Autonomous expenditure is a type of mandatory expenditure that must be done regardless of income. It refers to the components of an Autonomous expenditure economy’s aggregate expenditure that are unaffected by the actual amount of income in the same economy. These expenses are deemed necessary and are linked to an individual’s or government’s capacity to preserve autonomy. This may also be viewed as a positive indicator for the economy, as it is often assumed that if the autonomous expenditure is high, the output will be high in that year.

According to classical economic theory, every increase in autonomous expenditures would result in at least an equal, if not a bigger, increase in aggregate production, such as GDP. When income levels are zero, autonomous expenditures must be incurred independently of personal income and are largely covered by personal savings and other credit mechanisms, such as loans and credit cards. Autonomous expenditure is unaffected by an individual’s or a country’s actual income.

Autonomous spending has an impact on an economy’s aggregate production, according to classical economic theory. Autonomous expenditures include government spending, exports, and basic living needs such as food, shelter, and so forth. External variables such as trade policy, political uncertainty, interest rates, and so on have a significant impact on these. These costs are frequently linked to the capacity to preserve independence.

In the context of countries, autonomy refers to the ability to govern oneself. Individuals’ ability to function within a specific amount of societally accepted independence is referred to as autonomy. As a result, an increase or decrease in autonomous spending will have the same effect on aggregate production. Changes in disposable income alter induced expenditures, demonstrating the wealth effect, which states that when a person’s wealth increases, they tend to spend more. Expenditure on ordinary things, for example, is deemed to be induced.

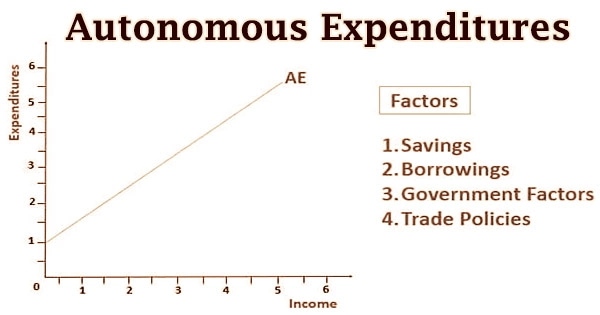

To be regarded an independent expenditure, the expenditure must be deemed required to sustain a minimum level of function or, in the case of a human, survival. When the level of revenue falls, the quantity of income devoted to autonomous expenditures may be changed, but they remain necessary spending. The curve indicating autonomous expenditure is upward sloping and has a slope larger than zero, whereas the curve showing induced aggregate expenditure is upward sloping and has a slope greater than zero.

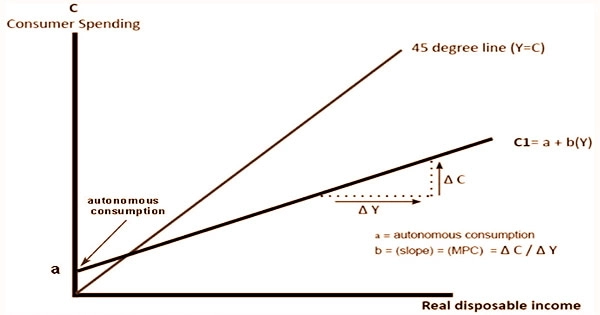

In assessing autonomous expenditure, the government also plays an important role. The money is being spent on behalf of the people to improve our country in a variety of ways, such as road maintenance, bridge building, and metro and train stations. The functional connection between total consumption and gross national income is described by the Keynesian Consumption Function, which is graphically represented as:

C = f(Y)

C = Cauto + MPC.Yd

Where:

Cauto is autonomous consumption

MPC is marginal propensity to consume

Yd is disposable income

Aggregate Expenditure (AE) = Cauto + MPC.Yd + Iplanned + G + NX

= AEauto + MPC.Yd

Autonomous spending is linked to autonomous consumption, which includes all financial commitments necessary to sustain a baseline quality of life. All other costs are classified as induced consumption, which is influenced by changes in disposable income. The SSM model highlights the importance of autonomous demand growth in determining the dynamics of an economy’s total output. It rests on the following assumptions:

- Autonomous demand exports, government spending, autonomous corporate spending, and autonomous consumption all include non-capacity generating components.

- Investment expenditure is not autonomous, even in the short term.

- Capitalist competition results in gradual changes in the marginal propensity to invest.

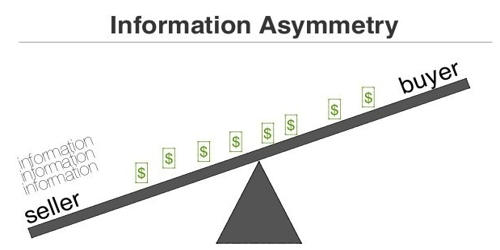

Autonomous spending is caused by a combination of internal and external causes. Non-essential spending, often known as discretionary spending or discretionary expenditure, is defined as spending that is neither required nor mandated. Many nations have distinct trade policies and tariffs, and in order to engage in nation-building, we must deal with foreign exchange to maximize profits, and one of the things to consider when estimating autonomous spending is trade policies.

Autonomous costs must still be paid even if personal income is insufficient. Personal savings, consumer borrowing mechanisms such as loans and credit cards, and other social programs can all be used to meet these demands. Changes in autonomous demand are transferred to output, therefore changes in other factors that are more important in driving demand, such as interest rate, inclination to invest, income distribution, and so on, have only a transient impact on economic growth.

The most essential example of autonomous expenditure is the expenditure made to meet all human beings’ fundamental necessities, such as food and shelter. Government spending, on the other hand, is controlled by factors such as the fiscal deficit, prospective tax receipts, and the ratio of government expenditures to GDP. As a result, government spending is not self-contained and only expands if GDP growth produces sufficient fiscal room.

Government expenditure has a significant link to its autonomy, and it determines how effectively a country can satisfy its basic demands. Autonomous expenditures are both an internal and an external element. Many trade policies and government tariffs are imposed in such a way that exporters and importers are forced to go to extreme lengths to hedge their market losses since other countries are also engaged.

Information Sources: