Ricardian equivalence is an economic theory that states that funding government spending with current or future taxes (and current deficits) has the same overall effect on the economy. The Ricardian equivalence proposition is an economic hypothesis that states that consumers are forward-thinking and, as a result, internalize the government’s budget constraint when making consumption decisions. It has fiscal policy implications. If the theorem holds true, fiscal policy becomes obsolete.

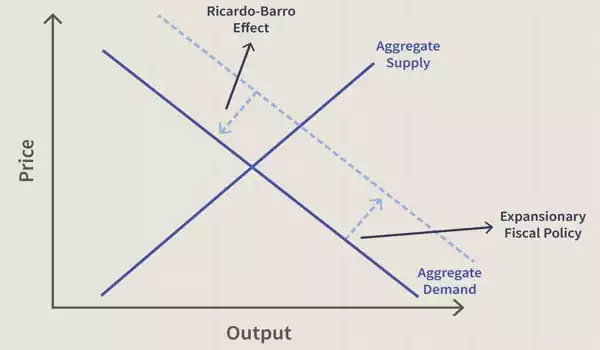

As a result, for a given pattern of government spending, the method of financing such spending has no effect on agents’ consumption decisions and thus has no effect on aggregate demand. According to the Ricardian equivalence proposition, any attempt by the government to stimulate the economy by increasing public spending or lowering taxes will not result in a private-sector reaction.

David Ricardo developed this theory in the early nineteenth century, and Harvard professor Robert Barro expanded on it later. As a result, Ricardian equivalence is also referred to as the Barro-Ricardo equivalence proposition.

Introduction

Governments can fund their spending by printing new money, levying taxes, or issuing bonds. Because bonds are loans, they must be repaid at some point, presumably by raising taxes in the future. As a result, the choice is “tax now or tax later.”

Assume the government finances some additional spending through deficits, i.e., it chooses to tax later. According to the hypothesis, taxpayers will expect to pay higher taxes in the future. As a result, they will save rather than spend the extra disposable income from the initial tax cut, resulting in no change in demand or output.

Governments can fund their spending by either taxing or borrowing (and presumably taxing later to service the debt). When the government purchases real resources, they are withdrawn from the private economy in both cases, but the method of financing differs. Ricardo argued that in some cases, even the financial effects of these can be considered equivalent because taxpayers understand that even if their current taxes are not raised in the case of deficit spending, their future taxes will be raised to pay the government debt. As a result, they will be forced to set aside some of their current income to save for future taxes.

In the early nineteenth century, David Ricardo was the first to propose this possibility; however, he was unconvinced of its empirical relevance. In the 1890s, Antonio de Viti de Marco developed Ricardian equivalence. In the 1970s, Robert J. Barro pursued the question independently in an attempt to provide the proposition with a solid theoretical foundation.

How is Ricardian Equivalence Used –

The underlying idea behind the Ricardian Equivalence proposition is that regardless of how a government increases spending (whether through debt or taxation), the economy’s demand remains constant. Individual taxpayers and households, according to David Ricardo and Robert Barro, save heavily in anticipation of a government deficit, which leads to higher taxes. Because taxpayers are aware that the government deficit will be repaid, they use excess savings to pay for anticipated tax increases, which are then used to repay government debt.

According to the Ricardian Equivalence proposition, a government cannot stimulate consumer spending because when the government increases debt-financed spending, demand by individuals and households remains constant.