Inflation is a measure of an economy’s rate of rising prices for goods and services. Inflation can have a negative impact on society if it leads to higher prices for basic necessities such as food. The rate of inflation in a country is typically used as the primary metric for monetary policy by most modern central banks. When prices rise faster than expected, central banks tighten monetary policy by raising interest rates or implementing other hawkish policies.

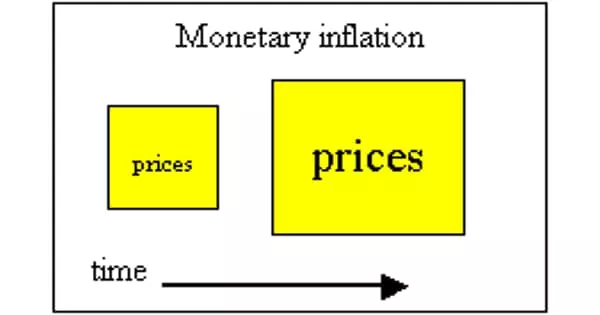

The artificial expansion of the money supply is referred to as monetary inflation. It is a sustained increase in a country’s money supply (or currency area). Many factors, particularly public expectations, the fundamental state and development of the economy, and the transmission mechanism, are likely to result in price inflation, also known as “inflation,” which is a rise in the general level of prices of goods and services. Monetary inflation is viewed as the direct cause of price inflation in monetarism and related economic approaches.

Economists generally agree that there is a causal relationship between monetary inflation and price inflation. However, there is no consensus on the precise theoretical mechanisms and relationships, nor on how to accurately measure it. According to the monetary theory of inflation, the cause of inflation is an increase in the money supply. Inflation rises faster when the money supply expands more quickly. In particular, a 1% increase in money supply growth leads to a 1% increase in inflation. With all else being equal, the price level is proportional to the money supply. Doubling the money supply would result in a doubling of prices.

This relationship is also constantly changing within the context of a larger, more complex economic system. As a result, there is a lot of disagreement about how to measure the monetary base and price inflation, how to measure the effect of public expectations, how to judge the effect of financial innovations on the transmission mechanisms, and how much factors like the velocity of money affect the relationship. As a result, different perspectives exist on what the best monetary policy targets and tools might be.

Monetary inflation is defined as a sustained increase in a country’s money supply. This is the process by which the Central Bank prints (or electronically creates) money, thereby increasing the monetary base and causing long-term inflation. Monetary inflation is the sole cause of long-term inflation, and it is the reason that everything today costs ten times what it did in the 1970s.

However, there is broad agreement on the importance and responsibility of central banks and monetary authorities in establishing public expectations of price inflation and attempting to control it. Keynesian economists believe that the central bank can assess detailed economic variables and circumstances in real time and adjust monetary policy to stabilize GDP. These economists support monetary policies that attempt to precisely smooth out the ups and downs of business cycles and economic shocks.