About Agency Cost

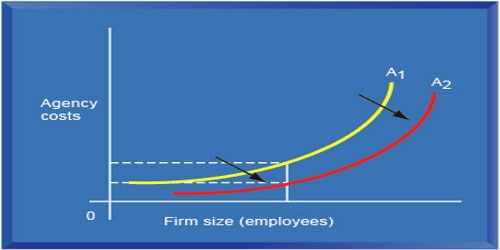

Agency costs are the costs of disagreement between shareholders and business managers, who may not agree on which actions are best for the business. Managers, instead, would prefer to expand the business and increase their salaries, which may not necessarily increase share value. It is an economic concept concerning the fee to a “principal” (an organization, person or group of persons) when the principal chooses or hires an “agent” to act on its behalf.

These costs arise because of core problems, such as conflicts of interest, between shareholders and management. Shareholders wish for management to run the company in a way that increases shareholder value, while management may wish to grow the company in ways that maximize their personal power and wealth that may not be in the best interests of shareholders.

The costs consist of two main sources:

- The costs inherently associated with using an agent (e.g., the risk that agents will use organizational resource for their own benefit).

- The costs of techniques used to mitigate the problems associated with using an agent gathering more information on what the agent is doing (e.g., the costs of producing financial statements) or employing mechanisms to align the interests of the agent with those of the principal (e.g. compensating executives with equity payment such as stock options).

Agency costs really take their toll on a company’s share price when there is substantial debt involved. Shareholders and bondholders have severe conflicts of interest, but shareholders have administrative power. They will pursue selfish strategies which will impose agency costs and lower the market value of the whole firm.

Though they are difficult for an accountant to track, agency costs are difficult to avoid as principals and agents can have separate motivations. Management can have more information than shareholders and can take advantage of their decision-making power over the company.

Dealing with the agency problem is never free — there is an agency cost associated with coping with the agency problem. Such agency costs usually fall under the category of operating expenses.

The conflict is based on the fundamental difference in the goals associated with the individuals on each side of the relationship, referred to as the principal-agent relationship. While the most common reference to the principal-agent relationship includes management as the agent and shareholders as the principal, other relationships contain similar characteristics, such as the relationship between politicians, functioning as the agent, and voters, functioning as the principal.

A non-financial way to consider agency costs is often the conflict of interest between voters and politicians. Voters select their representatives to act in their best interests, but the representatives gain the law-making power and will often act to maintain their positions of power instead of to fulfil their promises to constituents.

Information Source: