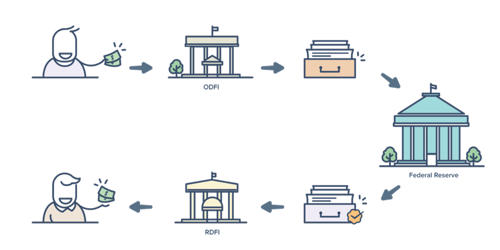

Automated Clearing House (ACH) is a secure payment transfer system that connects all U.S. financial institutions. An automated clearing house (ACH) is a computer-based electronic network for processing transactions, usually domestic low-value payments, between participating financial institutions. This payment system provides ACH transactions for use with payroll, direct deposit, tax refunds, consumer bills, tax payments, and many more payment services in the United States. It may support both credit transfers and direct debits. The use of the ACH network to facilitate electronic transfers of money has also increased the efficiency and timeliness of government and business transactions. It is here that payments linger in something akin to a holding pattern while awaiting clearance for their final banking destination.

The ACH network acts as the central clearing facility for all Electronic Fund Transfer (EFT) transactions that occur nationwide, representing a crucial link in the national banking system. The ACH system is designed to process batches of payments containing numerous transactions and charges fees low enough to encourage its use for low-value payments. ACH payments are a popular type of payment method for businesses to offer consumers because of the low per-transaction costs and predictable processing timelines. Recent rule changes are enabling most credit and debit transactions made through the ACH to clear on the same business day. These computerized payments can provide benefits to both merchants and consumers: Payments are inexpensive, they can be automated, and recordkeeping is often easier with electronic payments.

The ACH Network essentially acts as a financial hub and helps people and organizations move money from one bank account to another. ACH transactions consist of direct deposits and direct payments, including B2B transactions, government transactions, and consumer transactions. More than 25 billion ACH transactions are processed each year by the Automated Clearing House (ACH) Network, an electronic network of banks and financial institutions supporting both ACH credit and debit payments.

History

The first automated clearing house was BACS in the United Kingdom, which started processing payments in April 1968. In the U.S. in the late 1960s, a group of banks in California sought a replacement for check payments. This led to the first automated clearing house in the US in 1972, operated by the Federal Reserve Bank of San Francisco.

BACS operated from the beginning on a net settlement basis. Netting ACH transactions reduces the number of deposits a bank must hold. Funds move from one bank account to another with the help of a centralized system that directs funds to their final destination.