EXECUTIVE SUMMARY

Forecast of governmental expenditures and revenues for the ensuing fiscal year. In modern industrial economies, the budget is the key instrument for the execution of government economic policies. Because government budgets may promote or retard economic growth in certain areas of the economy and because views about priorities in government spending differ widely, government budgets are the focus of competing political interests. The budget has been announced with eight major objectives including creating employments, maintaining prices of essentials at a tolerable level, ensuring food security and extending social safety net.

INTRODUCTION

Forecast of governmental expenditures and revenues for the ensuing fiscal year. In modern industrial economies, the budget is the key instrument for the execution of government economic policies. Because government budgets may promote or retard economic growth in certain areas of the economy and because views about priorities in government spending differ widely, government budgets are the focus of competing political interests. A government budget is a legal document that is often passed by the legislature, and approved by the chief executive. For example, only certain types of revenue may be imposed and collected. Property tax is frequently the basis for local revenues, while sales tax may be the basis for state revenues, and income tax and corporate tax are the basis for national revenues.

On 9 June 2008, the Finance Adviser to the Caretaker Government presented the national budget for the financial year (FY) 2008-09 in a live broadcast over the national radio and TV. The marathon address touched upon almost all aspects of the nation’s economic life – the difficulties surmounted and the successes achieved. While highlighting the budget performance last year, he also laid before the nation the socio-economic targets for the coming year and how the government planned to achieve those. He covered a wide vista of governmental activities from agriculture to industries, from education to employment, from communications to power generation. However, there was not a word on ‘defence’, despite it being one of the largest expenditure sectors of the government.

In the past, there used to be a few cursory remarks by the Finance Ministers in their budget speech promising to “build a strong defence force, able to safeguard the national sovereignty” etc. etc; but not this time. In the official website of the Ministry of Finance the allocation is reported to be Tk. 6306 crore (US$ 935 mil). Defence came out as the eighth largest sector, representing about 6.4% of the Government spending, ahead of sectors like Transport and Communications (6.1%), Health (5.9%) or Public Order and Security (5.6%). However, like the previous years, the nation remained in the dark as to the rationale behind the defence expenditure. While we know how much electricity the government plans to generate, how many new schools, hospitals or industrial estates the government plans to build or how much additional food grain we plan to harvest, we do not know what we plan to achieve with the money spent for defence. Unlike the developed countries of the west, defence expenditure continues to remain shrouded in secrecy in our part of the world.

During the last financial year, while most government departments could not spend their allocated budget, the defence, like previous years, overspent and got additional budget of Tk.536 crore over the FY 2007-08 allocations. In fact, this had been the trend over the last five years when defence got additional allocation in the revised budget at the end of the year. Although the defence budget in the absolute term had been increasing, its share in the total national budget had been falling for more than a decade. While in the 80s and early 90s, the defence’s share used to be around 10% of the total government spending, it has come down to its present share of 6.4%, down from 7% in FY 2007-08. The chart below shows that defence budget has been rising at a rate slower than some important socio-economic sectors. The rise in government spending on education had been particularly impressive.

However, we need to remember that while in all other sectors there are external assistance components the defence budget is exclusively self-financed. A sizeable chunk of the defence budget is spent on import of armament, spares and fuel, draining our scarce foreign exchange reserve. The “burden of defence” falls squarely on the national exchequer. If we consider the revenue expenditure, the share of defence rises to 6.8%. In terms of the GDP, defence expenditure in Bangladesh represents 1.15% of the GDP. One need to compare this with agriculture and rural development (2.8%), education (2.3%), health (1%), Transport and Communication (1.8%) and the total budgetary expenditure being 15% of the GDP. The defence expenditure of Bangladesh, when expressed as a percentage of GDP, is quite low compared to our neighbors India (1.99%), Pakistan (3%), Sri Lanka (6%) and Myanmar (3.3%) of the GDP.

TK 99,962CR BUDGET BANKS ON HIGH BORROWING

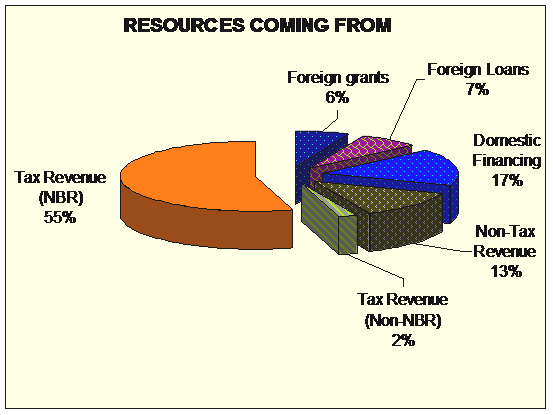

The government proposed an expansionary budget of Tk 99,962 crore for the next fiscal year (FY09), which is 26 percent bigger than that of FY08 with big outlays for social safety nets, subsidies, interest payments and block allocation.

In the proposed budget, non-development expenditure has received a 38 percent boost while in a rare move the government has cut development expenditure by 3.39 percent.

To pay for the big spending spree, the government has pushed up revenue target to Tk 69,362 crore, which is 21 percent higher than the target in the original budget of FY2007-08.

But, a large deficit of Tk 30,580 crore, 5 percent of the GDP, is still expected for which the government will borrow Tk 13,498 crore from the banking system–an 86 percent jump from the current fiscal year’s bank borrowing.

In the FY08 budget, bank borrowing target was Tk 7,253 crore, which was later revised at Tk 10,398 crore.

Finance Adviser Mirza Azizul Islam admitted that the government was compelled to take up such an expansionary budget because of a precarious international and local economic scenario still reeling from the oil and food price shocks.

“…In the backdrop of the negative impacts of international price hike of oil, food and fertiliser together with internal shocks, an expansionary fiscal policy to protect the poor and the low-income group of the community has become an essential necessity,” Mirza Aziz observed.

He said the budget would overcome the current economic crises by focusing on nine priority areas: maintaining tolerable food and energy prices, employment generation, ensuring food security, widening and deepening social safety-net programmes, reducing regional disparity, increasing agricultural production and power generation, and improving communication networks, including IT.

He also allayed any fears that a drop in development budget reflects a “lesser development thrust” because “the dichotomy of development and non-development budget is an artificial one”.

The finance adviser said the non-development budget will include Tk 16,932 crore for social safety-net programmes, Tk 13,648 crore for agricultural inputs, food and fuel subsidies, and Tk 10,253 crore for the salaries of teachers and doctors.

“All these expenditures are development in nature,” Mirza Aziz said.

NEW BUDGET

The budget for FY09 is around Tk 20,348 crore more than the original budget of Tk 79,614 crore for FY08.

Another Tk 12,565 crore has been allocated for interest payment on debts, going up by 18 percent from FY08.

The non-development expenditure has kept Tk 3,395 crore for block allocation, which is 133 percent higher than the Tk 1,453 crore allocation in FY08.

The destination for the block allocated funds was, however, not mentioned in the budget.

For development expenditure in FY09, the government has allocated Tk 25,600 crore against Tk 26,500 crore in FY08.

The government will spend Tk 72,584 crore on non-development budget, which is Tk 52,650 crore in the budget of the current fiscal year.

A break-up of the non-development expenditure reveals that 19.7 percent will be spent on pay and allowances, 18.4 percent for paying non-government teachers (grants in aid), and 17.3 percent on interest payments.

It will also include Tk 14,037 crore in salaries for government employees, which is Tk 13,508 crore in the original FY08 budget.

The government has also raised its revenue generation target by the National Board of Revenue to Tk 54,500 crore, a 24.28 percent rise from Tk 43,850 crore in the FY08 original budget.

Value added tax (VAT) income in the FY09 budget is expected to grow by 28 percent from the original FY08 budget, with another 21 percent rise expected in income tax, 16 percent growth in import duty collection and 33 percent increase in supplementary tax collection.

However, non-tax revenue is not expected to grow as much as tax revenue with the government expecting only a 10 percent rise to Tk 12,593 crore in FY09 from Tk 11,463 crore in the original FY08 budget.

To mitigate the large deficit, the government also plans on increasing non-bank borrowing to Tk 3,500 crore in addition to the high bank borrowing plans for FY09.

The government also plans on taking Tk 7,236 crore on foreign loans for FY09, a 14 percent rise from FY08, with another Tk 6,346 crore in foreign grants, which is 49 percent higher than FY08.

REVISED BUDGET

Expansion of social safety-net and increased subsidies have inflated the FY08 revised budget to Tk 86,085 crore from the original Tk 79, 614 crore.

But, including government bonds to repay Tk 7, 523 crore debt of Bangladesh Petroleum Corporation, the revised budget for FY08 comes to Tk 93,608 crore against the original Tk 87,137 crore.

The revised budget for non-development expenditure for FY08 is Tk 62,781 crore against the original Tk 52,650 crore.

Development expenditure for FY08 has been revised to Tk 22,500 crore from the original Tk 26,500 crore.

The revenue income has been unusually revised up for FY08 instead of revising it down, going up by Tk 3,238 crore to Tk 6,0539 crore.

“Despite the increase of price of petroleum products in the international market, no corresponding price adjustments were made in the domestic market. This resulted in additional quasi-fiscal costs of Tk 15,991 crore (3 percent of GDP). A sizeable chunk of the quasi-fiscal costs amounting to Tk 11,836 crore (2.2 percent of GDP) could be met from cash resources of the revised budget of FY2007-08 because of the increase in revenue earnings during the year. And this was possible even after meeting the expenditure involved in the Sidr and flood rehabilitation activities,” Mirza Aziz said in his budget speech.

BANGLADESH GOVT.’S BUDGET FOR 2008-2009 FINANCIAL YEAR

We have been suggesting few broad principles over the last year. And we are happy to see many of the things reflected on the broad planning. Thank you! Here are some additional points.

1. Introduce incentives for foreign owned local enterprises to invest in R&D. The main target would be to give incentives for the companies to invest their money here, instead of repatriating dollars. The goal would be to neutralize some of the reverse FDI. If a proper benchmark can be established, the incentives can be very generous. If one considers how much effort does it take to earn the dollars by our expatriate labors, the importance of restricting the reverse FDI should be fully appreciated. At the same time, a careful consideration has to be made so that this effort to neutralize some portion of the reverse FDI shouldn’t adversely affect inward FDI.

2. In case of inward FDI, there should be incentives for joint venture initiatives so the industrialization can be balanced without making undue pressure on our long-term forex.

3. Make donations for education tax free, please. There might be some mishandling of this opportunity. However, its much better option. Lets see how much mishandle they can do… the degree of mishandling would dicate the policy correction within two three years down the road. But it should start now.

4. Many of the foreign owned organizations can start expanding some serive wing in Dhaka to serve their external counterparts. For example, GP call center can start providing call center support to other sister organizations that are owned by Telenor. If they do that, a balance will be achieved in FDI flow. Currently, the high volume of the FDI outflow will be compenstated by the portion of these FDI inflows by this type of service extensions. Now, if policy makers takes a heavy handed approach to this idea, that would back fire. Businesses will do everything, just you have to take them into confidence, let them have a say in the decision making process and do the changes progressively. In short, govt. can start this process by giving incentives. Even if govt. dont get any corporate tax for this branches, we would think them to be good steps since they will generate employment for the local youth and also, they will increase the inward FDI. Off course, the detail arrangement will have to be decided by the experts after reviewing more data. At this stage, this is only an idea. Any thoughts?

5. Allocate an amount for a facilitating body or foundation for the promotion of open source movement in the ICT sector. This initiative can be styled as a non-profit or social business type entity. The actual amount can be decided based on some percentage (0.5%) of the outward forex flow that is spent on software and service purchase.

6. Allocate an for a venture capital company with a very low interest rate – just for service charge. Just give away this money to some promising venture initiative who will utitilize the money as a start-up fund to support new technology based companies. According to international standards, this type of companies are usually for-profit company. The actual amount can be decided based on some percentage (0.1%) of the outward forex flow that is spent on technology based products purchase. BTW, this is not same as IT Equity and Entrepreneurship Fund which is proposed. The devil is in the details – traditional banks can’t operate this fund, let alone the central bank. If that is the case, there won’t be thousands of venture capital companies throughout the world.

7. Allocate an amount for a professional services company initiative that will use money build the local capacity so that local industries can take full advantage of the increasing carbon trading regimes. Again, this professional services company will probably get better results if its incorporated as for-profit company. The actual amount can be decided based on some percentage (1%) of the estimated potential inward forex flow from the carbon trading through participation in CDM. Do not mix up this with the proposed climate change fund. That is a disaster managment approach – which is important. This particular proposal is a proactive approach, which will create job, transfer technology and invigorate overall economy.

8. Its time we make the salary of the elected officials much more competitive. If we want to be a giant Signapore one day, we better start that process by paying the elected officials following the same principles that Singpore follows.

9. Last but not the least, the govt. should set aside at least 5% of its energy subsidy allocation to invest in renewable energy research, development, commercialization and marketing for obviouis reason. These subsidies can’t go on forever if we have to come out of vicious cycle of poverty as a nation. However, government just shouldn’t withdraw subsidy without using their brain (just like what donors where suggesting with the jute mills). At the moment, a major thrust should be set up a three component project on solar energy. First component will be about technology transfer arrangement with some German company to build a leading edge PV cell manufacturing plant, second component should try to develop local technology and capacity to combine the cells in solar panels (neutral to any specific PV technology) and the third component should aim to develop a business model and solutions that will allow the individual level solar farms to sell their extra capacity to the national grid. The third component is now being in operation in many areas in California. Its not very complicated and a well-thought out plan could help mitigate our problems with shortage in power grid.

For proposals 6-8, the actual figures can be adjusted as suitable. However, for all the three initiative, its important that the person behind these initiatives are capable and want to serve the societies. Ideally, these initiatives can be taken with private funding. But the quality of the capital-holders in our current society is such that they would hardly understand and/or be motivated to this kind of initiatives. Hence, government should provide the initial seed funding for these considering the immense potential that these initiatives can bring for the national economy going forward. If you really consider doing these, just do not allocate funding in the budget and let them sit idle somewhere in the exchecker. You will have to identify the correct person(s) who can actually bring these into reality. Why is that? – one might ask. If you do not know the answer to this why, you should not allocate the money at the first place, since most likely that money will either be stolen or misappropriated by someone who has good connections in the bureacracy! Then how would we know where to find the right person? Well, that is the burden of good governance and the burden of being a good policy maker.

CRITICISM ABOUT BUDGET 2008-2009

1.The budget aims at 8 major objectives and claims the budget is investment friendly, implementable and poverty alleviating.

2. The budget investment friendly and is more public satisfying. It also that Govt’s increased borrowing won’t affect the private sector credit needs.

3. the budget reflects the challenges but the export leaders expressed that the budget is not export-supporting.

4. the budget didn’t give enough attention to employment generation and inflation control.

5. the budget is sought after the temporary solutions. Many essentials of the Agricultural sector are missing in the budget.

6. said that budget hinges on political stability.

7. Power crisis and the Budget

Bangladesh Budget acknowledges that currently 43% population enjoys electricity facilities and per capita electricity consumption is low compared to many developing countries. in 2007, our per capita electricity consumption stood at 140 KWH while it was 325 in SL, 498 in Pakistan and 665 in India.

Currently, our daily requirement of electricity is 4500 MW on an average against our average net generation 3600 MW.

It is said that huge investment will be required to cover the gap of 900 MW which will not be possible on the part of the Government. Government therefore want to involve the private sectors to generate the power in short term and long term basis.

But the frustrating reality is that in this way it will be 2020 to make Bangladesh free from power crisis.

International Atomic Energy(IAEA) has agreed to support the proposed Rooppur Nuclear Power Generation Plant. But God knows, when we shall able to generate power from nucear plant!

Efforts are also underway to generate electricity from coal and renewable solar energy. But solar enegy are so far fulfilling the small domestic requirments of rural areas only.

8. Bangladesh budget 2008-09 and ICT sector

Budget acknowledges Information and Telecommunication Technology (ICT) is our thrust sector

Taking into account this priority, Government is formulating national e- governance strategy supported by a national ICT road map. But this strategy is not yet declared.

Budget informs that the first phase of infrastructural work of a 231 acre hi-tech park at kaliakoir near Dhaka will be completed by the end of this year. Efforts are underway to attract the private and foreign investors to make investment inn this IT park. India, even West Bengal has more than on IT parks. They are establishing IT parks in small towns also. Bangladesh should advance to that direction

10. The proposed budget for the next fiscal year is “realistic”, not a very big one, and, if duly implemented, will help overcome the crisis the country is presently facing.

Terming food security and rising fuel prices a crisis at both domestic and global levels, he said, “This has created pressures on all of us…If the budget is implemented, it will help overcome the crisis.

11. The budget has been announced with eight major objectives including creating employments, maintaining prices of essentials at a tolerable level, ensuring food security and extending social safety net.

In the budget Tk 16,932 crore was proposed for social safety net and Tk 58,255 crore (58.3 percent) for poverty reduction. Implementation of the budget will not be difficult because the local government bodies, which will be elected soon, and the administration will implement it.

The size of the budget, its deficit and bank borrowing–none of these are that big and unrealistic compared to the GDP.

12. In response to economists’ criticism that too much bank borrowing will increase expenditures a major portion of the interest to be paid by the government would be injected domestically, which will have a positive impact on the country’s economy.

13. The expenditure for paying interests has been fixed at Tk 12,565 crore, of which Tk 11,274 crore will be paid domestically and Tk 1,291 crore as interests of foreign loans.

The government borrowing will neither create any liquidity problem for the private sector, nor will it increase interest rates, the adviser said, noting that the private sector credit growth is already 20-21 percent.

14. The government has decided to sell 8.5 lakh tonnes of rice at lower prices through open market sales, and distribute 12 lakh tonnes of rice through programmes like food for work, Vulnerable Group Feeding and Vulnerable Group Development.

15 The government proposed Tk 4,285 crore for agriculture, Tk 3,688 crore for fertilizer, Tk 57 crore for electricity, Tk 540 crore for diesel, Tk 6,106 crore for fuel, Tk 834 crore for gas and power, Tk 1,318 crore for food, Tk 1,050 crore for export and Tk 55 crore for others.

16. Economists criticize that too much bank borrowing will increase expenditures.

17. The budget does not spell out any specific strategy for reducing inflation and keeping the prices from going further up. It is difficult to understand how the government will be able to ensure macro-economic stability.

18. Business cautiously welcome proposed budget with its cuts in corporate tax rates and import duties, but there are concerns that increased government borrowing will squeeze out the private sector from the credit market.

Listed companies are to pay 27.5 percent corporate tax instead of existing 30 percent.

The Government has decided to sell 8.5 lakh tons of rice at lower prices through open market

sales and through programs like food for work, Vulnerable Group Feeding and Vulnerable Group Development.

In the budget 16,932 crore taka was proposed for social safety net and taka 58,255 crore for poverty reduction.

The Bangladesh caretaker government has allocated $43.7 million in the proposed budget for fiscal year 2008-2009 to create a fund to tackle climate change-related problems.

Finance Adviser Mirza Azizul Islam announced that the government will implement a number of infrastructure projects to reduce regional wealth disparity in the country.

POSITIVE SIDE

- A very positive feature relates to subsidies given on food, oil, agricultural inputs aimed at both raising productivity and alleviating poverty.

- Extending social safety net to more ultra–poor people is highly worthy

- Reduction of existing concessionary rate of duty on the import of capital machinery and spare parts from 5 percent to 3 percent will reduce the price of instruments.

- A farmer-friendly budget providing priorities to overcome the challenges of food crisis is the need of the hour. This is very important for unlocking the potential to achieve the target of poverty alleviation.

- The continuation of tax holidays will be helpful for employment and income generation

DISADVANTAGE:

- South Asian countries are facing inflationary pressures due to oil price hike, increase in price of essential commodities including agricultural produce and higher domestic demand. In the second quarter of the current fiscal year, the inflation rates in India, Pakistan and Sri Lanka were 6.9 percent, 8.1 percent and 19.3 percent respectively. In this context, 6.9 percent inflation in Bangladesh is abnormal.

- Government can’t draw a developed picture of a country in a single budget. A country like Bangladesh fully depends on the import business. Unfortunately Bangladesh is really big market for exporting countries (15 Cr people huh!!) but still we are not capable to start production. We can’t make a big change in one or two years.

- Taxes on IT/Computer accessories are inappropriate right at this moment. There should be some road map say for example 2/3 years time to establish or encourage foreign/local investment to go for production and after then impose the taxes on import items on this sector.

- The general middle class people of Bangladesh urge to consider the issue of allowing imports of reconditioned cars 6 years old. Actually the transport problem for middle class people especially the working women like me has become so acute that in the context of present caretaker governments various benefactor steps, we earnestly request to consider this issue.

- Now the car vehicle price is beyond our reach. If imports of cars more than 6 years old are given permission, then there is a hope that we can at least try to have

Our own vehicles. While a section of our people has the luxury of using Mercedes Benz, at the same context we can not even afford to buy a car just to meet our necessity.

RECOMMENDATION

There are some suggestion to collect the resources accurately and improving the Budget decision.

Simplification of VAT registration

- Maintain the current momentum of revenue mobilization

- Emphasis on assesses-friendly institutional issues

- Form a Task Force for accelerated disbursement of held-up project aid

- Avoid volatility in bank borrowing to avoid pressure on private borrowing.

- Enhanced public-private and government-NGO partnership.

- Quality must be ensured while including new projects.

- To gear up foreign aided projects

- Focus on power sector

- Public-private partnership to monitor progress in key areas.

- Computerization of tax mobilization activities.

- Generation of regular and periodic updates on key budget related indicators.