Introduction

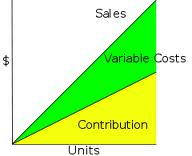

Cost Volume Profit analysis (CVP) is one of the most hallowed, and yet one of the simplest, analytical tools in management accounting. In a general sense, it provides a sweeping financial overview of the planning process (Horngren et al., 1994). That overview allows managers to examine the possible impacts of a wide range of strategic decisions. Those decisions can include such crucial areas as pricing policies, product mixes, market expansions or contractions, outsourcing contracts, idle plant usage, discretionary expense planning, and a variety of other important considerations in the planning process. Given the broad range of contexts in which CVP can be used, the basic simplicity of CVP is quite remarkable. Armed with just three inputs of data – sales price, variable cost per unit, and fixed costs – a managerial analyst can evaluate the effects of decisions that potentially alter the basic nature of a firm.

However, the simplicity of an analytical tool such as CVP can cut both ways. It can be both its greatest virtue and its major shortcoming. The real world is complicated, no less so in the world of managerial affairs; and a typical analytical model will remove many of those complications in order to preserve a sharp focus. That sharpening is usually achieved in two basic ways: simplifying assumptions are made about the basic nature of the model and restrictions are imposed on the scope of the model. Those simplifications and restrictions impinge on the reality and relevance of analytical models, so attempts to improve them will involve releasing some of their underlying assumptions or broadening their scope. In this article, we propose a variation of the CVP analytical model by broadening its scope to include cost of capital and the related impact of asset structure and risk level on strategic decisions, while at the same time preserving most of its admirable simplicity.

Our variation of the conventional CVP model provides more useful information to management because it focuses on more than operating expenses and sales revenues. Financial managers have long recognized the importance of including cost of capital and business risk variables in capital budgeting decisions (Brigham, 1995). Our model not only incorporates these admittedly important variables but recognizes the fixed and variable nature of capital costs.

Criticisms of CVP Analysis

Most criticisms of CVP relate to its basic underlying assumptions. Economists (Machlup, 1952; Vickers, 1960) have been particularly critical of those assumptions. Their criticisms take many forms, but they all arise from CVP’s departures from the standard supply and demand models in price theory economics. Perhaps the most basic difference between CVP analysis and price theory models is that CVP ignores the curvilinear nature of total revenue and total cost schedules. In effect, it assumes that changes in volume have no effect on elasticity of demand or on the efficiency of production factors. Managerial accountants recognize these economic critiques, but they believe nonetheless that CVP analysis is a very useful initial analysis of strategic decisions (Horngren et al., 1994).

Additional criticisms of the underlying nature of CVP analysis arise from its similarities to standard economic models, rather than its differences. Similar to standard economic price theory models, basic CVP analysis usually assumes, among other things, the following: single-stage, single-product manufacturing processes; simple production functions with one causal variable; cost categories limited to only variable or fixed; and data and production functions susceptible to certainty predictions. Further, CVP analysis is typically restricted to one time period in each case. The shortcomings of CVP seem daunting, but CVP is pliable enough to overcome them all, if necessary and desirable. Nonlinear and stochastic CVP models involving multistage, multi-product, multivariate, or multi-period frameworks are all possible, although a single model embracing all of those extensions would seem a radical departure from the whole point of CVP analysis, its basic simplicity.(1) In general, the durability and popularity of CVP analysis undoubtedly reflects the willingness of its users to “live with” the shortcomings revealed by criticisms of its basic nature.

In this article, we are also content to “live with” the basic CVP model. Our concerns lie elsewhere, namely, the somewhat restricted focus of CVP on only sales revenue and operating expenses. That limitation can leave some very important aspects of strategic decisions overlooked. Schneider (1992; 1994), for example, suggests that the scope of CVP analysis ought to be widened to include the impact of managerial compensation schemes on target profit levels. In a similar vein, we propose that the scope of CVP analysis be broadened to overcome three limitations of the model in regard to asset structure and risk. Those three limitations are as follows: CVP does not measure the impact of the decision on wealth; it does not incorporate the effect of asset structure changes required by the decision; and it does not acknowledge the risk created by the decision (Magee, 1975; Cheung and Heaney, 1990; Chan and Yuan, 1990). Some fairly simple extensions of the scope of the basic model can do much to alleviate the shortcomings caused by those limitations.

PRODUCT MIX DECISIONS AND CVP ANALYSIS

The selection of which products to produce, which to abandon, and which to postpone is one of the most critical decisions confronting a firm’s management. The products selected from the product mix decision determine the revenue, profit, and cash flow of the firm’s operations. Perhaps equally important, the products selected determine, in part, the firm’s competitive position vis-a-vis its competitors. The profit and cash flow from the products selected currently provide the funds required to develop and produce products in the future. A final, but frequently overlooked, aspect of product mix decisions involves the investment in long-term assets used to manufacture a product. The investments in these assets, once committed, are frequently difficult and/or costly to reverse. Therefore, once a product enters production, the firm may find it difficult to avoid economic losses.

CVP analysis is generally implemented with financial data taken from the firm’s accounting system. Financial data is readily available, as well as congruent, with the accounting profit objective inherent in the use of CVP analysis. The financial data needed for CVP may be taken from either a traditional cost accounting or an activity-based costing (ABC) system. Traditional cost accounting