The asset turnover ratio, also known as the total asset turnover ratio, is the ratio between a company’s net sales and the total average assets it holds over time; it aids in determining whether the company is generating enough revenue to justify holding a large amount of assets on its balance sheet. The ratio can be utilized as a marker of the proficiency with which an organization is utilizing its resources to produce income. The resource turnover proportion recipe is equivalent to net deals isolated by the aggregate or normal resources of an organization. When compared to competitors with a lower ratio, a company with a high asset turnover ratio performs more effectively.

To put it another way, this ratio demonstrates how well a corporation can use its assets to create revenue. Fixed asset turnover, which measures a company’s use of fixed assets to create revenue, and working capital turnover, which measures a company’s use of current assets minus liabilities to produce revenue, are two types of asset turnover. The higher the asset turnover ratio, the more effective an organization is at producing income from its resources. On the other hand, if an organization has a low resource turnover proportion, it demonstrates it isn’t productively utilizing its resources for creating deals.

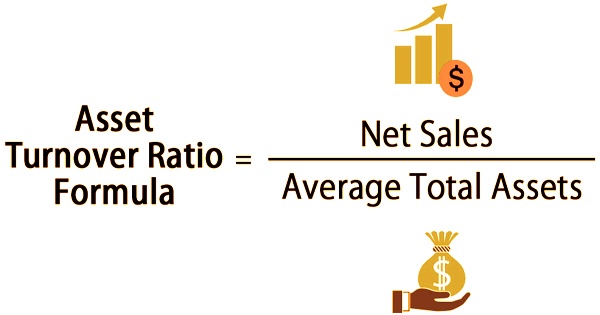

The formula for the ratio is as follows:

Asset Turnover Ratio = Net Sales / Average Total Assets

Where:

Returns and refunds must be stripped out of total sales to genuinely gauge the firm’s assets’ potential to create sales, which is calculated using net sales from the income statement.

The average of aggregate assets at the end of the current or previous fiscal year is referred to as average total assets. It is possible to utilize a more detailed weighted average calculation, although it is not required.

Investors utilize the resource turnover proportion to think about comparable organizations in a similar area or gathering. This proportion estimates how effectively a firm uses its resources to create deals, so a higher proportion is in every case more great. Higher turnover proportions mean the organization is utilizing its resources all the more proficiently. Lower ratios indicate that the organization isn’t making the best use of its resources and, more than likely, has management or production issues. Large asset sales, as well as considerable asset purchases in a given year, can have an impact on a company’s asset turnover ratio.

If the ratio is less than one, the company is in trouble since its total assets can’t generate enough revenue at the end of the year. In other words, for every dollar invested in assets, the company generates one dollar in revenue. The asset turnover ratio utilizes the worth of an organization’s resources in the denominator of the equation. To decide the worth of an organization’s resources, the normal worth of the resources for the year needs to initially be determined.

- Locate the value of the company’s assets on the balance sheet as of the start of the year.

- Locate the ending balance or value of the company’s assets at the end of the year.

- Divide the sum of the beginning and ending asset values by two to get the year’s average asset value.

- Locate total sales it could be listed as revenue on the income statement.

- Divide total sales or revenue by the average value of the assets for the year.

The asset turnover ratio, like other ratios, is based on industry standards. Some industries make better use of assets than others. In most circumstances, the asset turnover of the industry in which the firm operates is less than 0.5, while this company’s ratio is 0.9. This company is doing well irrespective of its lower asset turnover. To truly understand how successfully a company’s assets are being utilized, it must be compared to other businesses in its field.

There are several problems with the ratio, which are:

- The metric presupposes that more sales are good, but the true measure of success is the capacity to make a profit from those sales. As a result, a high turnover ratio does not always imply higher earnings.

- The ratio is only relevant in industries that are more capital-intensive, such as manufacturing. The ratio is less relevant in the services business because the asset base is often much smaller.

- If a firm chooses to outsource its manufacturing facilities, it will have a considerably smaller asset base than its competitors. Even though the company is no more profitable than its competitors, this can result in a substantially greater turnover rate.

- A corporation may be penalized if it intentionally increases its assets to strengthen its competitive position, for as by expanding inventory levels to fulfill more client orders in a shorter amount of time.

- The denominator includes accumulated depreciation, which varies depending on a company’s accelerated depreciation strategy. This has nothing to do with actual performance, but it can distort measurement findings.

The benchmark asset turnover ratio can fluctuate significantly relying upon the business. Ventures with low overall revenues will in general create a higher ratio and capital-concentrated businesses will in general report a lower ratio. Typically, the asset turnover ratio is calculated on an annual basis. The higher the asset turnover ratio, the better the company performs, because higher ratios indicate that the company generates more revenue per dollar of assets. The total asset turnover ratio (TATR) is a general efficiency metric that determines how effectively a corporation utilizes all of its assets. This gives creditors and investors an understanding of how a firm is run and how its assets are used to make things and sell them.

The asset turnover ratio will in general be higher for organizations in specific areas than in others. Retail and purchaser staples, for instance, have somewhat little resource bases however have high deals volume in this manner; they have the most elevated normal asset turnover ratio. Looking at the proportions of organizations in various businesses isn’t proper, as enterprises shift in capital seriousness. Companies in sectors like utilities and real estate, on the other hand, have vast asset bases and limited asset turnover. Investors may also be interested in how corporations employ more specific assets, such as fixed assets and current assets. Fixed asset turnover ratios and working capital ratios are turnover ratios that are similar to asset turnover ratios and are frequently used to measure asset efficiency.

Information Sources: