Economic forecasting is the practice of attempting to anticipate the economy’s future state by combining a number of key and frequently observed data. It is based on statistical forecasting approaches that employ variables, their relationships, and their connections to the broader economy. Estimates can be done at a significant degree of the total, for instance for GDP, swelling, joblessness, or the monetary shortfall or at a more disaggregated level, for explicit areas of the economy or even explicit firms. Economic forecasting is an action to discover the future success of an example of speculation and is the critical movement in a monetary investigation.

Historical data points provided in prior economic reports for countries or geographical regions are used in economic forecasting. It entails creating statistical models with numerous important factors or indicators as inputs, usually in order to forecast future gross domestic product (GDP) growth rates. Essential financial markers incorporate swelling, loan costs, mechanical creation, shopper certainty, specialist usefulness, retail deals, and joblessness rates. National governments, banks and central banks, consultancies, and private sector groups such as think tanks, corporations, and international organizations such as the International Monetary Fund, World Bank, and OECD all participate in economic forecasting.

Economic predictions are used by government authorities and corporate management to decide fiscal and monetary policies and plan future operations, respectively. “Consensus Economics” collects and compiles a wide range of projections; some forecasts are issued annually, while many are updated more regularly. Economic forecasting is primarily concerned with projecting an economy’s increase in Gross Domestic Product (GDP). The entire worth of goods and services generated in an economy over time is measured by GDP. It is often seen as a proxy for an economy’s wealth, as a more productive economy is deemed more prosperous.

Economists ordinarily use critique alongside information representation instruments like tables and graphs to convey their forecasts. In planning monetary gauges an assortment of data has been utilized trying to build the exactness. Economists, companies, government organizations, and investors all consider GDP growth as a key metric. The predicted GDP growth that governments provide has an influence on decision-making among various stakeholders. Because politics is so polarized, many sensible people view government economic projections with a fair dosage of skepticism.

Organizations utilize financial conjectures to design their working exercises. In the event that the development in GDP is relied upon to be solid, they can hope to have more discretionary cash flow, and they might choose to increase their capital consumptions. To improve predictions, researchers have employed macroeconomic, microeconomic, future market data, machine-learning (artificial neural networks), and human behavioral studies. Forecasts are also used by government agencies to organize their policy-making activities. The implementation of fiscal and monetary policy is dependent on the assumption of GDP growth.

Economists utilized by the bureaucratic, state, or neighborhood governments assume a critical part in assisting policymakers with setting spending and expense boundaries. Financial backers likewise use GDP development gauges to settle on educated choices. Investors may be more comfortable investing in riskier assets if the economy is projected to be robust, whereas investors may be more careful with their asset allocation if the economy is expected to be poor. Economists can utilize statistical analysis of historical data to figure out the apparent connections between specific independent factors and the dependent variable under investigation.

An economy will deliver what is known as markers, which are indicated information focuses identifying with the economy. Forecasts from different sources might be numerically consolidated and the outcome is regularly alluded to as a consensus forecast. To fulfill the high demand for economic prediction data, private companies, central banks, and government organizations produce a significant volume of forecast data. The indicators are related to the current economic cycle, which is the status of the economy.

Investors should also keep in mind that economic forecasting is subjective. Economic forecasting is similar to data analysis in that it produces predicted future values for important economic variables. In their forecasting process, an economist uses econometric tools. A lagging indicator is an economic variable that varies considerably after a change in the actual economy has been noticed.

Slacking markers are utilized to educate which phase of the business cycle an economy is in. They are additionally used to distinguish the general pattern of the economy and are utilized by people, organizations, and government substances to settle on educated choices. Expectations are intensely affected by what sort of financial hypothesis the forecaster becomes tied up with. For example, one economist believes that commercial activity is driven by the quantity of money, whereas another feels that large government expenditure is harmful for the economy.

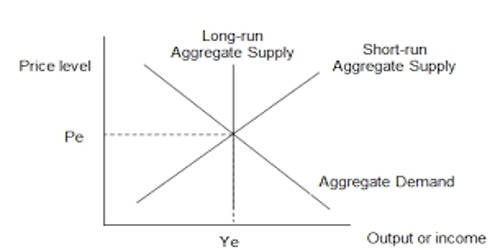

Forecasters can utilize dynamic stochastic general equilibrium models or computational general equilibrium models. Central banks frequently employ the latter. A leading indicator is an observable economic measure that varies considerably before a change in the actual economy is seen. Leading indicators are used to forecast when the economic cycle will change and other important movements in the economy will occur. The quality of forecasts appears to be time-sensitive, with certain exogenous factors affecting prediction accuracy.

As a result, while leading indicators are not always correct, they do give useful information and are frequently utilized by people, corporations, and government agencies. Forecasting the economy has been practiced for millennia. The Great Depression of the 1930s, on the other hand, was responsible for the current levels of analysis. Forecast success is influenced by a number of elements, including the model, the political economy (terrorism), financial stability, and so on. Expert predictions are typically better than market-based projections.

Information Source: