3.4.6 Double Benefit (TGDS)

- Minimum Tk. 5,000/- or any multiple of this amount may be deposited to open this DGDS A/C

- This deposit shall be accepted only for the period of 6 (Six) years. The depositor must maintain a saving or current account with any of the brunches of BCBL.

- “Deposit Receipt” will be issued to the customer while receiving deposit.

- Any Bangladeshi above 18 years of age can open this Account. A minor can also open this account by his/her own name. In this case his/her legal guardian will operate the account.

- If the depositor wants to encash this ‘Deposit Receipt” prior to maturity, profit will be paid at normal saving rate. But profit will be given if such encashment is made before completion of 6 (Six) month.

- In the event of death of the depositor prior to maturity of principal with profit will be disbursed his/her nominee(s). in absence of nominee(s), lawful heir(s) may receive the above on submission of succession certificate.

- Credit facility upto 80% may be availed against the deposit. In that case the client will be required to pay interest on the loan amount as determined by the Bank.

- If the “Deposit Receipt” is lost prevailing terms/condition in force fro issuing a duplicate receipt for term deposit will be applicable for issuing a “Duplicate Receipt”

- If Government Tax is imposed on earned income, depositors account will be debited to pay such Taxes.

- Money laundering prevention act, shall be exercise as per rules of BB.

- BCBL reserves the right to change/enhance the above terms & condition including revision of rate of interest.

- Photograph of Nominee duly attested by the applicant is to be enclosed herewith.

3.4.7 Triple Benefit (TGDS)

- Minimum Tk. 5,000/- or any multiple of this amount may be deposited to open this TGDS A/C

- This deposit shall be accepted only for the period of 9 (Nine) years 9 (Nine) months. The depositor must maintain a saving or current account with any of the brunches of BCBL.

- “Deposit Receipt” will be issued to the customer while receiving deposit.

- Any Bangladeshi above 18 years of age can open this Account. A minor can also open this account by his/her own name. In this case his/her legal guardian will operate the account.

- If the depositor wants to encash this ‘Deposit Receipt” prior to maturity, profit will be paid at normal saving rate. But profit will be given if such encashment is made before completion of 6 (Six) month.

- In the event of death of the depositor prior to maturity of principal with profit will be disbursed his/her nominee(s). in absence of nominee(s), lawful heir(s) may receive the above on submission of succession certificate.

- Credit facility upto 80% may be availed against the deposit. In that case the client will be required to pay interest on the loan amount as determined by the Bank.

- If the “Deposit Receipt” is lost prevailing terms/condition in force fro issuing a duplicate receipt for term deposit will be applicable for issuing a “Duplicate Receipt”

- If Government Tax is imposed on earned income, depositors account will be debited to pay such Taxes.

- Money laundering prevention act, shall be exercise as per rules of BB.

- BCBL reserves the right to change/enhance the above terms & condition including revision of rate of interest.

- Photograph of Nominee duly attested by the applicant is to be enclosed herewith.

3.5 Product & Services: Loan & advances

Like Deposit Scheme, BANGLADESH COMMERCE BANK LIMITED have formulated the following Loan Schemes

- Financing of Trade

- Term Loan

- Financing of small and medium Industries

- Agriculture Loan

- HouseBuilding Loan

- Financing of Transport

- Financing of Non-Banking Financial Institute

- Syndicate/Club Loan

- Loan against FDR/Loan against Special Scheme

- Financing of Export-Import

- Stuff Loan

- Bill Purchase/Loan against Share

- CCS

- Special Credit Scheme for Service holder

- Credit Scheme for Women entrepreneurs

- Prime Customer (5.00 crore or higher .

3.5.1 Financing of small and medium Industries

The main thrust of financing is given on small and medium Industries. This is the priority sector of our Bank.

3.5.2 Financing of Trade

Trade Finance includes CC (Cash Credit), SOD (Secured Overdraft) FO (Financial Obligation) and SOD (Secured Overdraft) RE (Real Estate) working capital. This will help the local trades and Businessmen to expand their trade and business unhindered.

3.5.3 Financing of Import & Export

All necessary Financing for Import & Export are done by opening L/C, buying documents providing, LIM, PAD, PC and LTR facilities for smooth functioning of foreign Trade.

3.5.4 Micro Credit and Micro Enterprise Scheme

For poverty alleviation micro credit is provided to poor people without security for their self-sustenance to rehabilitate them in the society.

3.5.5 Credit Scheme for Women entrepreneurs

For developing Women entrepreneurship in the country this type of credit is extended to unemployed and skilled women, through which they can transform their micro credit in to small enterprises

3.5.6 Consumers Credit Scheme

Domestic useable items i.e. Computer, Photocopier, Furniture, Washing Machine, Air Cooler, Refrigerator, Sewing Machine, Car, Pressure Cooker etc are financed for comfortable and modern living of the people of limited source of income.

3.5.7 Special Credit Scheme for Service holder

Under this scheme service holders of govt. bank or autonomous bodies are provided with 6 month’s basic salary as loan realizable in 18 equal installments. Professionals are also covered enter this special credit scheme

The Interest Rate of above Loans & Advances criteria are given below

| SL | LOANS & ADVANCES | INTEREST RATE(Applicable From 01.07.2008) |

| 1 | Financing of Trade | |

a | CC (Hypo) | 16.00% |

b | CC (Pladge) | 16.00% |

c | SOD (RE) | 16.50% |

d | LTR/LIM | 17.00% |

| 2 | Term Loan | |

a | Big & Medium Industry | 14.75% |

b | Small Industry (SME) | 18.00% |

| 3 | Financing of small and medium Industries | |

a | Big & Medium Industry | 14.50% |

b | Small Industry (SME) | 18.00% |

| 4 | Agriculture Loan | 12.00% |

| 5 | House Building Loan | |

a | Residential | 16.50% |

b | Commercial | 16.50% |

| 6 | Financing of Transport | 16.50% |

| 7 | Financing of Non-Banking Financial Institute | 16.00% |

| 8 | Syndicate/Clab Loan | 15.50% |

| 9 | Loan against FDR/Loan against Special Scheme | 03.00% more |

| 10 | Financing of Export-Import | 07.00% (Fixed) |

| 11 | Stuff Loan | |

a | Vehicle | Bank Rate |

b | Against PF | 09.50% |

c | HouseBuilding | 08.00% |

| 12 | Bill Purchase/Loan against Share | 16.50% |

| 13 | CCS | 17.00% |

| 14 | Special Credit Scheme for Service holder | 17.00% |

| 15 | Credit Scheme for Women entrepreneurs | 16.00% |

| 16 | Prime Customer (5.00 crore or higher ) | 16.00% |

3.6 Product & Services: Services

BCBL provides specialized services to its clients-

3.6.1 Capital Market Operation

The Bank operates capital market operation which will include Portfolio Management, Investors Account etc.

3.6.2 Counter for Payment of Bills

Dedicated counters are available at BCBL’s branches to receive the payment of various utility (DESA, Titas, BTCL) bills.

3.6.3 Other Services

- Remit funds from one place to another through DD, TT and MT etc.

- Conduct all kinds of foreign exchange business including issuance of L/C, Travelers’ Cheque etc

- Collect Cheques, Bills, Dividends, Interest on Securities and issue Pay Orders, etc.

- Act as referee for customers.

3.7 Various services of BCBL: Charges

Revised Schedule of Charges-

| SL | Type of Services | Service Charge+15.00% VAT (where applicable) |

| 1 | Remittance -Inland(DD/TT/MT issuance) | 0.15%, Min. Tk.50/- |

| At actual | ||

| At actual, Min. Tk.20/- | ||

| 2 | Issuance of Payment Order | Up to Tk.1.00 Tha Tk.20/- |

| Up to Tk.1.00 lac Tk.30/- | ||

| Up to Tk.5.00 lac Tk.50/- | ||

| Above Tk.5.00 lac Tk.100/- | ||

| 3 | Issuance of duplicate instrument | At actual Min. Tk.50/- |

| 4 | Cancelation Of DD/TT/PO | At actual Min. Tk.50/- |

| 56 | Cancellation of DD/TT/MT/PO | Out of Clearing area, 0.15%, Max-Tk.1000/-, Min-Tk.100/- |

| If Dishonored, Tk.50/- | ||

| At Actual conveyance | ||

| Cancellation of Out of Station Cheque/Document Bill | 0.15%, Max-Tk.1000/-, Min-Tk.100/- | |

| If Dishonored, Tk.50/- | ||

| At Actual conveyance | ||

| 7 | Standing Instructions | At actual Min. Tk.50/- |

| Every Instruction Tk.50/- @ monthly applicable | ||

| 8 | Inland Bill/Cheaque Cross | 0.15%, Max-Tk.1000/-, Min-Tk.50/- |

| Tk.20/- | ||

| At actual Min. Tk.50/- | ||

| Interest @ OT Rate | ||

| 9 | Guarantee (Internal) | First 3 months @ 0.75% |

| 100% margin Tk.1000/- | ||

| 10 | Locker | Small Per Year Tk.2000/- (Without Insurance Premium) |

| Medium Per Year Tk.2000/- (Without Insurance Premium) | ||

| Large Per Year Tk.2000/- (Without Insurance Premium) | ||

| 11 | Incidental Charge | Personal Tk.300/- |

| Commercial Tk.500/- | ||

| 12 | Account Close | Personal Tk.100/- |

| Commercial Tk.200/- | ||

| 13 | A/C Statement | First Time Free, Next every Tk.100/- |

| 14 | Loan Processing Fee (SME) | 1.00% on approved Loan |

| 15 | Loan Appraisal Fee | 0.25% on approved Loan Max Tk.400000/- Renewal Tk.200000/- |

| 16 | Certificate Issue/Solvency Issue | Tk.200/- |

| 17 | Service Charge | Yearly Tk.100/- |

| 18 | Cheaque Book Issue | Tk.1.00 per leaf and Tk.2.50 per leaf for new MICR |

| 19 | Cheaque Bounce/Return | Tk.200/- |

4.1 Investment policy of the Bank with Financial overview

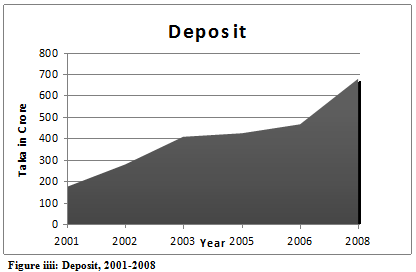

4.1 Deposit

At the end of December 2008 the deposit of the Bank was Tk. 678.69. The growth of deposit is 19.43% compared to last year. The Bank has given great stress on procurement of low cost fund including cost free fund for bringing down the average cost of fund.

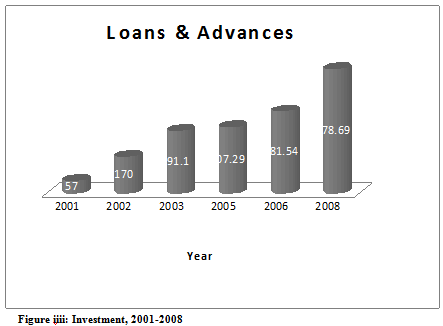

4.2 Loans & Advances

The Loans & advances of the Bank registered an impressive growth during the year 2008. The total loans & advances amounting to Tk. 578.60 Crore. The advance portfolio of the Bank is well diversified and covers funding to a wide spectrum of business and industries including agro-based and agro processing, ship scraping, steel& engineering, paper & paper products chemical, construction, real-estate and loans under consumers, credit schemes, various trading business, service holders loan and women entrepreneurs of the country.

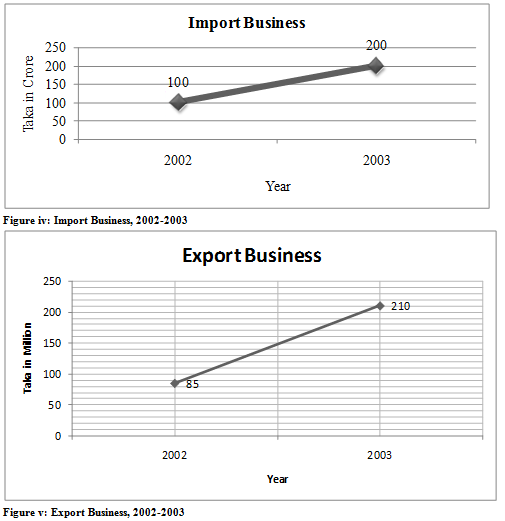

4.3 International trade

The international trade constitutes a major business activity conducted by the Bank. The important business of the Bank indicated a significant increase in the year. The import business during the year 2003 reached to Tk. 200.00 crores against Tk. 100.00 crores of the previous year which reflected a growth of 100%. The import business made by the Bank resulted in steady increase of revenues for the bank in spite of the downward trend in international trade. The export business handled by the Bank during the year 2003 was Tk. 210.00 crores compared to Tk. 85 crores in the previous year. The slow growth in export business is due to debacle in geopolitical arena, surrounding economic instability.

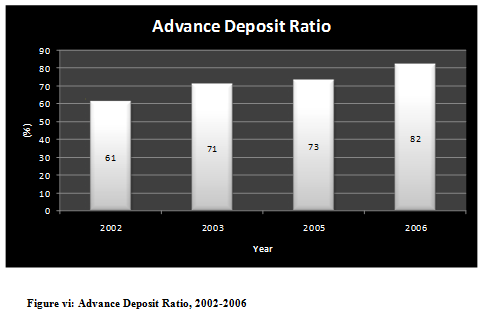

4.4 Advance Deposit Ratio

If we observe the Ratio on Investment and Deposit, it appears that the MFI uses most of there deposits to investment which refers that the MFI mobilize its resources for the best reproduction.

In 2002 the ratio was 61.00%. It rises to 82.00% in 2006.

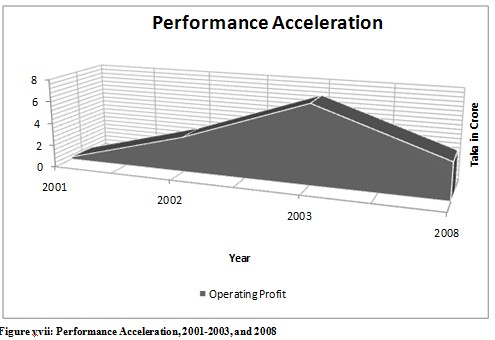

4.5 Operating Result and Profit

The Bank earned an operating profit of Tk. 7.04 crore during the year before making any provisions. The operating profit of the Bank during the year 2002 was Tk. 3.15 crore and this the Bank attained a growth of 124% in respect of operating profit. Due to having a cumulative loss of Tk. 5.43 crore no provision for income tax has been provided. After keeping a provision for loans & advances amounting to Tk. 2.23 crores the rest amount has been adjusted with cumulative loss which reduced the cumulative loss to Tk. 1.58 crores.

4.6 Guarantee Business

The Bank issued guarantees amounting to Tk. 50.00 crores during the year compared to Tk. 20.00 crores in the previous year registering a growth of 250%. The guarantees were issued in favour of different Govt. authorities, Autonomous bodies, Corporations, Multinational Companies etc. against proper securities on behalf of the clients of the Bank.

4.7 Investment

The Investment portfolio of the Bank during the year 2003 was Tk. 14.00 crore against Tk. 6.15 crore in the previous year registering a growth of 133%. The portfolio of investment included Govt. Treasury Bills, Prize Bonds, Share in Public Limited Companies etc. The Bank has always given emphasis on investment of fund in high yield areas and maintains Statutory Liquidity Requirement (SLR) as fixed by Bangladesh Bank.

4.8 Bank’s Performance at Glance

| BCBL at a Glance |

Figure in Crore | |||||

| Sl. No. | Particulars | 2001 | 2002 | 2003 | 2008 |

| 01. | Authorized Capital | 200.00 | 200.00 | 200.00 | 200.00 |

| 02. | Paid-up Capital | 82.00 | 692.00 | 92.00 | 105.79 |

| 03. | Loans & Advances | 57.00 | 170.00 | 291.10 | 578.60 |

| 04. | Deposits | 176.00 | 280.00 | 409.39 | 678.69 |

| 05. | Investment | 1.00 | 1.02 | 0.90 | – |

| 08. | Operating Profit | 0.22 | 3.15 | 7.04 | 3.25 |

| 09. | Loan as a % of total Deposit | 71.00% | 61.00% | 32.00% | – |

| 11. | Number of Employees | 384 | 375 | 436 | 433 |

| 12. | Number of Branches | 24 | 25 | 25 | 25 |

5.1 Deposit Products: Standard Bank Ltd.

5.1.1 SRDP – SBL Regular Deposit Program

SRDP is a special savings plan that allows you to save and a monthly basis and gets a handsome amount at maturity. SRDP Account gives you the convenience of saving regularly in time with your monthly income stream. So, if you want to create a big savings to fulfill your cherished dream SRDP in the right solution.

-To open a SRDP Account all you need is to be over 18 years of age and a Bangladeshi Citizen.

-You can open a SRDP Account within 10 days of the month by filling up a prescribed account opening form at any Branch of Standard Bank Limited.

-You need to open a SRDP Account for 3 (three) or 5 (five) years, i.e. 36 and 60 equal monthly deposits respectively.

-Under the SRDP you can choose between a minimum monthly deposit amount of Tk.300.00 and a maximum amount of Tk.1000.00

Monthly deposit amount and amount receivable after 3/5 years

| Installment Amount | Matured Value | ||

| 3 years | 5 Years | ||

| Tk. | 300.00 | 12,550.00 | 22,800.00 |

| Tk. | 500.00 | 20,900.00 | 38,000.000 |

| Tk. | 1,000.00 | 41,800.00 | 76,000.000 |

| Tk. | 2,000.00 | 83,600.00 | 1,52,000.00 |

| Tk. | 2,500.00 | 1,04,500.00 | 1,90,000.00 |

| Tk. | 5,000.00 | 2,09,000.00 | 3,80,000.00 |

| Tk. | 10,000.00 | 4,18,000.00 | 7,60,000.00 |

5.1.2 Flexibilities

- Easy procedure to open SRDP

- Upto 80% loan facility against SRDP deposit.

5.1.3 SRIP – SBL Regular Income Program

SBL Regular Income Program is an income program, which helps you to earn a monthly fixed amount on your deposits at SBL for a period of 3 years.If you are over 18 years of age, a Bangladeshi citizen and an account holder of SBL,

you are eligible to open SBL Regular Income Program with our any branch and any time you want. It’s that easy.

Deposit Amount | Monthly Interest Payable |

| 50,000.00 | 450.00 |

| 100,000.00 | 900.00 |

| 2,00,000.00 | 1800.00 |

| 3,00,000.00 | 2700.00 |

| 4,00,000.00 & above | 3600.00 & above |

- Easy procedure to open SRIP

- Automatic profit transfer to linked account

- Upto 80% loan facility against SRIP deposit.

5.2 (DI+) Double Income Plus

Double Income Plus is a 06 (six) years Program. Your deposit doubled plus in 06 (six) Months. Minimum initial deposit for the program is tk from 10,000/- (Ten Thousand) to Tk.25,00,000/- (twenty five lac).

5.2.1 Features of the Product are

To start with the Double Income Plus (DI+) deposit program one customer has to put Tk from 10,000/- (Ten Thousand) to Tk.25,00,000/- (twenty five lac) after maturity the deposited Double Plus. If the accounts/deposits are closed/encashed after one year of its opening, interest shall be allowed on the deposit at prevailing FDR interest rate.

5.2.2 Features & Regulations of the Program

-Deposit range is from 10,000/- (Ten Thousand) to Tk.25, 00,000/- (twenty five lac).

-Term of Deposit 06 (six) years 06.

-Double Plus amount will be paid after completion of the 06 (six) years term.

-Income Tax may be deducted as imposed by the government on the interest amount at the time of maturity/payment.

5.2.3 Special attractions

80% loan is allowed upon the deposit balance instantly. Payment Matrix [(for amount of tk from 10,000/- (Ten Thousand) to Tk.25, 00,000/- (twenty five lac).]

At Maturity is shown below

| Tenure | Deposit | Value at Maturity |

| 6 years6 months | 10,000/- | 20,200.00 |

| 6 years6 months | 20,000/- | 40,400.00 |

| 6 years6 months | 50,000/- | 1,01,000.00 |

| 6 years6 months | 1,00,000/- | 2,02,000.00 |

5.3 LSDIP- Life Secured Double Income Program

We know Savings increase Deposit and Deposit creates the opportunity of Investment. The Investment patronizes the establishment of Industry and presents wealthy economy of the country. So, the importance of Savings is vital for the country. Moreover, in personal life savings ensure our future. Out of all uncertainty death is the universal message of truth for all of us. Focusing on that SBL introduced Insurance Covered & life secured a special deposit program for fruitful utilization of its client’s hard earned savings.

5.3.1 Features & Regulations of the Program

-Deposit range is from Tk.1, 00,000.00 (One Lac) to Tk.25, 00,000.00 (Twenty Five Lac).

-Term of Deposit 07 years.

-Double amount will be paid after completion of the 7 years term.

-Saving rate will be allowed for any pre-mature encashment.

-In case of death of the depositor nominee will get double amount of the deposit balance. But it will effect after 12 (twelve) months from the date of account opening.

5.3.2 Special terms of the scheme

-Depositor’s age will be maximum 50 years.

-40 years above depositors will provide physical fitness certificate from the competent medical authority in case of the deposit amount of Tk.2, 00,000.00 (Two lac) above.

-In all cases depositors will provide a declaration about health fitness in a prescribed form

-Income Tax may be deducted as imposed by the government on the interest amount at the time of maturity/payment.

5.3.3 Special attractions

-In case of death of the depositor nominee will get double amount of the up to date deposit balance.

-80% loan is allowed upon the deposit balance instantly.

5.4 Revised Rate of Interest

Savings Deposit 7.00% & STD Deposit 6.00%

| Deposit Products | FDR for below Tk. 50 Lac | FDR for Tk. 50 Lac & above |

| FDR ( 1 Month but less than 3 Months) | 9.00% | 9.00% |

| FDR ( 3 Month but less than 6 Months) | 11.50% | 13.50% |

| FDR ( 6 Month but less than 1 Year) | 12.00% | 13.00% |

| FDR (1 Year and above) | 12.50% | 13.50% |

5.5 Loan Products: Standard Bank Ltd.

Standard Bank Limited, occupied the leading position in 3rd generation private commercial bank, to explore a new horizon in innovative modern Banking creating an automated computerized environment providing one stop service and prepare itself to face the new challenges of globalization of 21st century.

Bank provides assistance for local and international trade using every mood of finance to the traders, exporters, manufactures, individual etc.

The international trade encompasses a substantial portion of business conducted by the Bank. During the year 2004, the bank has contributed in the national economy after successfully handling of foreign exchange transactions viz. Import, Export (Both local and foreign).

In the wake of recession of business, the government is currently pursuing an accommodative monetary policy through a number of measures such as reduction in Bank rate, reduction in interest rate in government bonds and reduction on SLR requirement, simultaneously adoption of floating exchange rate and open market operation fueling incentives towards private investment with the aim of creating more capital avenues thereby generating more income to add to the GDP of the economy. In the juncture, it is very tough for a Bank to remain on track of competition to achieve desired goal in international trade. In order to achieve our cherished goal of achieving consumer satisfaction we extend our hand in the following sector:

Trade Finance

Small & Medium Business

HouseBuilding loan

Consumer Credit

Transport Loan

International Trade

Project Financing

Lease Financing

Financing for BMRE

Agricultural loan

Special finance for non-traditional item

Syndication Finance

5.6 Mood of Finance that we provide

Secured Overdraft: For Work Order, General purpose etc.

Cash Credit (Hypothecation)

Cash Credit (Pledge)

Letter of Credit

Back to Back L/C

Loan against Trust Receipt

Loan against Import Merchandise

Bank Guarantee

5.7 Retail Products: Standard Bank Ltd.

Consumer financing products are

- Salary loan scheme

- Car/auto vehicles loan

- House renovation loan

- Household durables loan

- Self employed professional loan

- Land purchase loan

- Marriage loan

5.7.1 Salary loan scheme

This scheme will cover all salaried executives/officers having confirmed / permanent job in any of the following organizations:

– Government Organizations

– Semi Government & autonomous bodies

– Banks, well-established and reputed insurance companies and any other alike financial institutions.

– Multinational companies, Large NGOs, Aid Agencies, UN Bodies.

– Large Private organization having corporate structure.

– Teachers of reputed Universities, Colleges & Schools.

– Hospitals, Pathology Labs, Air lines, 5 Star Hotel & Restaurants.

– Length of service: Minimum 2 (two) years for type A,B,C

– Minimum Monthly Salary: TK. 20,000 (Twenty Thousand) Gross.

– Loan limit: ranges up to 2.00 Lac but not exceeding 3 (three) times of gross salary.

– All other conditions as stated in serial 1 to 13 to be followed.

5.7.2 Auto loan (car, auto-rickshaw, micro-bus, taxi, pick-up van

Features

- Loan amount ranges from Tk. 1.00 Lac to 10.00 Lac

- Debt equity ratio 60:40.( Bank contribution 60% & Client 40%)

- Repayment tenure12, 24,36,48 or60 months.

- Loan amount excludes insurance, Vat, registration etc.

- Option of pre-paying after a minimum of 6 months from loan disbursement.

- The car /auto will be registered in joint name where in Standard Bank Ltd. Will be the first party. Customer will bear the insurance charges.

- All other conditions as stated in serial 1 to 13 to be followed.

5.7.3 Self employed professional loan

- Self employed professional Loan is a loan facility offered by the Retail Banking Division to facilitate the registered Doctors, Dentists, Pathologists, Engineers, Architects ,Scientists, Chartered accountants who are salaried as well as self employed.

- Minimum of 3 years continuos service experience.(Both salaried & self employed)

- Age-30 years to 57 years.

- Monthly Income- Tk. 15,000/- gross.( Minimum).

- Maximum Limit TK. 5.00 Lac.

- Maximum loan upto 10 times of gross salary or net income of self-employed.

- All other conditions as stated in serial 1 to 13 to be followed.

5.7.4 Marriage loan

Marriage Loan is a personal loan facility offered to executives/officers intends to marry to incur his/her marriage expenditure or their sons and daughters.

Limit: Maximum Tk. 2.00 lac.

Age: 25 years to 57 years.

All other conditions as stated in serial 1 to 13 to be followed.

No marriage loan will be provided against 2nd Marry.

5.7.5 Household durables loan

- Household durable loan is a personal loan offered to salaried /self employed persons to make their wishes true for purchasing computer, Refrigerator, A.C., T.V., Motorcycle, Washing Machine etc.

- All other conditions & eligibility as stated in serial 1 to 13 to be followed.

- Limit: Minimum Tk. 20000/- Maximum Tk. 1.00 Lac

- Product quotation to be obtained.

Some more parts-

Assignment On Bangladesh Commerce Bank Limited (Part-1)