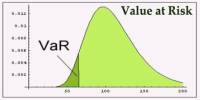

Appropriation is when cash is aside for a particular and unique intent or purpose. Companies, states, and individuals all appropriate resources for particular goals. For short-term or long-term needs that include employee wages, research and development, and dividends, a business may be ideal for cash. The budgeting process includes appropriating money during the fiscal year for various business expenses. Appropriations inform us how money or capital is distributed, whether it is through the budget of the federal government or the use of cash and capital by a corporation.

Appropriations by governments are made for administrative subsidizes every year for different projects. Appropriations for organizations may likewise be known as a capital portion. The income proclamation gives data about an organization’s money receipts and money installments during a period. Furthermore, it offers insight into how a corporation allocates its cash through operational activities, acquisition activities, and funding activities. Appropriation may also refer to the division of land or structures, such as municipal buildings or parks, for public use. Appropriation can also refer to when, by eminent domain, the government claims the private property.

(Example of Appropriation)

As discussed below, it is important to understand that the appropriation of cash spending is very much up to the interpretation of the three forms of corporate activities:

- Operating Activities: Operating activities are the chief revenue-producing activities of a corporation. Transactions that affect net income are operating flows. There are cash inflows and outflows under running operations, but only outflows can be appropriated. Companies may make appropriate payments or even resolve asset retirement commitments to vendors and creditors.

- Investing Activities: Investing activities are identified with the assortment of credits, venture exchanges, and exchanges spinning around property, plant, hardware, and immaterial resources. Capital use is an organization’s securing of long haul resources that will produce income in future periods. Therefore, if a corporation appropriates significant sums of capital for the purchase of productive assets, the dedication of the company to growth is implied.

- Financial Activities: Financial operations result in changes to the composition of the capital structure of a corporation. Cash flow funding revolves around capital generated by debt or equity, which eventually results in contractual cash payments or return on equity investments to lenders and shareholders. When leveraging debt to increase shareholder wealth, businesses carefully allocate their capital structure between equity and debt.

In the United States, allotment bills for the national government’s spending are passed by U.S. Congress. The public authority’s monetary year runs from October 1 through September 30 of each schedule year. Each financial year, the U.S. President presents a spending proposition to Congress. Spending advisory groups in the U.S. House and Senate, at that point, decide how the optional bit of the spending will be spent through a spending goal measure. For several initiatives that drive value for their people, governments are responsible for appropriating money. Federal services such as Social Security and Medicare fall into the category of discretionary spending and receive funds by an automatic formula instead of by the process of appropriations.

In achieving a higher credit score, the correct appropriation of capital for short-term and long-term debt obligations is important. Credit scores can be a crucial factor in the ability to live and more significantly, the cost of lending money from financial institutions. Corporate appropriations apply to how a corporation allocates its funds which may include share buybacks, dividends, debt repayment, and fixed asset acquisitions. Land, services, and equipment are fixed assets. In short, it is important to investors and the company’s long-term growth prospects how a company allocates capital spending.

Mechanical advancement prompts more improved planning apparatuses for people. Mobile phone applications give away to people to micromanage use on an occasional or movement type premise. Investors are watching to decide whether a company wisely uses its cash to generate shareholder value or whether the company uses its cash frivolously, which may contribute to the loss of shareholder value. For investors, the cash flow statement represents the financial health of a company, as the more cash available for business operations is generally the better.

Information Sources: