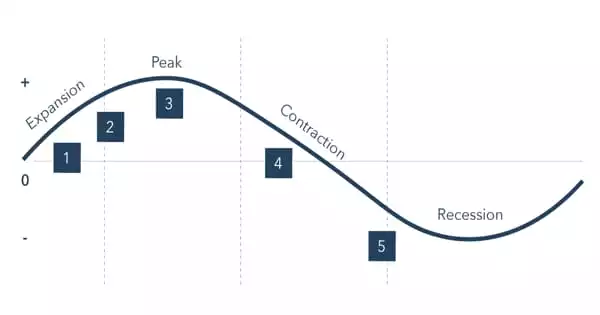

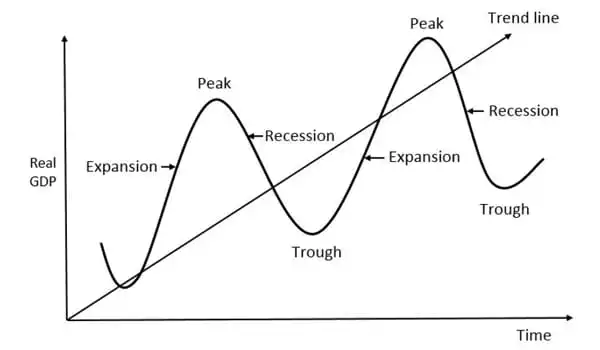

A recession is a business cycle contraction that occurs when there is a general decline in economic activity. It refers to a slowdown or a significant contraction in economic activity. Recessions typically occur when there is a significant decrease in spending. A financial crisis, an external trade shock, an adverse supply shock, the bursting of an economic bubble, or a large-scale anthropogenic or natural disaster may all trigger this (e.g. a pandemic). A significant drop in spending usually results in a recession. In such a case, economic indicators such as GDP, corporate profits, employment, and so on the decline.

A recession is a period of general economic activity decline, typically defined as a decrease in gross domestic product for two consecutive quarters in an economy. Rising unemployment, falling retail sales, slowed manufacturing growth, and a drop in real personal income are all signs of a recession. While unpleasant and frightening, it is critical to recognize that recessions are a natural occurrence in the modern economy.

This is accomplished by lowering interest rates. Increased government spending and lower taxation are also considered viable solutions to this problem. It is defined as “a significant decline in economic activity spread across the market, lasting more than a few months, normally visible in real GDP, real income, employment, industrial production, and wholesale-retail sales” in the United States. In the United Kingdom, it is defined as two consecutive quarters of negative economic growth. The 2008 global recession is the most recent example of a recession.

Some countries and economists define a recession as a two-quarter contraction, others as a six-month contraction, and still others do not define the time period at all, instead of taking a more comprehensive and nuanced view of different data points to indicate a recession. Most recessions are caused by a complex set of factors, such as high-interest rates, low consumer confidence, and stagnant or reduced real income in the labor market.

Governments typically respond to recessions by enacting expansionary macroeconomic policies, such as increasing the money supply, increasing government spending, and lowering taxation. This wreaks havoc on the entire economy. To combat the threat, economies typically respond by loosening monetary policies and injecting more money into the system, i.e., increasing the money supply.

Simply put, a recession is a decline in economic activity, which means that the public has stopped purchasing goods for a period of time, causing GDP to fall after a period of economic expansion (a time where products become popular and the income profit of a business becomes large). This leads to inflation (the rise of product prices). In a recession, the rate of inflation slows, stops, or even falls.

Economists use a variety of statistics and trends to determine whether an economy is in recession. The following are indicators of a recession:

- An increase in unemployment

- An increase in the number of bankruptcies, defaults, or foreclosures

- Interest rates are falling.

- Lower consumer spending and confidence

- Falling asset prices, including the cost of housing, as well as stock market declines

All of these factors can contribute to a decrease in the Gross Domestic Product (GDP). A recession is defined by the European Union and the United Kingdom as two or more consecutive quarters of negative real GDP growth.