1.11.Product of Southeast Bank Limited in regards of SME

There are three basic products under the SEBL’s SME financing. Each of them are enacted below –

1.11.1. Southeast Shopan

- Customer segment: Any SE client meeting definition criteria and target group criteria of southeast bank’s SME credit policy.

- Purpose : Any justifiable business purpose

- Nationality: Bangladeshi

- Age limit : From 22 years up to 55 years( the borrower’s age must not exceed 60 at the expiry of loan tenor). In case of partnership firm or private limited company, age of the key person/chief executive officer is to be considered.

- Minimum Income: Minimum income must be commensurate with the amount of loan required.

- Borrower’s eligibility: to be eligible for this loan borrower must have the following eligibility –

- The legal form of business of the borrower is Sole Proprietorship/Partnership/Private limited company.

- The business is legally valid and the business firm has got all required licenses, permissions, registration certificates which are valid and up to date at the time of application of credit facility.

- The business firm is registered in Bangladesh with majority shares owned by Bangladeshi nationals.

- The borrower’s principal place of business is in Bangladesh.

- The business is profitable and has a defined market with clear growth potentials.

- The entrepreneur is skilled, experienced and so far successful for managing the business for at least 02 (two) years. In special cases, this condition may be relaxed.

- In case of new the entrepreneur, he/she is experienced for at least 02 years in working similar line of business and has technical knowhow about the business which he/she wants to establish. In special case, this condition may be relaxed.

- The age of the proprietor/partners/key person of the business firm is within 22 years to 55 years.

- A clear succession plan is present

- The entrepreneur must be literate as per as practicable.

- The entrepreneur is socially acceptable and his/her reputation, integrity, trustworthiness, commitment are satisfactory.

- Loan size : taka 2.00 lac to Taka 8.00 lac.

- Security arrangement: the following security is required for this product as per case basis –

- Hypothecation on the inventory, receivables, advance payments, plant and machinery.

- Personal guarantee of the borrower. In case of limited companies, guarantee of the directors other than nominee directors shall be obtained.

- Personal guarantee of spouse(if married) or parents(if unmarried) of the borrower.

- Personal guarantees of two shop owners of the respective market/two businessmen/ any other person acceptable to the bank.

- Post dated cheques for all installments and one undated cheque for full loan value including full interest.

- Usual charge documents.

- Any other securities to be deemed suitbable by the bank depending on banker customer relationship.

- The full amount may be allowed without any collateral security.

Documentation: there are two types of documentation. Preapproval documentation and post approval documentation.

Preapproval documentation

- Photograph of the applicants

- Valid trade license

- At least 2 years old trade license.

- Partnership deed = notarized/registered by SRO

- M/A or A/A including certificate of incorporation duly certified by registrar Joint Stock Companies RJSC and attested by the Managing Director accompanied by an up to date list of Directors.

- Income Statement and Balance Sheet for last 3 years.

- Passport/ National ID/ Certificate from UP chairman or Ward Commissioner confirming applicant’s age, nationality, address.

- Duly filled in RFCF which will be provided by bank

- Duly filled in Personal Net Worth Statement of the applicants and guarantors

- Duly filled in CIB forms

- Any other documentation deemed to be necessary by the bank

Post approval documentation

- Acceptance of the Sanction advice.

- Others as per the sanction advice.

- Insurance: the hypothecated stocks/items will remain insured minimum 10% above the credit facilities covering Fire, RSD, Theft and Burglary, Flood & Cyclone, MBD with Bank mortgage clause, cost of which to be borne by the client. If the client is unwilling to insure the hypothecated stock covering theft and burglary and Flood & Cyclone, an undertaking is to be obtained from the client to the effect that in case of Theft and Burglary, Flood & Cyclone and MBD the client will bear all the losses.

- Loan processing fee : 1% on the approved loan amount.

- Rate of interest: 14 %-15% per annum. However, the rate may be charged based on the market condition and policy of the bank.

- Overdue service charge : 2% per annum above the regular interest rate on the overdue amount.

- Early settlement/prepayment fee: 1% on the prepaid amount if paid before 1 year or the outstanding amount exceeds 40% of the principal amount.

- Stamp charge: all relevant stamp charges must be borne by the customer.

- Loan tenure: it can time loan for fixed asset procurement for 5 years or time loan maximum of 3 years for other purposes or time loan of 1 year.

- Grace period: negotiable depending upon nature of business and purpose of loan.

- Repayment arrangement: monthly installment in case of term loan and lumpsum within expiry.

- Financing mode: term loan, time loan.

- Distribution precondition: all the documentation formalities must be completed prior to disbursement.

- Debt to burden ratio: DBR must not exceed 60%.

- Loan takeover from other bank: in case of loan takeover from other bank, the loan amount will be given in the form of a payment order favouring that particular bank to settle the outstanding as well as the closing charges.

- Contact Point Verification: all address of the applicant and guarantee must be verified by CPV agent where the Bank has agreement and in other case branch officials will do the same.

- Approval authority: as per delegation of business power for small Enterprise(SE) financing.

1.11.2. Southeast Shikor

- Customer segment: any SE client meeting definition criteria and target group criteria of southeast bank’s SME credit policy.

- Purpose : Any justifiable business purpose.

- Nationality: Bangladeshi

- Age limit: From 22 years up to 55 years( the borrower’s age must not exceed 60 at the expiry of loan tenor). In case of partnership firm or private limited company, age of the key person/chief executive officer is to be considered.

- Minimum Income: Minimum income must be commensurate with the amount of loan required.

- Borrower’s eligibility: : to be eligible for this loan borrower must have the following eligibility –

- The legal form of business of the borrower is Sole Proprietorship/Partnership/Private limited company.

- The business is legally valid and the business firm has got all required licenses, permissions, registration certificates which are valid and up to date at the time of application of credit facility.

- The business firm is registered in Bangladesh with majority shares owned by Bangladeshi nationals.

- The borrower’s principal place of business is in Bangladesh.

- The business is profitable and has a defined market with clear growth potentials.

- The entrepreneur is skilled, experienced and so far successful for managing the business for at least 02 (two) years. In special cases, this condition may be relaxed.

- In case of new the entrepreneur, he/she is experienced for at least 02 years in working similar line of business and has technical knowhow about the business which he/she wants to establish. In special case, this condition may be relaxed.

- The age of the proprietor/partners/key person of the business firm is within 22 years to 55 years.

- A clear succession plan is present

- The entrepreneur must be literate as per as practicable.

- The entrepreneur is socially acceptable and his/her reputation, integrity, trustworthiness, commitment are satisfactory.

- Loan size: Taka 2.00 lac to Taka 50.00 lac.

- Security arrangement: the following security is required for this product as per case basis –

- Hypothecation on the inventory, receivables, advance payments, plant and machinery.

- Personal guarantee of the borrower. In case of limited companies, guarantee of the directors other than nominee directors shall be obtained.

- Personal guarantee of spouse (if married) or parents(if unmarried) of the borrower.

- Personal guarantees of two shop owners of the respective market/two businessmen/ any other person acceptable to the bank.

- Post dated cheques for all installments and one undated cheque for full loan value including full interest.

- Usual charge documents.

- Any other securities to be deemed suitbable by the bank depending on banker customer relationship.

- The full amount may be allowed without any collateral security.

- Documentation: there are two types of documentation. Preapproval documentation and post approval documentation.

Preapproval documentation

- Photograph of the applicants

- Valid trade license

- At least 2 years old trade license.

- Partnership deed = notarized/registered by SRO

- M/A or A/A including certificate of incorporation duly certified by registrar Joint Stock Companies RJSC and attested by the Managing Director accompanied by an up to date list of Directors.

- Income Statement and Balance Sheet for last 3 years.

- Passport/ National ID/ Certificate from UP chairman or Ward Commissioner confirming applicant’s age, nationality, address.

- Duly filled in RFCF which will be provided by bank

- Duly filled in Personal Net Worth Statement of the applicants and guarantors

- Duly filled in CIB forms

- Any other documentation deemed to be necessary by the bank

Post approval documentation

- Acceptance of the Sanction advice.

- Others as per the sanction advice.

- Insurance: the hypothecated stocks/items will remain insured minimum 10% above the credit facilities covering Fire, RSD, Theft and Burglary, Flood & Cyclone, MBD with Bank mortgage clause, cost of which to be borne by the client. If the client is unwilling to insure the hypothecated stock covering theft and burglary and Flood & Cyclone, an undertaking is to be obtained from the client to the effect that in case of Theft and Burglary, Flood & Cyclone and MBD the client will bear all the losses.

- Loan processing fee : 1% on the approved loan amount .

- Interest rate or commission: if loan is funded then 13% -16% per annum. However, the rate may be changed based on the market condition and policy of the Bank. If the loan is nonfunded then charge is par bank schedule.

- Overdue service charge: 2% per annum above the regular interest rate on the overdue amount.

- Early settlement/Prepayment fee: 1% on the prepaid amount if paid before 1 year or the outstanding amount exceeds 40% of the principal amount.

- Stamp and Property valuation: all relevant stamp and property valuation charges must be borne by the customer.

- Loan Tenure: for term loan maximum 5 years for fixed asset procurement and maximum 3 years for other purposes. For time loan, OD, CC(H), CC(P), L/C,LTR,LIM,BTB L/C, PC, ECG, BG, FDBP, IDBP, AAA all of these for one year.

- Grace period: negotiable depending upon nature of business and purpose of loan.

- Repayment arrangement: monthly installment in case of term loan, monthly installments or lumpsum within expiry in case of time loan.

- Financing mode: term loan, time loan, OD, CC(H), CC(P), L/C,LTR,LIM,BTB L/C, PC, ECG, BG, FDBP, IDBP, AAA.

- Disbursement Precondition: all the documentation formalities must be completed prior to disbursement.

- Debt burden ratio: DBR must not exceed 80%.

- Loan takeover from other bank: in case of loan takeover from other bank, the loan amount will be given in the form of a payment order favouring that particular bank to settle the outstanding as well as the closing charges.

- Contact Point Verification: all address of the applicant and guarantee must be verified by CPV agent where the bank has agreement and in other case branch officials will do the same.

- Approval authority: as per delegation of business power for Small Enterprise financing.

1.11.3. Southeast Shuprova

- Customer segment: any SE Woman Entrepreneur meeting definition criteria and target group criteria of southeast bank’s SME credit policy.

- Proprietorship concern – 100% owned by the woman.

- Partnership concern & Limited Company – 50% or above share owned by the women.

- Purpose: Any justifiable business purpose.

- Nationality: Bangladeshi

- Age limit: From 22 years up to 50 years( the borrower’s age must not exceed 55 at the expiry of loan tenor). In case of partnership firm or private limited company, age of the key person/chief executive officer is to be considered.

- Minimum Income: Minimum income must be commensurate with the amount of loan required.

- Borrower’s eligibility: : to be eligible for this loan borrower must have the following eligibility –

- The legal form of business of the borrower is Sole Proprietorship/Partnership/Private limited company.

- The business is legally valid and the business firm has got all required licenses, permissions, registration certificates which are valid and up to date at the time of application of credit facility.

- The business firm is registered in Bangladesh with majority shares owned by Bangladeshi nationals.

- The borrower’s principal place of business is in Bangladesh.

- The business is profitable and has a defined market with clear growth potentials.

- The entrepreneur is skilled, experienced and so far successful for managing the business for at least 02 (two) years. In special cases, this condition may be relaxed.

- In case of new the entrepreneur, he/she is experienced for at least 02 years in working similar line of business and has technical knowhow about the business which he/she wants to establish. In special case, this condition may be relaxed.

- The age of the proprietor/partners/key person of the business firm is within 22 years to 55 years.

- A clear succession plan is present

- The entrepreneur must be literate as per as practicable.

- The entrepreneur is socially acceptable and his/her reputation, integrity, trustworthiness, commitment are satisfactory.

- Loan size: Taka 2.00 lac to Taka 50.00 lac.

- Security arrangement: the following security is required for this product as per case basis –

- Hypothecation on the inventory, receivables, advance payments, plant and machinery.

- Personal guarantee of the borrower. In case of limited companies, guarantee of the directors other than nominee directors shall be obtained.

- Personal guarantee of spouse(if married) or parents(if unmarried) of the borrower.

- Personal guarantees of two shop owners of the respective market/two businessmen/ any other person acceptable to the bank.

- Post dated cheques for all installments and one undated cheque for full loan value including full interest.

- Usual charge documents.

- Any other securities to be deemed suitbable by the bank depending on banker customer relationship.

- The full amount may be allowed without any collateral security

- Documentation: : there are two types of documentation. Preapproval documentation and post approval documentation.

Preapproval documentation

- Photograph of the applicants

- Valid trade license

- At least 2 years old trade license.

- Partnership deed = notarized/registered by SRO

- M/A or A/A including certificate of incorporation duly certified by registrar Joint Stock Companies RJSC and attested by the Managing Director accompanied by an up to date list of Directors.

- Income Statement and Balance Sheet for last 3 years.

- Passport/ National ID/ Certificate from UP chairman or Ward Commissioner confirming applicant’s age, nationality, address.

- Duly filled in RFCF which will be provided by bank

- Duly filled in Personal Net Worth Statement of the applicants and guarantors

- Duly filled in CIB forms

- Any other documentation deemed to be necessary by the bank

Post approval documentation

- Acceptance of the Sanction advice.

- Others as per the sanction advice.

- Insurance: the hypothecated stocks/items will remain insured minimum 10% above the credit facilities covering Fire, RSD, Theft and Burglary, Flood & Cyclone, MBD with Bank mortgage clause, cost of which to be borne by the client. If the client is unwilling to insure the hypothecated stock covering theft and burglary and Flood & Cyclone, an undertaking is to be obtained from the client to the effect that in case of Theft and Burglary, Flood & Cyclone and MBD the client will bear all the losses.

- Loan processing fee : 1% on the approved loan amount .

- Interest rate or commission: if loan is funded then 13% -16% per annum. However, the rate may be changed based on the market condition and policy of the Bank. If the loan is nonfunded then charge is par bank schedule.

- Overdue service charge: 2% per annum above the regular interest rate on the overdue amount.

- Early settlement/Prepayment fee: 1% on the prepaid amount if paid before 1 year or the outstanding amount exceeds 40% of the principal amount.

- Stamp and Property valuation: all relevant stamp and property valuation charges must be borne by the customer.

- Loan Tenure: for term loan maximum 5 years for fixed asset procurement and maximum 3 years for other purposes. For time loan, OD, CC(H), CC(P), L/C,LTR,LIM,BTB L/C, PC, ECG, BG, FDBP, IDBP, AAA all of these for one year.

- Grace period: negotiable depending upon nature of business and purpose of loan.

- Repayment arrangement: monthly installment in case of term loan, monthly installments or lumpsum within expiry in case of time loan.

- Financing mode: term loan, time loan, OD, CC(H), CC(P), L/C,LTR,LIM,BTB L/C, PC, ECG, BG, FDBP, IDBP, AAA.

- Disbursement Precondition: all the documentation formalities must be completed prior to disbursement.

- Debt burden ratio: DBR must not exceed 80%.

- Loan takeover from other bank: in case of loan takeover from other bank, the loan amount will be given in the form of a payment order favouring that particular bank to settle the outstanding as well as the closing charges.

- Contact Point Verification: all address of the applicant and guarantee must be verified by CPV agent where the bank has agreement and in other case branch officials will do the same.

- Approval authority: as per delegation of business power for Small Enterprise financing.

1.11.4. Performance of SEBL in Financing SME’s

There is an increasing trend in the disbursements of SME credit by Southeast Bank Limited. Recently 10 SMEServiceCenter’s has been established to concentrate more on SME Financing. Last four quarters performance is analyzed below:

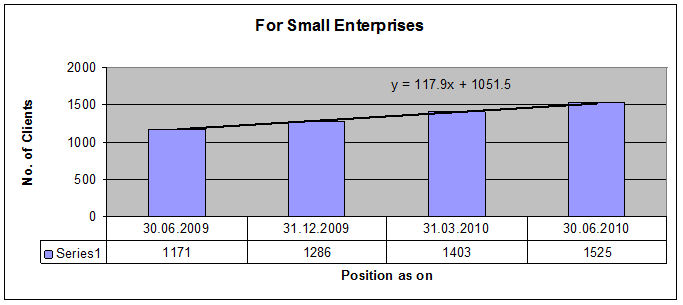

Figure-3.1: Growth of No. of Small Enterprises Client

There is an upward trend in the financing for small entrepreneurs. The number of small enterprises clients has increased in last 12 months. At June 2009, the no. was 1171. It increased to 1286 in December 2009, 1403 in March 2010, and 1525 at June 2010. Details of the quarterly data are provided on Annexure “A”. By analyzing the quarterly data, we see that the linear trend curve is upward sloping. The trend equation is Y = 117.9 + 1051.5, which represents that in every quarter, the no. of small enterprises clients is increases by 118.

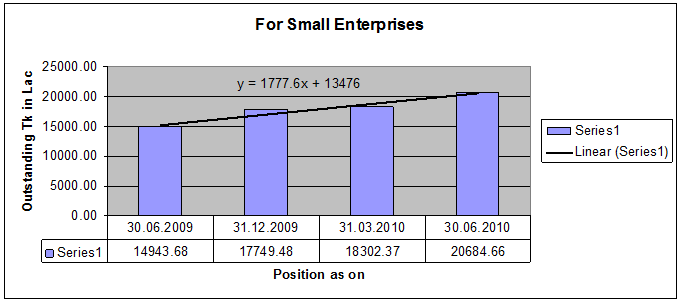

Figure-3.2: Growth of financing Small Enterprises

Again we see that, there is an upward trend in the amount of disbursement made to the small entrepreneurs. The disbursements at June 2009 were 14,944 lac which increased to 17,749 lac in December 2009, 18,302 lac in March 2010 and 20685 lac in June 2010. Details of the quarterly data are provided on Annexure “A”. This is obvious as the no. of clients has increased by the last four quarters. The trend line is upward sloping and the trend equation is 1777.6 x + 13476. The trend equation represents that, in every quarter, the amount of disbursement for small entrepreneur’s increases by approximately 1778 lac.

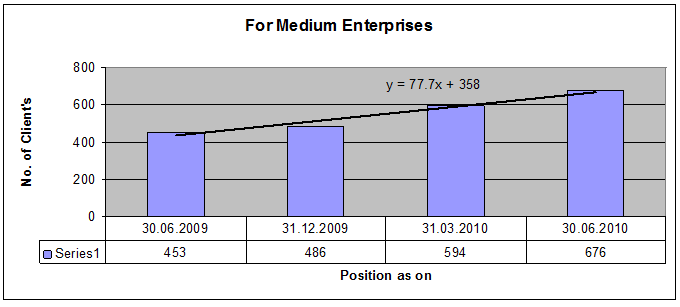

Figure-3.3: Growth of no. of Medium Enterprises client

There is a upward trend in the financing for Medium size entrepreneurs. The number of medium size enterprises clients has increased in last 12 months. At June 2009, the no. was 453. It increased to 486 in December 2009, 594 in March 2010, and 676 at June 2010. Details of the quarterly data are provided on Annexure “A”. By analyzing the quarterly data, we see that the linear trend curve is upward sloping. The trend equation is Y = 77.7 + 358, which represents that in every quarter, the no. of small enterprises clients is increases by approximately 78.

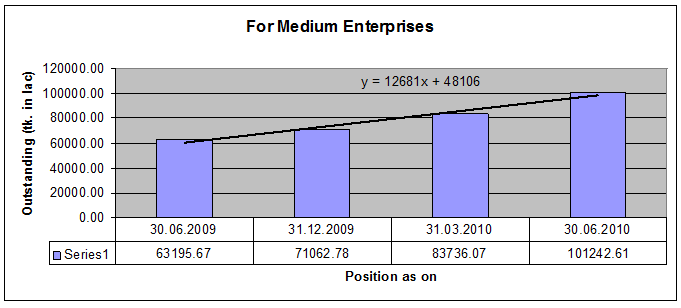

Figure-3.4: Growth of financing Medium Enterprises

We see that, there is an upward trend in the amount of disbursement made to the Medium entrepreneurs. The disbursements at June 2009 were 63,196 lac which increased to 71,063 lac in December 2009, 83,836 lac in March 2010 and 1, 01,243 lac in June 2010. Details of the quarterly data are provided on Annexure “A”.This is obvious as the no. of clients has increased by the last four quarters. The trend line is upward sloping and the trend equation is 12681 x + 48106. The trend equation represents that, in every quarter, the amount of disbursement for Medium size entrepreneurs increases by 12681 lac.

We see from the above data and graph that, though the no. of small enterprises clients is increasing more than the Medium size enterprises, the disbursements for medium size enterprises are higher than for the same of small enterprises.

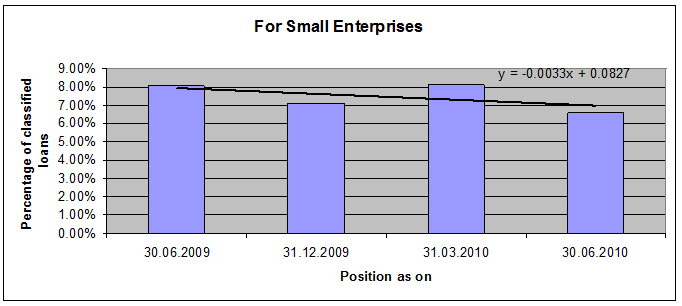

Figure-3.5: Historical trend of classified loan for Small Enterprises

The percentage of classified loans to total disbursements of loans for small enterprises is showing a decreasing trend. The trend line is downward sloping and the eqation is Y = -.0033+.0827. Details of the quarterly data are provided on Annexure “B”.

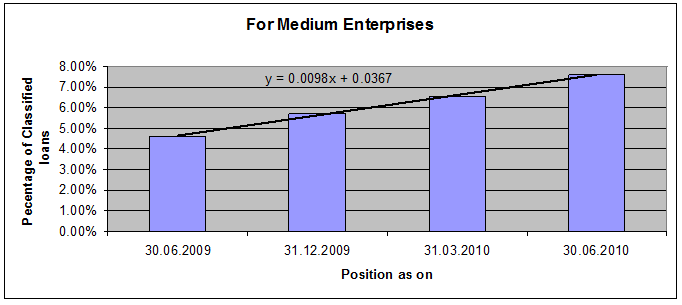

Figure-3.6: Historical trend of classified loan for Medium Enterprises

But for medium size enterprises, the percentage of classified loans to total disbursements of loans for medium size enterprises is showing an increasing trend. The trend line is upward sloping and the equation is Y = .0098+.0367. Details of the quarterly data are provided on Annexure “B”.

1.11.5. Performance of SME in Service Center’s

To Comply with Bangladesh Bank’s guideline and to concentrate more on SME financing, 10 SMEServiceCenter’s had been set up by Southeast Bank Limited. They are still going through the initial stages, with limited resources. It had total of 32 officers for the 10 SME Service Center’s. They are resided in Hathazari, Lohagara, Beanibazar, Tazpur, Biswanath, Shebarhat, Sonagazi, Tangail, Jessore and Brahmanbaria. This year, The Total loans and advances provided by them upto June 2010 is TK .6519 crore. Of them, only four had been able to provide SME loans. All the SMEServiceCenter’s are currently running at losses. The total loss this year up to June 2010 were 1.5129 crore.

1.12.SME Loan Procedures of SEBL

Loan Sanction activities

- Select potential enterprise: For SME loan, in this step the officer conduct a survey and identify potential enterprise. Then they communicate with entrepreneurs and discuss the SME program.

- Loan Presentation: The function of credit officer is to prepare loan presentation based on the information collected and provided by the entrepreneur about their business, land property (Where mortgage is necessary)

- Collect confidential information: Another important function of a CRO is to collect confidential information about the client from various sources. The sources of information are suppliers regarding the client’s payment, customers regarding the delivery of goods of services according to order, various banks where the client has account, which shows the banks transactions nature of the client.

- Open clients accounts in the respective bank: When the CRO decided to provide loan to the client then he/she help the client to open an bank account where SEBL bank has a STD a/c. SEBL will disburse the loan through this account. On the other hand the client will repay by this account. Although there is some exception occur by the special permission of the authority to repay by a different bank account.

- Filled up CIB form:Credit in charge give a CIB (Credit Information Burue) form to the client and the client fill and sign in it. In some case if the client is illiterate then the officer fill the form on behalf of the client. Then officer send the filled and signed form to the SME, head office.

- Sending CIB to Bangladesh Bank: The SME, head office collects all information and sends the CIB form to Bangladesh Bank for clearance. Bangladesh Bank return this CIB form within 10-12 days with reference no.

- CIB report from Bangladesh Bank: In the CIB report Bangladesh Bank use any of the following reference no:

- NIL: if the client has no loan facility in any bank or any financial institution then BB (Bangladesh Bank) use ‘NIL’ in the report

- UC (Unclassified): if the client has any loan facility in any bank or financial institution and if the installment due 0 to 5.99 then BB use UC in the report

- SS (Substandard): if the client has any loan facility in any bank or financial institution and if the installment due 6 to 11.99 then BB use SS in the report

- DF (Doubtful): if the client has any loan facility in any bank or financial institution and if the installment due 12 to 17.99 then BB use DF in the report

- BL (Bad lose): if the client has any loan facility in any bank or financial institution and if the installment due 18 or above then BB uses BL in the report. This report indicates that the client is defaulter and the bank should not provide loan the client.

- Loan decision considering CIB report: Considering CIB report, BRAC bank decide whether it will provide loan the client or not. If the bank decides to provide loan then the SME of head office keep all information and send all papers to the respective unit office to apply with all necessary charge documents.

1.13.Loan Sanction

The respective unit office sanction loan to the client if it is 2 to 5 lacks and the send the sanction letter including all necessary charge documents to the loan administration division for disbursement the loan. If the amount higher than 5 lacks then the respective unit office sends the proposal to SME, head office for sanction. The head of SME sanction the loan and send the sanction letter including all documents to the loan administration division for disbursement and inform the respective unit office regarding sanction of the loan.

1.14.Disbursement of SME Loan

Pre Disbursement Manual Activities

- Prepare loan file: Receiving all documents, Loan Administration Division prepare a loan file with all documents received from the unit office.

- Charge documents checking: The loan administration division checks all charge documents. Following charge documents are checked:

- Money receipt (Risk fund).

- Sanction letter.

- Demand promising note (With stamp)

- Letter of arrangement (With stamp)

- General loan agreement (With stamp)

- Letter of undertaken (With stamp)

- Letter of stocks and goods (With stamp)

- Letter of hypothecation book debt and receivable (With stamp)

- Letter of disbursement

- Photocopy of trade license (attested by credit in charge)

- Insurance (Original copy)

- Blank claque with signature (one cheque for full amount and others same as no of installment on Favor of SEBL , no date, no amount)

- Two guarantors (one must be Spouse/parents)

- If the loan provide for purchase of fixed assets or machineries and if the loan amount is over Taka 50,000/= then the stamp of a certain amount is required.

- Documents deficiency and problem resolving: If there is any error found then it informed to the respective Officer. If the application form is not filled properly then the file send to the officer to fill the application properly. If any document error found then the loan administration division asked the officer to send the require documents and the file stored to the loan administration division.

- Prepare disbursement list: The loan administration division lists all new sanctioned clients’ details and send a request to the treasury through internal mail.

- Disbursement of the amount: Sending the list to the treasury of SEBL bank for disburse the amount, the treasury disburse the amount to the client through the mother account of the clients bank. SEBL disburse amount through corporate branch nearer the SEBL head office and the corporate branch of the respective bank send the amount to the client account in the respective branch.

- Message sent to the unit office: Completing the disbursement, loan administration division sent a SMS to the respective CRO informing the disbursement of the sectioned loan

Bank Ultimus entries for loan disbursement

- Initial ID generation: After sending the list to the treasury, the loan administration division generates an initial ID against the borrower. Entering required information, the banking software Ultimus automatically provide a ID no for the borrower.

- Loan account opening: According to the ID, the loan administration division opens a loan account in Ultimus against the borrower. Entering all required information, the Ultimus automatically give an account no.

- Cost center assign: The loan administration division enter the following information in Ultimus:

- Security details set-up

- Guarantor details set-up

- Loan other details set-up

- Loan sanction details set-up

- Repayment schedule set-up and printing

- Loan activation

- Disbursement and CC wise voucher print

- Disbursement voucher posting

- Risk fund collection: The loan administration division opens a different account risk fund of the client. This is known as loan processing fees. Receiving the risk fund, the loan administration division prints voucher and posting the voucher in the Ultimus. The amount of risk fund is not refundable.

- Activision of the loan: Loan administration division do the following tasks to activate the loan

Post Disbursement Manual Activities

Repayment schedule sent to unit office: Completing the disbursement of the sanctioned amount the loan administration division prepare a repayment schedule in Ultimus and send it to the unit office. CRO from the unit office collect it and reached to the respective client. The client repays the loan according to this schedule.

Loan details Ultimus entry: The loan administration division enters details information regarding the loan in Ultimus. Each officer has an ID no in Ultimus and if there is any error found then the respective officer would be responsible for it. So everybody remain alert at the time of Ultimus entry.

Document stamp cancellation: The loan administration division cancels all document stamps. In future if any client found defaulter and the bank file sued against him then stamps of these document help to get the judgment favor of the bank. But If these stamps are not canceled then the judgment may not on favor the bank.

Send the loan file to archive: completing all activities, loan administration division sends the loan file to the archive for future requirement. In future if any document of the loan account requires then the bank can collect the file from archive and get the necessary document. If the client takes repeat loan then it is not require applying all documents because his all documents stored to the bank.

SME Loan Recovery Procedures

Receive SMS/Fax for installment deposits: When the borrower repays any installment of the loan then he/she informs it to the unit office. Then the unit office sends a SMS through mobile phone or a Fax to the loan administration division informing the repayment. Loan administration division collects these SMS /Fax and takes a paper print of these SMS.

Entry the installment information to Ultimus:

Loan administration division entry the repayment installment information to the banking software Ultimus.

Print Vouchers:

Completing the entry, the loan administration division takes paper print of all vouchers in a prescribed yellow paper.

Cross Check SMS/Fax and solve problems (If any): The loan administration is responsible for all entry in Ultimus. If the there is any error found in future then the respective officer who is entering these information in Ultimus will be liable for it. User ID will easily identify it. So they always aware to ensure the correct entry. Completing the entry of information, they print a hard copy and crosscheck it with the SMS/Fax. If there any error found then it is solved and ensure the correct information entry.

Repayment voucher check and posting: If it confirmed that all entering information is correct and there are no error, then the responsible officer of the loan administration division post it to Ultimus. If one time posted, it is not rectifiable without permission of the higher authority. So the loan administration is always aware regarding the recovery procedures of SME loan.

Closing procedures of SME loan in Southeast Bank:

i)Pre-closing manual activities

Receive SMS/Fax requesting for closing: The borrowers repay the loan as per repayment schedule. When the repayment is being complete the borrower request the unit office to close his loan account. The unit office sends an SMS/Fax the loan administration division requesting to close the loan account of the respective borrower.

Print the SMS/Fax: Receiving the request from the respective unit office, the loan administration division takes a paper print and takes necessary steps to close the account

Bring the loan file from archive: The loan account file of the respective borrower brought from the archive. Cross chequed the documents on file with Ultimus record.

Obtained approval from the concern authority: It is require the permission of concerned authority to close the loan. If concerned authority approved the closing of the loan account then next initiatives are taken.

Checking in Ultimus: The loan administration division checks the loan status in Ultimus. If there is any difference found with the SMS/Fax from unit office and Ultimus then deposits sleeps are re-checked. Then the loan administration division calculates the total balance of the loan account (Ledger balance + buffer interest +Excise duty)

SMS sent to concerned credit officer: Loan administration division sent an SMS to the concerned officer informing the current balance of the requested loan account.

Receive and print closing SMS/Fax checking & freezing: The concerned officer send a final SMS to loan administration division informing that the respective borrower cleared all his liabilities regarding the loan. The loan administration division takes paper print of the SMS, check it and finally close the loan account.

ii) Ultimus entries for loan closing

Pre closing data entry: Completing the manual activities, the loan administration division enters some information to Ultimus for future requirement and complete following tasks:

- Interest/provision charging & print voucher

- Charges collection & print voucher

- Final repayment entry & print voucher

- Final repayment entry checking

- Repayment voucher posting

Activate account closing in Ultimus : Completing above mentioned tasks, the loan administration division finally close the requested loan account in Ultimus.

Post-closing manual activities:

Re-checking with deposit slip: Completing Ultimus activities, the loan administration re-check all deposit sleeps of the loan account. If there is any error found then immediately resolves it otherwise the file sends to the archive for future requirements. The client may take repeat loan in future and then information from this file will help to approve and disburse loan, which will minimize risk. If the client asks to return security then the loan administration releases security completing following tasks:

- Documents photocopy before security release

- Closing certificate issuing and security release

Daily MIS updating for loan closing: Finally the authorized officer of the loan administration division update the banking software Ultimus (Millennium Banking System) by closing the respective loan account.

Concluding remarks

1.1. Findings & Recommendations

CSR

The issue of corporate social responsibility (CSR) has been a focus of interest at corporate level for some time. It focused in particular on how to promote CSR practices among small and medium-sized enterprises (SMEs). One of its main proposals was to set up a new ‘European multi-stakeholder forum’ to examine a range of CSR-related issues. It is argued that the fundamental concept of corporate responsibility is that the corporations have a symbiotic relationship with society, and have responsibilities toward society beyond profit maximization. Ethical commitments and corporate policies should be applicable throughout the company operations. However, a policy may not contribute much to the solution of any practical problem if there is no mechanism for its companywide implementation and measurement of accountability. Transparency of company activities should be ensured so that even the impact of any social responsibility programs can be evaluated by those who are most affected.

In particular, it focused on four main issues:

- improving knowledge of CSR and facilitating the exchange of experience and good practice

- the situation of SMEs and how to foster the concept of CSR among these companies;

- increasing the transparency of CSR practices and tools; and

- Examining the development aspects of CSR.

Raising awareness of core values and key principles

Public authorities and all other stakeholders increase awareness of the key principles and reference texts in the field of CSR. This could be achieved in a variety of ways, including codes of practice, collective agreements, partnerships and global framework agreements. Stakeholders should ensure that they cooperate, particularly in the area of how to turn values and principles into practice.

Collecting, exchanging and disseminating information about CSR

All stakeholders contribute to the process of collecting, exchanging and disseminating information about CSR and that, in order to make information publicly and easily available, there should be a European multi-stakeholder-run internet portal.

Researching and improving knowledge about and action on CSR

There is a lack of empirical research on CSR and therefore recommends that more comparative, qualitative research be undertaken, and in particular multi-disciplinary, multi-stakeholder and ‘action’ research, based on real case studies. Special attention should be paid to areas such as:

- the impact at the macro level of CSR on competitiveness and sustainable development;

- the integration of social and environmental criteria in public procurement and the impact of this;

- supply-chain issues and partnerships between large and smaller companies;

- the relationship between corporate governance and CSR; and

- Making CSR information accessible to consumers, investors and the public.

Enhancing the capacity of business to understand and integrate CSR

There should be more cooperation within and between companies, business organizations and stakeholders concerning the development and implementation of CSR policies. Further, the general availability of easily accessible, ready-to-use, practical information and advice on how to secure ‘coherent, incremental implementation’ of CSR should be increased. There should also be more exchange of experience between purchasers and suppliers so as to build capacities in sustainable supply-chain management.

For companies that are trying to integrate CSR into their daily business operations, the forum recommends that they: adapt tools to take account of their needs and circumstances; be willing to examine their performance against their CSR objectives; offer appropriate training to people working on CSR issues; and focus on developing internal learning opportunities in the area of CSR.

Building the capacity of ‘capacity builders’

There are certain organizations that can play a catalyzing or support role for companies in the area of CSR. These include business advisors, consumer organisations, investors, trade unions and the media. The forum therefore recommends that these organisations develop relevant understanding, skills and capacities in the area of CSR. In particular, business advisors and support organizations should, if they wish, develop know-how on effective CSR practices and assist businesses in their CSR efforts. Finally, public authorities, companies and other stakeholders should support capacity-building activities.

Including CSR in education and the curriculum

The forum states that business schools, universities and other education institutions have an important role to play in building the necessary capacity for CSR strategies. It therefore recommends that CSR and related topics be mainstreamed into traditional courses, in the curricula of future managers and graduate students, in executive education and in other educational institutions.

Creating the right conditions for CSR

Ensure that information reaching different stakeholders is meaningful and credible; identify the items that are pertinent to the company’s vision and objectives; and use relevant tools and frameworks to help them in the development of CSR strategies. Further, it recommends that information about Socially Responsible Investment (SRI) and other funds and their approach to CSR be made accessible so that potential investors and companies can understand, evaluate and use them better.

Developing stakeholder dialogue

Maintaining that constructive dialogue is very important in furthering the aims of CSR, the forum recommends that companies and stakeholders contribute to this. There should be a clear understanding of roles and expectations and a willingness to pursue ‘innovative, inclusive and dynamic cooperation’. It stresses that dialogue with employees and trade union/worker representatives at company level is particularly important.

SME

These are some of the findings and also recommendation that I have reached while preparing this report –

(1) Uniform Definition of SMEs: There should be a consensus on developing a uniform definition of each category of SMEs with generic classification around the country. It should be given standard industrial code (SIC). Without uniform definition, formulation policy and its implementation are not possible.

(2) Seed Money, Leasing, Venture Capital and Investment Funding: There is a need for improving different aspects of financial services of SMEs, such as seed money, leasing, venture capital and investment funding. There is a lack of long-term loans; interest rates are high, Guarantee/Security issues, exchange risks etc. All these limit the development of SMEs. Finance, both short and long term, should be provided at market cost of capital. Fund should be made available through encouragement for setting up ‘Venture Capital’ organization in Bangladesh. The concept of venture capital (VC) has successfully operating in the USA, EU countries, and Canada.

(3) Establishment of Small Business Investment and Lending Corporation (SBILC): We

should start with ‘something effective’ for industrial development in general and the SMEs sector in particular. Such a step, for example, could be the establishment of a separate Corporate body. That means a separate financing institution could be developed, with joint ownership of the public and private sector. To make the proposed initiative effective in achieving its goals, government may set up a Small Business Investment and Lending Corporation (SBILC).

(4) Internal methods of financing SMEs: Small business owners should not rely solely on

financial institutions and government agencies for capital. Instead, the business itself has the capacity to generate capital. This type of financing, called bootstrap financing, is available to virtually every small business and encompasses factoring, leasing rather than purchasing equipment, using credit cards, and managing the business frugally. Another source of financing could be raising fund from share market by flotation of IPO by SME under ‘Group IPO Scheme (GIPS)’. In the case of GIPS, a group of SME would utilize their assets for issuance of public shares to be managed by an independent agency.

(5) Seeking International Financing: Various international donor agency/bank extends financing to SMEs through National Development Financing Institutions (NDFIs). It is found that they are not explored properly. The procedure of those donor agencies/banks for loan facilities to SMEs through NDFIs may be reviewed and term and conditions may be examined in order to make international financing more accessible to SMEs in the country.

(6) The Role of Donors, particularly IDB: Donors, particularly IDB, may come forward to assist the financial institutions in alleviating the constraints faced by SMEs, primarily the access to credit and capacity building. Funding support in the form of grant may be sought from IDB for Technical Assistance and Consulting Services for products and skill development for the SMEs. In this area, BSCIC may also be involved for providing promotional and technical support services to the SMEs with funding support of IDB.

(7) Assistance for SMEs from Board of Investments and Export Development Centres:

Public sector agencies like Board of Investments and Export Development Centres can also provide useful information to SMEs. They can provide necessary information about trade fairs in member countries as well as training in organization of exhibitions. They can identify foreign buyers and assist local SMEs in establishing contacts with them. Information on changing demand conditions in various international markets can be provided and advisory services on exploring trade opportunities can be provided to prospective exporters.

(8) Periodical Professional Training Courses for SMEs & for Entrepreneurship Development: Periodical professional training courses should be arranged for technical staff of SMEs. Moreover training in management of small enterprises and efficientmarketing can also provided. Islamic Chamber regularly organizes training workshopson management, marketing, procurement of technologies, quality control system andfinancing of SMEs, for the benefit of representatives of private enterprises and staff ofmember chambers in different regions of the Islamic World. Training programme workshop should be organized for the development of SMEs capabilities to acquireenhanced knowledge and skills about how to choose, use and improve technology. Atpresent, no such institution exists except a project of the BSCIC called ‘SCITI (Small andCottage Industries Training Institute). IAT, BUET has conducted total eight trainingprograms for the light engineering industries during last several years. Training ondifferent aspects of SMEs activities for entrepreneurs is crucial for the development ofan entrepreneurial.

(9) BSCIC to be reorganized: Most entrepreneurs and businessmen express their dissatisfaction about BSCIC. BSCIC fails to provide needed services to the small industries due to manifold reasons; primarily due to its unorganized management. BSCIC has to be reorganized so that enacted policy for SMEs can be implemented to help grow small industries in the country in a better manner. Alternatively, a separate organization suchas Small and Medium Enterprise Development Authority (SMEDA) may be established to act as a one-stop consultancy Agency to: (a) act as a body for facilitating policy making for SMEs, (b) provide and facilitate support services for SMEs, (c) act as a resource base for the SMEs, and (d) represent SMEs on domestic and international forums. The authority may be state supported, private or jointly supported organization.

(10) Developing Institutional Network through Public-Private Partnership: The design of

most government agencies appears to be overly bureaucratic and unsuitable for effectively supporting SMEs in Bangladesh. As such, re-organization of the design of these agencies has for long been overdue. Public-private sector partnership, by redesigning the existing public agencies, could be developed, developing appropriate institutional network. The objective behind this would be to utilize the strengths of public and private agencies, while neutralizing the limitations, if any, inherent in their existing organizational design.

(11) Establishment of R&D Institute for Enterprise and Entrepreneurship Development,

Training and Research Institute: In a country like Bangladesh, where entrepreneurial initiative is rare and shy, a separate institute for enterprise and entrepreneurship development, training and research should be developed. To make it a ‘centre of excellence’ in SMEs development, it should be designed, involving educational institutions, business associations, relevant government bodies, private research agencies, and individual consultants having experience in SMEs development.

1.2. Conclusion

CSR activities of different organization in Bangladesh are not in accordance with the activities set by the government. This may be done because of the tax benefit that the organization enjoy while exercising this issue. SEBL is no exception in this case. They are also practicing it and try to convey the message that they are serious about it. Social responsibility issues are not a decisive factor for whether or not a company will invest in a country. Companies often argue that ‘if we are not investing someone else will do, and they will do worse than us with regard to social issues’. It seems obvious that one company on its own cannot make a very large and that collective action is required. Collective action clearly can be several things. In theory there could also be a basis for some concerted action in the activities of the various business forums and associations. Social reporting practices are done voluntarily by a very small number of listed companies in Bangladesh. The level of disclosures is also very poor. Disclosures made are limited to descriptive information only without their quantification. Companies portray CSR information in different places of the Annual Report. There is no standard or the reporting framework. The main problems involved in the CSR reporting are lack of provision in the Companies Act 1994, lack of separate International Accounting Standard, lack of understanding and awareness , lack of qualified and trained personnel and lack of motivation, poor performance and fear of bad publicity and finally lack of application and control of laws. The limitations of traditional legal approaches now mean that we must be innovative in developing effective regulatory measures to implement CSR.

For more parts of this post-

An Empirical Study On Southeast Bank Limited.(Part-1)

An Empirical Study On Southeast Bank Limited.(Part-2)

An Empirical Study On Southeast Bank Limited.(Part-3)

An Empirical Study On Southeast Bank Limited.(Part-4)

An Empirical Study On Southeast Bank Limited.(Part-5)

An Empirical Study On Southeast Bank Limited.(Part-6)

An Empirical Study On Southeast Bank Limited.(Part-7)