The advance-decline line (ADL) is a technical indicator that shows the regular difference in the amount of advancing and declining stocks. It’s a stock market technical indicator that investors use to determine how many individual stocks are involved in a market’s rise or fall. The pointer is combined, with a positive number being added to the earlier number, or if the number is negative it is deducted from the earlier number. Since price fluctuations in large stocks can have a disproportionate impact on capitalization-weighted stock market indexes like the S&P 500, the NYSE Composite Index, and the NASDAQ Composite Index, knowing how far this movement spreads into the broader universe of smaller stocks can be useful.

Accordingly, the ADL gives a sign to financial backers in regards to the cooperation of all stocks in a file toward the market. The ADL is utilized to show market assessment, as it tells merchants whether there are more stocks rising or falling. When there is divergence, it is used to validate market trends in major indices and can also alert of reversals. Since market indexes reflect a collection of stocks, they do not provide a complete image of the trading day and market results. Despite the fact that the market lists give a thought regarding what has occurred during the exchanging day, advance/decay numbers give a thought regarding the individual exhibition of specific stocks.

As major indexes rise while the ADL falls, it indicates that less stocks are participating in the rally, implying that the index is approaching the end of its rally. The development decay line is a plot of the aggregate amount of the day-by-day contrast between the quantity of issues progressing, i.e., over the earlier day’s end cost, and the quantity of issues declining in a specific securities exchange file. A dropping advance/decline line confirms the downtrend when major indices are decreasing. As major indices fall and the A/D line rises, less stocks fall over time, indicating that the index is nearing the end of its decline.

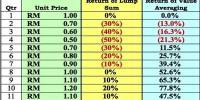

Formula for the Advance-Decline Line:

Advance-Decline Line = Advancing Stocks – Declining Stocks + Previous Net Advances

Where:

Advancing Stocks refers to the number of stocks that increased in value on a daily basis;

Declining Stocks refers to the number of stocks that decreased in value on a daily basis; and

Previous Net Advances refers to the net amount of advancing and declining stocks on a daily basis.

Calculate the Advance-Decline Line:

- Subtract the number of stocks that ended the day lower from the number of stocks that ended the day higher. This will give us the Net Advances.

- The Net Advances would be the first value used for the measure if this is the first time calculating the average.

- Calculate the Net Advances for the next day. If the total is positive, add it to the previous day’s total; if it’s negative, deduct it.

- Repeat steps one and three daily.

The ADL was the most common of all internal indicators and is one of the oldest indicators based on Advance-Decline Data. The advance-decline option is rarely used on its own. Instead, the ADL is compared to its corresponding index. Plotting the ADL against its significant list can assist financial backers with affirming patterns and the probability of inversions. The ADL is utilized to affirm the strength of a latest thing and its probability of turning around. The pointer shows if most of stocks are taking an interest toward the market.

If a stock market index moves in one direction while the ADL on that index moves in the opposite direction, this is known as “divergence.” If the index rises while the ADL falls, the index could be deceiving about the overall market’s true course. Alternately, if the indexes are proceeding to move lower and the ADL has turned upwards, called bullish dissimilarity, it very well might be a sign that the dealers are losing their conviction. If the ADL and the markets are still trending down, there’s a better chance that prices will continue to fall.

In the case of NASDAQ securities, the ADL cannot always have correct readings. This is due to the NASDAQ’s regular listing of small speculative businesses, many of which fail or are delisted. It’s possible that an index would show a gain at the end of the trading day. This addition might be brought about by an increment in a specific number of stocks. Be that as it may, a huge lead by declining stocks might be noticed comparative with the propelling stocks. While the stocks get delisted on the trade, they stay in the earlier determined upsides of the ADL. This at that point influences future computations which are added to the aggregate earlier worth.

Many times, a significant rise in an index has not been followed by an increase in the advance amount. In this scenario, it is fair to predict that the index will fall by the end of the trading day. All stocks are given equal weight in the ADL. As a result, it is a better indicator of the typical small- to mid-cap stock, rather than the fewer big- or mega-cap stocks.

Information Sources: