Main objective of this report is to analysis Overall Banking Activities of National Bank Limited. Other objectives are to know about the Banking activities, management efficiency and overall performance of National Bank and get a clear concept and practical knowledge on over all Marketing activities to apply in the future. Finally find out some current problems and recommend some solution to analyze them to facilitate the future bankers.

Mythology

The report has been written on the basis of information collected from the Primary sources and Secondary sources. In conducting the study I have followed the exploratory approach.

Primary Sources of Information:

- Face to face conversations with the employees of NBL.

- By personal interviewing and interacting customers at NBL.

Secondary Sources of Information:

- NBL Saver Branch & Head office

- The official records of NBL

- Website of NBL

- NBL annual reports

- Printed documents supplied by the executives and officers of NBL

- Relevant books, Journals, booklets

- Bangladesh Bank

Overview of National Bank Limited

National Bank Ltd. is the first private sector commercial bank of Bangladesh, fully owned by local entrepreneurs. NBL started its never-ending journey from 23 March 1983. The Board of Directors of the Bank consists of the finest intellects of the country’s business, commerce and banking areas. NBL brought a change in services in the banking sector besides the traditional Govt. banks with its excellent difference. The success of NBL is for its cooperative, helpful approach, understanding the real banking needs of each and every client and concern for their benefits and welfare. From the beginning NBL had the great objectives about the Share holders- to maximize their facilities as well as dividend. Now NBL is bigger concern compare to others in the same industry holding 91 branches in the inland area. In 1995 NBL acquired equity and management of Nepal Arab Bank Limited and in 1996 NBL opened a representative office at Myanmar. In different countries NBL has some exchange booths to facilitate the foreigners. With a string sense in all business area of commercial banking NBL could foresee tremendous growth in home bound remittance from Bangladeshi expatriates in USA, UK, Middle East and in different countries of the work. Consequently, NBL established a unique money remittance system with Western Union of USA for inbound and outbound remittance. Still now, NBL has this sort of novelty service facilities. NBL always is committed to fulfill its ethical responsibility to the society, country and to the whole world.

NBL has participated in the Brained Multi Purpose Project, a major enterprise undertaken for improving the ecological balance and the socio- economic conditions of the farmers the northern region of the country. Establishment of NBL Foundation, which operates National Bank Public School & College and sponsorship of various sports tournaments are few of the mentionable projects that display NBL’s commitment to the society. Besides the different types of Accounts, NBL has some special schemes that really represent bank’s concern about the clients, some of them are – MSS, SDS, SIS Credit Card, ATM services.

Vision Mission and Objective of NBL

Ensuring highest standard of clientele services through best application of latest information technology, making due contribution to the national economy and establishing ourselves firmly at home and abroad as a front ranking bank of the country is our cherished vision.

Efforts for expansion of our activities at home and abroad by adding new dimensions to our banking services are being continued unabated. Alongside, we are also putting highest priority in ensuring transparency, accountability, improved clientele services as well as to NBL’s commitment to serve the society, through which NBL want to get closer and closer to the people of all strata, Winning an everlasting seat in the hearts of the people as a caring companion in uplifting the national economic standard through continuous up gradation and diversification of our clientele services in line with national and international requirements is the desired goal we want to reach.

Objectives Of NBL

- Offering quick and improved clientele services through application of modern information technology.

- Playing an important role in the national progress by including improved banker customer relationship.

- Ensuring highest possible dividend to the respected shareholders by making best use of their equity.

- Pursuing the policy of nurturing balanced growth of the Bank in all sectors.

- Consolidating our position in the competitive market by introducing innovative banking products.

- Ensuring highest professional excellence for our workforce through enhancement of their work efficiency, discipline and technological knowledge.

- Expanding the Bank’s area of investment by taking part in syndicated large loan financing.

- Increases finances to small and medium Enterprises (SME) sector including agriculture and agro based industries, thus making due contribution to the national economy.

- Upholding the image of the bank at home and abroad by pursuing dynamic and time benefiting activities.

- Ensuring maintenance of capital adequacy, comfortable liquidity, asset quality and highest profit through successful implementation of the Management Core Risk program.

NBL at a Glance (2005-2008) [Taka in Million]

| Particulars | 2005 | 2006 | 2007 | 2008 |

| Authorized Capital | 1000.00 | 1000.00 | 1000.00 | 2450.00 |

| Paid up Capital | 430.27 | 516.33 | 619.59 | 805.47 |

| Reserve Fund | 1270.63 | 1345.99 | 2115.03 | 2468.79 |

| Deposits | 27762.12 | 28973.39 | 32984.05 | 40350.87 |

| Total Advance | 22257.15 | 23129.65 | 27020.21 | 32709,68 |

| Investments | 4044.20 | 4374.17 | 3564.82 | 5730,38 |

| Import Business | 19264.50 | 22028.30 | 31648.20 | 42458.50 |

| Export Business | 16341.80 | 17105.30 | 21344.10 | 28019.20 |

| Remittance Business | 7637.50 | 9035.50 | 13618.20 | 21311.10 |

| Total Income | 3622.31 | 3715.21 | 4202.52 | 5728,82 |

| Total Expenses | 2677.22 | 2980.06 | 3351.19 | 4582.04 |

| Profit (before provision & Tax) | 336.09 | 484,21 | 581.13 | 1058.73 |

| Profit (after provision & Tax) | 88.12 | 170.02 | 271.67 | 507.49 |

| Fixed Asset | 889.61 | 895.35 | 1431.23 | 1627.29 |

| Total Asset | 47929.57 | 48024.96 | 55046.13 | 66533.80 |

| Book Value of Share | 395.31 | 360.68 | 441.36 | 406.50 |

| Market Value of Share | 226.61 | 475.25 | 746.50 | 760.50 |

| Income per Share | 17.07 | 27.44 | 43.85 | 63.01 |

| Dividend Paid | 20% (Bonus Share) | 20% (Bonus Share) | 30% (Bonus Share) | 50% (Bonus Share) |

| No. of foreign correspondents | 358.00 | 410.00 | 391.00 | 400 |

| No. of employees | 2185.00 | 2133.00 | 2183.00 | 2270 |

| No. of Shareholders | 9276.00 | 9491.00 | 9564.00 | 1040 |

| No. of Branches | 76 | 76 | 76 | 91 |

Business of NBL

At present, NBL has been carrying on business through its 85 branches spread all over the country. Besides, the Bank has drawing arrangement with 415 correspondents in 75 countries of the world as well as with 32 overseas Exchange Companies. NBL was the first domestic bank to establish agency arrangement with the world famous Western Union in order to facilitate quick and safe remittance of the valuable foreign exchanges earned by the expatriate Bangladeshi nationals. NBL was also the first among domestic bands to introduce international Master Card in Bangladesh. In the meantime, NBL has also introduced the Visa Card and Power Card. The Bank has in its use the latest information technology services of SWIFT and REUTERS. NBL has been continuing its small credit programme for disbursement of collateral free agricultural loans among the poor farmers of Barindra area in Rajshahi district for improving their lot. Alongside banking activities, NBL is actively involved in sports and games as well as in various Socio-Cultural activities. Upto September 2006, the total number of workforce of NBL stood at 2239, which include 1689 officers and executives and 550 staff.

Social obligation and commitment

Inspired by its social obligation and commitment and responsibility, NBL has been running a School and College upto Class XII solely on its own guardianship. From the very inception, this institution has been maintaining a good track record of results at the SSC and HSC Examinations. Conducted by an well-educated and trained team of teachers, reputation of this institution has been increasing bay-by-day as a result of their relentless and sincere endeavor.

Awards

Transparency and accountability of a financial institution is reflected in its Annual Report containing its Balance Sheet and Profit & Loss Account. In recognition of this, NBL awarded Crest in 1999 and 2000, and Certificate on Appreciation in 2001 by the Institute of Chartered Accountants of Bangladesh.

Services of NBL

Consumer Credit Scheme

National Bank’s Consumer Credit Scheme gives you a great opportunity to buy household and office items on easy installments. This scheme gives you the advantage of part

Payment to cope with the high price tags of many necessary home and office appliances.

Television, Refrigerator, VCR, Personal Computer, Photo-Copier, Washing Machine, Furniture, Microwave Oven, Car, and a number of other expensive items are now within your buying range. With this

Scheme NBL makes better living possible for people living on fixed income. Customers can buy those home and office equipment’s without over taxing their budget.

Special Deposit Scheme

For most of the people on fixed income the opportunity to supplement their monthly earning is a golden one. And NBL Special Deposit Scheme gives a customer just that.

Under this scheme, customers can deposit, money for a term of 5 years. The deposited money is fully refundable at the expiry of the term. At the same time, during the term period they can enjoy a monthly profit corresponding to their deposited amount. As for instance, under this scheme a deposit of Tk,55,000/- gives a monthly income of Tk.500/-.

Monthly Savings Scheme(FDR)

This scheme is specially designed for the benefit of the limited income group members. This helps to accrue small monthly savings into a significant sum at the end of the term. So, after the expiry of the term period the depositor will have a sizeable amount to relish on.

A monthly deposit of Tk.500/- or Tk.1000/- for 5 or 10 years period earns in the end Tk.40,100/- or Tk.2,24,500/- respectively.

Through its Credit Card. National Bank Limited has not online initiated a new scheme but also brought a new life style concept in Bangladesh. Now the dangers and the worries of carrying cash money are memories of the past.

Credit Card comes in both local and international forms, giving the client power to buy all over the World. Now enjoy the conveniences and advantages of Credit Card as you step into the new millennium

National Bank Limited ATM Service

National Bank Limited has introduced ATM service to its Customers. The card will enable to save our valued customers from any kind of predicament in emergency situation and time consuming formalities. NBL ATM Card will give our distinguished Clients the opportunity to withdraw cash at any time, even in holidays, 24 hours a day, 7 days a week.

NBL ATM card – your access to prompt cash.

Saving Insurance Scheme

This is an uncertain World and the threatening silhouettes of future catastrophes are always looming around. This NBL scheme gives your family protection against the insecurities of the world. This scheme is the first of its kind in Bangladesh. It combines the benefits of regular savings and insurance scheme, so, you get the usual rate of interest on the deposited amount while you enjoy the protection of a comprehensive insurance coverage. Under this scheme, the beneficiary(ices) get equal the deposit in case of natural death of the account holder whereas in the event of accidental death of the account holder the beneficiary(ices) will receive twice the deposit. As for example, if a customer picks up Easy Class (Tk.50,000/-) he/she will get Tk.50,000/- for natural death and Tk.1,00,000/- for accidental death apart from his/her deposited amount and interest.

Western Union Money Transfer

Joining with the world’s largest money transfer service “Western Union”, NBL has introduced Bangladesh to the faster track of money remittance. Now money transfer between Bangladesh and any other part of the globe is safer and faster than ever before.

This simple transfer system, being on line eliminates the complex process and makes it easy and convenient for both the sender and the receiver. Through NBL – Western Union Money Transfer Service, your money will reach its destination within a few minutes.

NBL-4 Years Performance in 4 Major Sectors

- Deposit Position: (From 2003 to 2006)

The deposit of the Bank increased over the years. In 2003 it was 27762.12 million taka and at the end of 2006 its balance was 40350.87 million taka. Total deposits mobilized by the NBL in 2006 stood at tk. 40350.87 million, which is higher by the tk. 7366.82 or 22.33% than in 2005. Keeping in view the element of profitability, priority is given to mobilization of costless and low cost deposits. Deposits resources are raised by undertaking special saving mobilization programmers at the intervals throughout the year.

- Loan and Advance Position: (From 2005 to 2008)

Loans and advance also showing the upward trend over the years, which indicates a positive signal for a bank. Total loans and advances disbursed by the NBL during 2006 increased by tk. 5689.47million to tk 32709.68 million. the rate of growth was 21.06%.

- Profit Position (after tax): (From 2005 to 2008)

During the year Bank’s profit after tax has also increased i.e. Tk. 88.12 million in 2003 to Tk. 507.49million in the year 2006, a positive balance. And the growth of profit 2006 is too high than 2005.

- Export & Import Position: (From 2005 to 2008)

A huge source of bank’s income, both has increased over the years. In 2006 Export earning was 28019.20million- a golden period. NBL financed export trade worth US$ 405.33 million equivalent to tk. 28019.2million in 2006.as compares to us $ 329.00 million equivalent to tk. 21344.1 million in 2005. The rate of growth stood at 23.20% in terms of dollar and 31.27% in terms of tk.

The volume of import trade financed by NBL in 2006 amounted in us$ 606.30 million equivalence to tk. 42455.5 million as against us$ 485.00 equivalent to tk. 31648.2 million in 2005.

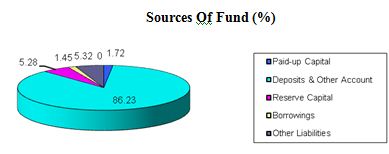

Sources and Uses of Fund

The Banks main sources of funds are shareholders equity and savings of the public, which the bank mobilizes as deposits and deploys as short and long-term loan and advances as well as invites in different financial institution including Bangladesh Bank to earn profit. Total funds of the Banks is controlled by and utilized through the Treasury Division, Loan Division And Merchant banking division. As per the latest directives of Bangladesh Bank 18.0% of the total demand and liabilities are required to the maintained as statuary Liquidity Ratio (SLR) of which 5.0% are to be maintained in cash as CRR in current Account with Bangladesh Bank ( on which no interest in receive) and the rest 13% are maintain in different approved securities, treasury bills, bonds, debenture and foreign currency. In utilizing its resources the Bank keeps in view the need for maintaining required liquidity and earning maximum profit through lending and investing.

Account Opening Department

A department which has direct interaction with customers, deal with opening of different types of Accounts. After getting all required papers Officer go to the senior executives for taking the permission of open the A/C. in the mean time s/he verify all papers and finally if the client is eligible for a A/c holder then Bank permit him to open the A/C.

Name of the different types of Accounts:

- Current Account ( CD)

- Short Term Deposit A/C(STD)–rate of interest 5.5%- 6%

- Saving A/C ( SD)- rate of interest 6%

- Fixed Deposit Receipt (FDR).

How to open an account:

- First interact with the client and understand his/ her interest to open an A/C, address, profession, social status and also his referee.

- Must have logical explanation to open the A/C

- Current Photograph

Asked for some papers:

- Tax Identification Note (TIN)

- Photocopy of passport

- Trade license

- Introduce mark on the form, from any employee of NBL

- Employment certificate

If joint A/C:

- Declaration – who will withdraw money?

- Notice from client – if client want to withdraw more then ¼ of their deposits or more then 50 thousand, notice must give before 1 week of withdrawal

- If it is a company’s A/C then MA is must After fulfillment of all requirements a client is permitted to open an Account.

Different types of Current Accounts:

- Individual

- Proprietorship

- Partnership

- Company

- Club, society etc.

Some Special packages:

- Monthly Saving Scheme (MSS):

Under this scheme one customer can open an account for 3 years @ 9% interest rate, 5 years @ 9.25% interest rate, and 8 years @ 9.5% interest rate. The monthly installments are – Tk. 500, Tk. 1000, Tk. 2000, Tk. 3000, Tk. 4000, Tk. 5000, and Tk. 10000. For opening an account customer need to submit only one copy of his/her recent photograph (passport size). Same person can open more than one account in the same branch or bank on different monthly installment.

- National Bank Limited Deposit Scheme (NDS)

The scheme will be titled as NDS. The period of deposits will be 3 years. Credit facilities up to 80% are allowed against lien on balance of NDS A/C, at 15% rate of interest of quarterly rest.

| NDS Amount (in Taka) | Monthly Benefit Payable (in Taka) |

| 50000 | 450 |

| 100000 | 900 |

| 200000 | 1800 |

| 300000 | 2700 |

| 400000 | 3600 |

| 500000 | 4500 |

| 1000000 | 9000 |

| 2000000 | 18000 |

| 5000000 | 45000 |

Cash department

| Number of Register | |

| Name of registersCash register |

|

The activities of Cash Department:

This cash Department deals with cash, maintain the registers of Incoming and outgoing of cash flows. Cash department has to properly maintain cash management policy. Within this policy cash department performs activities through some steps and follows some policy, especially insurance policy.

Types of Insurance Policies maintain in this department for getting insurance coverage:

- Cash in safe insurance: up to Tk. 5000000 coverage

- Cash on counter insurance: up to Tk.1000000 coverage

- Cash in transit insurance: up to Tk. 10000000 coverage

In cash department above mentioned registers are maintained. For example, in receive register there are two heads. One is receive from branch and other banks, other are receive from customers. Hence in payment register there are also two heads. One is payment to branch and other banks and another is payment to the customer.

Generally cash balance register is two types:

- Day cash balance book – incase of large branch this book is maintained one after one day, but in case of small branch this book is maintained on current date.

- Evening cash balance book – in case of emergency receive from customers, bank has to maintain this special kind of book for party services.

Calculation of Closing cash balance:

Opening balance……………

+Cash received……………..

Grand total…………………….

Total balance…………………

Closing cash balance………..

Deposit Department

Deposit Department

This Dept. plays an important role in deposit all cash, cheques, bills, DD, TT, PO or anything. Not directly interacted with customers but deals with the customers’ tasks. Mainly Debt, credit and transfer is the major part of their task.

After collecting cheque at first it goes to the computer operator. The officer entry the cheque no, judge validity of the cheque, check the current balance. If computer shows “good for payment” then cheque is approved for cancellation process.

If computer shows “do not pay” then no amount is debited from the A/C.

If the cheque amount is 25,000 and above and it is transfer cheque then second cancellation is needed Otherwise first cancellation is enough.

From this department anyone knows his current balance in his account by a balance slip. Deposit department has to furnish / bills master card formalities. Every day take printout of previous day’s works. Statement of last 6 months may be printed out if it is neede

| Section of department: |

|

| Operation Procedure:

| Operation is divided two parts; one is manually and other is computerized. |

| No. of work station : | 2 (with LAN) |

Inland Remittance Department

Inland Remittance Dept. Always busy to remit customers money from one destination to another destination with a minimum charge. Mainly money sent through TT. PO, DD, SDR etc.

Though Pay Order is an unconditional instrument so when a customer presents PO to this dept. Bank bound to pay the money unless any injunction of court. Without An account PO purchase is not allowed .If a PO of same bank another branch is presented then one branch has to send a credit advice to the paying branch.

Incase of TT minimum 3 parties are related. After getting a TT must justify the test number, TT number. After matching the test number “test agreed” seal is given upon telex message, then voucher has to prepare. At last paying branch debit its issuing branch and credit its customers account.

In case of DD, there is no responsibility of bank. Party has to bear DD of his own responsibility. In this case paying and issuing branches are different.

Pay slip is issue for meeting internal payment, FDR interest, a/c closing amount etc.

| Number of Register: | 4 Registers |

| Name of the Register: |

|

| No. Of work station : | 2 |

| Different types of instruments: | Inland remittance dept. Performs its work on different five types of instruments. These are::

|

| Charges of different instrument: |

|

Bills and Clearing Department

The bills and clearing department performs their duties for collection purpose. This purpose happens through two ways:

Through clearing house:

Clearing House is a combined place where all listed banks represent themselves and distribute all cheques drawn on the banks and collect cheques drawn on their own bank. Clearing house’s works are monitored by Bangladesh Bank. Every listed bank has account with Bangladesh Bank. Through clearing house every bank clear their liability. Mechanism of operation of the Clearing House is by now an well developed one. Generally the mechanism is as under:

- Every member bank of the Clearing House prepares a bank-wise list of cheques and drafts received from its customers and drawn on different banks.

- Representative of each bank visits the Clearing House with the cheques and their list in the morning and delivers the cheques and drafts to the representatives of the respective banks. Similarly, he/she also receives the cheques drawn on his/her bank from the representatives of the other banks.

- The representatives return to their respective banks to meet again in the afternoon to return the dishonoured instruments, if any, to the representatives of the respective banks.

- The representative of each bank computes the final balance payable or receivable by his bank or other bank from other banks after taking into account the various amounts of receipts and payment.

- The final settlement is effected by the supervisor of the Clearing House by debiting or crediting, as the case may be, the accounts

- of the respective banks as maintained with the Clearing House.

Registers:

For collection purpose maintains some register such as –

- Local bills for collection (LBC)

- Outward bills for collection (OBC)

- Inward bills for collection (IBC)

Loans & Advance Department

Loans and advanced section

Loans & Advance is a major earning source of a Bank. NBL is also very careful to provide loan, normally NBL sanction loan to individuals, small/medium or large industries. Actually loans give out of the Bank’s deposits, against valuable security.

NBL follows some general rules/principle to provide loan to its client.

- The bank shall provide suitable credit services and products for the markets in which it operates.

- Loans and advances shall normally the financed from customers’ deposits and not out of the share, temporary funds or borrowings from other banks.

- Credit will be allowed in manners, which will in no way compromise the Bank’s standards of excellence and to customers who will complement such standards.

- All credit extension must comply with the requirement of banking companies Act 1991 and Bangladesh Bank’s instructions as amended from time to time.

- The aggregate of all cash facilities shall not exceed 80% of customer deposits. It is further governed by the statutory and liquidity reserve requirement of Bangladesh Bank.

| Classification of Loans & Advances |

|

Cash Credit (CC) Section

| What is CC: | Actually cash credit is one kind of credit facilities to the customer. CC is a fully continuous loan. Generally this loan issued for providing working capital of a business. |

| Types of CC : |

|

| Some discussion about CC | Generally hypothecation is used in a large scale. In hypo stock acts as a primary security and keeps under borrowers full responsibility. In case of pledge stock possession is kept under bank and bank guard it own cost. After submitting bills by party bank pay bill amount to the supplier and party collect money from supplier. Party has to maintain certain % of margin to the bank. |

| Papers required to give the CC: |

|

| Documentation for giving the CC: | For registered mortgage::

|

| CC Recovery: | When borrowers are unable (unwillingly) to repay the loan then bank liquidate the mortgaged property. Before this bank make a personal interaction with borrower and in some case facilitate him/ her some time to improve his condition. But those party do not repay the loan willingly bank issue letter in favor of them for quick repayment of loan. Or facilitate them renewal of loan amount or make some arrangement to adjust their loan. There are 3 kinds of arrangement:

If borrower does not pay his/her liability although taking this reminder action then bank goes to legal action (file case). |

Secured Overdraft (SOD) Department

| The securities Can be: | Secured Overdraft works on :

|

| Different interest rate of different securities: | FDR: Loan against FDR between 80% – 90% interest rate is 2% – 3%. If loan issued above 90% Interest Rate is 3.5% – 4.5%. Savings Certificate: Interest Rate is 16% WEDB: Interest Rate is 16% |

| The steps of providing the SOD: | Generally SOD guarantee is issued for tender purpose Having SOD guarantee party has to submit work order Along with other required papers. If party needs advance payment to finish work, he needs APG, PG etc. party never paid total work value at a time, paid on a step by step after submitting bills. If bank wants every cheque drawn on bank then employer and party notarize it. On total bills employer cut up followings: Retention money: 10 % * Advance income tax: 4 % VAT: 4.5 %18.5 % * After service period this is refundable So party’s net bill receivable (NBR) is determined after cutting 18.5% charge on work value & this value is distributed step by step. |

| Terms & Conditions for SOD: | Necessary conditions of SOD advances ::

|

| Before sanctioning a Loan: | Before sanctioning guarantee-lending risk analysis (LRA) and proposal preparation is must. Branch sends the LRA report with the proposal to the board meeting (if loan is above 20lac) to finalize the decision of providing Loan. |

Bank Guarantee (BG) Department

| Different types of Bank Guarantee: |

|

| Party involvement: | There are three parties related with bank guarantee:

|

| Conditions for BG: |

|

| Validity of BG: | Work order must have a valid period and within this valid period party has to finish his work. But if employer wants he can extend this valid period. |

| Extension of validity period: | Extension of validity may be made on :

|

Loan General Section

| Types of Loan General: | There are 3 types of general loan are seen:

|

| Theme of ADB loan: | Asian Development Bank distributes a handsome fund to different developing countries. Generally in case of ADB loan charges 12% interest rate for 6 years repaid on monthly installment basis. Loan repayment starts after 1 year. |

| Theme of EHBL: | In case of EHBL purpose, loan provides employees having 8 years permanent/confirms services. Loan provides on the basis of 100 months basic salary (Basic salary*100). Installment pays Tk. 750 per lac. Within 18 years repayment must be made. Interest rate is 9% (simple) |

| Value delightment factors: | After retirement repayment can continue Safety Scheme: If any employee died on servicing then installment cut down from this scheme. If not died then after loan adjustment this deposit (70%) return with interest. For this regulation following rules must be followed:

|

| |

| Some Rules for EHBL: |

|

| Papers & Procedures for EHBL: | Photocopy of agreement of sale/allotment letter from concerned authority. Up to-date clearance from Rajuk/CDA/KDA for Dhaka/Narayangonj/Chittagong and Khulna areas or from local development Authority/Municipality for others areas stating that the land is free from acquisition. Sale permission from Housing estate if the plot is leased by Housing / other Govt. body. Clearance certificate from the Bank’s approved lawyer about the genuineness of the right title etc. of the seller of the land Whether the land is under direct possession of the seller and buyer will get possession on the same immediately after purchase. Valuation Certificate of land signed by a bank official. Whether the land is fit for immediate construction /requires Earth filling. Estimate for earth filling /development of plot , if required , duly signed by a PWD Engineer not below the rank of an assistant engineer |

Loan General (House Building Loan) Section

| Theme of HBL: | Generally HBL is issued for customers. Interest rate of house building loan is 17% |

| Required papers of HBL: | To build house on existing land /extension of the existing house:

|

To buy a Ready flat / Apartment:(Papers & Procedures)

- Photocopy of agreement of sale duly attested by the Recommending Authority.

- Clearance certificate form RAJUK/CDA/KDA for Dhaka/ Narayanganj/ Khulna and Chittagong areas and from competent authority for other areas for sale where necessary.

- Sale permission from Housing Estate if housing & settlement or other Govt. body leases the plot and house where necessary.

- Valuation certificate of ready- made / apartment signed by a PWD engineer not below the rank of Asst. engineer.

- Clearance certificate form the Bank’s approved lawyer about the genuineness of right, title etc. on the land and house.

- Whether the house is in habitual condition.

- Whether the house is under direct possession of the seller and the buyer will get the possession immediately after purchase

Different Securities for Different Types of Advances:

| Types of Advances | Securities | Interest Rate |

| Inland Bills Purchased (IBP) | Bill itself | 16% |

| Payment Against Document (PAD) | Shipping documents for import | 16% |

| Loan Against Imported Merchandise (LIM) | Pledge of imported merchandise | 16% |

| Trust Receipt (TR) | Trust receipt obtained in lien of import documents. | 16% |

| Export Cash Credit (ECC) | Pledge or Hypothecation | 7% |

| Foreign Bills Purchased (FBP) | Shipping documents for export | 7% |

Recovery of Secured Overdraft Section

| Rescheduling Rules: | After receiving rescheduling application bank has to query why loan account becomes defaulted. Considering rescheduling bank has to observe borrowers liability with other bank. Bank must have to observe borrower’s cash flow statement, Income statement, Balance sheet. Sometime bank can inspect borrower’s industry/firm physically to ensure borrower’s repayment capacity of rescheduling liability. Bank must preserve this report .if bank satisfied with above conditions, and then loan can be rescheduled. Otherwise legal action must be taken, keeping sufficient provision and write off the loan. Rescheduling must be for minimum time period. |

| Rescheduling of Term loan: |

|

| Rescheduling of demand and continuous loan: | In case of demand and continuous loan’s rescheduling rate of down payment vary in order to loan amount. Overdue loan amount Rate of down payment One Crore taka 15% One – five crore taka 10% Five crore and above 5% |

Classified Loan and keeping Provision

[Phase wise Program]

| A. Classification Status | 1st Phase | 2nd Phase | 3rd Phase | 4th Phase | 5th Phase |

| Length of overdue | Length of Overdue | Length of overdue | Length of Overdue | Length of overdue | |

| Unclassified:

Substandard:

Doubtful:

Bad/loss: | Less than 12 months 12 months or more but less than 36 months 36 months or more but less than 48 months 48 months or more | Less than 9 months 9 months or more but less than 24 months 24 months or more but less than 36 months 36 months or more | Less than 9 months 9 months or more but less than 24 months 24 months or more but less than 36 months 36 months or more | Less than 6 months 6 months or more but less than 12 months 12 months or more but less than 24 months 24 months or more | Less than 3 months 3 months or more but less than 6 months 6 months or more but less than 12 months 12 months or more |

| B. Provision Requirement Unclassified Substandard Doubtful Bad/Loss C. Frequency of classification | 1% 10% 50% 100% Annual | 1% 20% 50% 100% Half-yearly | 1% 15% 50% 100% Half-yearly | 1% 10% 50% 100% Quarterly | 1% 20% 50% 100% Quarterly |

Classified Loan Section

Some Statement of Classified Loans:

A) Statement of recovery against CL advances

B) Statement of Term loan

C) Statement of position of newly classified account

D) Statement of classification of loan

E) Statement of rescheduled loan.

Preparation of Consolidated Statements To meet up Bangladesh Bank requirement

A consolidated statement as per Bangladesh Bank requirement sends it through Head Office as a continuous basis. As when required others additional statements have to prepare.

Some important Statement that send in regular basis:

- Statement of highest 20 defaulter (monthly)

- Statement of Fraud & Forgery (monthly)

- Bangladesh Bank inspection compliance report

- Statement of loan between 1-10 crore (quarterly)

- Statement of loan above 10 crore (quarterly)

- Statement of directors liability

- Statement of other bank’s directors liability

- Statement of Ex-directors liability

- Statement of sector-wise advances

- Statement of suit file

- Statement of decreed suit file

- Statement of year-wise fresh loan disbursement 1997 to Up to date

- Statement of consumer credit scheme ( half-yearly )

- Statement of Bank reform program &credit development (half-yearly)

- Statement of sector-wise outstanding & overdue

- Statement of deposit analysis

- Statement of trend deposit analysis

- Statement of contingent liabilities Statement of term loans

- Statement of unclaimed non-transactional deposit a/c of above 10 years

- Statement of SOD loan & advances against cash/quasi Cash security

- Statement of loan & advances in Govt. & private sector at Inspection date.

Card Division

NBL provide both Credit card & Debit Card Basically this department deals with credit cards, and now days only the ‘Master Card’. But NBL recently is starting the operation of VISA Power Card as a Debit Card. Master Card is using as an alternative of cash. In the real world cash carrying is not safe always that’s why credit card is very popular in the modern world and also in Bangladesh. People can draw cash from the ATM with out any involvement of human, by credit card one can buy anything from the shop.

– NBL has 2 types of Master cards:

Silver & Gold, both has local & International range.

– Interest rate is 2% for both Local and International.

Application and proposal prepare to open a card:

- Application receive from a party

- Verify the securities (FDR, Saving Certificate, CD or SD A/C)

- For exporter lien will be his F.C A/C and payment of card will be through USD.

- Send the certificate to the top management

- If approved by the management the card will punch and deliver after 1 day to the Clint.

Charging procedure of Master Card:

| Gold | Silver | ||

| International | Local | International | Local |

| $50 + 15% (vat) | Tk. 2000 + 15% (vat) | $ 25 + 15% (vat) | Tk. 1200 + 15% (vat) |

Debit Card (Visa Power Card):

NBL Power Card Issued to a cardholder to avail of services and to purchase or to draw cash by properly presenting the same at the notified Member Establishment / Bank/ATM. Three types of Power Card is available –

- Local Card

- International Card.

- Dual Card

The card holder may avail any of the above Cards subject to fulfillment of necessary requirements.

Salient Features of the NBL Power card:

- NBL Power Card can be used for purchases at merchants where VISA Cards are accepted through electronic point of sales terminals.

- NBL Power Card can be used for withdrawing cash from Automated Teller Machines (ATM) s.

- Personal Identification Number (PIN) necessary for withdrawal of cash will be provided by the bank

- For Local Card there is no issuance fee for the 1st year and from the 2nd year only Tk. 200 will be charged.

- For the International Card highest charge will be $ 40 & lowest will be $ 15.

- To get a NBL Power Card customer has to submit only two copies of his/her recent photograph and the TIN (Tax Identification Number).

About Merchant marketing:

Here merchant is our client who has a shop/ outlet. Merchant uses our NBL card machine. NBL take 3% interest from the merchant.

2 types of machine are using in this business:

- POS (Point Of Sales)- Automatic machine

- Manual machine

For manual machine phone call come from the merchant to take the approval, whether the card is valued or not, card has sufficient balance or not And person of this Dept. Check the cardholder’s current situation and give the decision to the merchant.

For POS merchant can know the current situation of the cardholder in his computer.

Merchant marketing people always keep on follow to find the problems in the market and doing their maintenance and servicing job.

Indemnity:

The Merchant will indemnify and not will NBL responsible for any claims, demands, actions, suits or proceeding, liabilities, losses, costs, expenses, legal fees or damages asserted against NBL by any holder on account of acts or omissions by the Merchant in connection with the sale of goods and services and the performance of this agreement. The indemnity provided herein shall service the termination hereof in so far as it pertains to events, which transpired during the subsistence hereof.

Imprinters:

Imprinters for use by the Merchant will be provided on request. The imprinter provides to the Merchant must be returned on termination of this agreement. Any other Imprinter used by the Merchant not provided by NBL must be one, which can accommodate MasterCard charge slips or email or fax/telex. CCD will stop function of that stolen card.

Cash Advance by Master card:

Cash drawing is very easy in Master Card. People can draw money from ATM or from the bank also. For using the ATM pin code is require punching into the machine.

About Supplementary card:

Cardholder can get a supplementary card for another person. But the main cardholder will carry all charges.

Nominee of a card:

One cardholder cans delegate his authority to get the insurance coverage after his death, so that nominee will get all insurance payment after cardholder’s death.

WesternUnion Money Tran

Advantages:

- No bank account is needed.

- Money can be send with Master Card or Visa Card.

- Fastest & safest way to transfer money.

- People can collect money from any branches of the National Bank Ltd.

Sending Process of money:

- Sender has to fill up a form supplied by the agent of Western Union.

- After filling up the form sender has to give the form and money to the agent.

- Sender has to collect a recite of MTCN (Money Transfer Control Number).

- Sender has to inform the recipient about the amount of money and the MTCN.

Receiving Process of money:

- Receiver has to collect the MTCN and information about the amount of money.

- Then recipient has to fill up a form after presenting his/her identity in any branch of NBL.

- After examining the identification through the computer network the agent of the Western Union will give the money to the customer.

Necessary Identity of the recipient:

To receive money the recipient has to show any of the following legal identity

- Passport

- Voter Identity Card.

- Driving License

- Local Commissioner Certificate.

PROBLEMS AND LIMITATION

Problems

- No privacy for party to talk personality with the officers.

- No Advising facility for new party/ Importer.

- All manual register- a lengthy process of keeping accounts.

- No online facility.

- No services recovery system.

- Completely absent of employee motivation.

- Telex message goes after 1 or 2 days.

- Sometimes communication gap between officers and executive.

- No marketing activities to Boost up Export & Import activities.

- No promotion or features for the valued parties.

- All amendment goes through Telex not through E-mail.

- No analysis for competitors – what they are doing.

- No alternative arrangement for customer during rush hour.

- Poor customer services, poor care of customers.

- New competitors entry into the same market with greater facilities.

- Advising charge is high compare to other Bank.

- LIM / LTR interest rate seems to high.

- No Local Area Network (LAN) system within the computers.

- Customers’ always run from table to table with their files not the employees.

- No good Photocopy machine inside the department.

All problems that I mentioned may not the real problem at all or not the present problem and the solutions and recommendations may not match with the organizational goals and objective. I just tried to do a study as a part of my internship program. I expect if at least one problem of NBL match out of my findings and with the solutions that will be my success of the story. I believe some of the problems of my point of view are really practical problem of the departments

Analysis of National Bank Limited.

SWOT is an acronym for the internal strength and weakness of a firm and the environmental Opportunity and Threat facing that firm. So if we consider NBL as a business firm and analyze its strength, weakness, opportunity and threat the scenario will be as follows:

Conclusion

Firm can motivate employee in various way. But rewarding employees financially improves level of employees work.. Renowned organization of the world gets success by using this motivating tool. But use of other tools re also very important. Because need of money is not important I all level of employee. Higher-level employee want something more than money.