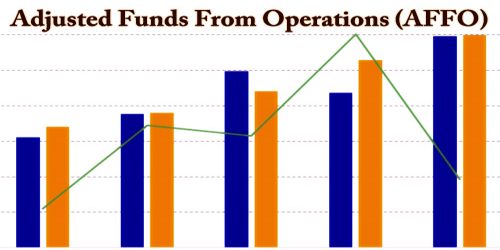

Adjusted Funds From Operations (AFFO) is an indicator of real estate investment trusts (REIT)’s financial efficiency and is used as an alternative to Funds From Operations (FFO). The AFFO of a REIT, though subject to varying methods of computation, is usually up to the trust’s funds from operations (FFO) with adjustments made for recurring capital expenditures accustomed to maintain the standard of the REIT’s underlying assets. AFFO’s value is obtained by making changes to the FFO statistic to subtract ongoing expenses needed to keep the property running and revenue-generating.

Regardless of the chosen method of measuring Adjusted Funds From Operations (AFFO), it stands out to be a more accurate way for stakeholders to calculate the remaining cash flow than operating funds. Though no one official measure exists, an AFFO formula is along the lines of AFFO = FFO + rent increases – capital expenditures – routine maintenance amounts. Investors are using AFFO as a stronger predictor of the capacity of the REIT to pay dividends from its net earnings. This also provides a clearer understanding of the dividends which REITs will be able to afford paying in the future; it is considered a non-GAAP measure.

The primary step in determining the AFFO is to determine the funds from operations, which assess the cash flows from the operating activities of a REIT. The FFO was originally introduced by the National Association of land Investment Trusts (NAREIT) as a measure of money flows generated by REITs. FFO takes under consideration the REIT’s net profit including amortization and depreciation, but it excludes the capital gains from property sales. The explanations these gains aren’t included is that they’re onetime events and customarily don’t have a long-term effect on the REIT’s future earnings potential.

The formula for FFO is:

FFO = net income + amortization + depreciation – capital gains from property sales

After calculating FFO, one can calculate AFFO with this formula:

AFFO= FFO + increase in rent – capital expenditures – routine maintenance amounts

AFFO’s valuation offers investors a better view of the REIT’s ability to pay dividends.

Example of Adjusted Funds From Operations (AFFO) Calculation –

Net profit of REIT for the corresponding reporting period was $2 million. During that time, it gained $400,000 by selling a house, and by selling another, it suffered a $100,000 loss. Amortization and depreciation costs were respectively $35,000, and $50,000. It was also worth $40,000 in rent rises, $30,000 in daily repairs and $40,000 in capital expenses. With this information provided, FFO will be ascertained in the following manner:

FFO = $2,000,000 + $35,000 + $50,000 – ($400,000 – $100,000) = $1,785,000

FFO being $1,785,000 will help in calculating AFFO:

AFFO = FFO + $40,000 – $75,000 – $30,000 = $1,785,000 – $65,000 = $1,720,000

Information Sources: