Unconditional probability, often known as marginal probability, is the likelihood that one of the multiple alternative outcomes will occur. It’s a likelihood that isn’t influenced by past or future occurrences. Unlimited probability is the likelihood that an occasion will end with a particular outcome regardless of different conditions that might be available. All in all, it is the probability of an occasion paying little mind to the first or future event of different occasions.

An unconditional probability is a likelihood that snow will fall in Jackson, Wyoming, on Groundhog Day, without taking into account historical weather trends and climate data for northern Wyoming in early February. In the least difficult terms, the unconditional probability is basically the likelihood of an occasion happening. The unconditional probability is determined by separating the occurrences of a positive result by the all-out number of occasions. If a die lands on the number five 15 times out of 60 times, the unconditional chance of landing on the number five is 25% (15 outcomes / 60 total lots = 0.25).

In contrast to an unconditional probability, conditional probability is the likelihood of an occurrence that is influenced by another event. The unconditional probability of an event is calculated by multiplying the event’s outcomes by the entire number of potential outcomes. Traders utilize unconditional probability to predict a security’s future profitability.

The formula for Unconditional Probability –

Unconditional Probability of “A” = P(A)

As a result, the unconditional chance of an event occurring is just the event’s probability. There is no constraint on an unconditional probability. The likelihood of rain tomorrow, for example, is an unconditional probability in and of itself. Otherwise called marginal probability and measures the shot at an event overlooking any information acquired from past or outer occasions. Since this likelihood disregards new data, it stays steady.

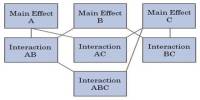

Conditional probability, on the other hand, is the chance of an event or result occurring if another event or outcome occurs before. It’s the likelihood of one occurrence influencing or being influenced by another. It’s determined by multiplying the previous event’s probability by the updated likelihood of the next, or conditional, occurrence.

In other words, a conditional probability comes with a condition, as the name indicates. It’s commonly written as P(A|B), which stands for “probability of A given B.” Unconditional probability is frequently mentioned in the news. According to a CNBC story, traders are pricing in a 100 percent chance of an interest rate decrease in July 2019 using the CME Group’s FedWatch program. This is an example of an unconditional probability in and of itself.

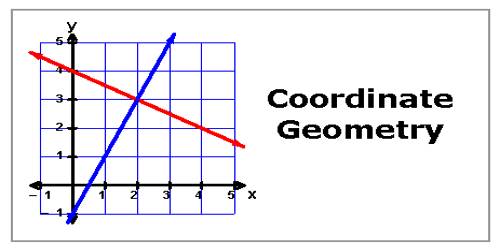

As a speculative model from finance, we should inspect a gathering of stocks and their profits. A stock can either be a champ, which procures a positive return, or a failure, which has a negative return. Say that out of five stocks, stocks A and B are champs, while stocks C, D, and E are washouts. So, what is the absolute likelihood of picking a winning stock? Because there will be a winner in two of the five potential outcomes, the unconditional chance is 2 successes divided by 5 total outcomes (2 / 5 = 0.4), or 40%.

Information Sources: