The Balance of Payments (BoP) is a statistical record of a country’s international transactions with the rest of the world over a specific period of time, usually a year. It summarizes all the economic transactions between the residents of a country and the residents of other countries, including trade in goods and services, income flows, and financial transactions.

In international economics, the balance of payments (also known as balance of international payments and abbreviated BOP or BoP) of a country is the difference between all money flowing into the country in a particular period of time (e.g., a quarter or a year) and the outflow of money to the rest of the world. These financial transactions are made by individuals, firms and government bodies to compare receipts and payments arising out of trade of goods and services.

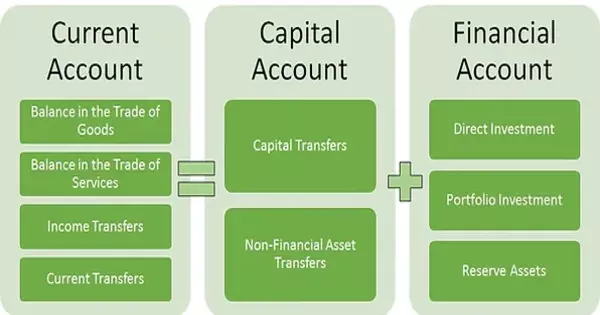

The balance of payments (BOP) is a record of all economic transactions between a country and the rest of the world over a specific period, typically a year. The BOP accounts are divided into three main categories:

- Current account: This includes transactions in goods, services, income, and current transfers between the country and the rest of the world. It reflects the net income earned or paid by a country on its international trade, investments, and other income-generating activities.

- Capital account: This includes transactions that involve the purchase or sale of non-financial assets, such as real estate, and financial assets, such as stocks and bonds, between the country and the rest of the world. It also includes capital transfers, such as debt forgiveness and migrant remittances.

- Financial account: This includes transactions in financial assets, such as currency, bank deposits, and securities, between the country and the rest of the world. It reflects changes in a country’s foreign investment position and indicates the flow of financial resources in and out of the country.

A surplus in the Current Account indicates that a country’s exports of goods and services, as well as its receipts of income, exceed its imports and payments of income. A deficit in the Current Account indicates the opposite, where a country is importing more goods and services than it is exporting, and is paying out more income to foreign investors than it is receiving.

A surplus in the Capital and Financial Account indicates that a country is a net lender to the rest of the world, meaning that it is investing more abroad than it is borrowing from foreign investors.

Application

The BOP is used to assess a country’s economic position in relation to the rest of the world and to monitor the sustainability of its external sector. A positive BOP, also known as a surplus, indicates that a country is earning more from its international transactions than it is paying out, while a negative BOP, also known as a deficit, indicates the opposite.

The BoP is an important indicator of a country’s economic health and can affect its exchange rate and overall economic stability. A persistent deficit in the Current Account, for example, can lead to a depreciation of a country’s currency, while a surplus can lead to an appreciation.