Accepting risk, or risk acceptance is a concept in which a person or organization identifies risk and makes it appropriate, making no attempt to minimize or mitigate it. Often known as “risk retention,” it is a risk management aspect generally found in the fields of business or investment. The expected misfortune from the recognized and acknowledged danger is viewed as tolerable. This is done on the grounds that the expense of staying away from the danger might be too incredible to even consider justifying it when contrasted with the chance of the danger being figured it out. As a risk management technique, the principle of risk acceptance is widely applicable in investment areas and companies. There are several cases where the risk acceptance approach can be used, including the creation of investment portfolios and project management.

A few organizations can’t safeguard against their dangers if the expense of bearing it is relatively lower; henceforth tolerating hazard is otherwise called hazard maintenance. Risk acceptance posits that rare and minor threats that do not have the capacity to be disastrous or otherwise too costly are worth embracing with the understanding that if and when they occur, any issues will be dealt with. The consequences of such uncertainties are commonly assumed to be bearable or otherwise too costly and are thus recognized and dealt with as they arise as part of the system.

(Example of Accepting Risk)

Without experiencing some form of risk, it is almost impossible to enter into some new initiative. Due to its decreased outlay on a premium, risk acceptance is the hallmark of a good priority and contingency budgeting. Self-insurance is a form of recognition of risk; insurance transfers risk to a third party, on the other hand. A business venturing into another market risks extending its assets excessively far. In most organizations and danger, the board faculty will find that they have more noteworthy and more various dangers than they can oversee, alleviate, or evade given the assets they are assigned.

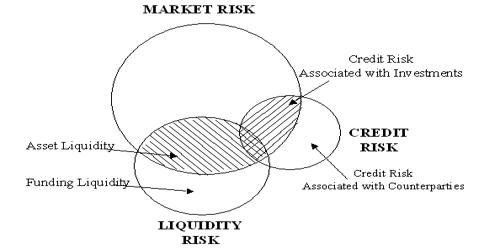

Although risk acceptance provides a net financial return, the optimal decision for its adoption is based on the viewpoint of a manager and not on systemic market risks. An investor who chooses to continue purchasing a new company’s stock runs the risk that the company will not last long enough to earn positive returns. Thusly, organizations must discover a harmony between the possible expenses of an issue coming about because of a known danger and the cost associated with dodging or in any case managing it. Risk categories include financial market volatility, project delays, legal obligations, credit risk, injuries, natural causes and disasters, and competition that is excessively hostile.

Risk acceptance may take various financial and organizational forms, such as the establishment of a financial reserve on an ongoing basis, the use of captives, or the accumulation of financial capital in special accounts. The acceptance of risk can be seen as a form of self-insurance; it is said that “retained.” is any and all risks that are not embraced, transferred, or prevented. Preferably, the risk should be one that is not difficult to handle or at least one that is unlikely to come to fruition. Likewise, any possible misfortunes from a danger not covered by protection or over the safeguarded sum are an illustration of tolerating hazard.

Deductibles and underinsurance, as well as gross deductible policies, can also be included in the risk acceptance of insurance firms. In an insurance company, all the components include the formation of a contingency fund to cushion the portion of damages that are uninsured due to deductibles. There are a few ways to view and handle risk in risk management in addition to embracing risk. They’re including:

- Risk Avoidance: Risk avoidance requires removing any operation that poses possible losses. It is suitable for threats that are likely to have a significant effect on a project or business. Via policies and procedures, technology implementation, as well as training and education, managers achieve risk avoidance.

- Risk Transfer: Applicable to multi-party initiatives. Not used regularly. This also requires insurance. Insurance schemes, also known as “risk-sharing”, essentially move risk from the insured to the insurer.

- Risk Mitigation: Risk mitigation means minimizing the impact of coping with risk as it happens. The solution is usually accomplished by hedging.

- Risk Exploitation: Some risks are good, such as that there are not enough workers to keep up with sales if a product is too popular. The danger can be exploited in such a situation by hiring more sales workers.

A significant differentiation must be made between the act of tolerating hazard and basically disregarding it. Such a business should discover a harmony between the likely expense of an issue coming about because of a known danger and the cost includes in dodging. In the business world, decision-makers must always weigh the costs and benefits of all potential maneuvers and be frank with themselves about the challenges that certain risks pose.

Information Sources: