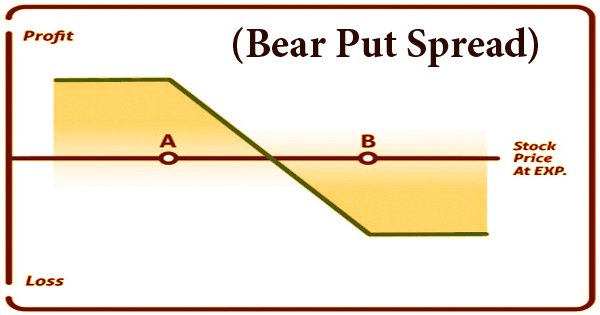

A bear put spread is a restricted benefit, restricted danger choices exchanging system that can be utilized when the alternatives broker is reasonably bearish on the hidden security. It is a form of option strategy where an investor or trader expects the price of a security or asset to decrease moderately to dramatically and wants to reduce the cost of holding the option trade. The goal is a reduction in the stock price, with a closing equal to or below the lower strike price at the time of expiration. It is entered by:

- buying higher striking in-the-money put options and

- the same amount of lower hitting out-of-the-money selling put options on the same underlying security and the same month of expiration.

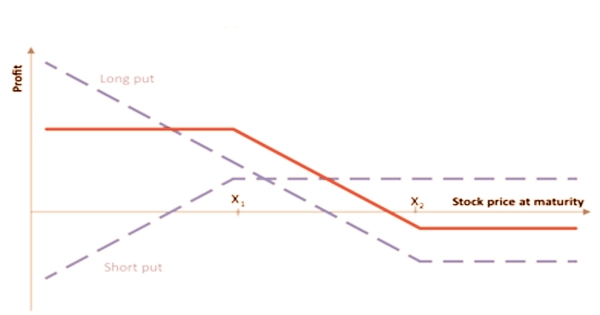

A bear put spread is accomplished by buying put alternatives while additionally selling a similar number of puts on a similar resource with a similar lapse date at a lower strike cost. The most extreme benefit of utilizing this system is equivalent to the contrast between the two strike costs, less the net expense of the alternatives. The put option offered with the lower strike price is obviously worth less than the put option bought with the higher strike price. As the cash earned for selling the lower strike price put is less than the cash charged for the higher strike price put, this results in a net debit.

As an update, an alternative is a privilege without the commitment to sell a predetermined measure of hidden security at a predefined strike cost. A bear put spread’s general strategy is to buy a higher strike price package and then sell a lower one; the aim is to watch the stock fall and close at any point at the time of expiration that is equal to or above the lower strike price. A bear put spread is otherwise called a charge put spread or a since quite a while ago put spread. On the off chance that the stock closes at or underneath the lower strike value, the dealer benefits the distinction between the strike costs, short the premium at first paid.

The key benefit of the spread of a bear is that the net trade risk is minimized. With the lower strike price, selling the put option helps cover the expense of buying the put option with the higher strike price. A simple understanding of options is important to better understand the spread of a bear. There are two option types: calls and puts. A call empowers a proprietor to buy a choice’s hidden resource at the contracted strike cost, up until the date that the call alternative terminates. Along these lines, the net expense of capital is lower than purchasing a solitary put inside and out.

Also, since the risk is limited to the net cost of the bear put spread, it carries much less risk than shorting the stock or protection. Theoretically, selling a stock short has infinite risk if the stock moves higher. A put alternative, then again, permits the proprietor to sell the choice’s hidden resource at the strike cost illustrated in the agreement, up until the date that the put choice lapses. If the trader expects that the underlying stock or security would fall between the trading date and the expiration date by a limited sum, then an optimal play might be a bear put spread.

The outcome of a bear put spread is a net debit, as mentioned above. The maximum amount that a trader loses is the amount that the trader paid for it, otherwise referred to as the net debit, on any debit spread such as the bear put spread. The choices dealer trusts that the cost of the fundamental drops, expanding his benefit when the basic dips under the strike cost of the composed alternative, netting him the distinction between the strike costs less the expense of going into the position. It is the cost of the choice of the higher strike price minus the price of the choice of the lower strike price. It occurs if the underlying asset closes at any price higher than the strike price of the acquired put option at the time of expiration.

However, if a larger amount of the underlying stock or security falls, then the trader gives up the right to demand the extra profit. It is the trade-off that is desirable to many traders between risk and possible reward. The trader exercises his higher strike position in such a situation, selling the stock at the higher strike price. On the off chance that it’s in the cash, the other, lower strike value put alternative is practiced naturally, and the broker buys the stock at the lower strike cost. In this manner, no net situation in the hidden stock is made. There is always the possibility of early allocation, which is to actually purchase or sell the asset’s assigned number at the agreed-upon price. Early exercise of options also happens when there is a merger, takeover, special dividend or other news that impacts the underlying stock of the contract.

Information Sources: