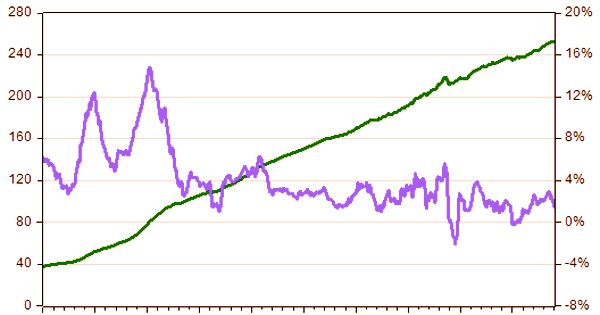

As it is generally known, the Consumer Price Index (CPI) is an index indicator of the aggregate price level of an economy. A CPI is a statistical approximation developed using the prices of a sample of representative objects whose prices are regularly collected. It is measured by taking price changes and combining them for each item in the predetermined basket of goods. A package of frequently purchased products and services consists of the CPI. In order to determine price fluctuations associated with the cost of living, changes in the CPI are used. One of the most commonly used statistics for the detection of inflation or deflation cycles is the CPI.

The CPI is calculated for a set list of products called the consumer basket, including food, lodging, clothing, transportation, electronics, medical care, education, etc. It is possible to calculate sub-indices and sub-sub-indices for various categories and sub-categories of goods and services, combined to create an aggregate index with weights representing their shares in the total spending of the customer covered by the index. Basically, it endeavors to evaluate the total value level in an economy and along these lines measure the buying intensity of a nation’s unit of money. It is one of a few value lists determined by most public factual offices.

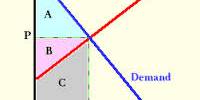

(Example of Consumer Price Index)

The Consumer Price Index (CPI) represents the change in the current market basket prices in terms of prices over the same period in the preceding year. In calculating CPI, the weighted average of the prices of goods and services that approximates the consumption habits of a person is used. Note that the value information is gathered occasionally, and consequently, the CPI is utilized to ascertain the swelling levels in an economy. In many nations, the CPI, alongside the populace evaluation, is one of the most firmly watched public monetary measurements.

Usually, the CPI is measured monthly or quarterly; it is based on the pattern of expenditure of almost all urban residents and includes individuals of all ages. Note, the CPI varies from the WPI, or wholesale price index, which calculates wholesale inflation. Subsequently, the list is a fixed-weight file, yet once in a while a genuine Laspeyres list, since the weight-reference time of a year and the value reference period, normally a later single month, don’t correspond. A list of 90 shows a 10% abatement in the cost of the market container contrasted with the reference time frame.

The CPI provides an indication of price shifts in the economy to the government, companies, and people and can serve as a reference in order to make informed economic decisions. The theory of the index in some countries, especially in the United States and Sweden, is that it is influenced by and approximates the notion of a true cost of living (constant utility) index, whereas it is viewed more pragmatically in most of Europe. The equation used to figure the Consumer Price Index (CPI) for a solitary thing is as per the following:

CPI = Cost of Market Basket in Given Year / Cost of Market Basket in Base Year × 100

The CPI is calculated as regards to a base of 12 months, which is used as a benchmark. The price change relates to that year. Keep in mind, when we calculate the CPI, notice that the rate of the basket in 1 yr needs to be first divided by using the rate of the market basket of the bottom year. Then, its miles accelerated through 100.

The index may also be used to change the qualifying standards of persons for some forms of government benefits, including Social Security, and it automatically provides domestic employees with cost-of-living salary changes. An uncontrollable rise in the CPI, however, suggests a decreasing period of growth in which a growing proportion of the population cannot afford basic goods and services. The CPI insights cover experts, independently employed, poor, jobless, and resigned individuals in the nation. The CPI speaks to the expense of a bushel of merchandise and enterprises the nation over consistently.

For all demographic groups, the Consumer Price Index does not apply; it may not provide official figures for subgroups of a population. In several nations, the manner in which owner-occupied residences should be discussed in a consumer price index has been and continues to be a source of heated debate. CPI is a restrictive typical cost for basic items measure and doesn’t gauge each viewpoint that influences expectations for everyday comforts. Social and natural elements are past the definitional extent of the index.

Information Sources: