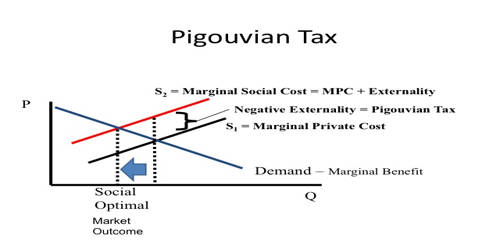

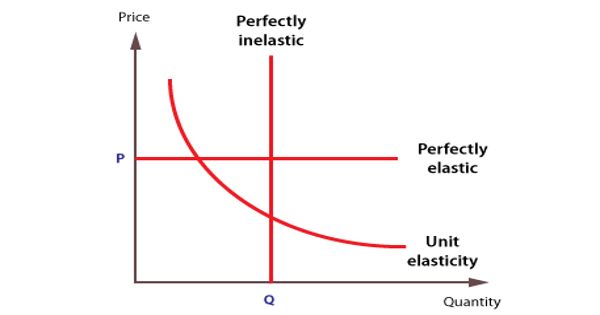

A Pigovian tax is a tax on any market activity that generates negative externalities (costs not included in the market price). It is a government cost on any activity that creates socially harmful externalities. It is a tax assessed against private individuals or businesses for engaging in activities that create adverse side effects for society. The tax is intended to correct an undesirable or inefficient market outcome (a market failure), and does so by being set equal to the social cost of the negative externalities. The government imposes Pigouvian taxes on non-compliant vehicles to impose a higher cost on the drivers to compensate for the suffering they cause. Social cost include private cost and external cost. However, in the presence of negative externalities, the social cost of a market activity is not covered by the private cost of the activity. A Pigovian subsidy works on the same basis – if a good has positive externalities, then it will be under-consumed in a free market. In such a case, the market outcome is not efficient and may lead to over-consumption of the product. Often-cited examples of such externalities are environmental pollution, and increased public healthcare costs associated with tobacco and sugary drink consumption.

A Pigovian tax is placed on any activity that creates socially harmful externalities. The revenue from the tax is often used to ameliorate the external cost. These include environmental pollution, strains on public healthcare from the sale of tobacco products, and any other side effects that have an external, negative impact. In the presence of positive externalities, i.e., public benefits from market activity, those who receive the benefit do not pay for it and the market may under-supply the product. Similar logic suggests the creation of a Pigovian subsidy to help consumers pay for socially-beneficial products and encourage increased production. The aim of a Pigovian tax is to make the price of the good equal to the social marginal cost and create a more socially efficient allocation of resources. An example sometimes cited is a subsidy for the provision of flu vaccine. The costs arising from negative externalities are not reflected in the final cost of a product or service. Therefore, the market becomes inefficient.

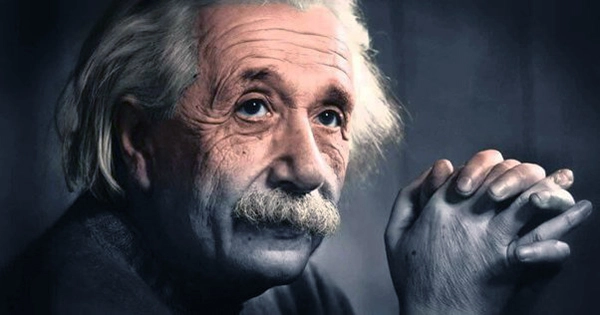

Pigovian taxes are named after English economist Arthur Cecil Pigou (1877–1959) who also developed the concept of economic externalities. William Baumol was instrumental in framing Pigou’s work in modern economics in 1972. The main purpose of Pigouvian taxes is to oppose market inefficiencies by increasing the marginal private cost by the amount generated by the negative externality.