The term “annual percentage rate (APR)” refers to the annual interest rate that a person has to pay on a loan, or earn on a deposit account. It is corresponding sometimes to a nominal APR and sometimes to an effective APR (EAPR). APR is employed on everything from mortgages and car loans to credit cards. When choosing between credit cards, APR will help us to calculate how costly a charge would be on each. This covers any commissions or other expenses related to the sale but does not take into account the compounding.

APR may be a finance charge expressed as an annual rate. It provides consumers with a bottom-line number they will easily compare with rates from other lenders. Ultimately, APR could be a simple percentage term accustomed expresses the numerical amount paid by a private or entity yearly for the privilege of borrowing money. In some areas, the annual percentage rate (APR) is that the simplified counterpart to the effective rate that the borrower can pay on a loan.

Credit card companies typically offer a grace period for new acquisitions. In many countries and jurisdictions, lenders (such as banks) are forced to report the “cost” of borrowing as a form of consumer protection in some uniform way. If we just make transactions and pay off our ending balance by the due date per month, we pay only the amount that we owe without interest. If we plan to hold a balance on our bill, however, we will pay the accepted interest on our outstanding balance. Before any agreement is signed, financial institutions will need to report the Existence of a financial instrument.

Each time an individual or element obtains cash as a customary advance (think acquiring to buy a house, vehicle, or other major budgetary costs), there is an expense for the benefit of getting cash, known as premium. It can be difficult for customers to compare APRs because lenders have the ability to select which charges are included in their rate calculation. The (effective) APR was intended to make lenders and loan choices easier to compare. An APR may not mirror the genuine expense of obtaining in light of the charges that are incorporated or barred.

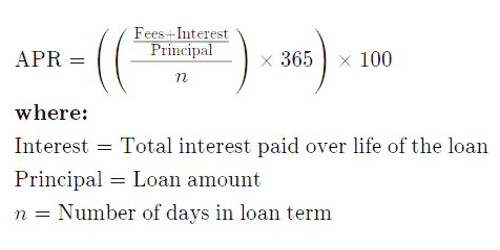

The nominal APR is measured as: the rate, multiplied by the number of payment periods in a year, for a payment period. The monthly payment is also used to pay back both the balance of the principal loan and the interest owed on the loan. It calculates what level of the foremost we will pay every year by considering things, for example, regularly scheduled installments. APR is additionally the yearly pace of premium paid on ventures without representing the exacerbating of enthusiasm inside that year. The monthly payment sum stays the same, but as more installments are made, the breakdown (or what percentage of the sum goes toward repaying the principal and what percentage goes toward the interest) varies.

The rate is determined by multiplying the periodic rate of interest by the number of periods in a year the periodic rate is applied. It does not mean how many times the equilibrium rate is applied.

Individuals or businesses don’t seem to be always on the paying end of the APR. When a private or business maintains a time deposit account at a financial organization, they will earn interest on their deposits. The European Union (EU) focuses on consumer rights and financial transparency in defining this term. One formula for calculating the rate of interest was established for all EU member nations, although individual countries have some leeway over determining the precise situations within which this formula is to be adopted above and beyond EU-stipulated cases.

However, the exact legal meaning of “effective APR” or EAR, depending on the type of fees involved, such as participation fees, loan origination fees, monthly service fees, or late fees, will vary greatly in each jurisdiction. The effective APR has been called the “mathematically-true” interest rate for each year. The APR borrowers are charged also depends on their credit. Loans offered to those with excellent credit carry significantly lower interest rates than the rates charged to those with bad credit.

For any person who borrows money, it is important to understand the rate and conditions of their APR, including whether it is fixed or variable. The APR does not actually reflect the total amount of interest paid over a year: if one pays part of the interest before year-end, the total amount of interest paid is less. This empowers the borrower to build up a financial plan, utilize their credit shrewdly, and make steady installments toward both the chief advance equalization and the enthusiasm for the benefit of acquiring cash. A fixed APR advance has a financing cost that is ensured not to change during the life of the advance or credit office. An APR contingent loan has an interest rate that can adjust at any given time. Inconsistent or missed payments may make a huge difference in the overall amount of interest charged over the loan’s lifespan.

Information Sources: