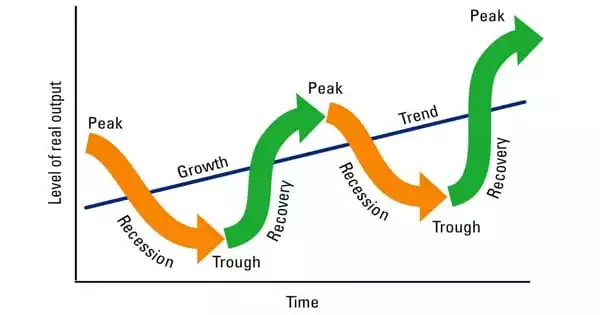

Recessions (decreases in real GDP) are primarily the result of a decrease in aggregate demand (AD). A recession is a significant economic downturn that lasts more than a few quarters and affects the entire economy. More specifically, the term refers to a period in which the gross domestic product (GDP) falls for two consecutive quarters. The nature and causes of recessions are both obvious and uncertain. Recessions are essentially a cluster of business failures that occur at the same time.

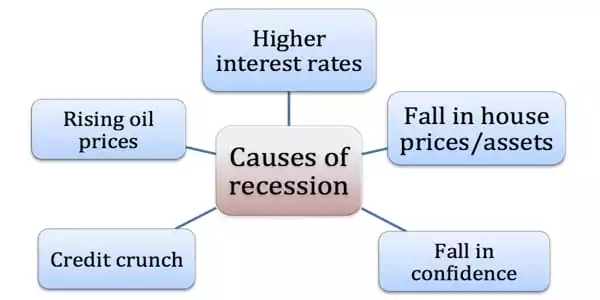

However, there are a plethora of indicators that determine whether or not we are in a recession. A recession can begin in a variety of ways, ranging from a sudden economic shock to the aftermath of uncontrolled inflation. These are some of the primary causes of a recession:

- A sudden economic shock

An economic shock is a problem that occurs unexpectedly and causes significant financial damage. OPEC cut off the supply of oil to the United States without warning in the 1970s, causing a recession and endless lines at gas stations. An unforeseeable event, such as a natural disaster or a terrorist attack, causes widespread economic disruption. The most recent example is the COVID-19 outbreak. A more recent example of a sudden economic shock is the coronavirus outbreak, which shut down economies worldwide.

- High interest rates

Consumers face increased costs when purchasing homes, automobiles, and other large purchases due to high-interest rates. A rise in interest rates raises the cost of borrowing while decreasing demand. Companies reduce their spending and expansion plans because the cost of financing is prohibitively expensive. The economy is contracting.

- Excessive debt

When individuals or businesses incur excessive debt, the cost of servicing the debt can escalate to the point where they are unable to pay their bills. When banks lack liquidity, they reduce lending, which reduces investment. The economy is then capsized as debt defaults and bankruptcies increase. The mid-aughts housing bubble, which led to the Great Recession, is a prime example of excessive debt causing a recession.

- Asset bubbles

When investing decisions are influenced by emotions, poor economic outcomes are not far behind. During a strong economy, investors may become overly optimistic. In an asset bubble, the prices of items such as tech stocks during the dot-com era or real estate prior to the Great Recession rise rapidly because buyers believe they will continue to rise indefinitely. Irrational exuberance causes stock market or real estate bubbles to form, and when the bubbles burst, panic selling can crash the market, causing a recession. The bubble then bursts, people lose what they had on paper, and fear sets in. As a result, people and businesses cut back on spending, resulting in a recession.

- Too much inflation

Increased interest rates reduce borrowing and investment. Inflation is defined as a consistent upward trend in prices over time. Inflation isn’t necessarily a bad thing, but excessive inflation is a dangerous phenomenon. Inflation is controlled by central banks raising interest rates, and higher interest rates dampen economic activity. In the 1970s, out-of-control inflation was a persistent issue in the United States. To break the cycle, the Federal Reserve raised interest rates rapidly, resulting in a recession. For example, when the UK raised interest rates to 15% in the early 1990s, mortgage payments increased and consumers were forced to cut back on spending.

- Too much deflation

While excessive inflation can cause a recession, deflation can be even more damaging. Deflation, the inverse of inflation, occurs when product and asset prices fall as a result of a significant drop in demand. Deflation occurs when prices fall over time, causing wages to contract, further depressing prices. Prices fall as demand falls, as sellers try to attract buyers. When a deflationary feedback loop becomes too strong, people and businesses stop spending, undermining the economy. People postpone purchases in order to wait for lower prices, resulting in an ongoing downward spiral or slower economic activity and higher unemployment. Central banks and economists have few tools to fix the underlying problems that cause deflation.

- Loss of consumer confidence

The negative multiplier effect exacerbated the drop in consumer/business confidence. When consumers are concerned about the state of the economy, they reduce their spending and save as much money as they can. Because consumer spending accounts for nearly 70% of GDP, the entire economy could suffer a significant slowdown.

- Technological change

New inventions boost productivity and benefit the economy in the long run, but there may be a period of adjustment to technological breakthroughs. There were waves of labor-saving technological advancements in the nineteenth century. The Industrial Revolution rendered entire professions obsolete, resulting in recessions and difficult times. Some economists are concerned that artificial intelligence and robots will cause recessions by eliminating entire job categories.