1. a. Introduction

Internship program is a pre-requisite for acquiring M.B.A. degree. Before completion of the degree, a student must, undergo the Internship program. As the classroom discussion alone cannot make a student perfect in handling the real business situation, therefore, it is an opportunity for the students to know about the real life situation through this program. The program consists of three phases:

- The orientation of the Intern with the organization, its function and performance.

- The project work pertaining to a particular problem or problems matching with the Intern’s area of specialization and organizational requirement.

- The report writing to summarize the Intern’s analysis, findings and achievements in the proceeding of the followings.

1. b. Objectives of the Report:

The report has two objectives:

- General Objective

- Specific Objective

1) General objectives of the report:

The general objective of the report is to complete the internship. As per requirement of MBA program of Chittagong University, a student need to work in a business organization for two months to acquire practical knowledge about real business operations of a company.

2) Specific objective of the report:

The specific objective of this report is to find and analyze the Credit facilities (its outstanding, recovery, classified loans etc), approval and monitoring process of Dhaka Bank Limited, Local office. It will also include gathering an idea about the securities behind the loan facilities and issuing different bank guarantees. The detail objectives of my study are as follows-

- To access the credit structure of banks in practice.

- To measure the effectiveness of the selected banks in utilization of their available deposit and resources.

- To identify the relationship with their customers.

- To identify the loan recovery performances of the selected banks.

- To find out the deposit utilization problems.

- To find out the implementation of credit risk management policy of the selected banks.

- To find out the implementation of the credit risk grading manual of Bangladesh bank by the selected banks.

- To find out the unsound credit according to the credit risk management policy.

1.c. Methodology

Methodology of the study:

This report is mainly prepared by the secondary sources of information & some few primary sources of information like –

☻ Direct observation.

☻ Information discussion with professionals.

☻ Questioning the concerned persons.

The secondary sources of my information –

☻ Annual reports of DBL.

☻ Credit rating report of DBL by credit rating information & services limited.

☻ Desk report of the related department.

☻ Credit manual information.

☻ Different reference books of the library.

☻ Some of my course elements as related to this report.

1.d .Scope of the study:

This report will cover an organizational overview of Dhaka bank. It will give a wide view of the different stages of credit appraisal system of Dhaka bank, starting from the loan application to Loan disbursement and the comparison between standard and existing credit appraisal system of a Bank. The study is organized as follows:

- Credit profile of the selected banks.

- Loan recovery.

- The nature of default.

- Credit management and guidelines.

- Analysis of the findings and recommendation.

1.e. Limitations

There are some limitations I had to face while preparing this report. It is very difficult to collect some of the important data and information. There is some information very secret and the Bank didn’t want to provide this information. But this information may help to build a good report. Another limitation is availability of the data. The bank doesn’t have sufficient documents of the interest amount they collect from different loans. For this there is no specific profit calculation of the credit department. So, These kinds of limitations I faced while preparing the report.

2. a. Dhaka Bank Limited

DHAKA BANK LIMITED was incorporated as a public limited Company on 6th April 1995 under the company act. 1994 and started it’s commercial operation on June 05, 1995 as a private sector bank. The bank started its journey with an authorized capital of Tk. 1,000.00 million and paid up capital of Tk. 100.00 million.

The strength of a bank depends on its management team. The Employer in Dhaka Bank is proud to have a team of highly motivated, well-educated and experienced executives who have been contributing substantially in the continued progress of the bank.

The marketing activities at the Dhaka Bank are very implicit and vast comparing to that of other bank in the country today. The Philosophy of the bank is “EXCELENCE IN BANKING”. Dhaka Bank is always willing to offer new product features to the client. Besides the applications of these products or services are prepared in a very modern way so that the service can be provided in least time required.

The Credit facilities approved by Dhaka Bank are increasing day by day because of its well-organized and trained management and also well-equipped facilities. In recent time banking sector becomes very competitive and without giving good and attractive facilities and service no bank can survive in this time. Dhaka Bank is also trying to provide good service to keep going with this competition.

2. b.Mission Statement:

To be the premier financial institution in the country providing high quality products & services backed by latest technology and a team of highly motivated personnel to deliver Excellence in Banking.

2. c.Vision Statement:

At Dhaka Bank, we draw our inspiration from the distant stars. Our term is committed to assure a standard that6 makes every banking transaction a pleasurable experience. Our endeavor is to offer you razor sharp sparkle through accuracy, reliability, timely delivery, cutting edge technology, and tailored solution for business needs, global reach in trade and commerce and high yield on your investments.

Our people, products and processes are aligned to meet the demand of our discerning customers. Our goal is to achieve a distinction like the luminaries in the sky. Our prime objective is to deliver a quality that demonstrates a true reflection of our vision- Excellence in Banking.

2. d.Slogan: Excellence in Banking.

2. e. Company Philosophy

The motto or the philosophy of the Bank is “Excellence in Banking”. Whether in Personal, Corporate, Treasury or Trade transactions of Dhaka Bank Limited is committed to provide the best. Meeting the demand of the bank’s discerning customers is not the sole objective. The Bank endeavor to deliver a quality that makes every transaction a pleasurable experience. Dhaka Bank feels that, if they can meet maximum clientele requirements in less time with efficiency, then they will be able to accomplish a successful business in the world of banking. Their main objective is – they want to provide every single customer service available in today’s banking procedure for their clientele. Thus they can guarantee the excellence in banking to their valuable customers.

2. f. Company Activities and Performances

Paid up Capital

The paid up capital of Dhaka Bank Limited amounted to Tk. 1,547 million as on December 31, 2008 which was Tk. 100 million when the Bank started its operation. The total equity (capital and reserves) of the Bank as on December 31, 2008 stood at Tk. 3125 million.

Deposits

A strong deposit base is critical for success of a bank. During the years the Bank has mobilized a substantial amount in deposits in transactional and savings account. The deposit base of the bank continued to register a steady growth and stood at Tk. 48,731 million excluding call as of 31 December 2008 compared to Tk. 41,554 million of the previous year registered a 17% growth.

Investment

Dhaka Bank has diversified its investment portfolio through Lease Financing, Hire Purchase, and Capital Market Operations besides the investment in treasury bills and Prize Bonds. The emphasis on high quality investment has ensured the bank to maximize its profit.

Dhaka Bank Limited is a member of the Dhaka Stock Exchange and Chittagong Stock Exchange. A specialized unit of the Bank, the Investment Division manages the Bank’s portfolio and actively participates in the screen-based on-line trading of both the Stock Exchanges.

Profit

Dhaka Bank Limited registered an operating profit of Tk. 2,010 million in 2008 compared to Tk. 1,183 million in 2007 making a growth of 70%. After all provisions including general provisions on unclassified loans, profit before tax stood at Tk. 1,531 million. Provision for tax for the year 2008 amounted to Tk. 827 million. The net profit of the bank as on 31 December 2008 stood at Tk. 704 million compared to previous year’s Tk. 580 million making growth of 21%. Earning per share (EPS) was Tk. 46.06 in 2007 compared to Tk. 45.17 in 2007.

Loans and Advances

The Bank implemented the system of credit risk assessment and lending procedures by stricter separation of responsibilities between risk assessment, lending decisions and monitoring functions to improve the quality and soundness of loan portfolio. The Bank recorded a 17 % growth in advances with a local loans and advances portfolio of Tk. 39,972 million at the end of December 2008 compared to Tk. 34049 million at the end of December 2007.

As of 31 December 2008, 96.85 % of the total Bank’s loan portfolio was regular while only 3.15 % of the total portfolio was non-performing as compared to 1.64 % of 2007. Bank made required provision as on 31 December against performing loans as per rate and classification norm provided by Bangladesh Bank (se note-2c). The volume of non-performing loans stood at Tk. 1,258 million in 2008 from Tk. 554 million in 2007. Of the total loan provision of Tk. 904 million, Tk. 465 million was general provision, which was 51 % of total provision. The rest Tk. 439 million was against the classified accounts.

- Non-performing loan

- Regular Loan

A wide range of business industries and sectors constitutes the Bank’s advance portfolio. Major sectors where the Bank extended credit include steel and engineering, ship breaking, edible oil, sugar, housing and construction, pharmaceuticals, chemicals, electronic and automobiles, energy and power, service industries, trade finance, personal or consumer credit, leasing etc. The Bank continued to support Small and Medium Enterprises (SME) and expended credit facilities to them through its SME Cell.

Sector wise allocation of advances reveals a well-diversified portfolio of the Bank with balance exposure in different sectors. High concentration sectors are textile and garment industries with outstanding of Tk. 7,524 million, housing and construction with Tk. 4,093 million, food and allied industries with Tk. 2,949 million and engineering and metal including ship braking with Tk. 1,903 million as at 31 December 2008.

Customer Service

Customer is in the core of everything a service-oriented company does. Accuracy, reliability, and timely delivery are the key elements of the Dhaka Bank’s service. Well-qualified and experienced officials always prepared to provide efficient, personalized and quality service man Dhaka Bank Limited. The banks prime objective is to provide high quality product and services to the customers. The bank also performs according to the needs of its corporate clients and provides a comprehensive range of financial services to national and multinational companies.

International Trade & Foreign Exchange

International trade constituted the major business activity conducted by the bank. Dhaka Bank offer a full range of trade finance services, namely, Issue, Advising and Confirmation of documentary Credits; arranging forward Exchange cover; Pre-shipment and post- shipment finance; Negotiation and purchase of Export bill; Discounting of bills of Exchange, Collection of bills etc.

In the year 2008, Dhaka Bank Limited was active in extending services to their valued clients related with import business. As of 31st December 2008 the import volume was Tk. 49,496 million compared to the volume of 2006 for Tk. 46,277 million marking as increase of 7% from the last year.

Dhaka Bank Limited experienced sound growth of export business in 2007 from 2006. The volume of export business rose to Tk. 31,081 million from Tk. 23,269 million in 2007 showing an increase of 34%.

Branches

Dhaka Bank has opened already 41 branches in different Cities, Places and areas in Dhaka and also in Chittagong, Sylhet, Narayangonj, Norshingdi and Savar. This shows the banks commitment to provide services to their valued customers through an extensive branch network at all commercially important places across the country. They also have planned to open more branches in the sort coming year. These branches are well decorated and well secured with the new technologies.

Human Resources and Training

The driving force behind Dhaka Bank has always its employees. The bank recognizes that professional development of its people is vital to establishing workers as a provider of quality service. In this regard, the bank have expanded its training facilities and set up a full-fledged training institute at Sara Tower, Motijheel, Dhaka.

Environmental Management Program

The Bank’s Environmental Management Program stipulates adherence with environmental, health and safety regulations and guidelines, refraining from business that impairs the ability of future generations to meet their own needs, assessing an mitigating risks concerning environment, health and safety issues that the bank undertake.

Technologies, Products and Services

Community Service

The Bank extends assistance to socio-cultural and community development programs. During the years under review, the Bank had provided support to a number of community welfare programs. At present Dhaka Bank assist the National Hokey Federation.

Dhaka Bank’s products and services are regularly upgraded and realigned to fulfil customer expectation. Their delivery standards are constantly monitored and improved to assure the highest satisfaction. The bank specially emphasizes on the service base on technologies. Because the life became very fast and people want take service within sort time. The consumer-banking sector of the Bank deals with number of tasks related to various services. The products that are recently being offered by the bank are as follows –

Accounts: Dhaka Bank provides the Savings Account; Current Account; Short Term Deposit; Fixed Deposit Receipt etc. for the customers.

ATM (Automated Teller Machine): Dhaka Bank ATM Cards enable their valued customers to carry out a variety of banking transactions 24 hours a day.

Credit Cards: Dhaka Bank Credit Card has earned wide acceptability and reputation within a very short time. The Bank has developed the process such that it can deliver the Credit Card within only 7 days against security; for unsecured cards it takes only 10 days.

Phone banking: Dhaka Bank phone banking service allows customers to conduct a variety of transactions by simply making a phone from anywhere. Customers can inquire about the balance in their account, check transaction details or request for account statement by fax or e-mail.

Locker: By this facility customers can put their valuable things such as jewelry items, valuable papers etc. for the safety reason.

Consumer Credit: Dhaka Bank also provides consumer credit facilities with very attractive terms and conditions.

Industrial Loan: Loans issued for purchasing equipment, inventories, plants, payrolls etc.

Any Branch Banking: By this customers can transact from any branch insight the country.

Utility Bill Payment: Customers can pay different utility bill such as phone bill, credit card bill etc.

3. a. Bank:

Banks are among the most important financial institutions in the economy. They are the principle source of credit (loanable fund) for millions of households (individuals and families) and for most local units of government. Moreover, for small businesses ranging from grocery stores to automobile dealers, banks are often the major source of credit to stock the shelves with merchandise or to fill a dealer’s showroom with new goods. When the business and consumers need financial information and financial planning, it is the bankers to whom they turn most frequently for advice and council.

3. b. Types of Bank Loans:

The banks make a wide variety of loans to a wide variety of customers for many different purposes-from purchasing automobiles and buying new furniture, taking dream vacations and pursuing college education to constructing homes and office buildings. Bank loans may be divided into the following broad categories of loans, delineated by their purpose:

1. Real Estate Loans,which are securedby real property-land, buildings, and other structures- and include short-term loans for construction and land development and longer-term loans to finance the purchase of farmland, residential, and commercial structures etc.

2. Financial institution Loans, including credit to banks, insurance companies, finance companies, and other financial institutions.

3. Agricultural Loans, extended to farm and ranch operations to assist in planting and harvesting crops and to support the feeding and care of livestock.

4. Commercial and Industrial Loans, granted to business to cover such expenses as purchasing inventories, plant, and equipment, paying taxes, and meeting payrolls and other operating expenses.

5. Loans to Individuals, including credit to finance the purchase of automobiles, homes, appliances and other retail goods to repair and modernize homes, cover the cost of medical care and other personal expenses, either extended directly to individuals or indirectly through retail dealers.

6. Lease Financing Receivables, where the bank buys equipment or vehicles and leases them to its customers. Among the categories, the largest volume is in the real estate loans. The next largest category is commercial and industrial loans.

7. Asset-based Loans, loans secured by a business firm’s assets, particularly accounts receivable and inventory.

8.Installment Loans, credits that is repayable in two or more consecutive payments, usually on a monthly or quarterly basis.

9. Letter of credits, a legal notice in which a bank or other institution guarantees the credit of one of its customers who is borrowing from another institution.

10. Retail Credit, smaller-denomination loans extended to individuals and families as well as to small business.

11. Term loans, credit extended for longer than one year and designed to fund longer-term business investments, such as the purchase of equipment or the construction of new physical facility. Term Loans are designed to fund long-and medium-term business investments, such as the purchase of equipment or the construction of physical facilities, covering a period longer than one year. Usually the borrowing firm applies for a lump-sum loan based on the budgeted cost of its proposed project and then pledges to repay the loan in a series of installment.

12. Working Capital loan, provide businesses with short-run credit, lasting from a few days to about one year. Working Capital Loans are most often used to fund the purchase of inventories in order to put goods on shelves or to purchase raw materials; thus, they come closest to the traditional self-liquidating loan described above. Frequently the Working Capital Loan is designed to cover seasonal peaks in the business customer’s production levels and credit needs.

3. c. Credit Analysis:

The division of the bank responsible for analyzing and making recommendations on the fate of most loan applications is the credit department. This department must satisfactorily answer three major questions regarding each loan applicat

1. Is the Borrower Creditworthy and how know that?

The question must be dealt with before any other is whether or not the customer can service the loan- that is, pay out the credit when due, with a comfortable margin for error. This usually involves a detailed study of six aspects of the loan application: –

Character :( well defined purpose for loan request and a serious intention to repay),

Capacity :( proper authority to request for the loan and legal standing to sign a loan agreement),

Cash 🙁 ability to generate enough cash, in the form of cash flow),

Collateral :( enough quality assets to provide adequate support for the loan),

Conditions 🙁 aware borrower’s line of work and also economic conditions), and

Control : All must be satisfactory for the loan to be a good one from the lender’s point of view.

2. Can the loan agreement be properly structured and documented so that the bank and depositors are adequately protected and the customer has a high probability of being able to service the loan without excessive strain?

The loan officer is responsible to both the customer and the Bank’s depositors and stockholders must seek to satisfy the demands off all. This requires, first, the drafting of a loan agreement that meets the borrower’s need for funds with a comfortable repayment schedule. The borrower must be able to comfortably handle any required loan payments, because the bank’s success depends fundamentally on the success of its customers. If a major borrower gets into trouble because it is unable to service a loan, the bank may find itself in serious trouble as well. So, the bank’s loan officer must be a financial counselor to customers as well as a conduit for their loan applicants.

3. Can the bank perfect its claim against the assets or earnings of the customer so that, in the event of default, bank funds can be recovered rapidly at low cost and with low risk?

While large corporations and other borrowers with impeccable credit ratings often borrow unsecured, with no specific collateral pledged behind their loans except their reputation and ability to generate earnings, most borrowers at one time or another will be asked to pledge some their assets or to personally guarantee the repayment of their loans. Getting a pledge of certain borrower assets as collateral behind a loan really serves two purposes for a lender. If the borrower cannot pay, the pledge of collateral gives the lender the right to seize and sell those assets designated as loan collateral, using the proceeds of the sale to cover what the borrower did not pay back. Secondly, collateralization of a loan gives the lender a psychological advantage over the borrower. Because specific assets may be at the stake a borrower feels more obligated to work hard to repay his or her loan and avoid losing valuable assets.

The most popular assets pledged as collateral for bank loans are- Accounts Receivable, Factoring, Inventory, Real Property, Personal Property, Personal Guarantee etc.

3. d. Loan Review:

Banks today use a variety of different loan review procedures; nearly all banks follow a few general principles. These include:

1) Carrying out reviews of all types of loans on a periodic basis- for example, every 30, 60, or 90 days the largest loans outstanding may be routinely examined, along with a random sample of smaller loans.

2) Structuring the loan review process carefully to make sure the most important features of each loan are checked.

3) Reviewing most frequently the largest loans, because default in these credit agreements could seriously affect the bank’s own financial conditions.

4) Conducting more frequent reviews of troubled loans, with the frequency of review increasing as the problems surrounding any particular loan increase.

5) Accelerating the loan review schedule if the economy slows down or if the industries in which the bank has made a substantial portion of its loans develop significant problems.

3.e. Handling Problem Loans:

Inevitably, despite the safeguards most banks build in their lending programs, some loans on a bank’s books will become problem loans. Usually this means the borrower has missed one or more promised payments or the collateral pledged behind a loan has declined significantly in value. The process of recovering the bank’s funds from a problem loan situation- suggests the following key steps:

1) Always keeps the goal of loan workouts firmly in mind: to maximize the bank’s chances for the full recovery of its funds.

2) The rapid detection and reporting of any problems with a loan are essential: delay often worsens a problem loan situation.

3) Keep the loan workout responsibility separate from the lending function to avoid possible conflicts of interest for the loan offers.

4) Estimate what resources are available to collect the troubled loan.

5) Loan workout personnel should conduct a tax and litigation search to see if the borrower has other unpaid obligations and many other processes.

CREDIT MANAGEMENT: POLICY & PROCEDURES

In general, a banking system aggregates a high number of low value deposits to fund enterprises with a smaller number of high value loans. This intermediation through a well functioning bank helps to achieve some economic benefits for the depositors, the borrowers and above all — the economy in the following ways:

The depositors:

- Higher return

- Lower risk

- Greater liquidity

The borrowers:

- Availability of fund for all credit worthy borrowers

- Thus allows to enterprises grow and expand

The economy

- Economic growth is maximized as the banks channels the country’s scare financial resources into those financial opportunities with maximum return

- Thus profitable enterprises receive funding, grow and expand.

- Loss making enterprises are refused funding and allowed to go out of the business – thus saving the economy from drainage of resources.

The bank must allocate loans effectively for achieving these broad objectives of the economy and the pre-requisites are:

- Banks are able to identify reliably those enterprises that can repay their loans.

- Banks allows loans to those enterprises likely to yield high return and deny loan to those likely to yield low or negative returns.

While identifying profitable enterprises, the bank – in fact – identifies risks of the borrower and business in order to allow loan in the context of its risk – return profile.

Credit risk management (CRM) is a dynamic process, which enables banks to proactively manage loan portfolios. Four major areas of CRM are:

- Policy – lending guidelines

- Procedure – evaluating viability and associate risks of business enterprises.

- Organizational structure – segregation of risk taking and risk approving authority

- Responsibility – decision making and accountability

A clear understanding of the four areas are crucial for maximizing bank’s earning by carefully evaluating credit risks and attempting to minimize those risks.

4. a. Policy objectives:

1) Maximize Bank’s earning from loan portfolio

2) Improve quality of loan portfolio to maximize earnings by:

a) To keep non-performing assets below 10%

b) Arresting new loans to become classified.

3) Utmost emphasis on loan sanctioning is to be given in order to improve quality of the loan portfolio. Credit facilities are to be considered solely on viability of business / enterprises / project / undertaking having adequate cash flows to adjust the loans, and management capacity of the borrower to run the business profitably.

4) Evaluate credit risks before sanctioning, which may hamper generation of the projected cash flows of the borrower and might delay or hinder repayment of bank’s loan.

5) Monitoring continuously performances of the financed projects / business / enterprises will be bank’s main trust for ensuring repayment of the loan, and receiving early warning (EL) for taking timely corrective measures.

6) Price the loans on the basis of loan pricing module of the bank focusing on risk rating of the borrower.

7) Strict adherence to Bangladesh Bank’s policy guidelines

4. b. Lending guidelines:

As the very purpose bank’s credit strategy is to determine the risk appetite of the bank, so bank’s focus should be to maintain a credit portfolio to keeping in mind of our risk absorbing capacity. Thus its strategy will be invigoration loan processing steps including identifying, measuring, containing risks as well as maintaining a balance portfolio through minimizing loan concentration, encouraging loan diversification, expanding product range, streamlining security, insurance etc. as buffer against unexpected cash flow.

Types of credit facilities

Bank will go for:

- Term financing for new project and BRME of existing projects (Large, Medium, SE)

- Working capital for industries, trading, services and others (Large, Medium, SE)

- Import and export Finance

- Lease Finance

- Consumer Finance

- Fee Business

- Islamic mode of finance

Single borrower/ Group limits / Large Loans / Syndication

The limit for single client / group under one obligor concept will be as under:

- The total credit facilities by a bank to any single person or enterprise or organization of a group shall not any point of time exceed 35% of the bank’s total capital subject to the condition that the maximum outstanding against fund based financing facilities (fund facilities) shall not exceed 15% of the total capital.

- Non-funded credit facilities, e.g. letter of credit, guarantee etc. can be extended to a single large borrower. But under no circumstances, the total amount of the funded and non-funded credit facilities shall exceed 35% of bank’s total capital

- However, in case of export sector, single borrower limit shall be 50% of the bank’s total capital. But funded facilities in the form of export credit shall not 15% of the total capital

Large loan

1. Loan sanctioned to any individual or enterprise or any organization of a group amounting to 10% or more of bank’s total capital shall be considered as large loan.

2. The bank shall be able to sanction large loans as per the following limits set against their respective classified loans:

Rate of net classified loans | The highest rate fixed for large loans against bank’s total loans & advances |

Up to 5% | 56% |

More than 5% but up to 10% | 52% |

More than 10% but up to 15% | 48% |

More than 15% but up to 20% | 44% |

More than 20% | 40% |

3. In order to determine the above maximum ceiling for large loans, all non-funded credit facilities e.g. letter of credit, guarantee etc. shall also be considered to arrive 50% credit equivalent. However the entire amount of non-funded credit facilities shall be included while determining the total credit facilities provided to an individual or an enterprise or an organization or a group.

4. A Public Limited Company, which has 50% or more public share holdings, shall not be considered as an enterprise / organization of any group.

5. In case of credit facilities provided against government guarantees, the aforementioned restrictions shall not apply

6. In the case of loans backed by cash and excusable securities (e.g. FDR), the actual lending facilities shall be determined by deducting the amount of such securities from the outstanding balance of the loans.

7. Banks shall collect the information to the borrowers from Credit Information Bureau (CIB) of Bangladesh Bank before sanctioning, renewing or rescheduling loans to ensure that credit facilities are not provided to defaulters.

8. Banks shall perform Lending Risk Analysis (LRA) before sanctioning or renewing large loans. If the rating of an LRA turns to be “marginal”, a bank shall not sanction large loan, but it can consider renewal of an existing large loan taking into account other favorable conditions and factors. However, if the result of an LRA is unsatisfactory, neither sanction nor renewal of large loans shall be considered.

9. While sanctioning or renewing large loan, a bank shall assess borrower’s overall debt repayment capacity taking into consideration the borrower’s liabilities with other banks and financial institutions.

10. A bank shall examine its borrower’s Cash flow Statement, Audited Balance Sheet, income Statement and other financial statement to make sure that the borrower has the ability to repay the loan.

Term Financing and Syndication

Like large volume of loan, long term financing is one of the riskiest areas of the bank because of long duration of repayment. Long duration casts uncertainties on repayment as variable with which financial and other projections are made very widely in a dynamic global economic scenario.

Thus utmost care is to be exercised while considering long term financing

- Long term relationship with the borrower is prerequisite for considering term financing

- Due diligence is to be exercised for accessing viability of the projects in terms of Management ability, Market gap, Technical suitability, Financial viability.

- Information on projects should be adequate and reliable

- Minimum information for project viability analysis is to be given.

Syndication

Syndication means joint financing by more than one bank to the same clients against a common security basically, to spread the risk. It also provides a scope for an independent evaluation of risk and focused monitoring by the agent / lead bank.

In syndication financing banks also enter into an agreement that one of the lenders may act as Lead Bank, who has to co-ordinate the activities at various stages of handling the proposal i.e. appraisal, sanction, documentation sharing of the security, disbursement, inspection, follow – up, recovery etc. it may also call meetings of syndication members, whenever necessary to finalize any decision

Discouraged business types

In the context of present economic situation vis-à-vis government policy as well as market scenario, the following industries and lending activities are considered as discouraged

- Military Equipment / Weapon Finance

- Highly leveraged Transactions

- Finance of speculative business

- Logging, Mineral Extraction/ Mining or other activity that is ethically or environmentally sensitive

- Lending to companies listed on CIB black list or known defaulters

- Counter parties in countries subject to UN sanctions

- Share lending

- Taking an equity stake in borrowers

- Lending to holding companies

- Bridge loans relying on equity / debt issuance as a source of repayment

Loan facility parameters

Size: Funded: maximum 15% of Bank’s total capital

: Funded + Non Funded:

1) Shall not exceed 35% of bank’s total capital

2) Maximum 50% of Bank’s total capital for export sector.(Funded facility shall also not exceed 15% of bank’s total capital).

Tenor: Short term: Maximum 12 months

Medium Term: Maximum 5 years

Long Term: Maximum 15 years

Margin: To be determined by Banker Customer relationship and nature of business.

Security: Return of Banks funding to any business is ensured primarily on the cash flow of the business. A smooth flow of cash in the business requires efficient management competence in conducting the business in a given market. However as the market never remains stable owing to various uncontrollable factors, the continuity of well-managed business cash flow is difficult to visualize in the long run. As such to ensure realization of Banks finance in case of any eventuality, other adequate security coverage deemed necessary with a view to protects interest of the bank.

General Covenants

- Bank shall not extend any credit facility to any defaulter as defined in the bank company act 1991(clean CIB report required.)

- The borrower shall have valid Trade license,

- In case of partnership firm there must be a partnership deed duly notarized / registered.

- Limited Company must be registered with the Registrar of Joint Stock Company.

- Directors and other loans will be subordinated to Dhaka Banks loan. Directors loan (if any) will be interest free and no dividend will be declared/paid before full adjustment of Term Loan of Dhaka Bank.

- The borrower shall submit annual audited/un-audited/projected financial statements regularly where applicable.

- The borrower shall maintain current ratio of not less than 1.5 times..

- The borrower shall obtain and maintain in full force and effect all Government of Bangladesh (GOB) authorizations, licenses and permits required to implement and operate Borrowers business.

- The borrower shall maintain all insurance as detailed in Loan Documents.

- The borrower shall maintain satisfactory swing/turnover of the limit in case of continuous loans/advance.

- The borrower shall pay all fees , duties , taxes etc, that are due to the Government of Bangladesh (except where waivers or deferrals have been granted by Government of Bangladesh) when due.

- The borrower shall not create any charge, mortgage or any encumbrances of any other security interest over any of its assets without the prior written consent of the Bank.

- The borrower shall not avail any credit facility from other source without the prior written consent of the bank.

- The borrower shall not make any amendment/alteration in the Company’s Memorandum & Articles of Association without obtaining prior approval of Dhaka Bank Ltd in writing.

- The borrower shall not furnish any corporate guarantee to other firm/company without Banks permission.

Events of Default

Bank will have the right to call back the Loan/Advance in the event of default under the following circumstances:

- Failure to repay

- Breach of Covenants of the loan agreement.

- Bankruptcy or liquidation or insolvency event affecting the Borrower.

- Occurrence of a material adverse change in the financial position of the Borrower.

- Any change in GOB directives, which in the opinion of the Lenders would prejudice the Borrowers ability to meet the financial obligations in respect of this facility,

- Any security interest over any asset of the Borrower becomes enforceable or any execution or distress is levied against or any person is entitled to or does take possession of the whole or any part of the assets or undertakings.

Facility Wise Charge Documents

L/C | LTR | BG | TL | CC Hypo/CC Pledge (Key Stock to Bank) |

1. Promissory Note | 1. Promissory Note | 1. Promissory Note | 1. Promissory Note | 1. Promissory Note |

2. Letter of Undertaking | 2. Letter of Undertaking | 2. Letter of Undertaking | 2. Letter of Undertaking | 2. Letter of Undertaking |

3. A/C Balance confirmation Slip | 3. A/C Balance confirmation Slip | 3. A/C Balance confirmation Slip | 3. A/C Balance confirmation Slip | 3. A/C Balance confirmation Slip |

4. Letter of Continuity | 4. Letter of Continuity | 4. Letter of Continuity | 4. Letter of Continuity | 4. Letter of Continuity |

5. Letter of Revival | 5. Letter of Revival | 5. Letter of Revival | 5. Letter of Revival | 5. Letter of Revival |

6. Letter of Guarantee for Opening L/C | 6. Loan Disbursement Letter | 6. General Counter Guarantee | 6. Loan Disbursement Letter | 6. Loan Disbursement Letter |

7. Right of recall the loan | 7. Trust Receipt

| 7. Right of recall the loan | 7. Right of Recall the Loan | 7. General Letter of Hypothecation/ General Letter of Pledge |

| 8. Right of recall the loan |

|

| 8. Right of recall the loan |

8. General & Collateral Agreement | 9. General & Collateral Agreement | 8. General & Collateral Agreement | 8. General & Collateral Agreement | 9. General & Collateral Agreement |

|

|

|

|

|

4. c. Credit Assessment and risk Grading

Credit assessment:

A thorough credit and risk assessment is to be conducted prior to the granting of loans, and at least annually thereafter for all facilities. The results of this assessment shall be present in a Credit appraisal that originates from the Relationship Manager/Accounts Officer (RM) and approved by Credit Risk Management (CRM). The RMs should be the owner of the customer relationship, and will be held responsible to ensure the accuracy of the entire credit application submitted for approval. RMs shall follow the Banks lending guidelines and shall consult dur diligence on new borrowers, principals and guarantors.

It is essential that RMs know their customers and conduct dur diligence on new borrowers. Principals and guarantors to ensure such parties are in fact who they represent themselves to be. The RMs shall adhere to the Banks established Know Your Customer (KYC) and Money laundering guideline at all times.

Credit proposals shall contain summarizing of the results of the RMs risk assessment and include, as a minimum, the following details:

- Amount and type of loans proposed,

- Purpose of loans,

- Loan structure(Tenor, Covenants, Repayment schedule, Interest)

- Security arrangements.

In addition the following risk areas to be addressed:

- Borrower Analysis: The majority shareholders , management team and group of affiliate companies shall be assessed, Any issue regarding lack of Management depth, complicated ownership structures of inter group transactions shall be addressed, and risk mitigated.

- Industry Analysis: The key risk factors of the borrowers industry shall be assessed. Any issues regarding the borrower’s position in the industry, overall industry concerns or co9mpetitive forces shall be addressed and the strengths and weaknesses of the borrower relative to its competitor shall be identified.

- Supplier/buyer Analysis: Any customer or supplier concentrating shall be addressed, as these will have a significant impact on the future viability of the borrower.

- Historical Financial Analysis: An analysis of a minimum of 3 years historical financial statements of the borrower shall be presented, where reliance if placed on a corporate guarantor, guarantor financial statements shall also be analyzed. The analysis shall address the quality and sustainability of earnings, cash flow and the strength of the borrowers balance sheet, Specifically, cash flow, leverage and profitability must be analyzed,

- Projected Financial Performance: Where term facilities (tenor.1 year) are being proposed, a projection of the borrowers future financial performance should be provided, indicating an analysis of the sufficiency of cash flow to service debt repayments. Loans should not be granted if projected cash flow is insufficient to repay debts.

- Account Conduct: For existing borrowers the historic performan5tc in meeting repayment obligations (trade payments, Cheques, interest and principal payments etc, should be assessed,)

- Adherence to lending Guidelines: Credit applications should clearly state whether or not the proposed applications in compliance with the Banks lending Guidelines. The Banks Head of Credit or Managing Director will approve Credit Applications that do not adhere to the banks lending guidelines.

- Mitigating Factors: Mitigating factors for risk identified in the credit assessment should be identified. Possible risks include, but are not limited to merging sustainability and/or volatility, high debt load (leverage/gearing), overstocking or debtor issues, rapid growth, acquisition or expansion new business line/product expansion, management changes or succession issues customer or supplier concentrations and lack of transparency or industry issues.

- Loan Structure: The amount and tenors of financing proposed should be justified based on the projected repayment ability and loan purpose. Excessive tenor or amount relative to business needs lead to increase the risk of fund diversion and may adversely impact the borrower’s repayment ability.

- Security: A current valuation of collateral should be obtained and the quality and priority of security being proposed should be assessed. Loan should not be granted based solely on security. Adequacy and the extended of the insurance coverage should be assessed.

- Name Lending: Credit proposals should not be unduly influenced by an over reliance on the sponsoring principals reputation, reported independent means or their perceived willingness to inject funds into various business enterprises in case of need. These situations should be discouraged and treated with great caution. Rather, credit proposals and the granting of loans should be based on sound fundamentals, supported by a thorough financial and risk analysis.

Risk grading

A credit risk grading system defines the risk profile of the borrowers to ensure that account management, structure and pricing commensurate with the risks involved. Risk grading is a key measurement of a Bank’s asset quality, and as such, it is essential that grading is a robust process.

The following risk grading matrix is provided as a guideline. The more conservative risk grade (higher) should be applied if there is a difference between the personal judgment and the risk grade scorecard results. It is recognized that the banks may have more or less Risks Grades; however, monitoring standards and account management must be appropriate given the assigned risk grade.

Risk Rating | Grade | Definition |

Superior – Low Risk | 1 | Facilities are fully secured by cash deposits, government bonds or a counter guarantee from a top tier international bank. All security documentation should be in place. Aggregate score of 99 – 100 based on the Risk Grade Scored. |

Good – Satisfactory Risk | 2 | The repayment capacity of the borrower is strong. The borrower should have excellent liquidity and low leverage. The company should demonstrate consistently strong earnings and cash flow and have an unblemished trade record. All security documentations should be in place. Aggregate score of 95 or greater or based on the Risk Grade scorecard. |

Acceptable – Fair Risk | 3 | Adequate financial condition through may not be able to sustain any major or continued setbacks. These borrowers are not as strong as grade 2 borrowers, but should still demonstrate consistent earnings, cash flow and have a good track record. A borrower should not be graded better than 3 if realistic audited financial statements are not received. These assets would normally be secured by acceptable collateral (1st charge over stocks/ debtors/ equipment/ property). Borrowers should have adequate liquidity, cash flow and earnings. An aggregate score of 75 – 94 based on the Risk Grade Scorecard. |

Marginal – Watch list | 4 | Grade 4 assets warrant greater attention due to conditions affecting the borrower, the industry or the economic environment. These borrowers have an above average risk due to strained liquidity, higher than normal leverage, thin cash flow and/ or inconsistent earnings. Facilities should be down graded to 4 if the borrower incurs a loss, loan payments routinely fall past due, account conduct is poor, or other untoward factors are present. An Aggregate Score of 65 – 74 based on the Risk Grade Scorecard. |

Special Mention | 5 | Grade 5 assets have potential weaknesses that deserve management’s close attention. If left uncorrected, these weaknesses may result in a deterioration of the repayment prospects of the borrower. Facilities should be down graded to 5 if sustained deterioration in financial condition is noted (consecutive losses, negative net worth, excessive leverage), if loan payments remain past due to 90 days, or if a significant petition or claim is lodged against the borrower. Although full repayment of facilities is still expected, interest will be taken into Interest suspense A/C. An Aggregate Score of 55 – 64 based on the Risk Grade Scorecard |

Substandard | 6 | Financial condition is weak and capacity or inclination to repay is in doubt. These weaknesses jeopardize the full settlement of loans. Loan should be downgraded to 6 if loan payments remain past due for 12 months in case of Long Term Loans (more than 5 years) and 6 months for Other Loans, if the customer intends to create a lender group for debt restructuring purposes, the operation has ceased trading or any indication suggesting the winding up or closure of the borrower is discovered. Interest will be booked into Interest Suspense A/C. Loan loss provisions are to be provided for. Bank should pursue legal options to enforce security to obtain repayment or negotiate an appropriate loan rescheduling. An Aggregate Score of 45 – 54 based on the Risk Grade Scorecard |

Doubtful | 7 | Full repayment of principal and interest is unlikely and the possibility of loss is extremely high. However, due to specifically identifiable pending factors, such as litigation, liquidation procedures or capital injection, the asset is not yet classified as Bad and Loss. Assets should be downgraded to 7 if loan payments remain past due in excess of 18 months in case of Long Term Loan (more than 5 years), 12 months in case of Short Term & Medium Term Loans (up to 5 years) and 9 months for Other Loans. Interest will be booked into Interest Suspense A/C. Loan loss provisions are to be raised. The adequacy of provisions must be reviewed at least quarterly on all non-performing loans. Bank should pursue legal options to enforce security to obtain repayment or negotiate an appropriate loan rescheduling. An Aggregate Score of 35 – 44 based on the Risk Grade Scorecard |

Bad and Loss | 8 | Assets graded 8 are long outstanding with no progress in obtaining repayment (remain past due in excess of 24 months incase of Long Term Loans, 18 months in case of Short Term & Medium Term Loans and 12 months in case of Other Loans) or in the late stages of wind up/ liquidation. Charging of interest should be stopped but interest is to be charged while initiating legal action booked into Interest Suspense A/C. The prospect of recovery is poor and legal options have been pursued. The proceeds expected from the liquidation or realization of security may be awaited. The continuance of the loan as a bankable asset is not warranted, and the anticipated loss should have been provided for. This classification reflects that it is not practical or desirable to defer writing off this basically worthless asset even though partial recovery may be affected in the future. Bangladesh Bank guideline for timely write off of bad loans must be adhered to. An Aggregate Score of 35 or less based on the Risk Grade Scorecard |

(4) Risk Rating Schedule

Borrower/ Group

Industry Code:

Date of Grading:

Date of Financials:

Completed by: | Score 99-100 95-98 75 – 94 65 – 74 55 – 64 45 – 54 35 – 44 <35 | Risk Grade 1 2 3 4 5 6 7 8 |

Aggregate score ——–

Risk Grade ————– |

Criteria | Weight | Points | Weighted Scores |

Gearing

The ratio of a borrower’s Total Debt to Tangible Net worth | 20% |

|

|

Liquidity

The ratio of a borrower’s Current Assets to Current Liabilities | 20% |

|

|

Profitability

The ratio of a borrower’s Operating Profits to Sales | 20% |

|

|

Account Conduct

| 10% |

|

|

Business Outlook

A critical assessment of the medium term prospects of the borrower, taking into account the industry, market share and economic factors. | 10% |

|

|

Management Management team has been in the industry | 5% |

|

|

Personal Deposits

The extent to which the bank maintains a personal banking relationship with the key business sponsors/ principals | 5% |

|

|

Age of Business

| 5% |

|

|

Size of Business

The size of the borrower’s business measured by the most recent year’s total sales. | 5% |

|

|

4.d.Approvals Authorities

The authority to sanction/ approve loans is delegated to Senior Executives by the Managing Director & Board based on the executive’s knowledge and experience. Approval authority is delegated to individual executives and not to committees to ensure accountability. The following guidelines in the approval/ sanctioning of loans:

- Credit approval authority is delegated in writing from the MD & Board.

- Delegated approval authorities is reviewed by Board/ MD from time to time

- The credit approval function is separate from the marketing/ relationship management (RM) function.

- The role of credit committee is restricted to only review of proposals i.e. recommendations.

- Approvals shall be evidenced in writing or by electronic signature.

- Executives within the authority limit delegated to them by the MD authorize all credit risks.

- Credit approval is centralized within the CRM function. The Board/Managing Director/Deputy Managing Director/Head of Credit/Delegated Head Office Credit Executive shall approve all large loans.

- The Managing Director delegates authority to each individual in writing.

- All the officials in different ranks their delegated authority for conducting day to day business of the bank judiciously prudently abiding by the directives, circulars, standing instructions/order issued by the bank and or Bangladesh Bank from time to time and conforming to the credit policy of the Bank.

- The Managing Director has the right to exercise lending authority delegated to other executives having authority lower than him.

- The Managing Director is authorized to sub-delegate his business discretionary authority, if deemed necessary.

- The Managing Director further has the right to suspend/and or withdraws either partially or fully the business discretionary authority delegated to any sub-ordinate officials.

- Once the credit facility is granted to any individual/group by business power delegated to higher authority, exercise of lower authority by the subordinate will automatically stand ceased for the same individual/group.

- A monthly summary of all new facilities approved, renewed, enhanced and a list of proposals declined stating reasons thereof reported by CRM to MD.

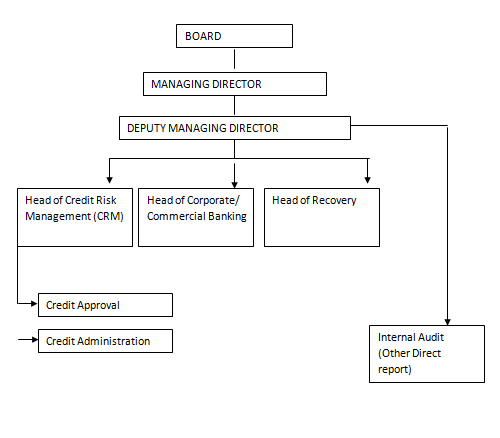

Organizational Structure and Responsibilities

Quality level of credit Officers:

Executives charged with approving loans have relevant training and experience to carry out their responsibilities effectively.

Organizational Structure

CREDIT MANAGER

General Credit | CREDIT MANAGER

PLD/LF | CREDIT MANAGER

Garments | CREDIT MANAGER

SEF | CREDIT MANAGER

Consumer Finance |

Credit Analyst Team | Credit Analyst Team | Credit Analyst Team | Credit Analyst Team | Credit Analyst Team |

RELATIONSHIP MANAGER

General Credit | RELATIONSHIP MANAGER

PLD/LF | RELATIONSHIP MANAGER

Garments | RELATIONSHIP MANAGER

SEF | RELATIONSHIP MANAGER

Consumer Finance |

Relationship Manager Team | Relationship Manager Team | Relationship Manager Team | Relationship Manager Team | Relationship Manager Team |

Business/ Product Development | Business/ Product Development | Business/ Product Development | Business/ Product Development | Business/ Product Development |

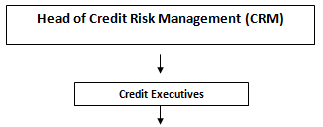

Credit Risk Management (CRM)

- Oversight of the Banks credit policies, procedures and controls relating to all credit risks.

- Oversight of the Banks asset quality.

- To approve (or decline), within delegated authority, credit applications recommended by RM. Where borrower exposure aggregate is in excess of approval limits, to provide recommendation to DMD/MD for approval.

- To ensure that lending executives have adequate experience and/or training in order to carry out job duties effectively.

Credit Administration

- To ensure that all security documentation compiles with the terms of approval and is enforceable.

- To monitor insurance coverage to ensure a-appropriate coverage is in place over assets pledged as collateral

- To control loan disbursements only after all terms and conditions of approval have been met and all security documentation stand completed.

- To monitor borrowers compliance with agreed terms and conditions.

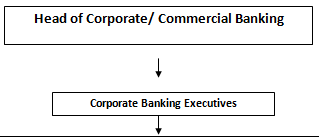

Relationship Management/Marketing (RM)

- To maintain thorough knowledge of borrowers business and industry through regular contact, factory/warehouse inspection etc. RMs should proactively monitor the financial performance and account conduct of borrowers.

- To be responsible for the timely and accurate submission of Credit Applications for new proposals and annual reviews.

- To highlight any deterioration in borrowers financial standing and amend the borrowers Risk Grade in a timely manner.

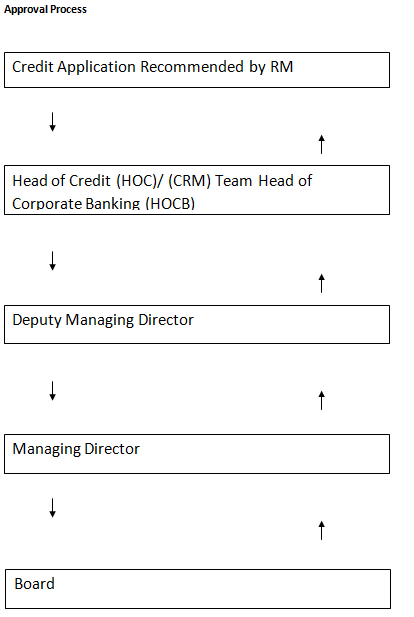

4.e. APPROVAL PROCESS

The responsibility for preparing the Credit proposal rest with the RM within the corporate/commercial-banking department. Credit proposal is recommended for approval by the RM team and forwarded to the approval team within CRM and approved by individual executives.

The recommending or approving executives are responsible and accountable for their recommendations or approval. DMD and MD approve all proposals where the facilities are up to 3% of the banks capital are approved at the CRM level, facilities up to 7% and 10% of capital respectively, and the Board approves proposals in excess of 10% of capital.

Approval Process

- Proposals forwarded by RM (Branch Manager) to Head of Credit (CRM).

- HOC/CRM Executives advises the decision as per delegated authority to RM.

- HOC supports & forwards to Deputy Managing Director.

- Deputy Managing Director advises the decision as per delegated authority to HOC.

- Deputy Managing Director support and forwards to Managing Director.

- Managing Director Advices the decision to Deputy Managing Director/Head of Credit.

- Managing Director presents the proposal to Board.

- Board advices the decision to Managing Director.

Risk Management:

A. Credit Risk:

The credit risk is managed by the CRM Division, which is completely segregated from business / sales. The following elements contribute to the management of credit risk.

The Credit risk associated with the products is managed by the following:

- Loans will be given only after proper verification of customer’s static data and after proper assessment & confirmation of income related documents, which will objectively ascertain customer’s repayment capacity.

- Proposals will be assessed by CRM Division completely separated from business / sales.

- Every loan will be secured by hypothecation over the asset financed, and customer’s authority taken for re-possession of the asset in case of loan loss.

- There will be dedicated ‘collection’ force that will ensure timely monitoring of loan repayment and its follow up.

Contact Point Verification

Contact Point Verification should be done whenever possible for all applicants. The external CPV includes residence, office and telephone verifications.

B.Third Party Risk

In case of third party deposits/ security instruments, banks should verify third party’s signature against the specimen attached to the original instrument and bank will also send the instrument to the issuing office for their verification and written conformation on lien marking and encashment of the instrument.

C.Fraud Risk

There is an inherent fraud risk in any lending business. The most common fraud risks are:

Application Fraud

The applicant’s signature may not be verified for authenticity. However, the applicant’s identity should be confirmed by way of scrutiny of identification and other documentation.

There always remains the possibility of application fraud by way of producing forged documents. However, bank should be aware of this threat.

D.Liquidity and Funding Risk

This risk should be managed and the position monitored by the Asset Liability Committee headed by the Managing Director of the bank.

E.Political and Economic Risk

Political and economical environment of a country play a big role behind the success of business. The Banks should always keep a close watch in these areas so that it is able to position it self in the backdrop of any changes in country’s political and economical scenario.

F.Operational Risk

For SEF, the activities of front line sales and behind-the-scene maintenance and support are clearly segregated. Credit & Collections Unit (CCU) will be formed.

CCU will manage the following aspects of the product:

a) Inputs, approvals, customer file maintenance, monitoring & collections

b) The operation jobs like disbursal in the system including rising debit standing orders and the lodgment and maintenance of securities

Type ‘a’ jobs & type ‘b’ jobs will be handled by separate teams within CCU; therefore the risk of compromise with loan / security documentation will be minimal.

Maintenance of Documents & Securities

CCU or Operations Unit will hold the applications and other documents related to SE loans in safe custody. All this documents will go under single credit file per customer.

The physical securities and the security documents will be held elsewhere inside fireproof cabinets under CCU’s or Operation’s custody.

Internal Audit

Audits should be carried out on a regular or periodically to assess various risks and possible weaknesses and to ensure compliance with regulatory guidelines, internal procedures, and Credit Risk Management Policy Guidelines and Bangladesh Bank requirements.

4.f. Collection & Remedial Management

Monitoring

Banks loan portfolio should be subject to a continuous process of monitoring. This will be achieved by regular generation of over limit and overdue reports, showing where facilities are being exceeded and where payments of interest and repayment of principle are late. There should be formal procedures and a system in place to identify potential credit losses and remedial actions has to be taken to prevent the losses.

Recovery

The collection process for SE loans start when the borrower has failed to meet one or more contractual payment (installment). It therefore, becomes the duty of the Collection Department to minimize the outstanding delinquent receivable and credit losses.

This procedure has been designed to enable the collection staff to systematically recover the dues and identify / prevent potential losses.

Collection objectives

The collector’s responsibility will commence from the time an account becomes delinquent until it is regularized by means of payment or closed with full payment amount collected.

The goal of the collection process is to obtain payments promptly while minimizing collection expense and write-off costs.

Identification and allocation of accounts

When a customer fails to pay the minimum amount due or installment by the payment due date, the account is considered in arrears or delinquent. When accounts are delinquent, collection procedures are instituted to regularize the accounts without losing the customer’s goodwill whilst ensuring that the bank’s interests are protected.

Appeal Process

Any declined credit may be re-presented to the next higher authority for reassessment /approval through HOCB. However, there should be no appeal process beyond the Managing Director.

Credit Administration

The Credit Administration function is critical in ensuring that prope4r documentation and approvals are in place prior to the disbursement of loan facilities. For this reason, it is essential that the functions of Credit Administration be strictly segregated from Relationship Management/Marketing in order to avoid the possibility of controls being compromised or issues no being highlighted at the appropriate level.

Disbursement:

- Security documents are prepared in accordance with approval terms and are legally enforceable. Bank’s standard loan facility documentation reviewed by legal counsel are used in all cases.

- Disbursements under loan facilities are only to be made when all security documentation is in place. CIB report should reflect/include the name of all the lenders with facility, limit & outstanding. All formalities regarding large loans & loans to Directors should be guided by Bangladesh Bank circulars & related section of Banking Companies Act. All Credit Approval terms have been met.

Custodial Duties:

- Storage of security documents are maintained at the branch jointly by two authorized officers within RM Team.

- Appropriate insurance coverage is maintained (and renewed on a timely basis) on assets pledged as collateral.

- Security documentation to be held under strict control, preferably in locked fireproof iron-safe at branches under dual custody.

Compliance Requirements:

- Ensure all excess & exceptions are approved from the appropriate credit discretion level.

- All required Bangladesh Bank returns are to be submitted in the correct format in a timely manner.

- Bangladesh Bank circulars/regulations are to be maintained and advised to all relevant departments to ensure compliance.

- All third party service providers (valuators, lawyers, insurers, CPAs etc.) are to be approved. List of Lawyers to be enlisted and approved and circulated accordingly.

4. g. Credit Monitoring:

To minimized credit losses, monitoring procedures and systems are in place that provides an early indication of the deteriorating financial heath of borrower. At a minimum, systems should be in place to report the following exceptions to relevant executives in CRM and RM team.

Past due principal or inters payments, past due trade bills, account excesses, and breach of loan covenants:

Loan terms and conditions are monitored, financial statements are received on a regular basis, and any covenant breaches or exceptions are referred to HO Credit for timely follow-up.

Timely corrective action is taken to address findings of any internal, external or regulator inspection/audit.

All borrower relationships/loan facilities are reviewed and approved through the submission of a Credit Application at least annually.

Early Alert Process

An Early alert Account is one that has risks or potential weaknesses of a material nature requiring monitoring, supervision, or close attention by management.

If these weaknesses are left uncorrected, it may result in deterioration of the repayment prospects with a likely prospect of being downgraded to CG 5 or worse, within the next twelve months.

Early identification, prompt reporting and proactive management of Early Alert Accounts are prime credit responsibilities of all Relationship Managers, An Early Alert report completed by the RM sent to the approving authority in CRM for any account that is showing signs of deterioration within seven days from the identification of weaknesses.

If there are other concerns, such as breach of loan covenants or adverse market rumors that warrant additional caution, an Early Alert report is sent to CRM.

Credit Recovery:

The Recovery Division at Head Office directly manages accounts with sustained deterioration (a Risk Rating of Sub Standard (6) or worse). Account graded 4-5 transferred to the Recovery Division for efficient exit based on recommendation of CRM and Corporate Banking.

The Recovery Division’s primary functions are:

Determine Account Action Plan/Recovery Strategy

Pursue all options to maximize recovery.

Ensure adequate and timely loan loss provisions are made base o-n actual and expected losses.

Regular review of grade 6 or worse accounts.

NPL Account Management:

All Non Performing loans are assigned to an Account Manager. Within the recovery Division, for coordinating and administrating the action plan/recovery of the accounts, and should serve as the primary customer contact after the account is downgraded to substandard.

Account Transfer Procedures:

Recovery Units should ensure that the following is carried out when an account is classified as Sub Standard or worse:

- Facilities are withdrawn or repayment is demanded as appropriate. Any drawings or advances should be restricted, and only approved after careful scrutiny and approval from HO Credit.

- CIB reporting is updated according to Bangladesh Bank guidelines and the borrower’s Risk Grade is changed as appropriate.

- Loan loss provisions are taken based on Force Sale Value (FSV)

- Loans are only rescheduled in conjunction with the Large Loan Rescheduling guidelines of Bangladesh Bank. Any rescheduling should be based on projected future cash flows, and should be strictly monitored.

- Prompt legal action is taken if the borrower is uncooperative.

Non-Performing Loan (NPL) Monitoring:

On a quarterly basis, a Classified Loan Review (CLR) is prepared by Recovery Division Account Mangers to update the status of the action/ recovery plan, review and assess the adequacy of provisions, and modify the banks strategy as appropriate.

NPL Provisioning and Write Off:

The guidelines established by Bangladesh Bank for CIB reporting, provisioning and write off of bad and doubtful debts and suspension of interest are followed in all cases. Provisions are raised against the actual and expected losses at the time they are estimated. The approval to take provisions, write offs, or release of provisions/upgrade of an account are restricted to MD/ Board.

The Recovery Division Account Manager determines the Force Sale Value (FSV) for accounts grade 6 or worse. Force Sale Value is generally the amount that is expected to be realized through the liquidation of collateral held as security. Any shortfall of the Force Sale Value compared to total loan outstanding is fully provided when an account is downgraded to grade 7.

Security Compliance Certificate Chick List

|

|

|

1A | Initial Requirements: |

|

|

|

|

| Credit proposal has been properly approved and signature verified. |

|

| Updated due date diary for 90 days expiry. |

|

|

|

|

B | Post Approval and Prior Activation of the limits |

|

| Rechecking of Clean CIB report |

|

| Within large loan requirements? |

|

| Caused L/c approval from BB |

|

| Updated list of Directors of the company – Form xii duly certified by RJSC |

|

|

|

|

C | Sanction Advice: |

|

| All alterations if any has been counter signed by the signatory / Relationship Manager (RM) |

|

| Un-conditional acceptance of Sanction Advice. |

|

| Acceptance Signature verified. |

|

|

|

|

D | Borrowing Power (Memorandum and Article of Association) |

|

1 | Board Resolution(BR) covering as per object clause(MOA) |

|

a | Resolution Date |

|

| Quorum fulfilled |

|

| Borrowing Amount |

|

| Mortgage/Hypothecation authority |

|

| Authorized signatory |

|

| Signature verification |

|

|

|

|

E | Documentation As per Ho Sanction Advice No. Date |

|

| Promissory Note covering full amount and dated. |

|

| Properly executed (as per BR), Company seal affixed. |

|

| Signed across the Revenue Stamp |

|

| Signature verified |

|

| Letter of Arrangement covering full amount and dated –Signature verified. |

|

| Letter of disbursement covering full amount and dated – Signature verified (for term loan and Loan General) |

|

| Letter of installment dated- Signature verified |

|

| Letter of Continuity for continuous loan covering full amount dated. |

|

| Letter of Guarantee (Individual) |

|

| Letter of Guarantee (Limited Company) |

|

| Letter of Hypothecation over Stocks |

|

| Collateral Security in the form of Letter Hypothecation over Book Debts |

|

| Letter of Hypothecation over Machinery |

|

| PARI-PASSU Security Sharing Agreement |

|

| Modification (amount/banks etc.) Pari-Passu security sharing agreement |

|

| Letter of Hypothecation over (Tea Crops |

|

| Joint Registration /Mortgage of the vehicles. |

|

| Letter of Hypothecation (Over Vehicles) with schedule |

|

| Letter of Modification (a) Stocks (b) Book Debt(c) Machinery (Property) |

|

| Lien on FDR |

|

| Pledge of PSP/BSP/WEDB/ICB unit/Shares etc. |

|

| Mortgage over property |

|

| Lease property |

|

| Procedures A) Collect Stamp duty/Registration charges from customer to obtain stamps from Treasury. B) For creating charge over company property in the office of RJSC. |

|

| Insurance Policies |

|

| Bank guarantee/Indemnity |

|

| Pledge of Goods |

|

| Letter of Authority |

|

| Proprietorship/Partnership Borrowers-Hypothecation(s) |

|

| Registered General Power of Attorney to sell the Assets without reference |

|

| Inter Borrowing amongst Corporate Borrowers (3rd party) |

|

| Loan against Trust Receipt |

|

| Term Loan Agreement-For Term Loans |

|

| Other Agreement |

|

Bangladesh Bank – Prudential Regulations

Facilities to Related Persons

The consumer finance facilities extended by banks to their directors, major shareholders, employees and family members of these persons shall be based on normal terms and conditions applicable for other customers of the banks.

Regulaton-1

Regulaton-2

Limit on Banks exposure against total consumer financing

Banks shall ensure that the aggregate exposure under all consumers financing facilities at the end of first year and second year of the start of their consumer financing does not exceed 2 times and 4 times of their equity respectively. For subsequent years, following limits are placed n the total consumer financing facilities.

PERCENTAGE OF CLASSIFIED CONSUMER FINANCE TO TOTAL CONSUMER FINANCING | MAXIMUM LIMIT |

a) Bellow 5% b) 6% – 10% c) 11% – 15% d) 15% and above | 10 times of the equity 6 times of the equity 4 times of the equity Equal to equity |

Method of classification for the above purpose shall be in accordance with the classification requirement as prescribed under Prudential Regulation no.4 (Appendix-X)

Regulation-3

Total Financing Facilities to be commensurate with the income

While extending financing facilities to their customer, the banks would ensure that the total installment of the loans extended by the financial institutions is commensurate with the take home income/disposable income and repayment capacity of the borrower.

Regulation-4

Classification and provisioning for assets

1. Banks shall observe the prudential guidelines for classification of their Consumer Finance portfolio and provisioning there-against

2. In addition to the time-based criteria, subjective evaluation of performing and non-performing credit portfolio shall be made for risk assessment and, where considered necessary, any account including the performing account will be classified.

3. Apart from specific provisioning requirement banks shall maintain a general reserve at least equivalent to 5% of their unclassified consumer finance portfolio to protect them from the risks.

4. Bank shall submit the borrower –wise annual statements regarding classified loans/advances to the Banking inspection Department.

5.Banks shall review, at least on a quarterly basis, the collectibles of their loans/advances portfolio and shall property document the evaluations so made.

Regulation-5

Rescheduling of loan

Rescheduling of loan will be governed by rules & regulations as prescribed by Bangladesh Bank from time to time.

Regulation-6

Transfer Facilities from one category to another to avoid classification

The bank shall not transfer any loan or facility to be classified from one category of consumer finance to another to avoid classification.

Regulation-7

Credit information Bureau (CIB) Clearance

While considering proposals for any exposure, banks should give due weight age to the credit report relating to the borrower and his group obtained from Credit information Bureau (CIB) of Bangladesh Bank.

Regulation-8

The banks should take reasonable steps to satisfy themselves that cardholders have received the card, whether personally or by mail.

Regulation- 9

Banks shall provide the credit card holders with the statements of account at monthly intervals.

Regulation- 10

Banks shall be liable for all transactions not authorized by the credit card holders after they have been properly served with a notice that the card have been lost/ stolen.

Regulation- 11

Banks should take into account the partial payment before charging service fee/ mark-up amount on the outstanding/-billed amount.

Regulation- 12

Due date for payment must be specifically mentioned on the accounts statement.

Regulation- 13

Maximum unsecured limit under credit card to a borrower (supplementary cards shall be considered part of the principal borrower) shall not exceed Tk. 500,000/-, provided the excess amount is secured appropriately. However, in no case the limit will be allowed to exceed Tk. 2 million.

Regulation- 14

The vehicles to be utilized for personal use. Vehicle for commercial purpose shall not be covered under the Prudential Regulation for consumer finance

Regulation- 15

The maximum tenure of the auto loan finance shall not exceed six-year.

Regulation- 16

The banks shall not allow auto loan (including insurance) exceeding Tk. 2 million per individual under this head. While allowing auto loans, the banks shall ensure that the minimum down payment does not fall below 10% of the value of vehicle.

Regulation- 17

In addition to any other security arrangement, the vehicles financed by the banks shall be properly secured by way of hypothecation.