market as to deposit mobilization and there was a pressure on interest rate. Besides, instability in political atmosphere was adversely affecting business, which stood as a hindrance to the smooth operation of banks including deposit mobilization. Despite all these unfavorable factors JBL was able to instill confidence in customers as to its commitments to the depositors and borrowing customers and thereby could mobilize a total deposit of tk.42356.20 million in 2009 against that of tk. 27307.94million in the preceding year showing an increase of tk. 15048.26 million being .55.10 percent. Endeavor is underway for augmenting low cost deposit by accommodating good customers at competitive price. For healthy growth of business JBL puts emphasis on no cost and low cost deposit all the time. A number of savings schemes are in place for mobilizing long term deposits which can be planned to be invested in term loans in the area lease finance, project finance and SME with a view to having better yields.JBL’s such move will motivate the people to have good savings habit, as well. The comparative position of deposit mix of the bank as on 31.12.2009 and 31.12.200.8 are .42356.20 and .27307.94 (Figure in BDT million).

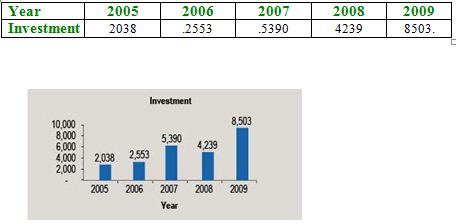

Investments

The investment portfolio of the bank as on 31.12.200.9 stood at tk.8503.44 million from tk. 4238.63 million as on 31.12.2008.The investment portfolio was blended with government treasury bills amounting to tk .1374.86 million, Treasury Bonds of tk. 6939.68 million, investment in primary share and zero coupon bonds of tk 3.93 million. The bank’s major portion of investment is in Govt. Treasury Bills and Bonds for the purpose of fulfilling statutory Liquidity Requirement.

Cash Section

Banks, as a financial institution, accept surplus money from the people as deposit and give them opportunity to withdraw the same by cheque, etc. But among the banking activities, cash department play an important role. It does the main function of a commercial bank i.e. receiving the deposit and paying the cash on demand. As this department deals directly with the customers, the reputation of the bank depends much on it. The functions of a cash department are described bellow:

Functions of Cash Department

| Cash Payment | 1. Cash payment is made only against cheque 2. This is the unique function of the banking system which is known as “payment on demand” 3. It makes payment only against its printed valid Cheque |

| Cash Receipt | 1. It receives deposits from the depositors in form of cash 2. So it is the “mobilization unit” of the banking system 3. It collects money only its receipts forms |

Cash packing:

After the banking hour cash is packed according to the denomination. Notes are counted and packed in bundles and stamped with initial.

Allocation of currency:

Before starting the banking hour all tellers give requisition of money through “Teller cash proof sheet”. The head teller writes the number of the packet denomination wise in “Reserve sheet” at the end of the day, all the notes remained are recorded in the sheet.

Dividend

Jamuna Bank Ltd is continuously upgrading itself with a view to be competitive and to remain the leader of the Banking Industry. It has distributed a substantial amount of dividends in the preceding years and also strengthens the platform of the Bank. The percentages of distribution of Dividends are as follows:

Table-

| Year | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 |

| Cash dividend | Nil | 14% | 25% | 8% | 40% | Nil |

| Stock dividend | Nil | Nil | 12.50% | 24% | Nil | 23.50% |

| Total | Nil | 14% | 37.50% | 32% | 40% | 23.50% |

Manpower

The Manpower of the Bank is increasing steadily and proportionately with the expansion of branches and activities of the Bank. At the end of 2009, the total manpower of the Bank stood at 938. The Bank is trying to ensure optimum utilization of its manpower by improving the standard of their efficiency and quality of service.

Table

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| No. of Manpower | 237 | 343 | 500 | 627 | 938 |

Local Remittance

Carrying cash money is troublesome and risky. That’s why money can be transferred from one place to another through banking channel. This is called remittance. Remittances of funds are one of the most important aspects of the Commercial Banks in rendering services to its customers.

Types of remittance:

- Between banks and non banks customer

- Between banks in the same country

- Between banks in the different centers.

- Between banks and central bank in the same country

- Between central bank of different customers.

The main instruments used by the Jamuna Bank ltd of remittance of funds are-

- Payment order ( PO)

- Demand Draft ( DD)

- Telegraphic Transfer (TT)

The basic three types of local remittances are discussed below

| Points | Pay Order | Demand Draft | TT |

| Explanation | Pay Order gives the payee the right to claim payment from the issuing bank | Demand Draft is an order of issuing bank on another branch of the same bank to pay specified sum of money to payee on demand. | Issuing branch requests another branch to pay specified money to the specific payee on demand by Telegraph /Telephone |

| Payment from | Payment from issuing branch only | Payment from ordered branch | Payment from ordered branch |

| Generally used to Remit fund | Within the clearinghouse area of issuing branch. | Outside the clearinghouse area of issuing branch. Payee can also be the purchaser. | Anywhere in the country |

| Payment Process of the paying bank | Payment is made through clearing | 1. Confirm that the DD is not forged one. 2.Confirm with sent advice 3.Check the ‘Test Code’ 4.Make payment | 1.Confirm issuing branch 2.Confirm Payee A/C 3.Confirm amount 4.Make payment 5.Receive advice |

| Charge | Only commission | Commission + telex charge | Commission + Telephone |

Test – key Arrangement: Test key arrangement is a secret code maintained by the banks for the authentication for their telex messages. It is a systematic procedure by which a test number is and the person to whom this number is given can easily authenticate the same test number by maintaining that same Jamuna Bank ltd has test key arrangement with so many banks for the authentication of LC message and for making payment.

Commission for PO: Jamuna Bank ltd charges different amount of commission on the basis of Payment order amount. The bank charges for pay order are given in the following chart:

Table

| Total amount of PO | Commission | VAT |

| Up to TK. 10,000.00 | TK. 15.00 | Tk.3 |

| TK. 10,001.00 – TK.1,00,000.00 | TK. 25.00 | Tk. 4 |

| TK. 1,00,001.00 – TK. 5,00,000.00 | TK. 50.00 | Tk. 8 |

Clearing Section

Cheque, Pay Order (P.O), Demand Draft (D.D.) Collection of amount of other banks on behalf of its customer is a basic function of a Clearing Department.

- Clearing: Clearing is a system by which a bank can collect customers fund from one bank to another through clearing house.

- Clearing House: Clearing House is a place where the representatives of different banks get together to receive and deliver cheque with another banks. Normally, Bangladesh Bank performs the Clearing House in Dhaka, Chittagong, Rajshahi, Khulna & Bogra. Where there is no branch of Bangladesh Bank, Sonali bank arranges this function.

- Member of Clearing House: Jamuna Bank ltd. is a scheduled Bank. According to the Article 37(2) of Bangladesh Bank Order, 1972, the banks, which are the member of the clearinghouse, are called as Scheduled Banks. The scheduled banks clear the cheque drawn upon one another through the clearinghouse.

Accounts Section

Accounts Department is called as the nerve Centre of the bank. In banking business, transactions are done every day and these transactions are to be recorded properly and systematically as the banks deal with the depositors’ money. Improper recording of transactions will lead to the mismatch in the debit side and in the credit side. To avoid these mishaps, the bank provides a separate department; whose function is to check the mistakes in passing vouchers or wrong entries or fraud or forgery. This department is called as Accounts Department. If any discrepancy arises regarding any transaction this department report to the concerned department.

Besides these, the branch has to prepare some internal statements as well as some statutory statements, which are to be submitted to the Central Bank and the Head Office. This department prepares all these statements.

Workings of this department:

- Recording the transactions in the cashbook.

- Recording the transactions in general and subsidiary ledger.

- Preparing the daily position of the branch comprising of deposit and cash.

- Preparing the daily Statement of Affairs showing all the assets and liability of the branch as per General Ledger and Subsidiary Ledger separately.

- Making payment of all the expenses of the branch.

- Recordings inter branch fund transfer and providing accounting treatment in this regard.

- Preparing the monthly salary statements for the employees.

- Preparing the weekly position for the branch which is sent to the Head Office to maintain Cash Reserve Requirement (C.R.R)

- Preparing the monthly position of the branch, that is sent to the Head Office to maintain Statutory Liquidity Requirement (S.L.R).

- Make charges for different types of duties

- Preparing the budget for the branch by fixing the target regarding profit and deposit so as to take necessary steps to generate and mobilize deposit.

- Checking of Transaction List

- Recording of the vouchers in the Voucher Register.

- Packing of the correct vouchers according to the debit voucher and the credit voucher.

Loans and Advances

This section leads the fund what the bank mobilizes through its various deposit accounts. This is the second function of banks two generic function –deposit mobilization and credit creation. The major part of banks income is derived from credit and since the banks credit is customer’s fund, bank takes extreme caution in lending. Otherwise defaulted loan can take place and because of it banks profitability and credit giving facility will fall and which is not expected. Though there was an unfavorable business environment due to political turmoil throughout the year JBL was in constant efforts to explore different areas of credit operation and could raise the credit portfolios to tk..32287.66 million in 2009 with an increase of tk. 11250.80 (53.48%) over that of the preceding year. The total credit was on 31.12.2009 was Tk.21036.86 million

Table

| Year | 2005 | 2006 | 2007 | 2008 | 2009 |

| Loans & Advances | .11012 | 12797 | 16617 | 21037 | 32288 |

Sanctioning Loans and Advance

To have a clear idea about the credit management of JBL analysis of the following are essential:

- Credit Policy of the Bank

- Credit Sanctioning Authority of JBL and

- Processing and Screening of Credit Proposal

Credit Policy of the Bank

JBL Credit Policy contains the views of total macro-economic development of the country. As a whole by way of providing financial support to the trade, commerce and industry. Throughout its credit, operation JBL goes to every possible corners of the society. They are financing large and medium scale business house and industry. At the same time they also take care entrepreneur through its operation of lease finance and some micro credit, small loan scheme etc. As a part of its credit policy JBL through its credit operation maintains commitment for social welfare. The bank has come up with a scheme where women will be given financial support for their self employment and development.

From its operational aspects it is observed that as a matter of policy

- JBL put emphasis on the customer previous credit performance in selecting borrowers rather than concentrating on Individual and Business.

- It takes care of diversity in credit portfolio.

- It takes care in maintaining proper mix of short, medium, and long term finance in its credit portfolio. Usually they do not go for long term finance for a period not exceeding five years

- Charging of interest is flexible depending on insisting of the proposal and the customer.

Credit Sanctioning Authority of JBL

Delegated power is expected to be exercise by the authorized executives sensitively keeping the bank’s interest in mind. In exercising the power so delegated authorized executives shall also have credit restriction, tools and regulations as governed by Banking Company Act, Bangladesh Bank, and other usual credit norms. However, the following guidelines are laid down before the executives of JBL for exercising the delegated power

- The borrower must be a man of integrity and must enjoy good reputation in the

- The borrower must have the capacity and capability for utilizing credit .properly and profitably.

- The enterprise of the borrower must be viable and profitable. That is proposal of the borrower must be evaluated properly and carefully so as to ascertain its profitability. The enterprise must generate sufficient fund for debt and servicing. “

- A customer to 9vhom credit is to -be allowed should be far as possible within the command area. .

- No sanctioning officer can sanction any credit to any of his near relatives and to any company where his relatives have financial interest.

Tools for Appraisal Credit

The 10 C’s of Good and Bad Loan

In addition to the formal credit appraisal, the credit officials of JBL tries to judge the possible client based on-some criteria. These criteria are called the C’s of good and bad loan. These are described below:

- Character: Make sure that the individual or company they are lending has outstanding integrity.

- Capacity: Make sure that the individual or the company they are lending has the capability of repaying the loan.

- Condition: Understanding the business and economic conditions that whether it will change after the loan is made.

- Capital: Make sure that the individual or the company they are lending has an appropriate level of investment in the company.

- Collateral: Make sure that there is a second way out of a credit but do not allow that to drive the credit decision.

- Complacency: Official do not rely on past history to continue. They remain alert every time whether any mistake is taking place or not.

- Carelessness: They believe that documentation, follow up and consistent monitoring are essential to high quality loan portfolio.

- Communication: They share credit objectives and credit decision making both vertically and laterally within the bank.

- Contingencies: Make sure that they understand the risk, particularly the downside possibilities and that they structure and price the loan consistently with the understanding.

- Competition: They do not get swept away by what others are doing

Lending Risk Analysis (LRA)

LRA is a. financial tool use to ana1yz the risk associate in a loan proposal. According to Bangladesh Banks order every bank has to conduct LRA. for every loan amounting Tk. 1 Crore and above. JBL is frequent user of this technique.

SWOT Analysis

It is a technique used by the credit officers to evaluate credit proposal submitted by the company especially by the production concern. Here,

S stands for Strength

W stands for Weakness

O stands for Opportunity

T stands for Threat

Strength

It analyze the inherent of the company, resilience, and brand loyalty, endowment etc.

Weakness

This analyzes the inherent weakness of a company, such as management, supply risk etc.

Opportunity

This analyzes the opportunity, which will be available to a company in a near future, such as tax, incentives, export credit facilities etc.

Threat

It analyzes the threats, which the company may face such as legal barriers, withdrawals of tax, exemption and international law, withdraw of most favorable nation (MFN) and GSP facilities etc.

Credit Monitoring and Supervision Cell

JBL is a unique characteristic in its loan management to make sure that there will ‘be no bad loan in its-loan portfolio, JBL established a loan monitoring and supervision cell headed by an First Assistant Vice President. He along with other official frequently visit “customer premises or business whether loan amount, which is taken is used properly or not. Sometimes customer need more fund or ether types of facilities to run business profitably, then the monitoring authority takes necessary steps to meet customer’s .

Processing and Screening of Credit Proposal

There are some common regulation governed by Banking Company Act, Bangladesh Bank and the law of the State which has to be followed strictly at the time of screening a credit proposal. In addition. credit proposals are appraised critically by JBL credit officials from various angle to judge the feasibility of proposal.

The customer at the branch of die bank place credit proposals. When a customer comes with accredit proposal, the credit department officials of the branch make an open discussion with the customer on different issues of the proposal to judge worthiness of the proposal and customer. If the proposal seems worthwhile in all aspect then the proposal is placed before credit committee of the bank. After threadbare discussion, if the committee agrees in principle the proposal is sanctioned as per the delegated business power of the branch.

However, if the magnitude of the proposal is beyond the delegated business power of the branch they forward it to the Head Office with recommendation for sanction or approval.

On receiving the proposal, the Credit Division of Head Office places the proposal in the Head Office Credit Committee. The committee further analyzes proposals critically and if agree in principle they sanction the same as per delegated business power. Again if the merit and magnitude of the proposal is beyond the delegated business power of the Head Office Credit Committee or Managing Director they forward proposal to the Board of the Bank with recommendation for approval.

If the proposal is found unviable at the branch level they decline the same from their desk. In the same way, proposal is also declined from the Head Office Credit Committee and from Board if it is not feasible.

Foreign Exchange

Foreign exchange is an important department of Jamuna Bank Limited, which deals with import, export and foreign remittances. Foreign Exchange is an International Department of the Bank. It facilitates international trade through its various modes of services. It bridges between importers and exporters. This department mainly deals in foreign currency, that’s why it is called foreign exchange department.

Documentary Letter Of Credit

Letter of credit is a credit contract where the Opening/Issuing Bank is committed to place an agreed amount of money at the beneficiary’s disposal under some agreed conditions.

Forms of Documentary Credit

- Revocable Credit: A revocable credit is one where the issuing bank is at liberty to revoke, that is it can cancel the credit at any time. According to UCPDC (Uniform Customs for Practice of Documentary Credit), a revocable credit may be amended or canceled by the issuing bank at any time and without prior notice to the beneficiary before shipment of consignment against the L/C.

- Irrevocable Credit: An irrevocable L/C is one, which cannot be revoked or amended by the bank with the concurrence of the interested party.

Some Important Terms Of Letter Of Credit

Amendment of credit: Some times the importer may require amendment to be made in the L/C, but this amendment must be made with in the consent pf exporter, otherwise amendment will have no validity.

Adding Confirmation: Sometimes the importer may not rely on the L/C issuing bank. Exporter requires the L/C to be confirmed by another bank situated in his country. Then on request of issuing bank, any bank in exporter’s country gives guarantee about the payment. This is called confirming bank. By adding such confirmation, confirming banks undertakes the liability to honor the Bill of Exchange of exporter.

Validity and Expiry of Credit: All L/C must mention the expiry date of L/C with in which the documents for payment /acceptance must be presented. This must exceed the date of issuance of the bill of lading or other shipping documents, during which presentation of documents for payment/acceptance must be made.

FOB (Free on Board): Under FOB basis, the exporter quotes the price covering all his expenses until the goods duty packed are delivered “on board”, the carrying vessel named and arranged by the buyer with the freight and the insurance being paid by the buyer. The importer bears any cost incurred and all risks from the time the goods are placed on board inclusive of those arising out of the ship’s failure on berth.

Cost and Freight(C & F): In this case the exporter quotes the FOB price plus insurance cost. The responsibilities of carrying out all formalities for shipment of the goods developed upon the seller.

CIF (Cost, Insurance and Freight): Under CIF, the exporter quotes C&F price plus the insurance cost. The responsibility of carrying out all formalities for shipment of the goods develop upon the seller.

FAS (Free alongside Ship): Under FAS, the seller quotes the price covering all his charges until such time as goods are loaded on Train at the specified railway station. The buyer is responsible for all charges from the time he takes delivery of all goods from the exporter’s yard.

EX-Factory: The seller quotes the price of the goods ex-factory on the date agrees. The importer is responsible for all further necessary arrangements and charges.

Parties To Letter Of Credit

- Importer (Buyer)/Applicant

- The issuing Bank (Opening Bank)

- The Advising Bank/Notifying Bank

- Exporter/seller

- Confirming Bank

- Negotiating Bank

- The paying/Accepting/Remitting Bank

Applicant: The person who request the bank (opening bank) to issue letter of credit. As per instructing and on behalf of the applicant bank opens L/C in line with the terms and conditions of the seller contract between the buyer and the seller.

Opening Bank/Issuing Bank: The bank which open/issue letter of credit on behalf of the applicant/importer. Issuing bank’s obligation is to make payment against presentation of documents drown strictly as per terms of the L/C.

Advising/Notifying Bank: The bank through which the L/C is advised/forward to the beneficiary (exporter). The responsibility of the advising bank is to communicate the L/C to the beneficiary after checking the authenticity of the credit. It acts as an agent of the issuing bank without having any engagement on their part.

Beneficiary: Beneficiary of the L/C is the party in whose favor the letter of credit is issued. Usually they are the seller or exporter.

Confirming Bank: The bank which under instruction in the letter of credit adds confirmation of making payment in addition to the issuing bank. It is done at the request of the issuing bank having arrangement with them. This confirmation constitutes a definite undertaking of the part of confirming bank in addition to that of issuing bank.

Negotiating Bank: The bank which negotiates documents and pays the amount to the beneficiary when presented complying credit terms. If the negotiations of documents are not restricted to a particular bank in the L/C, normally negotiating is the banker of the beneficiary.

Reimbursing / Paying Bank: The bank nominated in the letter of credit by the issuing bank to make payments stipulated in the document, complying with reimbursing bank.

The Description Of Process

- The contract is concluded between the importer and exporter.

- The importer addresses in serving bank with the request to let out irrevocable the letter of credit (to open the letter of credit) according to condition to the contract and transfers the sum of a covering under the letter of credit.

- The bank of the buyer opens the required letter of credit and the bank-correspondent asks to notify the supplier on opening the letter of credit.

- Straight Bank (the bank-correspondent of the bank-emitter) informs the supplier on opening of the letter of credit.

- The exporter organizes transportation of the goods by means of the conclusion of the agreement with the transport or insurance company and receives the transport invoice or insurance policy.

The exporter gives, according to the contract, the following documents:

- Proforma Invoice,

- Commercial Invoice,

- Bill of loading,

- Insurance policy,

- Packing sheet/list,

- Certificate of quality,

Forwarding

Forwarding is the letter given by the advising bank to the issuing bank. Several copies are sent to the issuing bank. All copies including original should be kept in the bank.

Bill of Exchange

According to the section 05, Negotiable Instruments (NI) Act-1881, A “bill of exchange” is an instrument in writing containing an unconditional order signed by the maker, directing a certain person to pay [on demand or at fixed or determinable future time] a certain sum of money only to or to the order of a certain person or to the bearer of the instrument. It may be either at sight or certain day sight. At sight means making payment whenever documents will reach in the issuing bank.

Invoice

Invoice is the price list along with quantities. Several copies of invoice are given. Two copies should be given to the client and the other copies should be kept in the bank. If there is only one copy, then its photocopy should be kept in the bank and the original copy should be given to the client. If any original invoice contains the custom’s seal, then it cannot be given to the client.

Packing List

Packing list is the letter describing the number of packets and there size. If there are several copies, then two copies should be given to the client and the remaining should be kept in the bank. But if there is only one copy, then the photocopy should be kept in the bank and the original copy should be given to the client.

Bill of Lading

Bill of Lading is the bill given by shipping company to the client. Only one copy of Bill of Lading should be given to the client and the remaining copy should be kept in the bank.

Certificate of Origin

Certificate of origin is a document describing the producing country of the goods. One copy of the certificate of origin should be given to the client and the remaining copy should be kept in the bank. But if there is only one copy, then the photocopy should be kept in the bank and the original should be given to the client.

Modes of Sales of Goods

- Cash in advance: Risk is minimum and The Proforma invoice is issued.

- Open Account: Goods are sent first and payment is made afterwards. There are no intermediaries. Proforma invoice is used here as well.

- Documentary Collection: Same as an open account but the use of bank as an intermediary. Here the risk is zero. Here the bank acts like an agent.

- Documentary Credit: L/C

Here modes 1, 2 and 3 are built on good faith and relationship, but mode 4 comes with a third party guarantor.

Back-to-Back L/C

Back-to-back L/C means one credit backs another. It is new credit in favor of another beneficiary. Sometimes beneficiary seller of a credit himself is unable to supply goods specified in the L/C and required to purchase from another supplier by opening second credit. Besides, the formalities and requirements for (L/C opening) the following formalities and documents are also required for opening back-to-back L/C-

- Master L/C

- Valid bonded wear house licenses

- Quota allocation for quota items

- ERC in addition to IRC

- Indemnity/Undertaking

- No objection from previous banker

- Factory inspection certificate

- BGMEA Membership

Payment against Document (PAD)

Under this arrangement, credit is allowed against documents for import of goods. This kind of loans are provided after L/C.

Eligibility

PAD is generally granted to importer for import of goods.

Interest Rate:

16 % per annum

Internal Bills Purchased (IBP)

This kind of arrangements is allowed for purchase of internal bills. Some times Contractors needs money to his liquidity problem. To avoid this kind of situation they want to take loan against their future dated cheque.

Eligibility

IBP is usually provided for future dated cheque against some service charge before 21days of the maturity date.

Loan against Imported Merchandise (LIM)

This is as similar as CC Pledge. But these loans are provided to the selected customers with internal contract.

Eligibility

This loan only for old and some special customers.

Loan against Trust Received (LTR)

Under this arrangement, credit is allowed against trust receipt and the exportable goods remain in the custody of exporter but he is required to execute a stamped export trust receipt in favor of the bank. Where the declaration is made that he holds purchased with financial assistance of the bank in trust for the bank.

Eligibility

LTR is generally granted to exporter for exportation of goods.

Local/Foreign Documentary Bills Purchased (LDBP/FDBP)

Under this arrangement, credit is allowed for exporter for exportable goods. Banks provide all the agency commission. Its pay back period is 21 days.

Eligibility

LDBP/FDBP is generally granted to exporter for exportation of goods.

Hire Purchase

The feature of hire purchase is that borrower pays his remaining amount over a period of 6 month to 2 years & some times more then 2 years. For this kind of credit the goods, which has been purchased, registered to the bank as owner. And after end of final payment goods are registered to owner formally.

Eligibility

Hire purchase facility is allowed to those people who have either fixed source of income or desire to pay it in lump sum.

Findings

While doing my internship program in Jamuna Bank Limited I got some experience which is uncommon for me. I think if the authority think on it then it will be helpful for the bank.

- There is shortage of computer in this Branch. Sometimes this shortage makes some unfortunate event in that section.

- JBL online baking services are comparatively poor.

- JBL does not take responsibility of clearing cheque of other branch.

- They are not using Data Base Networking in Information Technology (IT) Department. So they have to transfer data from branch to branch and branch to head office by using floppy disk and sure it is not a good system.

- The bank doesn’t have mass use of this medium of communication.

- Space shortage is another major problem in Foreign Exchange Department.

- JBL Credit Policy contains the views of total macro-economic development of the country.

- JBL has tools for appraisal Credit which contains 10 C’s of good and bad loan.

- JBL also analyze risk of lending loan amount of 1 Corer and above.

- SOWT Analysis of Borrower Company must be submitted to credit officer before sanctioning loan.

- JBL does not provide Credit Card to customer.

- JBL does not provide CCS to out side customer except their existing employee.

- Most of the loan types are related with Foreign Exchange Department and most of loans are provided to Foreign Exchange Department.

Recommendations

- JBL should provide more computers for this branch.

- JBL also take proper step to improve their online banking services and provide best services to customer.

- JBL Credit Policy mainly focuses on Macro Economic Development which is blessing for middle and large scale business house and industry. They should provide more loans to small and lower scale business with easy conditions.

- JBL Should use Data Base Networking in Information Technology (IT) Department.

- In foreign exchange department it is required to communicate with foreign banks frequently and quickly. To make the process easy modem communication media for example e-mil, Fax and win fax, Internet etc. Should be used.

- Only SWOT analysis can not be a helpful technique for evaluating credit proposal. JBL should aware of performance, financial stability, Competitive advantage etc. of applicant borrower.

- JBL not providing the credit cards in market which now a days one of the most important part of banking. So they are loosing too many customers. They should provide Credit Card to Customers.

- JBL also should provide more CCS to outsides customers. As a result customers of CCS can fulfill their dream and JBL can increase their interest income.

Conclusion

The Banking sector in any country plays an important role in economic activities. Bangladesh is no exception of that. As because its financial development and economic development are closely related. That is why the private commercial banks are playing significant role in this regard.

From the practical implementation of customer dealing procedure during the whole period of my practical orientation in Jamuna Bank Ltd, I have reached a firm and concrete conclusion in a very confident way. I believe that my realization will be in harmony with most of the banking thinkers. It is quite evident that to build up an effective and efficient banking system to the highest desire level computerized transaction is a must.

This report focused and analyzed on the performance of General banking and Foreign Exchange departments of Jamuna Bank ltd. Jamuna Bank ltd a new bank in Bangladesh but its contribution in socioeconomic prospect of Bangladesh has the greater significance.

JBL is attaining offer of special deposit scheme with higher benefits, which is a crying need for long-term position in financial market. Because of the entrance of more banks in the financial market, deposits will splits over. Therefore, it is high time to hold some permanent customers by offering special deposit scheme otherwise in future amount of deposit may come down. To strengthen the future prospect of branch, it is an emergency to collect more deposits.

Comparably the JBL’s local remittance is less than the other banks because of fewer numbers of branches. JBL should extend its branches to become a sustainable financial institution in this country.

In conclusion, as a new bank, JBL has been able to maintain its recovery position in sector wise credit financing is up to the satisfactory level. At last, it should give more emphasis in this sector to acquire more profit.