A price floor is a set of minimum prices for products and services that is generally imposed by the government. Governments typically establish a price floor to guarantee that the market price of a commodity does not fall below a level that would jeopardize the financial viability of the commodity’s producers. To be successful, a price floor must be greater than the equilibrium price. The harmony cost, generally called the “market cost,” is the cost where monetary powers, for example, organic market are adjusted and without any outside impacts the (balance) upsides of financial factors won’t change, frequently portrayed as where amount requested and amount provided are equivalent (in a totally aggressive market).

The relevance of a price floor in the labor market has been discovered. Minimum wage laws have been enacted in a number of nations to establish the minimum wages that must be given to employees. Minimum wage regulations and supply management are two frequent price ceilings in Canadian agriculture. Other cost floors incorporate managed US airfares preceding 1978 and the least cost for every beverage law for liquor. Thusly, it can give a lift to the providers and vendors, who might accomplish a higher pay, therefore.

Minimum wages assist the government in ensuring better salaries and a fair quality of living for workers; nevertheless, there is a downside to this as well. While governments frequently enforce price floors, there are also price floors established by non-governmental entities such as businesses, such as resale price maintenance. Price floors are intended to guarantee that suppliers attain a minimum price that allows the company to continue in operation.

Types of Price Floors:

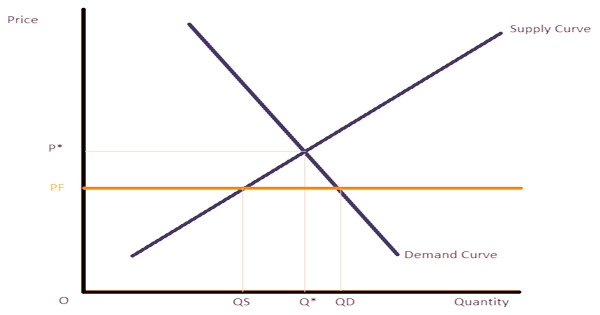

Binding Price Floor – A binding price floor is one that is greater than the equilibrium market price. Consider the figure below:

P* denotes the equilibrium market price, and Q* denotes the equilibrium market quantity. The consumers’ demand for the commodity matches the producers’ supply of the product at the price P*. The government imposes a PF price floor. As a result, market prices cannot go below PF.

Consumer demand is QD (less than Q* owing to the downward slope of the demand curve) and producer supply is QS (greater than Q* due to the upward slope of the supply curve) at price PF. The market does not clear when the price floor is established, and there is an excess supply of QS-QD.

In the event of a price floor, fewer employees are employed than in the case of an equilibrium wage. If the higher price (higher than equilibrium price) compensates for the reduced quantity sold, producers benefit from the bound price floor. A binding price floor usually disadvantages consumers since they must pay more for a smaller amount.

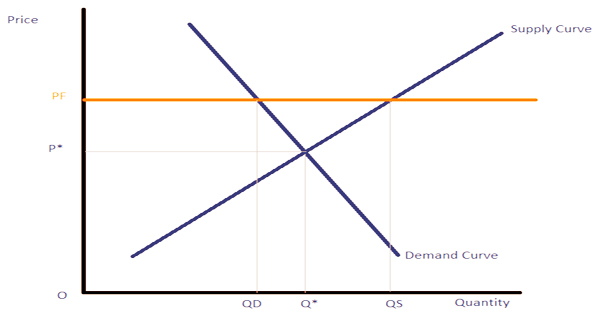

Non-Binding Price Floor – A non-binding price floor is one that is lower than the equilibrium market price. Consider the figure below:

P* denotes the equilibrium market price, and Q* denotes the equilibrium market quantity. The consumers’ demand for the commodity matches the producers’ supply of the product at the price P*. The government imposes a PF price floor. Consumer demand is QD (higher than Q* owing to the downward sloping demand curve) and producer supply is QS (lower than Q* due to the upward-sloping supply curve) at price PF.

A price floor works best when it is set above the equilibrium point, forcing prices to rise from the current equilibrium to the desired price. The market, on the other hand, is unaffected by the non-binding price floor. P* is the market price, and Q* is the amount sought and delivered. A non-binding price floor has no impact on producers or consumers.

A manufacturer and its distributors agree to sell the manufacturer’s goods at certain prices (resale price maintenance), at or above a price floor (minimum resale price maintenance), or at or below a price ceiling (resale price ceiling) (maximum resale price maintenance). Price floors are best when they are set over the harmony point whereby organic market meets. This is since, supposing that the price floor is set underneath the harmony, then, at that point, the value floor is set beneath the market esteem.

The impact of a price floor on manufacturers is difficult to predict. As a result of the legislation, producers may be better off, no better off, or worse off. A connected government or gathering forced intercession, which is additionally a value control, is the value roof; it sets the greatest value that can legitimately be charged for a decent or administration, with a typical government-forced model being rent control. The impact of a value floor on purchasers is more direct. Purchasers never acquire from the action; they might be more regrettable off or the same.

Other Effects of a Price Floor –

- Black Market: When prices are artificially raised above market value, black markets emerge as manufacturers try to sell their excess production. For example, the NFL used to have a price floor on resale tickets that set a minimum price. Season ticket holders and other resellers were forced to sell at a certain price. In any case, this made it more hard for them to sell as the cost was in overabundance of what many were ready to pay. Thusly, an underground market was made to permit the individuals who needed to offer passes to discover purchasers.

- Higher Prices: When price floors are placed higher than the equilibrium point, prices might rise. Doughnuts, for example, cost $2 apiece. If the price floor is set at $2.50, the client will have to pay an additional 50 cents for each doughnut. As a result, while the baker may gain, the customer does not, which is why price floors are sometimes viewed as corporate charity.

- Lower Demand: Customers will seek out replacement items if prices are greater than they would be in a market equilibrium. For example, if a loaf of bread’s price floor rises from $1.50 to $2, people may begin to move to cereals that are likewise $2 a box.

- Over-Production: Suppliers are prepared to supply substantially in excess of demand when the price is above the equilibrium. Suppliers are prepared to supply more when the price floor is placed above the equilibrium, as seen in the graph below, while demand declines as prices rise. As a result, there is a surplus. In order to assist businesses stay in business, the government may offer to acquire any excess output as part of imposing a price floor.

- Price Support: Governments may try to sustain the price floor by acquiring any spare capacity that arises, as previously said. This is to assist firms who may actually suffer as a result of the higher pricing. For example, they may really lose sufficient business that indeed, it aggravates them off in spite of the greater costs. So the public authority steps in to guarantee that the market is balanced out and those organizations are secure.

Price floors are commonly established by governments to aid producers. For example, if a government wishes to promote coffee bean production, it might create one in the coffee bean market. The harmony wage for laborers would be subject to their ranges of abilities alongside economic situations. Generally, value floors are intended to give a lift in pay to the makers on the inventory side, however, for this situation, it is as far as possible utilization from the interesting side.

Information Sources: